The US consumer good economy in a nutshell right now:

Corporate handouts: EIDL, PPP, ERC, and 2020’s earnings money

VS

Supply chain: rapidly accelerating costs across the board

VS

Consumer savings: UI, stimulus money, child tax credits, and rising wages

What happens?

1/2

Corporate handouts: EIDL, PPP, ERC, and 2020’s earnings money

VS

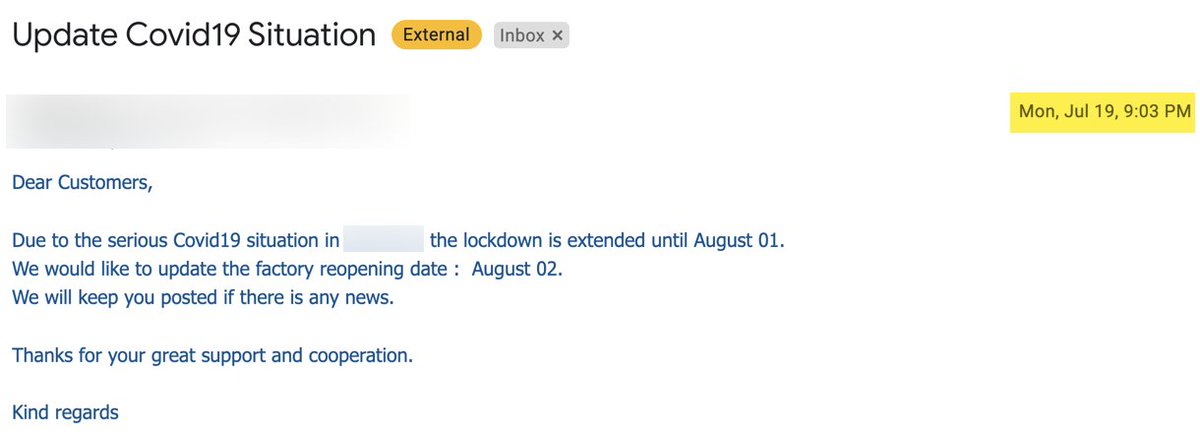

Supply chain: rapidly accelerating costs across the board

VS

Consumer savings: UI, stimulus money, child tax credits, and rising wages

What happens?

1/2

Throw a little bullwhip inventory effect, price reflexivity, fomo, human psychology, and tons of debt in there.

And I don’t see how this doesn’t lead to a subprime like economic crisis.

2/2

And I don’t see how this doesn’t lead to a subprime like economic crisis.

2/2

Bonus: What’s crazy about this is that you also have shortages and government issues like infrastructure and the debt ceiling (did this get fixed?) that I didn’t even mention.

I just don’t see how we get through this without a blow up 🤷♂️

I just don’t see how we get through this without a blow up 🤷♂️

Q&A: how does this actually lead to a blow up?

Like this:

Like this:

https://twitter.com/molson_hart/status/1444327443163140096

• • •

Missing some Tweet in this thread? You can try to

force a refresh