Raising money for startups is wild right now. I’ve never seen anything like it.

Lots of Founders are wondering how to approach it and who to partner with.

Here are 10 practical tips I've shared with 50+ Founders in the last few months 👇👇👇

Lots of Founders are wondering how to approach it and who to partner with.

Here are 10 practical tips I've shared with 50+ Founders in the last few months 👇👇👇

Tip 1: If you’ve got the hot hand, take the shot

At some point the music will stop.

Until then, there’s $1T+ sitting on the sidelines looking to be put to work.

If you are showing strong traction, there’s never been a more "Founder Friendly" time to raise capital.

At some point the music will stop.

Until then, there’s $1T+ sitting on the sidelines looking to be put to work.

If you are showing strong traction, there’s never been a more "Founder Friendly" time to raise capital.

Tip 2: If you don’t have a hot hand, it’s tough out there

Huh? You just said there’s a bunch of capital available.

Yes, BUT it’s reserved for the best deals.

In 2020, $50B+ was deployed into tech (all time high), but only 3.3k deals got done (lowest in 8 years).

Huh? You just said there’s a bunch of capital available.

Yes, BUT it’s reserved for the best deals.

In 2020, $50B+ was deployed into tech (all time high), but only 3.3k deals got done (lowest in 8 years).

Tip 3: Do your prep work up front

Deals are moving a lot faster. AngelList recently put out data showing the timespan between fundraises is compressing big time.

Implication: Have your materials ready to go

- Deck

- Financials

- Metrics

- Docs

- Reference Checks

Deals are moving a lot faster. AngelList recently put out data showing the timespan between fundraises is compressing big time.

Implication: Have your materials ready to go

- Deck

- Financials

- Metrics

- Docs

- Reference Checks

Tip 4: Diligence is still diligence

Deals moving faster has a counterintuitive effect.

I’m seeing the smallest miscommunications kill deals.

Implication: Be transparent

It's better for a deal to potentially die up front, then definitely die when you're at the finish line.

Deals moving faster has a counterintuitive effect.

I’m seeing the smallest miscommunications kill deals.

Implication: Be transparent

It's better for a deal to potentially die up front, then definitely die when you're at the finish line.

Tip 5: Valuation is only one consideration

Some investors are throwing out big numbers (Series As are up ~80%)

Flattering, but don’t anchor to it.

It can take out a lot of investors that are better fits.

Remember: Fundraising isn’t the goal.

Building a mega company is.

Some investors are throwing out big numbers (Series As are up ~80%)

Flattering, but don’t anchor to it.

It can take out a lot of investors that are better fits.

Remember: Fundraising isn’t the goal.

Building a mega company is.

Tip 6: Pressure test your timeline

Tier 1 takes time. Angels / Tier 2-3 firms make faster decisions.

Don’t conflate this with “conviction.”

It’s a different game.

Work through who you're pitching and in what order.

Mismanaged timing = under-optimized fundraising.

Tier 1 takes time. Angels / Tier 2-3 firms make faster decisions.

Don’t conflate this with “conviction.”

It’s a different game.

Work through who you're pitching and in what order.

Mismanaged timing = under-optimized fundraising.

Tip 7: Lead with the Numbers

If your numbers are good, put them in the summary you send to investors and make sure they’re in the first 3 slides of your deck.

Attention spans are shorter than ever, but consideration spans are long.

Good numbers always force engagement.

If your numbers are good, put them in the summary you send to investors and make sure they’re in the first 3 slides of your deck.

Attention spans are shorter than ever, but consideration spans are long.

Good numbers always force engagement.

Tip 8: Leverage your current investors

There are a lot of “unprecedented” things going on right now - amount/speed of capital raised, vehicles, terms, etc.

Your investors have 100x the data points you have.

Use them to match those data points to your situation.

There are a lot of “unprecedented” things going on right now - amount/speed of capital raised, vehicles, terms, etc.

Your investors have 100x the data points you have.

Use them to match those data points to your situation.

Tip 9: Be cognizant of the new benchmarks

300% YoY is the new 100% YoY.

Decacorns are the new unicorns.

When you see fundraising articles and think “That s*%t is crazy”, remember Investors have recalibrated “what good looks like.”

The benchmarks have never been higher.

300% YoY is the new 100% YoY.

Decacorns are the new unicorns.

When you see fundraising articles and think “That s*%t is crazy”, remember Investors have recalibrated “what good looks like.”

The benchmarks have never been higher.

Tip 10: There are no rules in fundraising!

