Tatva Chintan -

Difficult to understand its chemistry and products for me but i tried my best to understand and now trying to make notes in a simple way

Manufacturing unit -

1- Dahej

2- Ankeleshwar

Capacity- 280 KL and and expansion is going on for 200 KL

Difficult to understand its chemistry and products for me but i tried my best to understand and now trying to make notes in a simple way

Manufacturing unit -

1- Dahej

2- Ankeleshwar

Capacity- 280 KL and and expansion is going on for 200 KL

. In particular, zeolites promoted with transition metals such as copper and iron have been proven to be active for the selective catalytic reduction, which is currently considered as one of the preferred technologies for emission control in automotive applications.

So in simple language Zeolites are useful in reducing emission ( Apart from other uses ) so with BS 6 emission norm its uses will increase and Tatva chintan manufacture chemicals required for Zeolite manufactring so this may be a growth driver .

The catalyst functions like a detergent for solubilizing the salts into the organic phase. Phase-transfer catalysis refers to the acceleration of the reaction upon the addition of the phase-transfer catalyst.

By using a PTC process,

- one can achieve faster reactions,

-obtain higher conversions or yields,

-make fewer byproducts,

- eliminate the need for expensive or dangerous solvents

- one can achieve faster reactions,

-obtain higher conversions or yields,

-make fewer byproducts,

- eliminate the need for expensive or dangerous solvents

- eliminate the need for expensive raw materials and/or minimize waste problems.

Phase-transfer catalysts are especially useful in green chemistry—by allowing the use of water, the need for organic solvents is reduced.

Phase-transfer catalysts are especially useful in green chemistry—by allowing the use of water, the need for organic solvents is reduced.

So PTC segments will grow with increasing adoption for green chemistry applications given its ability to reduce by-products, wastes generation and

organic solvents use.

The global PTC market is expected to grow at a CAGR of 5% and reach USD 1,328.4 million by 2024.

organic solvents use.

The global PTC market is expected to grow at a CAGR of 5% and reach USD 1,328.4 million by 2024.

The growth is likely to be driven by growth

in key end user industries of pharmaceutical at 5.7%, chemical at 4.2%, and agrochemical 5.2%. Asia-Pacific (APAC) region is expected to grow fastest at 6.5% .

in key end user industries of pharmaceutical at 5.7%, chemical at 4.2%, and agrochemical 5.2%. Asia-Pacific (APAC) region is expected to grow fastest at 6.5% .

India accounts for ~3.5% of the global PTC market. With multiple favorable initiatives by the Government to drive growth of pharmaceutical and agrochemical industries, the USD 37.3 million Indian PTC market is expected to grow at a faster CAGR of 6.6% to

reach USD 51.3 million in

reach USD 51.3 million in

2024 with a market share of ~4%.

The Company is one of the largest producers of an entire range

of PTCs in India and one of the leaders globally

Other Manufacturer of PTCs

• US: SACHCEM Inc.

• Japan: Tokyo Chemical Industry Co. Ltd., Nippon Chemical Industrial Co. Ltd.

The Company is one of the largest producers of an entire range

of PTCs in India and one of the leaders globally

Other Manufacturer of PTCs

• US: SACHCEM Inc.

• Japan: Tokyo Chemical Industry Co. Ltd., Nippon Chemical Industrial Co. Ltd.

• India: Tatva Chintan Pharma Chem Ltd., Dishman Group, Central Drug House Pvt. Ltd., Pacific Organics

Private Limited, Otto Chemie Pvt. Ltd.

• China: Volant-Chem Corp.

• Germany: Evonik Industries, Sigma Aldrich

• Belgium: Solvay

Private Limited, Otto Chemie Pvt. Ltd.

• China: Volant-Chem Corp.

• Germany: Evonik Industries, Sigma Aldrich

• Belgium: Solvay

So Demand for PTC is expected to grow owing to an increase in demand for the adoption of

green chemistry in organic synthesis. The rising demand for technologically advanced environment-friendly and natural, chemical-free catalysts supports the evolution of the PTC

green chemistry in organic synthesis. The rising demand for technologically advanced environment-friendly and natural, chemical-free catalysts supports the evolution of the PTC

3-Electrolyte salts for Super Capacitor batteries-

The demand for electrolyte market is largely being driven by increasing demand of SCs for energy harvesting applications, vehicles (aircraft and trains) and large storage capacity across consumer electronics and energy and

The demand for electrolyte market is largely being driven by increasing demand of SCs for energy harvesting applications, vehicles (aircraft and trains) and large storage capacity across consumer electronics and energy and

utility sectors.

