Writing a data-driven newsletter about economics @ https://t.co/IanQ9oPoPi | Nuance? In this economy? | Full Employment Stan, Brazilian Coffee Tariff Victim

5 subscribers

How to get URL link on X (Twitter) App

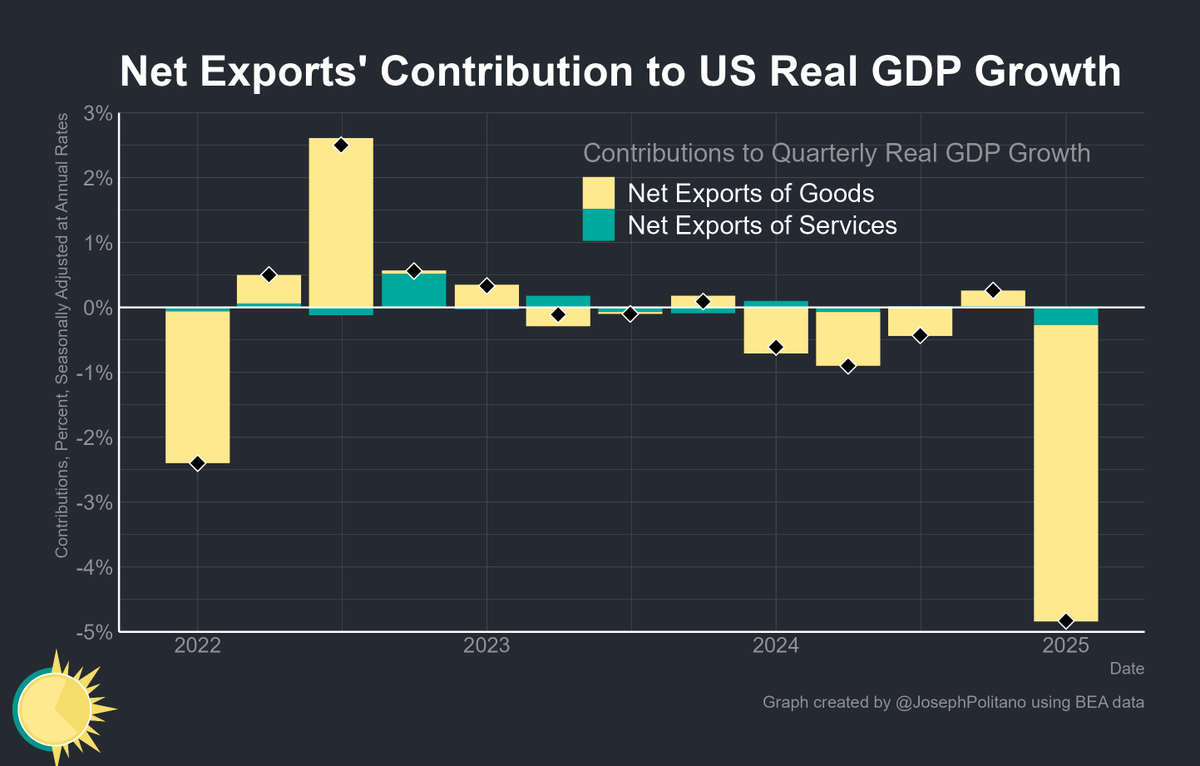

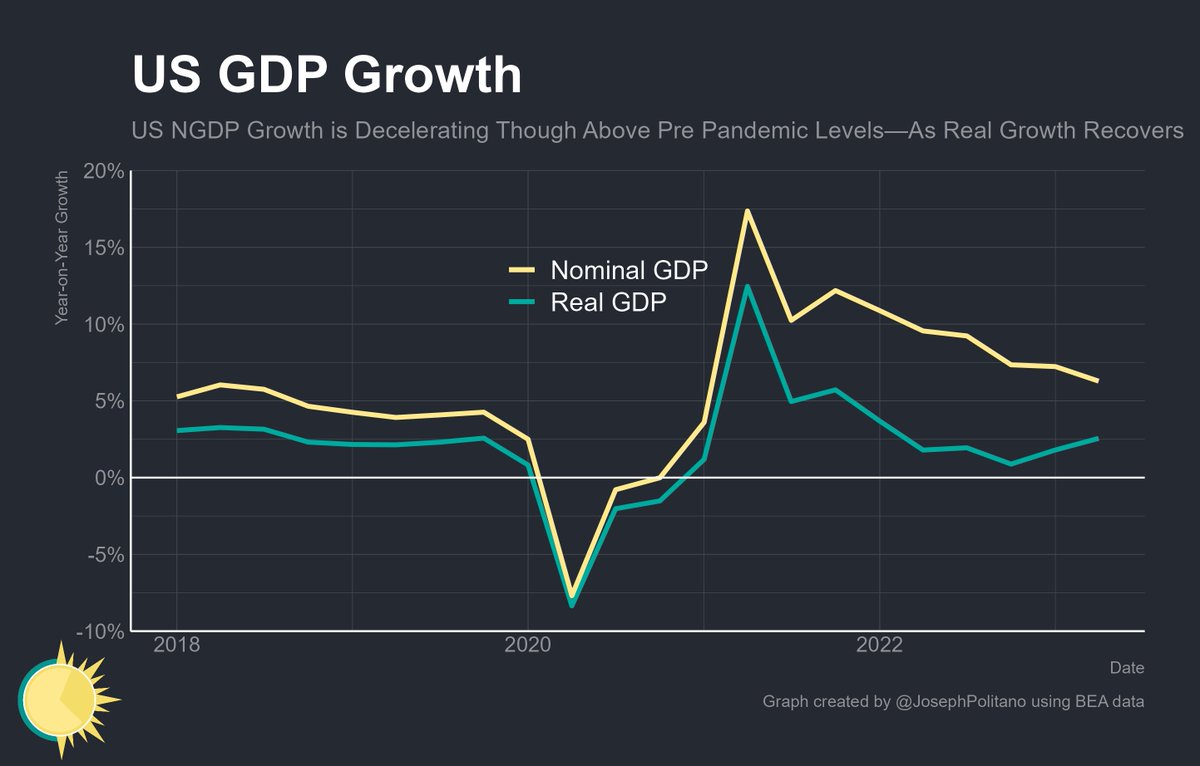

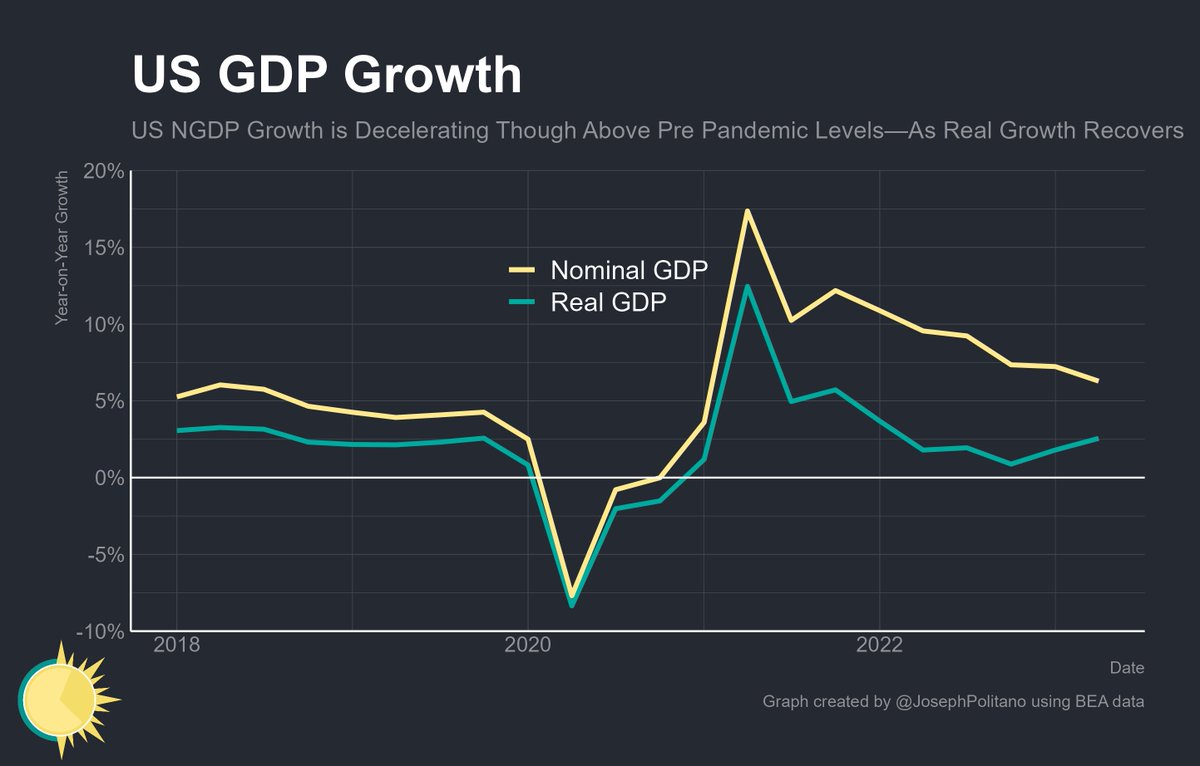

The big story of Q1 was trade—and even though few of Trump's tariffs were in place by end-of-March, there was still a historic increase in the trade deficit.