My friend @ChrisJBakke sums this up better than I’ve heard from anyone:

$1k spent on a story telling coach > $10k on a designer for your deck.

Pithy, but important - fundraising is the ultimate “sale.”

Focus on what matters.

My friend @ChrisJBakke sums this up better than I’ve heard from anyone:

$1k spent on a story telling coach > $10k on a designer for your deck.

Pithy, but important - fundraising is the ultimate “sale.”

Focus on what matters.

So why is everyone excited?

We’re going through a modern day renaissance.

COVID is disrupting and accelerating everything.

- Markets are bigger than ever

- New business models are emerging

- Trend habits are becoming permanent

Most importantly, the winners are WINNING.

We’re going through a modern day renaissance.

COVID is disrupting and accelerating everything.

- Markets are bigger than ever

- New business models are emerging

- Trend habits are becoming permanent

Most importantly, the winners are WINNING.

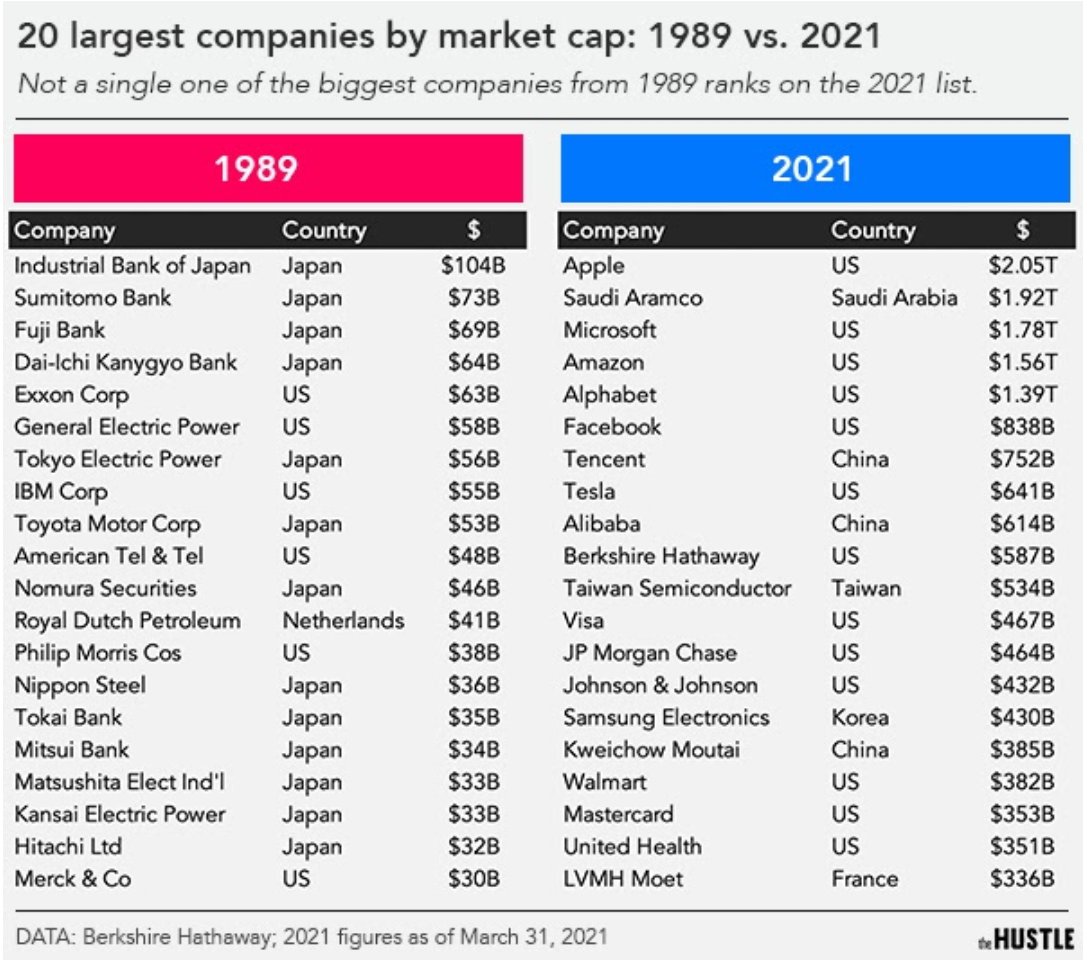

Take look at this chart of the Top 20 companies in the world in 1989 and in 2020 from Berkshire’s latest Shareholder Meeting.

2021 is laying the foundation for the 2050 list.

Happy fundraising :)

2021 is laying the foundation for the 2050 list.

Happy fundraising :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh