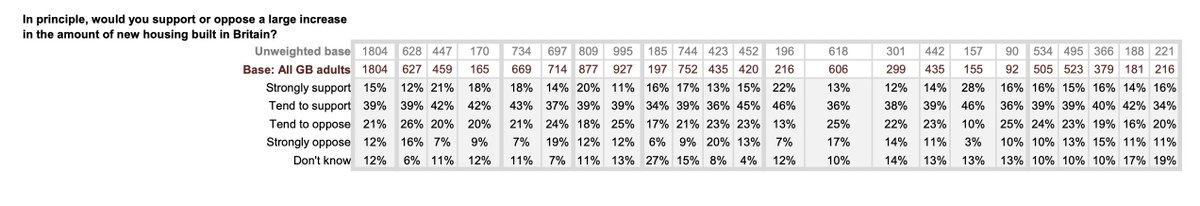

Just digging into recent @yougov polling and found a fascinating reproof to Boris's conference speech - even Tory voters want more housing built! (second column)

It's true that the numbers fall when you change the question to 'in my local area', but it is still a majority - and much, much tighter among Tory voters than you would expect from the rampant Nimbyism on stage.

(Anecdotal side note: it is worth flagging that the true blue activist crowd at our @CPSThinkTank fringe meeting with @jacob_rees_mogg went near-unanimously for more housebuilding when he asked for a voice vote.)

Another interesting finding that should be better-known - voters really want house prices to fall! Finding true across all social groups. People are completely aware of the damage they are doing.

In fact, telling people it will cause house prices to fall is one of the best ways to get them to support more housebuilding...

Of course, in fairness to Boris, people really do oppose building on greenfield. But that's partly because they read it as 'green field' rather than 'often quite scrubby land'

• • •

Missing some Tweet in this thread? You can try to

force a refresh