The big story of Q1 was trade—and even though few of Trump's tariffs were in place by end-of-March, there was still a historic increase in the trade deficit.

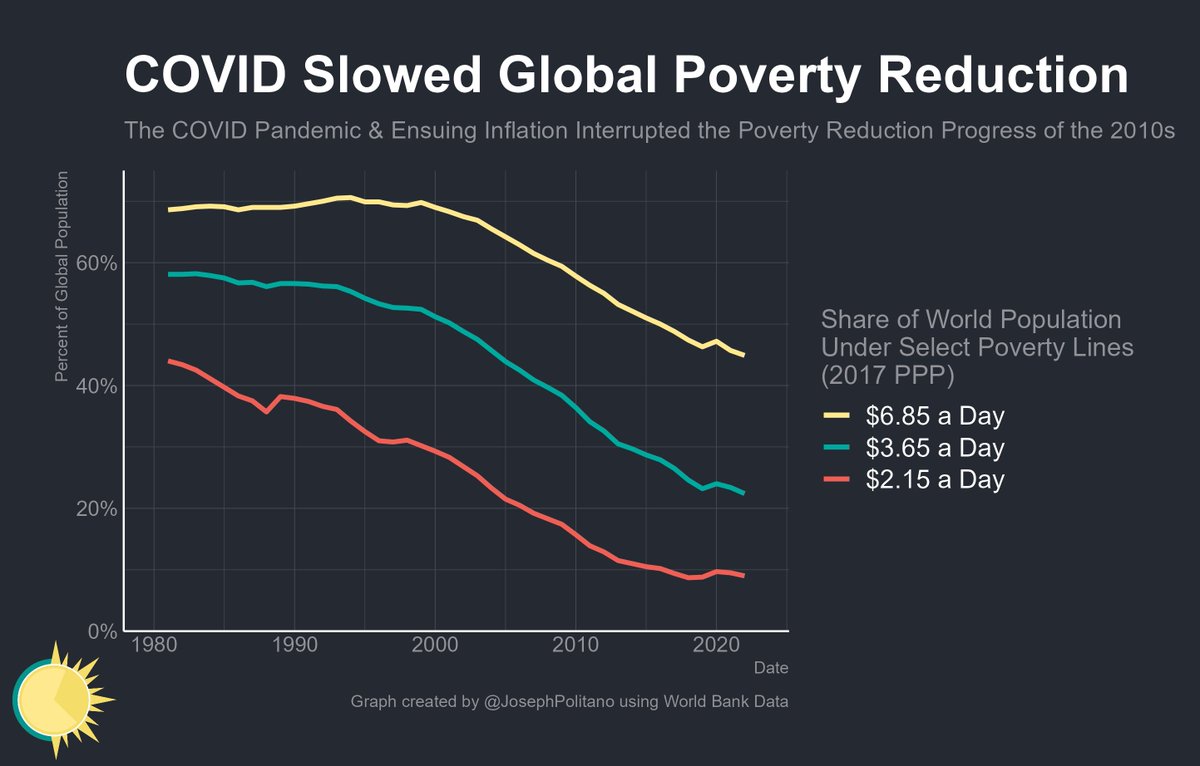

the average USAID project is less effective than the average EA donation (because EAs are hard-filtering for the most effective known interventions) but even still USAID spends hundreds of millions on like effective anti-malaria programs, it's total impact is massive and now gone

the average USAID project is less effective than the average EA donation (because EAs are hard-filtering for the most effective known interventions) but even still USAID spends hundreds of millions on like effective anti-malaria programs, it's total impact is massive and now gone

In Texas, Houston was able to claim the crown for the triangle's fastest-growth amidst a regional oil boom.

