Mini $BOL.FP #chartstravaganza. Allons-y!

1 / $VIV.FP buying back ~1.5% shares / week at a stub enterprise value of... 0. In next 2 months, self-buyout via ORPA should launch.

1 / $VIV.FP buying back ~1.5% shares / week at a stub enterprise value of... 0. In next 2 months, self-buyout via ORPA should launch.

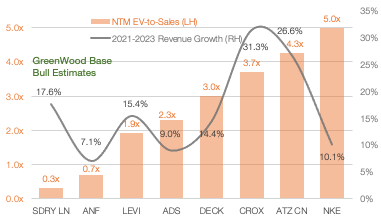

2/ Then $BOL.FP trades for less than the value of its $UMG shares. So basically in 2 months, we will own businesses that generate ~€1.4 billion of EBIT/FCF for.... free... while the share count rapidly shrinks.

3/ Only $VIV.FP buying shares now, but would expect $BOL.FP to start taking out small minority companies with its cleaner balance sheet in the near-term. Especially given the $VIV.FP take-out is largely self-financed...

4/ So you're getting paid €2 billion to take ports + logistics businesses that will generate over €1 billion in EBITDA this year. -2x multiple. "but is the 'e' real?" 😂

5/ While I really love $UMG, with all of the buybacks ongoing/coming, you'll end up owning more UMG / share as this continues, and will be getting ~€2.5 billion in ‘21 EBITDA for free. Oh... and who would you rather at the helm of capital allocation? Just sayin'

• • •

Missing some Tweet in this thread? You can try to

force a refresh