The global SCs market valued at USD 1.4 billion in 2019 is expected to grow at a CAGR of 26% to reach USD 4.4 billion by 2024

Key drivers for super-capacitators

• Automotive and transport: Advent of fuel-efficient technology for hybrid electric and battery EVs

The global SCs market valued at USD 1.4 billion in 2019 is expected to grow at a CAGR of 26% to reach USD 4.4 billion by 2024

Key drivers for super-capacitators

• Automotive and transport: Advent of fuel-efficient technology for hybrid electric and battery EVs

• Consumer electronics: Rising internet connectivity penetration

• Energy storage: Rising on-grid connection system

• Infrastructure and residential properties: Rapid urbanization

in developing countries to boost transport and power

infrastructure

• Energy storage: Rising on-grid connection system

• Infrastructure and residential properties: Rapid urbanization

in developing countries to boost transport and power

infrastructure

4-specialty chemicals intermediate -Many but i am writing about some

Glyme- is used in various applications of drug research, battery research, biological research and others.

The Global glyme market is estimated to register growth at a rate of 15-17% during 2020-25F;

Glyme- is used in various applications of drug research, battery research, biological research and others.

The Global glyme market is estimated to register growth at a rate of 15-17% during 2020-25F;

Currently, very few players in India produce this, namely, Tatva Chintan, Prasol Chemicals, Sanjay

Chemicals, Tolani Chemicals. Tatva Chintan is one of the largest producers of Glymes across the globe. It is the largest producer of Glymes in India and third largest in the world

Chemicals, Tolani Chemicals. Tatva Chintan is one of the largest producers of Glymes across the globe. It is the largest producer of Glymes in India and third largest in the world

Ethyltriphenylphosphonium Bromide (ETPB) is a phase transfer catalyst that is used to speed up the treatment of epoxy resins based on phenolics, some fluoroelastomer resins and powder coatings.

I already wrote about epoxy resin in my another thread.

I already wrote about epoxy resin in my another thread.

Benzyl Trimethyl Ammonium Chloride (BTMAC) is used as a cellulose solvent, a polyester resin gel inhibitor, a

chemical intermediate, a rubber industry paint dispersant, and as an acrylic dyeing assistant. Growing demand from the construction industry, coupled with rising

chemical intermediate, a rubber industry paint dispersant, and as an acrylic dyeing assistant. Growing demand from the construction industry, coupled with rising

infrastructure activities, is driving the demand for paints and coatings thereby benefitting BTMAC

The raw materials

: (i) tertiary amines

(ii)alkyl halides

(iii) general solvents; and

(iv) general and fine chemicals.

In Fiscals 2019, 2020, and 2021, the cost

of raw materials consumed represented 57.34%, 55.52%, and 50.24% respectively

: (i) tertiary amines

(ii)alkyl halides

(iii) general solvents; and

(iv) general and fine chemicals.

In Fiscals 2019, 2020, and 2021, the cost

of raw materials consumed represented 57.34%, 55.52%, and 50.24% respectively

tertiary amines are sourced from both domestic as well as overseas suppliers located at USA, Germany and China. Apart from tertiary amines, the remaining raw materials are primarily sourced from the domestic suppliers in Gujarat and Maharashtra, on a purchase order basis.

What I like

1- Focus on environmental friendly products and green chemistry

2-Fully integrated chain of products

What i dont like

-High valuations

- R&D expenses very low ( 5cr on 300 Cr Sell)

1- Focus on environmental friendly products and green chemistry

2-Fully integrated chain of products

What i dont like

-High valuations

- R&D expenses very low ( 5cr on 300 Cr Sell)

Read about supercapacitors allaboutcircuits.com/technical-arti…

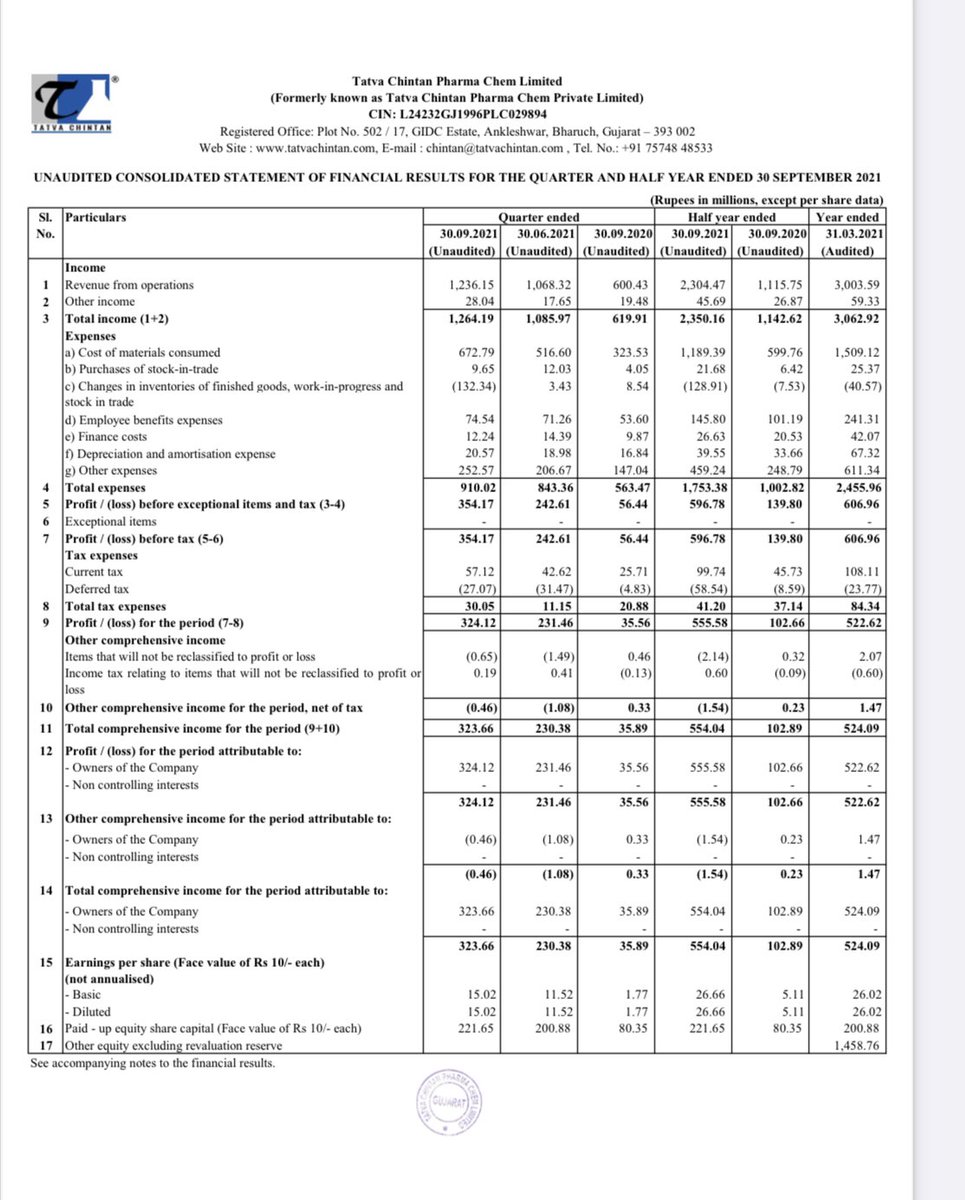

*Tatva Chintan Pharma Q2FY22 concall ( I couldn’t attend- it’s WhatsApp forwarded)

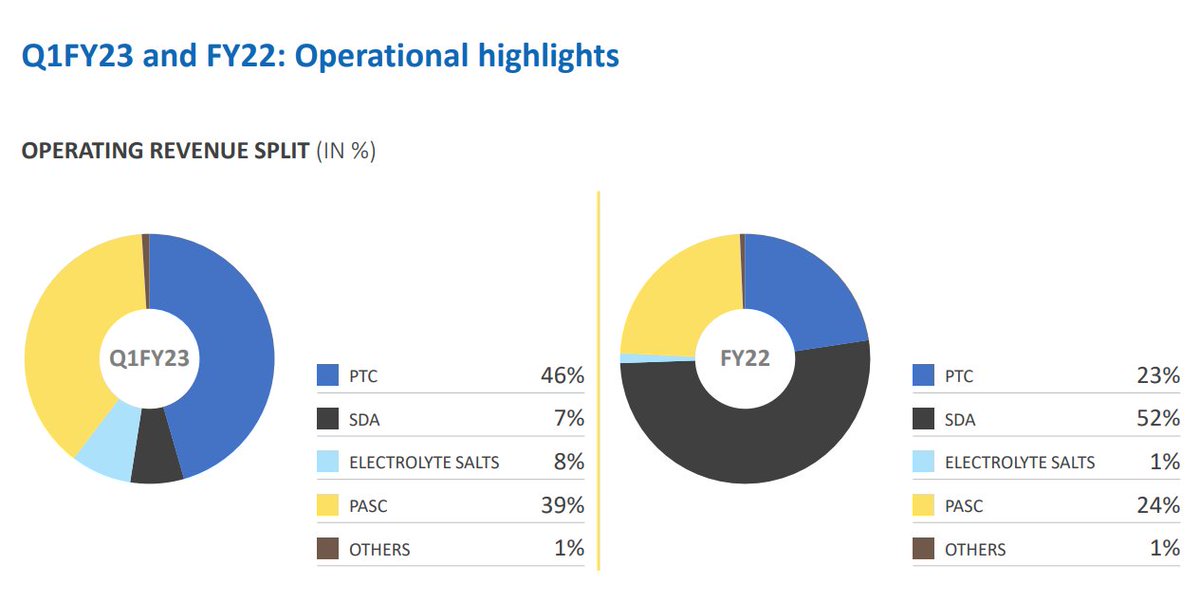

•Segmental contribution - Structure Directing Agents (SDAs) -62%, Phase Transfer Catalysts - 17%, Pharma, Agro Intermediates and Specialty chemicals - 21%, less than 1% Electrolytes salts(SC)

•Segmental contribution - Structure Directing Agents (SDAs) -62%, Phase Transfer Catalysts - 17%, Pharma, Agro Intermediates and Specialty chemicals - 21%, less than 1% Electrolytes salts(SC)

•Growth and margins driven by higher proportion of SDAs in overall revenue mix

•Electrolytes salt for supercapacitors - low revenues in Q2, however good orders in hand, performance to recover from current quarter onwards

•SDA - highest margin

•Electrolytes salt for supercapacitors - low revenues in Q2, however good orders in hand, performance to recover from current quarter onwards

•SDA - highest margin

PASC and electrolytes - similar margins, PTC - lowest among the group

•Normalised EBITDA margins - 24-27%

•Exports - 81% (71%)

•Cash and eq. end-Q2 - ₹ 1,784mn

•Lower Q2 effective tax rate - Lower tax rate at Dahej and export benefits

•Normalised EBITDA margins - 24-27%

•Exports - 81% (71%)

•Cash and eq. end-Q2 - ₹ 1,784mn

•Lower Q2 effective tax rate - Lower tax rate at Dahej and export benefits

•Dahej - last year for 100% tax waiver, 50% of applicable tax rate for the next 5 financial years, extendable by another 5 years based on certain amount of investments/ capex

•Power and fuel cost - 4-5% of overall cost.

•Power and fuel cost - 4-5% of overall cost.

