3. Supply is so much you are allowed to pick Apples for free..and take home.

In this particular orchard, the exchange rate or trade deficit is immaterial.

You can't sell an apple, it's excess supply.

In this particular orchard, the exchange rate or trade deficit is immaterial.

You can't sell an apple, it's excess supply.

4. However drive a few miles to the nearest town and Apples are being sold.

The price of Apples here are based on supply from orchards.

More supply, price falls

Less supply, price rises

The trade deficit or $ to ¥ or National debt is immaterial. All that matters is supply

The price of Apples here are based on supply from orchards.

More supply, price falls

Less supply, price rises

The trade deficit or $ to ¥ or National debt is immaterial. All that matters is supply

5. Same for these tomatoes

They are everywhere.

If dollar $1 is N1 it does not change the price per basket of tomatoes..IN THIS FIELD

They are everywhere.

If dollar $1 is N1 it does not change the price per basket of tomatoes..IN THIS FIELD

6. Yet a 40kg basket of tomatoes sells for about N31k online. Why?

There is no value chain investment

1. No post harvest processing

2. No storage

3. Poor logistics

That N30k is the opportunity cost of having poor local infrastructure, not the cost of the basket.

There is no value chain investment

1. No post harvest processing

2. No storage

3. Poor logistics

That N30k is the opportunity cost of having poor local infrastructure, not the cost of the basket.

One thing you notice is the infrastructure around farms in the abroad, how the produce is aggregated,STORED and processed.

This ensures there are inputs for processing post harvest

In effect, supply after the unnaturally high supply during harvest.

This ensures there are inputs for processing post harvest

In effect, supply after the unnaturally high supply during harvest.

The FGN has about 33 Silos of about 33,000 to 100,000 tonnes. So let's assume 3.3m total capacity, or even 5m

Nigeria is the largest producer of maize in Africa about 10m tonnes a year.

You can see the excess harvest if not consumed or processed, is likely to waste.

Nigeria is the largest producer of maize in Africa about 10m tonnes a year.

You can see the excess harvest if not consumed or processed, is likely to waste.

You see corn during corn season in 🇳🇬 and prices fall.

After harvest, prices go right back up, not because exchange rate changed or inflation but demand stayed constant while supply fell.

To beat food inflation, you artificially "extend" harvest by processing & storage

After harvest, prices go right back up, not because exchange rate changed or inflation but demand stayed constant while supply fell.

To beat food inflation, you artificially "extend" harvest by processing & storage

In essence, you take tomatoes from this field, store, process, brand, market and distribute.

Thus tomato "harvest" prices stay longer than just harvests periods.

Thus tomato "harvest" prices stay longer than just harvests periods.

This is what Dangote and others are seeking to accomplish with Dangote Processing Plants.

But infrastructure is so weak that Dangote Tomato struggles to get raw tomatoes, according to Bloomberg.

But infrastructure is so weak that Dangote Tomato struggles to get raw tomatoes, according to Bloomberg.

What Nigeria needs is smaller processing plants in clusters of harvest, maybe in LGAs that are predominately rural.

The US value chain has been processed as key. Processing and Storing

The US value chain has been processed as key. Processing and Storing

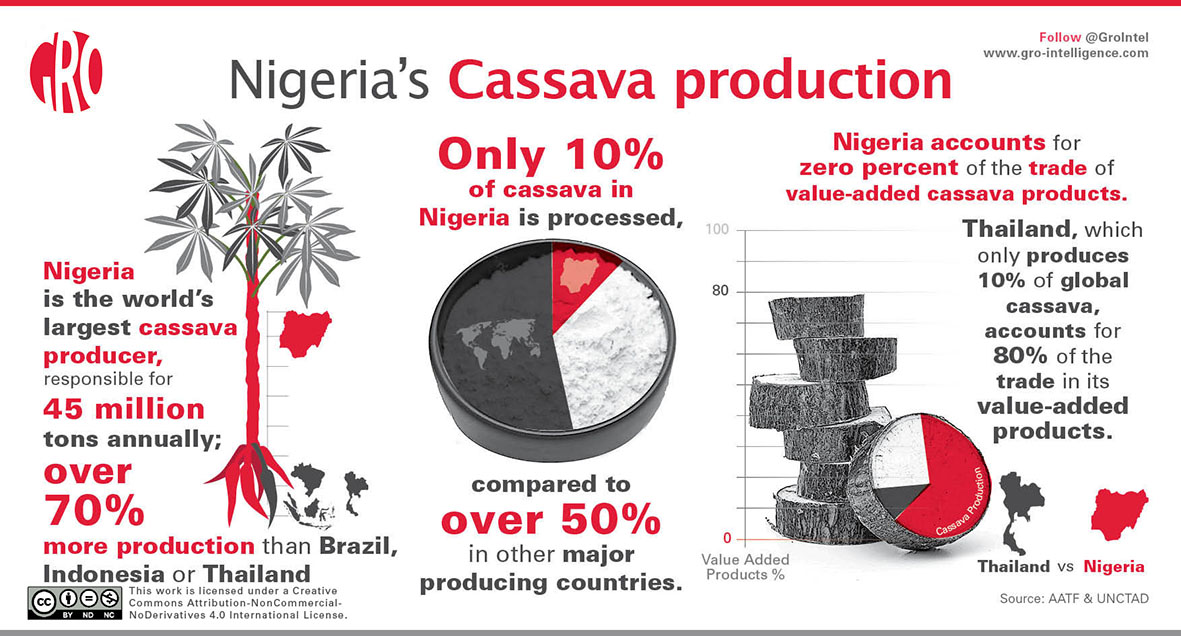

Take cassava.

Go from small scale manual processing to medium scale processing.

These containers process cassava from tuber to flour or paste.

Remember, the goal is to extend the harvest prices and keep supply up.

Go from small scale manual processing to medium scale processing.

These containers process cassava from tuber to flour or paste.

Remember, the goal is to extend the harvest prices and keep supply up.

Think of this.

Nigeria is the worlds largest producer of cassava, yet gari is expensive

Thailand produces less cassava than Nigeria but gets 80% value-added trade-in products.

Nigeria is the worlds largest producer of cassava, yet gari is expensive

Thailand produces less cassava than Nigeria but gets 80% value-added trade-in products.

In summary, move up the value chain.

Prioritise, Storage and processing.

Then harvest prices stay longer.

Even if they are imported, it's a one time CAPEX, but it's payback is lower food inflation.

Prioritise, Storage and processing.

Then harvest prices stay longer.

Even if they are imported, it's a one time CAPEX, but it's payback is lower food inflation.

• • •

Missing some Tweet in this thread? You can try to

force a refresh