In Texas, Houston was able to claim the crown for the triangle's fastest-growth amidst a regional oil boom.

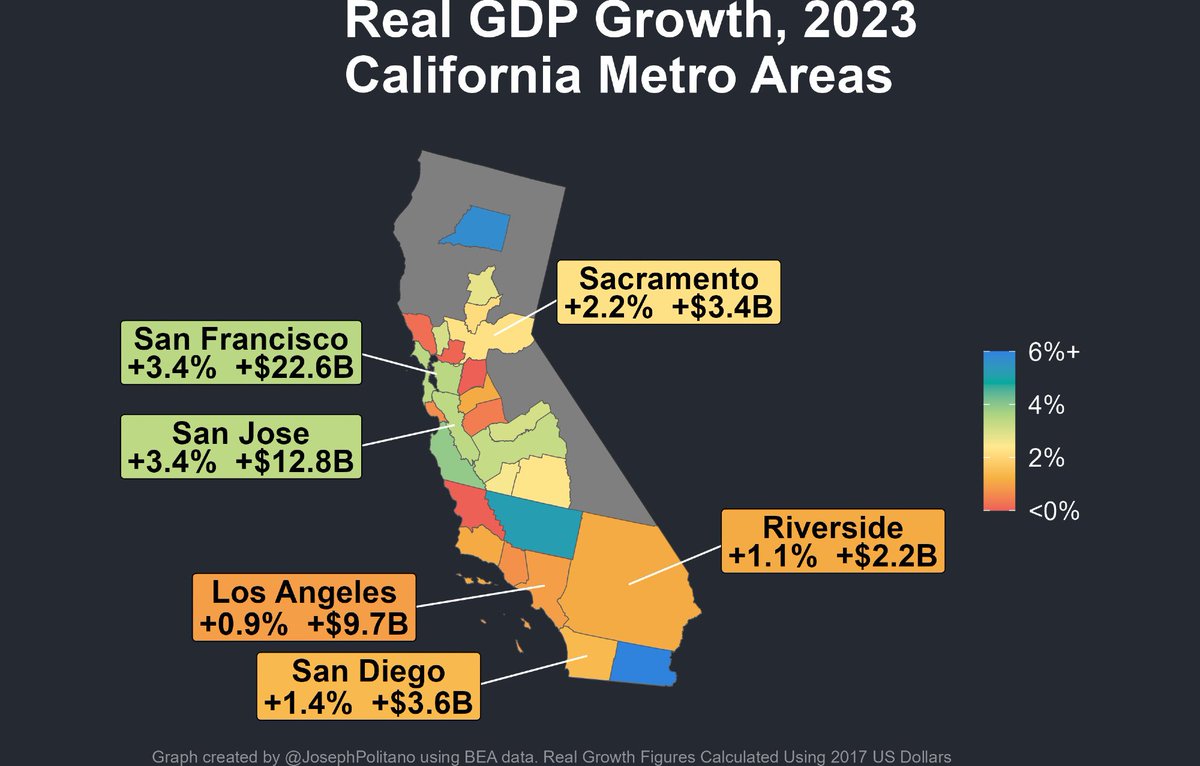

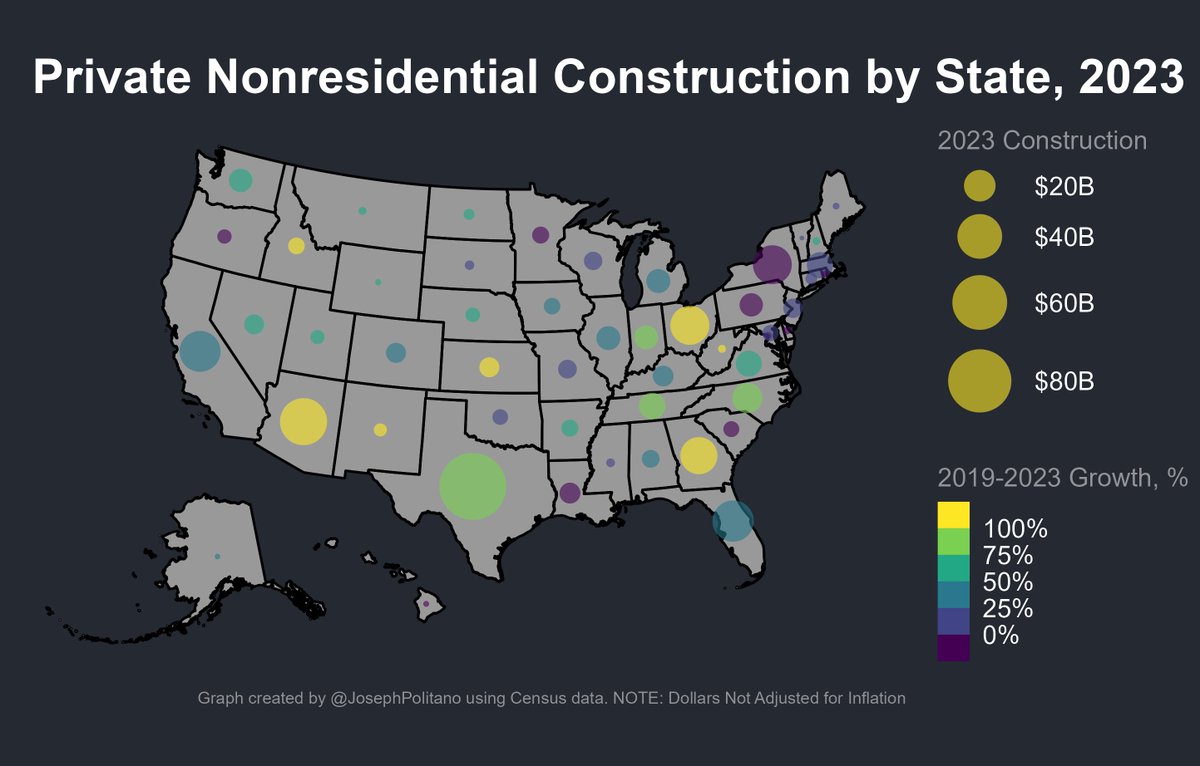

America's investment boom has affected every part of the country, but intentionally wasn't spread evenly across the US

America's investment boom has affected every part of the country, but intentionally wasn't spread evenly across the US

In October 2022, America imposed comprehensive sanctions on China designed to hamstring their domestic semiconductor industry

In October 2022, America imposed comprehensive sanctions on China designed to hamstring their domestic semiconductor industry

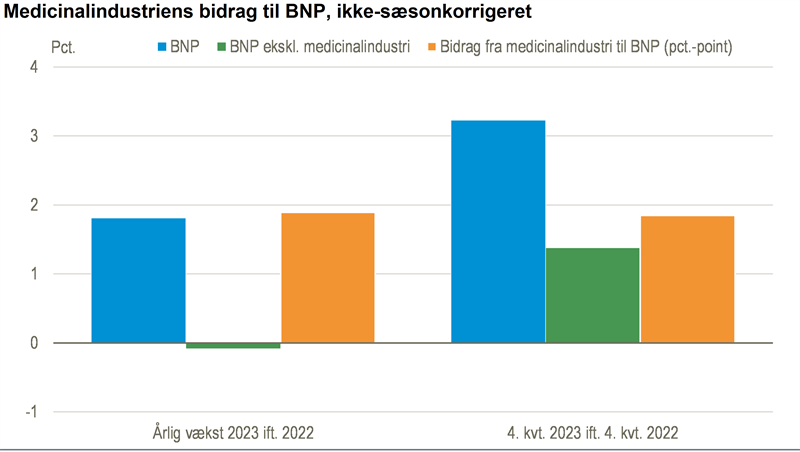

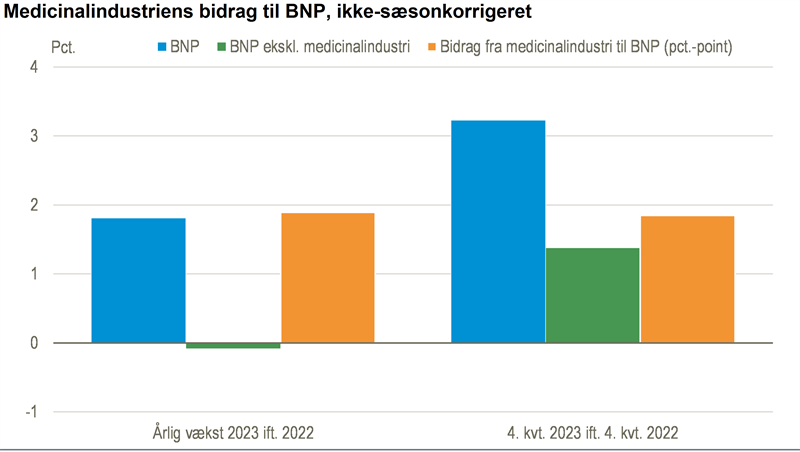

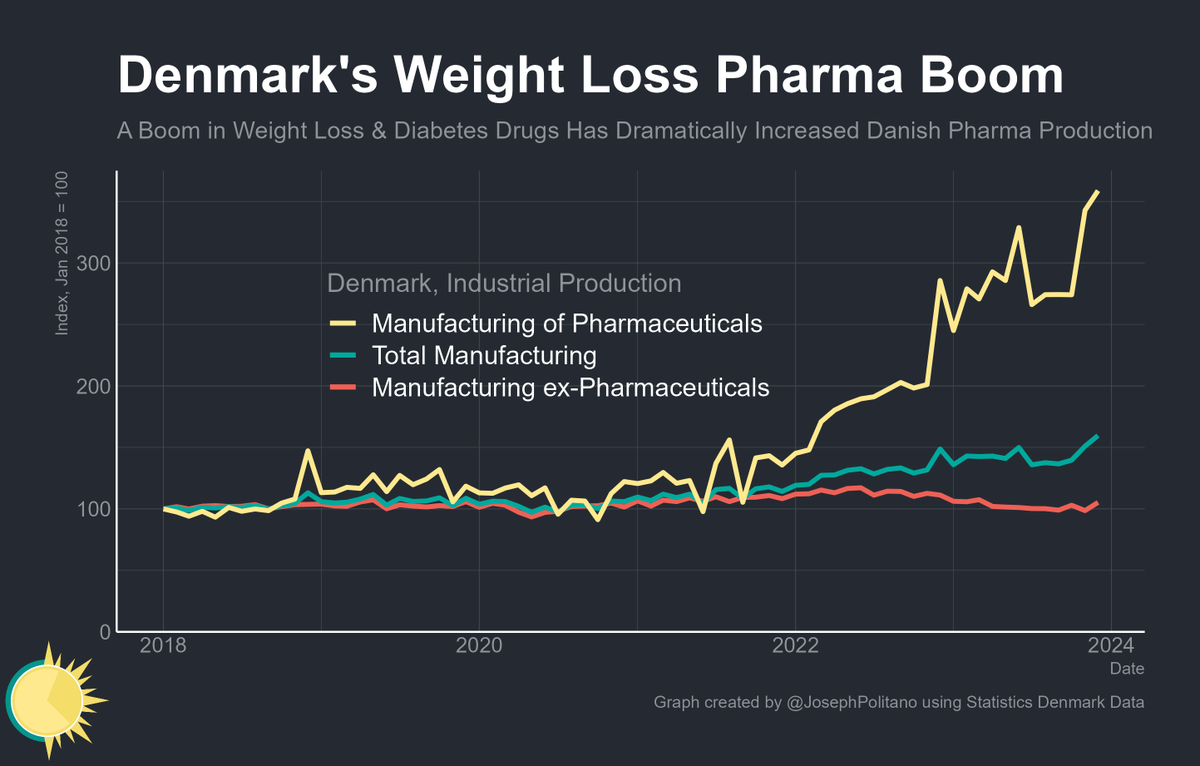

Danish industrial production is also at record highs thanks to a more-than-tripling of pharmaceutical manufacturing since 2018 amidst the weight-loss drug boom

Danish industrial production is also at record highs thanks to a more-than-tripling of pharmaceutical manufacturing since 2018 amidst the weight-loss drug boom

https://twitter.com/creation247/status/1759367190644469922Hey if they get to repost so do I

https://twitter.com/JosephPolitano/status/1750512068711584128

Meanwhile, rising government output contributed 0.56% annualized to real GDP growth in the fourth quarter.

Meanwhile, rising government output contributed 0.56% annualized to real GDP growth in the fourth quarter.

The US represents only a small part of China's semiconductor imports, the vast majority of which come from Taiwan and South Korea. The US will need high levels of cooperation from Asian manufacturers to win the chip war, which it is only partially achieving now.

The US represents only a small part of China's semiconductor imports, the vast majority of which come from Taiwan and South Korea. The US will need high levels of cooperation from Asian manufacturers to win the chip war, which it is only partially achieving now.