How to get URL link on X (Twitter) App

2/ the company took demoralized maintenance teams, added a few engineers and programmers, as well as partnered with the best university talent to put together its own skunk works R&D team. Rather than being an expensive experiment, it's bending cost curves, saving capex and increasing operations up time.

2/ the company took demoralized maintenance teams, added a few engineers and programmers, as well as partnered with the best university talent to put together its own skunk works R&D team. Rather than being an expensive experiment, it's bending cost curves, saving capex and increasing operations up time.

1/ order book for new container ships is massive- 23% of current fleet, while not a peak from % perspective, it means a tremendous amount of new capacity coming online in 23 & 24. In fact, notional capacity added in 2023-2024 will be the same as 2007-2008, which was no bueno.

1/ order book for new container ships is massive- 23% of current fleet, while not a peak from % perspective, it means a tremendous amount of new capacity coming online in 23 & 24. In fact, notional capacity added in 2023-2024 will be the same as 2007-2008, which was no bueno.

2/ Investors associated the stock reaction with a communication & management failure- which was really lost on me. After being "burned," no buy-siders bothered to attend the late day "chat" with Sergio... it was only that skeleton crew in the distance

2/ Investors associated the stock reaction with a communication & management failure- which was really lost on me. After being "burned," no buy-siders bothered to attend the late day "chat" with Sergio... it was only that skeleton crew in the distance

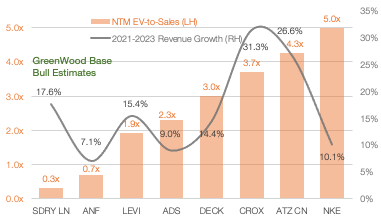

2/ Investors continue to question the viability of Superdry'a brand due to prior management errors and Covid-19.. $SDRY.LN stock is down -87% since 2018, significantly underperforming the FTSE250

2/ Investors continue to question the viability of Superdry'a brand due to prior management errors and Covid-19.. $SDRY.LN stock is down -87% since 2018, significantly underperforming the FTSE250

2/ Then $BOL.FP trades for less than the value of its $UMG shares. So basically in 2 months, we will own businesses that generate ~€1.4 billion of EBIT/FCF for.... free... while the share count rapidly shrinks.

2/ Then $BOL.FP trades for less than the value of its $UMG shares. So basically in 2 months, we will own businesses that generate ~€1.4 billion of EBIT/FCF for.... free... while the share count rapidly shrinks.

https://twitter.com/mjmauboussin/status/1329019808323686400?s=20