•Capacity utilisation - 90%, almost at saturation

•Offered shorter credit (due to availability of IPO funds) with better pricing, benefitted margins

•SDAs - Normally 50-55% of sales

•SDA demand may slow in next 2-3 months due to chip shortages

•Offered shorter credit (due to availability of IPO funds) with better pricing, benefitted margins

•SDAs - Normally 50-55% of sales

•SDA demand may slow in next 2-3 months due to chip shortages

•SDAs -industry growth rate is 20-25%

•Electrolyte salts - Till Q1, 1 commercial customer and 1 under approval, currently 1 commercial customer and 3 customers under approval phase, none from China

•Each SDA - different price

•24-25 SDAs commercial products

•Electrolyte salts - Till Q1, 1 commercial customer and 1 under approval, currently 1 commercial customer and 3 customers under approval phase, none from China

•Each SDA - different price

•24-25 SDAs commercial products

•Ankaleshwar revenues - ~₹ 100-125cr per year

•Current capacity 280000 kl

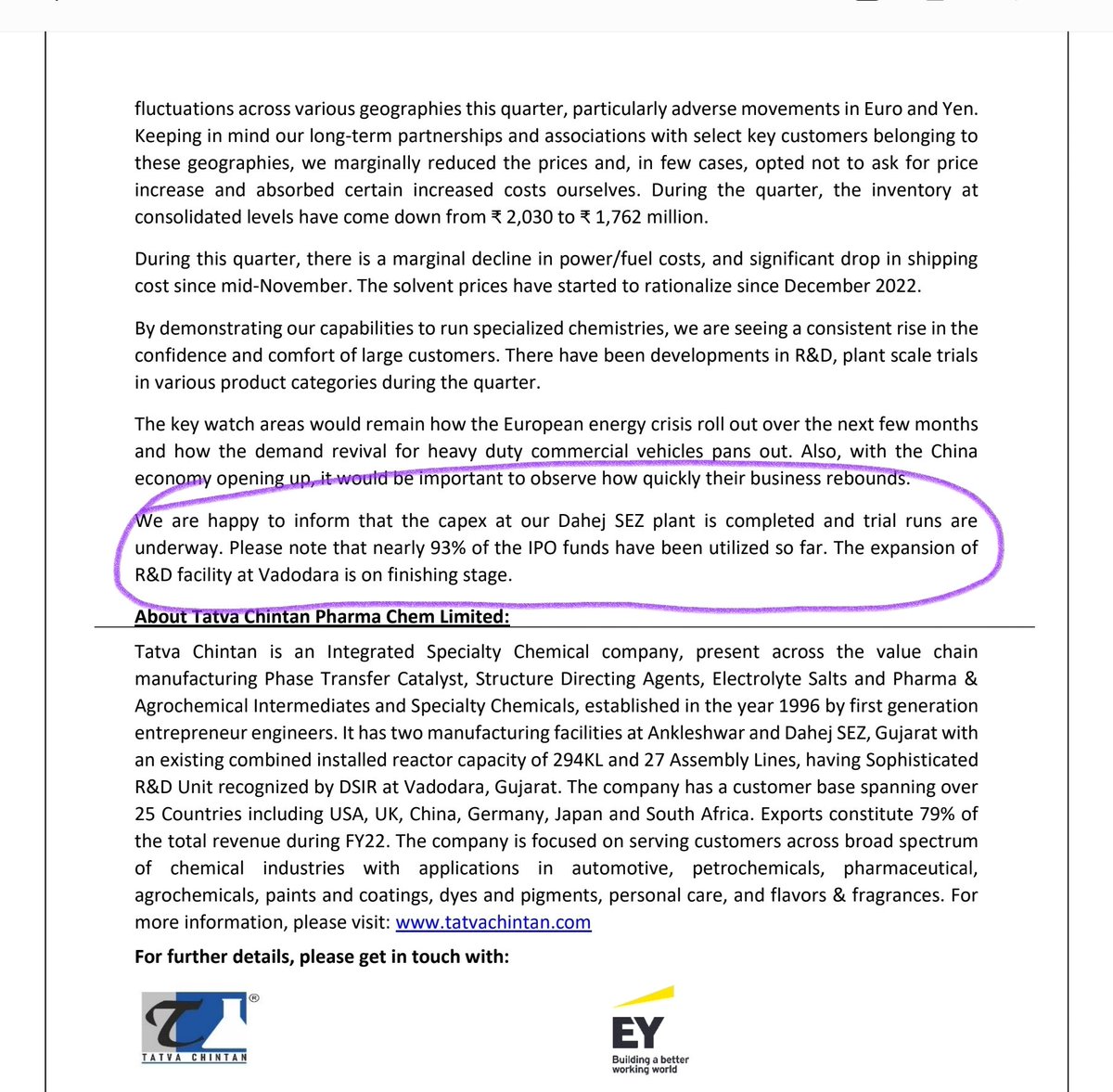

•Dahej expansion expected to be commissioned by November 22

•Current capacity 280000 kl

•Dahej expansion expected to be commissioned by November 22

•Dahej capacity expansion from 200,000KL to 400,000KL

•Dahej capex - ₹ 150cr, ₹ 24-25cr for R&D at Baroda

•Dahej Asset turnover will be 2.5 -3

•Potential to double Dahej revenues post expansion - production by December 2022, commercial production from January 2023

•Dahej capex - ₹ 150cr, ₹ 24-25cr for R&D at Baroda

•Dahej Asset turnover will be 2.5 -3

•Potential to double Dahej revenues post expansion - production by December 2022, commercial production from January 2023

•Scientists - currently 8 Phds., to expand to 20-25 Phds. post R&D expansion.

•3 key products in continuous flow chemistry, moving from R&D to pilot, in pharma and agro intermediates

•Continuous flow chemistry - 4 products currently (from 2 products during IPO),

•3 key products in continuous flow chemistry, moving from R&D to pilot, in pharma and agro intermediates

•Continuous flow chemistry - 4 products currently (from 2 products during IPO),

6 products in pipeline

•Don't expect gross GM pressure in Q3

•Looking for industrial land for next phase of expansion, to be completed in next 3-6 months, post which 12-18 months for environmental approvals

•New player will take at least 4-5 years to come at Tatva's scale

•Don't expect gross GM pressure in Q3

•Looking for industrial land for next phase of expansion, to be completed in next 3-6 months, post which 12-18 months for environmental approvals

•New player will take at least 4-5 years to come at Tatva's scale

•Entry barriers - technology challenge ,technology to produce PTC long customer approval process

•Strong opportunities in Agro and pharma intermediates

•Strong opportunities in Agro and pharma intermediates

Tatva Chintan - ( Chintu ) disappointed me with below expectations results,margins down, Top line disappointed ( Disclosure - Invested and will remain invested)

3-During the quarter, received formal approval for SDAs from two large customers; slow commercialization with these customers will begin in 2022. It has taken three years five years to get formal

product approvals from these customers .

product approvals from these customers .

4-On new product development front, we have successfully submitted commercial sample of a good potential agrochemical intermediate with very stringent quality requirements. We should see commercialization happening in next 12 to 18 month

5-we have a good breakthrough in synthesizing a versatile catalyst which has successfully synthesized three

different products on continuous flow chemistry

Out of Three one is going to be a key raw material for our electrolyte salts itself and also it

different products on continuous flow chemistry

Out of Three one is going to be a key raw material for our electrolyte salts itself and also it

second product is having applications into inks industry. The third one which is being

used as a solvent for coating of metals on the electrodes of the lithium battery

6-During the quarter, purchased a new industrial plot measuring about 5 lakh square feet in the Dahej.

used as a solvent for coating of metals on the electrodes of the lithium battery

6-During the quarter, purchased a new industrial plot measuring about 5 lakh square feet in the Dahej.

7-New Expanded capacity will start by nov 2023

8-had supplied two new electrolyte salts to a different customer. Now this has been commercially approved by them and we are expecting the commercial order to begin from them in this current quarter.

8-had supplied two new electrolyte salts to a different customer. Now this has been commercially approved by them and we are expecting the commercial order to begin from them in this current quarter.

9-Supercapicitor demand-New application in storage area so renewable energy storage space and the existing application where we are selling is into a mix of applications but primarily more into the EV application so its going as a combination with the lithium battery to support

the life of the lithium battery and also to give additional power, booster power of the EV vehicle so that is the kind of application where now this is being used commercially.

10- what happens is when you have supercap battery and when you want to accelerate your EV vehicle

so the moment you press the accelerator there is a larger demand of power that comes out so this instantaneous power requirement is fed by the supercapacitor battery so this is

so the moment you press the accelerator there is a larger demand of power that comes out so this instantaneous power requirement is fed by the supercapacitor battery so this is

what leads to you know saving of your

lithium battery and enhancing its lifecycle within a single charge so that is how this is being applied as a

hybrid system with lithium batteries. This is the kind of new application that is coming up in this area

lithium battery and enhancing its lifecycle within a single charge so that is how this is being applied as a

hybrid system with lithium batteries. This is the kind of new application that is coming up in this area

11- SDA-We have seven customers on board, but one of the largest customers is still where we are into the approval phase yet so that we expect that commercial should happen within this FY2022. Then I can claim that we are there almost with all the major quality customers.

Correction- November 2022 ( not 2023)

Tatva Chintan( Chintu) weak results at every front, probably because of lower revenue from SDA segment .

Tatva Chintan - Concall updates( only Imp points)

PTC segement- we got commercial approval from two well-known MNC customers in pharma

and agro space each, who will start commercial usage from current year. We expect the

revenues for PTC segment to grow at a historical pace.

PTC segement- we got commercial approval from two well-known MNC customers in pharma

and agro space each, who will start commercial usage from current year. We expect the

revenues for PTC segment to grow at a historical pace.

SDAs- ongoing shortage of semiconductor chips availability is leading to a subdued demand of SDAs. The ongoing political crisis has further impacted the semiconductor availability leading into still further postponement of demands of SDAs into auto emission control area.

- expect Q1 and Q2 of FY23, will see a weaker demand in SDAs, though the

underlying demand of SDAs continues to remain very strong. We expect strong demand

revival upon improvement of semiconductor chip availability.

underlying demand of SDAs continues to remain very strong. We expect strong demand

revival upon improvement of semiconductor chip availability.

During the past year, we have got

formal approval from two large customers. Commercial business with one of these customer supply is to begin from Q2. Commercial business with a second customer is under discussion and expected to begin supply from Jan 2023.

formal approval from two large customers. Commercial business with one of these customer supply is to begin from Q2. Commercial business with a second customer is under discussion and expected to begin supply from Jan 2023.

PASC, we manufacture Pharma and Agro Intermediate and Specialty Chemicals products. Under this segment, we have seen year-on-year growth of 12% and revenues have crossed INR 100 crore contributing 23.6% to the revenue.

Under this segment, one of the products is bought into full screen commercialization and should start

getting a good volume growth. One more product which was under the approval

has now been fully approved by the customer and we are beginning actual commercial supply

from Q2.

getting a good volume growth. One more product which was under the approval

has now been fully approved by the customer and we are beginning actual commercial supply

from Q2.

we have developed and submitted our plant scale sample for a new product into area of metal extractions. We expect the commercial supplies to start towards Q4,

5- flame retardants category. We would undertake the full-scale plant trials from June post installation of the

5- flame retardants category. We would undertake the full-scale plant trials from June post installation of the

necessary infrastructure at the Dahej SEZ plant.

We are beginning with one product and gradually intend to develop a portfolio of multiple

products under this category. This is a large product segment, wherein we are focusing on

high purity and niche application area customers,

We are beginning with one product and gradually intend to develop a portfolio of multiple

products under this category. This is a large product segment, wherein we are focusing on

high purity and niche application area customers,

Capacity in Flame Retardants category- 80 to 100 metric tons a month. And with the expansion

coming up online from December of this year, we can increase this capacity to about 4000

metric tons to 5000 metric tons per year, so roughly about 400 to 450 metric tons a month.

coming up online from December of this year, we can increase this capacity to about 4000

metric tons to 5000 metric tons per year, so roughly about 400 to 450 metric tons a month.

Which segment of flame Retardants-printed circuit boards which involve high purity grade of flame retardants applications. There are other commercial applications, for example, in your roofing

sheets, or even in your electric cables,where you don't require very high purity grade

sheets, or even in your electric cables,where you don't require very high purity grade

and Tatva is in high purity grade segment

Using our electrolysis technology, we are seeing good progress towards achieving ultra-high

purity levels of products having application into semiconductors and electronic space. We

have been offered an opportunity by a large MNC customer to take us into approval process

purity levels of products having application into semiconductors and electronic space. We

have been offered an opportunity by a large MNC customer to take us into approval process

Commercialization can take about 18 to 24 months after Once successful, we would be the only Indian company in this segment and also among the select few companies globally.

Our development team has come up with a unique and brilliant solution enabling us to reuse

the solvent. We have recently implemented this technique commercially in our Dahej SEZ

plant. This will enable us to reuse the solvent to the tune of few hundred MTPA.

the solvent. We have recently implemented this technique commercially in our Dahej SEZ

plant. This will enable us to reuse the solvent to the tune of few hundred MTPA.

- for sustainability platform, we have

drastically improved our audit score year on year basis from 54% to 78% last year and this

year we have achieved 87%.

drastically improved our audit score year on year basis from 54% to 78% last year and this

year we have achieved 87%.

Growth expectations- SDA flat,PTC segment to grow at a normal pace where we have been growing at about 20% in that area. The pharma segment where now the commercialization has begun on a full-scale commercialization this is the area where we may expect about 30%to 50% of growth.

Also, the electrolyte salt segment is where we will see a multifold growth maybe four to five times of this year's revenue is what we expect( Low Base) And then we have this addition of flame retardants which will be our new revenue.

Margins- They pass inflated RM price to customers but overall margins affected due to SDA muted growth which is a highest margin business.

MonoGlyme Business-demand for monoglyme could be anywhere in the range of 15,000 to 18,000 metric

tons Globally and TCPL can fulfill 3000 to 4000 metric tons of demand,Mono glyme they are developing dual dehydration process where RM demand will be low and margins will be better

tons Globally and TCPL can fulfill 3000 to 4000 metric tons of demand,Mono glyme they are developing dual dehydration process where RM demand will be low and margins will be better

MonoGlyme will be for EV- Solvent in EV battery prominently used is the dimethyl carbonate, but then with dimethyl carbonate they also add a

few other solvents. So monoglyme is one of those solvents used as a mix combination with

dimethyl carbonate or other solvents to dissolve

few other solvents. So monoglyme is one of those solvents used as a mix combination with

dimethyl carbonate or other solvents to dissolve

the electrolyte salts. So, this becomes the

part of the electrolyte solution within the Li battery.( MonoGlyme in pilot stage after that they will start commercial production )

part of the electrolyte solution within the Li battery.( MonoGlyme in pilot stage after that they will start commercial production )

Read how Glyme based EV battery can be safe ,low cost and sustainable .pubs.rsc.org/en/content/art…

Tatva Chintan - expected bad results because of underperformance of SDA segment ( Semiconductor shortage)

Tatva Chintan-

-✍️During this quarter, we have successfully completed various projects which will have a positive impact in our performance going forward. Just to name a few:- Began re-using a large volume solvent at Dahej SEZ by deploying a latest technology.

-✍️During this quarter, we have successfully completed various projects which will have a positive impact in our performance going forward. Just to name a few:- Began re-using a large volume solvent at Dahej SEZ by deploying a latest technology.

This will ensure competitiveness & cost saving in few products.-

✍️Formulated plans to set-up this similar technology at our Ankleshwar plant.

✍️ Successfully completed plant scale trials of flame retardants.

✍️Formulated plans to set-up this similar technology at our Ankleshwar plant.

✍️ Successfully completed plant scale trials of flame retardants.

✍️ Successfully supplied from pilot scale a new pharma intermediate to a new customer for validation. This product is expected to commercialize in 2024.- -Successfully completed pilot scale trial runs of a new product using continuous flow chemistry.

✍️This product is expected to be commercialized by 2024.- Successfully completed lab scale development of a very important starting material for agro chemical intermediate

Tatva chintan concall- ( Some imp points)

✍️🏿Electrolyte salts-The off take from one of our large customers which was on hold that customer has instructed us to resume supplies from June 2023. The pilot scale sample with another customer has been formally approved and we shall… twitter.com/i/web/status/1…

✍️🏿Electrolyte salts-The off take from one of our large customers which was on hold that customer has instructed us to resume supplies from June 2023. The pilot scale sample with another customer has been formally approved and we shall… twitter.com/i/web/status/1…

• • •

Missing some Tweet in this thread? You can try to

force a refresh