1/ $OHM and @OlympusDAO is one of the most interesting protocols in #DeFi. The protocol makes money via bonding which is currently approaching $10mm in revenue per day and trading fees through LP stakes it controls approaching $100k in rev/day...

$50.05mm in the last 7 days

$50.05mm in the last 7 days

2/ With the total treasury balance approaching $300mm and growing rapidly (+~180% since August 31st), the token trades at roughly 7.2x book value...

3/ #OlympusPro adds an additional layer of future potential revenue having already raised $672k in bonds for 6 partner projects in the last week and helping them to grow their own pools of owned trading liquidity. $OHM takes a 3.3% fee equating to $22k in revenue so far...

4/ At the same time, many of the assets held in treasury can be staked or lent to provide additional revenue from staking rewards and lending income. Today $OHM earns staking rewards on $xSushi tokens and from lending yield deposits with @ConvexFinance

5/ Now, assuming the current rate of revenue is sustainable but no future growth, $OHM would be doing nearly $3.68bn in revenue. This doesn't take into account any revenue from Olympus Pro, just bond sales, LP fees, and staking/lending rewards...

5/ 90% of the protocol's revenue is distributed back to token holders via the rebase which occurs roughly every 8 hours increasing the supply of $OHM tokens to holders implying roughly $3.32bn in distributable profits...

6/ $OHM's current market cap is $2.1bn meaning the token trades at a paltry 0.58x 1YR FW sales and 0.64x 1YR FW profits... incredibly attractive prices given the growth and profitability...

And again this assumes it can maintain its existing revenue but zero future growth...

And again this assumes it can maintain its existing revenue but zero future growth...

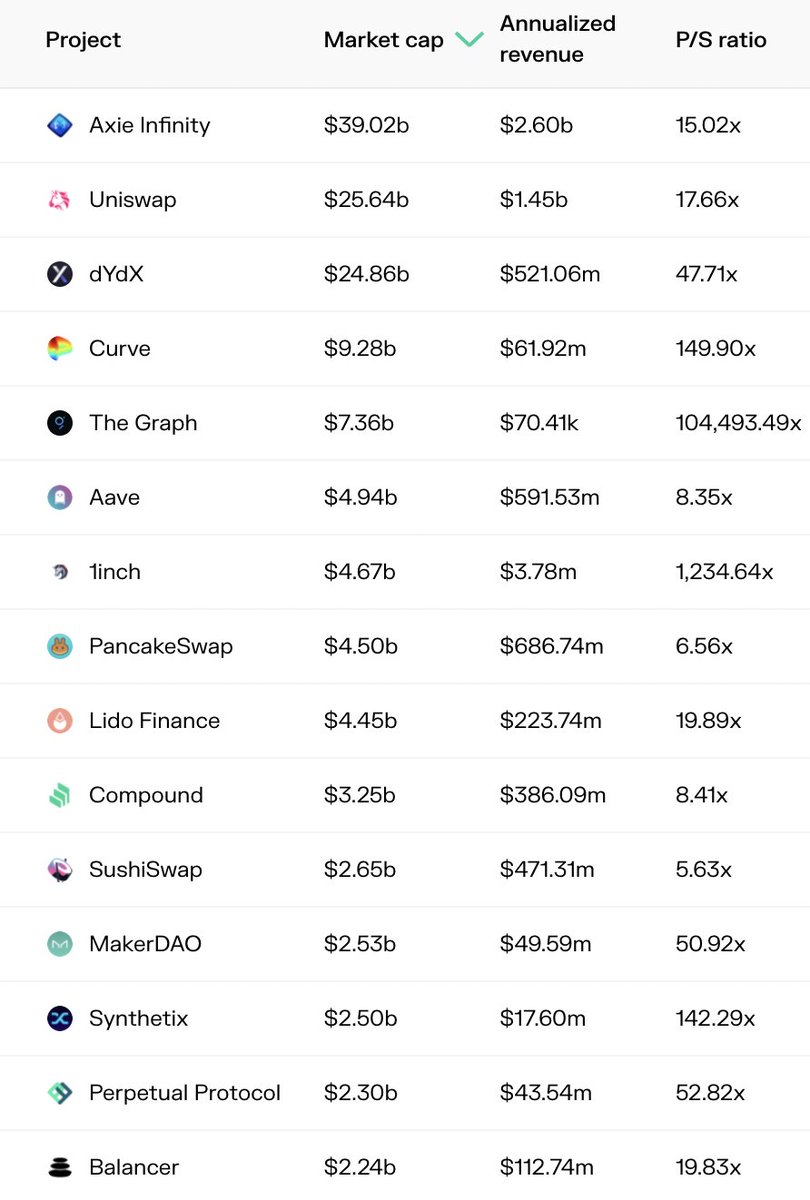

7/ At these levels, this may be one of the most profitable projects in #DeFi trading at the lowest multiples in DeFi and nearly all of the benefits accrue directly to the token holders

8/ At the same time the ecosystem around $OHM continues to grow creating opportunities for future growth

8th largest and 4th most traded liquidity pool on #Sushiswap.

Partnerships with Rari, Abracadabra, and FRAX creating borrowing and lending opportunities...

8th largest and 4th most traded liquidity pool on #Sushiswap.

Partnerships with Rari, Abracadabra, and FRAX creating borrowing and lending opportunities...

9/ All of this has been done organically and in a decentralized way through people working together on a common goal and all of this has occurred since launching in March 2021, just 6 months ago

Now let's imagine what the next 6 months can bring!

Now let's imagine what the next 6 months can bring!

The integration with @MakerDAO assuming it passes will be massive. OHM is already a top 8 holder of DAI via reserve bonds and liquidity bonds, but this expands OHM's use as collateral to a premier DeFi application. Incredible move towards future adoption

forum.makerdao.com/t/ohm-olympus-…

forum.makerdao.com/t/ohm-olympus-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh