🛣️My Journey from 5000₹ to 1Cr₹

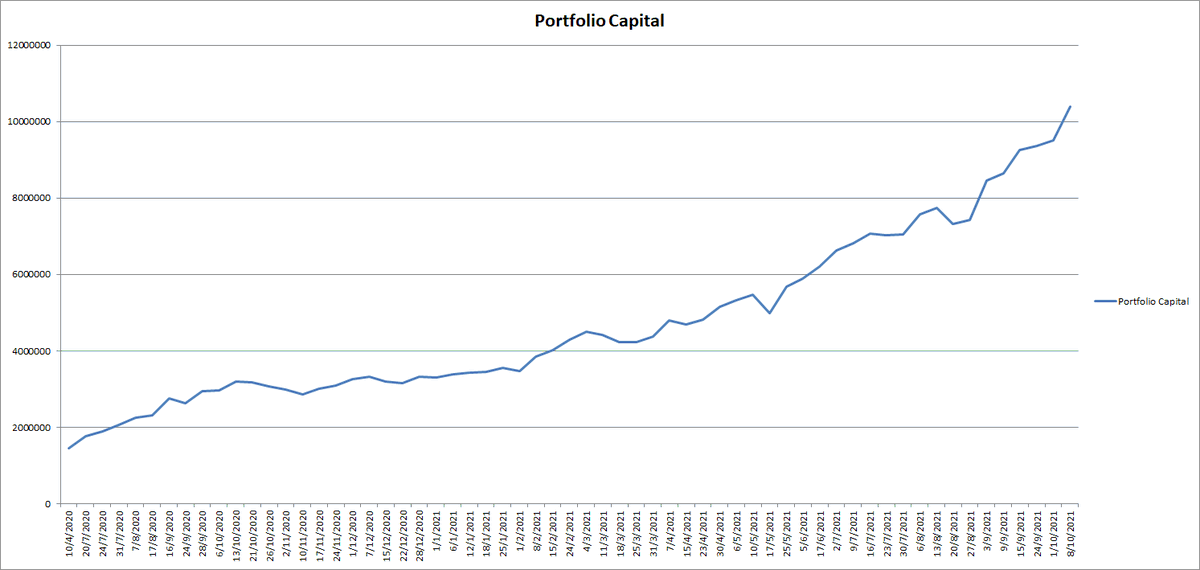

Stock market journey that started with just 5000, now with 7.2X return on PF from Apr20 With Capital in Apr20 was 14.5L &

With 617%(7.2X) return in 17months PF increased to 1.04Cr₹(equity trade only)

Here is my journey in brief,

Stock market journey that started with just 5000, now with 7.2X return on PF from Apr20 With Capital in Apr20 was 14.5L &

With 617%(7.2X) return in 17months PF increased to 1.04Cr₹(equity trade only)

Here is my journey in brief,

In 2011, when I joined my 1st Job, A banker came to our hostel to open Bank Acc. of all new Joinee along with that he also opened our Demat acc. in HDFC sec by taking many signs

Few of my colleague (from metro cities) started dabbling in share market, So I also thought to (3/n)

Few of my colleague (from metro cities) started dabbling in share market, So I also thought to (3/n)

Start as I was always curious about share market from college days but does not know anything other than sensex headline in TOI paper.

I bought Indiabulls Power share worth Rs 5000 only as was working in same and in 2 months I earned 500₹.

Then from one of my friend 4/n

I bought Indiabulls Power share worth Rs 5000 only as was working in same and in 2 months I earned 500₹.

Then from one of my friend 4/n

I heard the name of legendary investor Rakesh Jhunjhunwala but actually he said only negative points about him, लेकिन मैंने सोचा ऐसा नही हो सकता and I started searching about him on internet in my company's computer. फिर मुझे पता चला कि मेरा दोस्त गलत है & RJ actually made a 5/n

Fortune from share market by good way & by buying good companies &holding it for years.

फिर मैंने सोच लिया कि मुझे भी ऐसी ही अच्छी कंपनिया ढूंढ़नी है और लंबे समय रखनी है.

मेरे पास Computer नही था, तो मैंने room partner का laptop लिया(क्योंकि वो कुछदिन घर गया था) और फिर 6/n

फिर मैंने सोच लिया कि मुझे भी ऐसी ही अच्छी कंपनिया ढूंढ़नी है और लंबे समय रखनी है.

मेरे पास Computer नही था, तो मैंने room partner का laptop लिया(क्योंकि वो कुछदिन घर गया था) और फिर 6/n

Continuous 3 दिन पूरी रातभर मैं कंपनीयो के बारे में research करने लगा. उस समय तो 4G नही था मोबाईल के 2G net से ही में काम चला रहा था. 3 रात research करने के बाद मैने 6-7 sectors से 1-2 कंपनिया चुनी जैसे Alembic Pharma, Persistent, Yes bank, Biocon ,Bajaj corp etc. on purely 7/n

Fundamental data. मेरा ये ध्येय था कि I have to choose a small size company which potentially become bigger.

But, I don't had starting capital, as I am coming from lower middle class family & my father already retired few yrs ago I had to sent money back home. My salary was 22K

But, I don't had starting capital, as I am coming from lower middle class family & my father already retired few yrs ago I had to sent money back home. My salary was 22K

By keeping just 7K with me, rest i used to sent home, from that 5K left with me for share market after expenses.

I started investing in selected stocks from whatever small amount I had from may 2012.

I bought Alembic pharma at 50, persistent at 150 & they started to rise & 9/n

I started investing in selected stocks from whatever small amount I had from may 2012.

I bought Alembic pharma at 50, persistent at 150 & they started to rise & 9/n

Few of my stocks became 3X to 10X in next 3-4 years. But in 2013-14 bull run in euphoria I also bought some infra/real estate stocks that gave me some big losses though I always remain net positive due to few big winners.

I learned my 1st lesson never buy Infra/RE/Debt 10/n

I learned my 1st lesson never buy Infra/RE/Debt 10/n

Laden stocks blindly.

In 2015 I got to know that earnings has some good relationship with price rise & I started buying the stocks which are giving good earnings surprises, like I bought Minda at 40 in 2015, Balaji amines, Navin fluorine, Canfinhomes & few comm. Chemicals

In 2015 I got to know that earnings has some good relationship with price rise & I started buying the stocks which are giving good earnings surprises, like I bought Minda at 40 in 2015, Balaji amines, Navin fluorine, Canfinhomes & few comm. Chemicals

in 2016. In 2017 many stock gave me good return. My biggest stock Minda ind. Gave 8X return but in 2018 tide started to turn and profits from my winners started shrinking.

I learned my 2nd lesson that I should also follow Technicals and trend along with fundamentals 12/n

I learned my 2nd lesson that I should also follow Technicals and trend along with fundamentals 12/n

So that I can exit them without eroding much profit. 2018-19 not the good year for small/mid caps during this time , I read how to made money in stocks by william O niel & @markminervini books & surprised to see what I learned & experienced all these years actually written 13/n

In these books. So from all this I develop my #MovingTechnoFunda strategy.

I also traded FnO here & there in 2017-19 but not able to do much but in options in 2019 I was consistently in profit for last 3 months & earned 1-2% return on capital from weekly expiry but as 14/n

I also traded FnO here & there in 2017-19 but not able to do much but in options in 2019 I was consistently in profit for last 3 months & earned 1-2% return on capital from weekly expiry but as 14/n

Volatility increased in late dec 2019 due to my shift job I stopped that as it require more screen time.

From June 2019 market also started going up & few good stocks I bought from my #movingTechnoFunda strategy also started going up like polycab, amber, Dixon, Deepaknitrite

From June 2019 market also started going up & few good stocks I bought from my #movingTechnoFunda strategy also started going up like polycab, amber, Dixon, Deepaknitrite

Giving 50 to 80% return in 6 months and then came corona crash but sensing situation in China in Jan & in Italy I was always on alert & exited all my holdings in Last week of Feb as market started to become volatile & that really helped me to preserve my hard earned capital 16/n

In all through this brutal phase of bear market. & Then came the biggest opportunity of my life I put all my learnings & experience of 10years into work & started buying stronger #TechnoFunda names slowly from Apr20 & then aggressively from June 20 starting with Aarti drugs 17/n

This time I bought stocks with bigger position size of more than 15-20% and that really lift my equity curve sharply.

Bcoz position sizing came from conviction is big edge.

And I also apply Technical analysis to exit my winners after 3X to 6X gains & enters into next 18/n

Bcoz position sizing came from conviction is big edge.

And I also apply Technical analysis to exit my winners after 3X to 6X gains & enters into next 18/n

Multibagger stocks that helped me to compound my capital at good speed

Some of my big winners of this bull run are

AartiDrugs 5X

Laurus 6X

Neuland 6X

Balaji Amines 6X

Happiest minds 5X

Solara 3X

Ease my trip 3X

Granules 2X

Panama 2X

Rajratan 4X

Globus 3.5X

IRCTC 2.5X

Some of my big winners of this bull run are

AartiDrugs 5X

Laurus 6X

Neuland 6X

Balaji Amines 6X

Happiest minds 5X

Solara 3X

Ease my trip 3X

Granules 2X

Panama 2X

Rajratan 4X

Globus 3.5X

IRCTC 2.5X

Apollo tricot 2X

Apollo pipes 2X

Nitin spinners 2.5X

Venkys 2X

Tyche 2X

And few other 30 to 60% winners 20/n

Apollo pipes 2X

Nitin spinners 2.5X

Venkys 2X

Tyche 2X

And few other 30 to 60% winners 20/n

I really took inspiration from @Mitesh_Engr sir @madan_kumar sir the way they compound their capital by option trading & @vivbajaj sir the way he compound his money in commodity trading in 08

That gave me belief & helped me to compound my capital from 14.5L in Apr20 to 1Cr now

That gave me belief & helped me to compound my capital from 14.5L in Apr20 to 1Cr now

In all these years I haven't took any Traning or course or not subscribe to any paid advisory services, all self learning & free services of @mystockedge & @screener_in helped me a lot. My 98% research and 100% trading is done by mobile only.

I just recently bought Monitor 22/n

I just recently bought Monitor 22/n

And took subscription of @mystockedge @screener_in @in_tradingview.

This 617% return on capital is not easy for me bcoz I have full time job & that too with shift duty including night shifts, 33% of time(in a yr) I have to sleep during trading hrs due to night shift duty & 23/n

This 617% return on capital is not easy for me bcoz I have full time job & that too with shift duty including night shifts, 33% of time(in a yr) I have to sleep during trading hrs due to night shift duty & 23/n

have to miss all trading action , plus morning/afternoon/night shift duty takes a complete toll on day to day schedule be it meal/sleep/health/other activity due to continuous changing shift every 2 days

But the passion & will power to succeed kept me ignited all these years 24/n

But the passion & will power to succeed kept me ignited all these years 24/n

In all these years whenever I thought it's not working for me & feel down/depressed, फिर मै Chhatrapati Shivaji Maharaj और उनके पराक्रम & Chhatrapati Sambhaji Maharaj के बलिदान के बारे में सोचता हूं. कैसे छत्रपती शिवाजी महाराज ने विपरीत परिस्थितियों इतने सारे दुश्मनों/लुटेरों 25/

से लड़कर शून्य से स्वराज्य स्थापन किया. मुघल औरंगजेब को तह के नुसार अपने 23 किले देने के बाद भी उन्होंने हार नही मानी और आग्रा के कैद से औरंगजेब को चकमा देकर फिर से सारे किले जीत लिये. This motivates me to continue to do hard work भले कितनी भी कठिनाइया आती रहे. (26/n)

जैसे भगवान श्रीकृष्ण कहते है.

कर्मण्येवाधिकारस्ते मा फलेषु कदाचन ।

अपना कर्म करते रहिए , उसका फल अपने आप एकदिन आपको मिलेगा

जय हिंद जय शिवराय जय शंभुराजे 🚩

कर्मण्येवाधिकारस्ते मा फलेषु कदाचन ।

अपना कर्म करते रहिए , उसका फल अपने आप एकदिन आपको मिलेगा

जय हिंद जय शिवराय जय शंभुराजे 🚩

This is just the new begining for me. And like in cricket after hitting century good batsman again takes a guard and continue to Bat, i am also taking may guard again.

Though i was not active on twitter before 2019 , but after that made few good friend here @dcoolsam @zeeeshansyed @swing_ka_sultan

And i also thanks all my well wishers

And i also thanks all my well wishers

I also thank @unseenvalue and @varinder_bansal for there good fundamental inputs on various topics

Stock Exit Signals

https://twitter.com/KiranBhosale007/status/1426189760498786314?t=2cvX45X8AFXelM_Awx7uPQ&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh