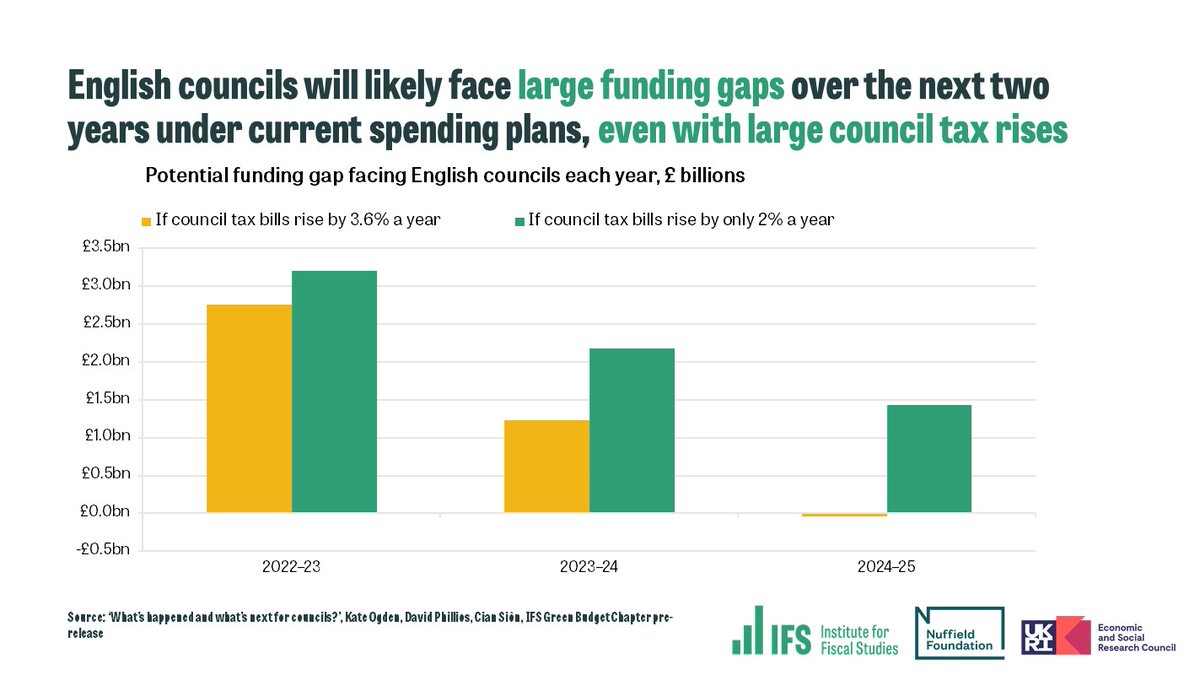

NEW: English #councils will need billions more from government and big #counciltax rises just to maintain services at their pre-COVID levels.

Read our #IFSGreenBudget chapter on local government funding, funded by @NuffieldFound > ifs.org.uk/publications/1…

Read our #IFSGreenBudget chapter on local government funding, funded by @NuffieldFound > ifs.org.uk/publications/1…

One issue with using council tax to raise revenues is that increases generate less for councils in poorer parts of the country.

This means bigger increases to tax rates or cuts to services in poorer areas, unless government redistributes grant funding from richer areas.

This means bigger increases to tax rates or cuts to services in poorer areas, unless government redistributes grant funding from richer areas.

As COVID pressures abate, underlying demand and cost pressures will grow, pushing up what councils must spend to maintain services.

Our central projection is that councils will have to spend £10bn more in 2024 than in 2019 – but several factors could push costs up even more.

Our central projection is that councils will have to spend £10bn more in 2024 than in 2019 – but several factors could push costs up even more.

The government is providing £5.4bn over the next three years for social care reform. It seems unlikely it can achieve everything it wants with this amount – long-term, the reforms are more like £5bn a year.

Without extra funding, some care recipients could actually lose out.

Without extra funding, some care recipients could actually lose out.

Read the full #IFSGreenBudget chapter for our analysis of issues for Wales, funding and local tax reform, devolution, and social care, and join our event at 11am today here > ifs.org.uk/events/1933

ifs.org.uk/publications/1…

ifs.org.uk/publications/1…

• • •

Missing some Tweet in this thread? You can try to

force a refresh