0/ In today’s Delphi Daily, BTC is leading the way and @0xPolygon transactions drop.

BTC’s dominance has been rising and taking the total crypto market cap with it.

For a deeper dive 🧵👇

BTC’s dominance has been rising and taking the total crypto market cap with it.

For a deeper dive 🧵👇

1/ Market Update-

Besides a market sell of $40m worth of BTC leading to pullback yesterday, the weekend was rather uneventful, with a handful of altcoins outperforming BTC.

Bitcoin swiftly recovered and continues exuding strength, relative to most of the digital assets market.

Besides a market sell of $40m worth of BTC leading to pullback yesterday, the weekend was rather uneventful, with a handful of altcoins outperforming BTC.

Bitcoin swiftly recovered and continues exuding strength, relative to most of the digital assets market.

2/ It’s officially Bitcoin season. In the last 24 hours, only 4 crypto assets in the CoinGecko top 100 have managed to outperform Bitcoin’s immense strength.

In the last 7 days, only 12 crypto assets outperformed BTC.

In the last 7 days, only 12 crypto assets outperformed BTC.

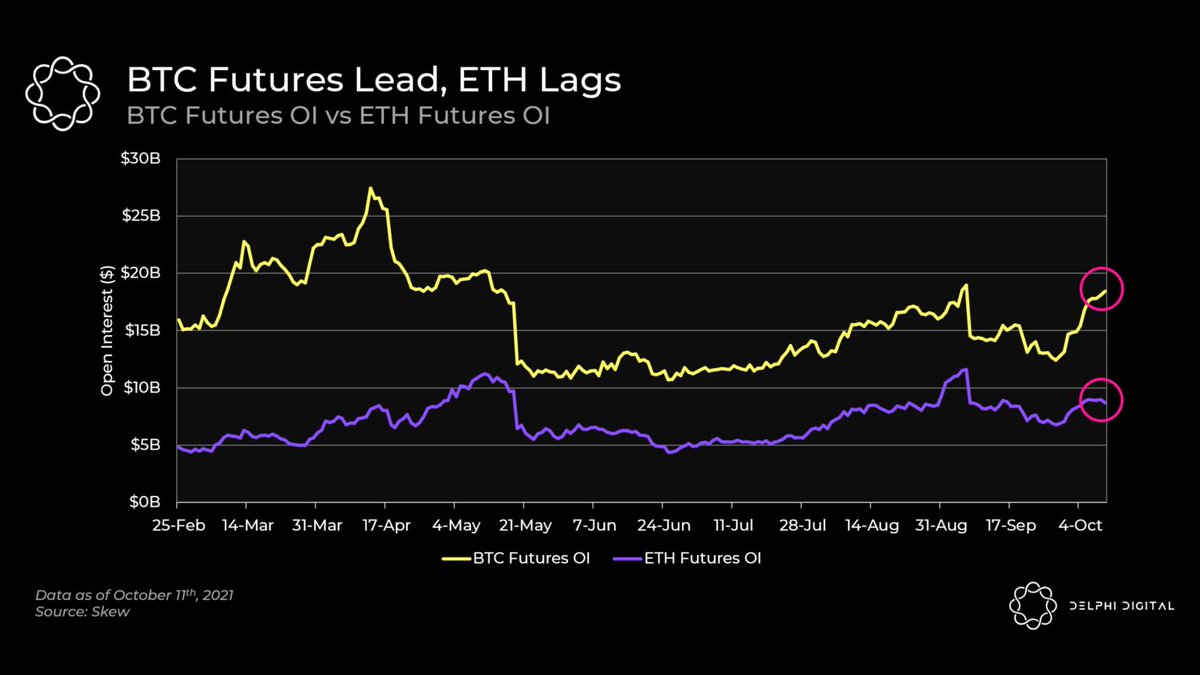

3/ ETH and BTC OI have been mirroring each other from July until End of September. This changed in early October when a clear divergence between the two emerged.

BTC OI is still 30% away from May highs, suggesting that markets have yet to reach a state of euphoria & FOMO.

BTC OI is still 30% away from May highs, suggesting that markets have yet to reach a state of euphoria & FOMO.

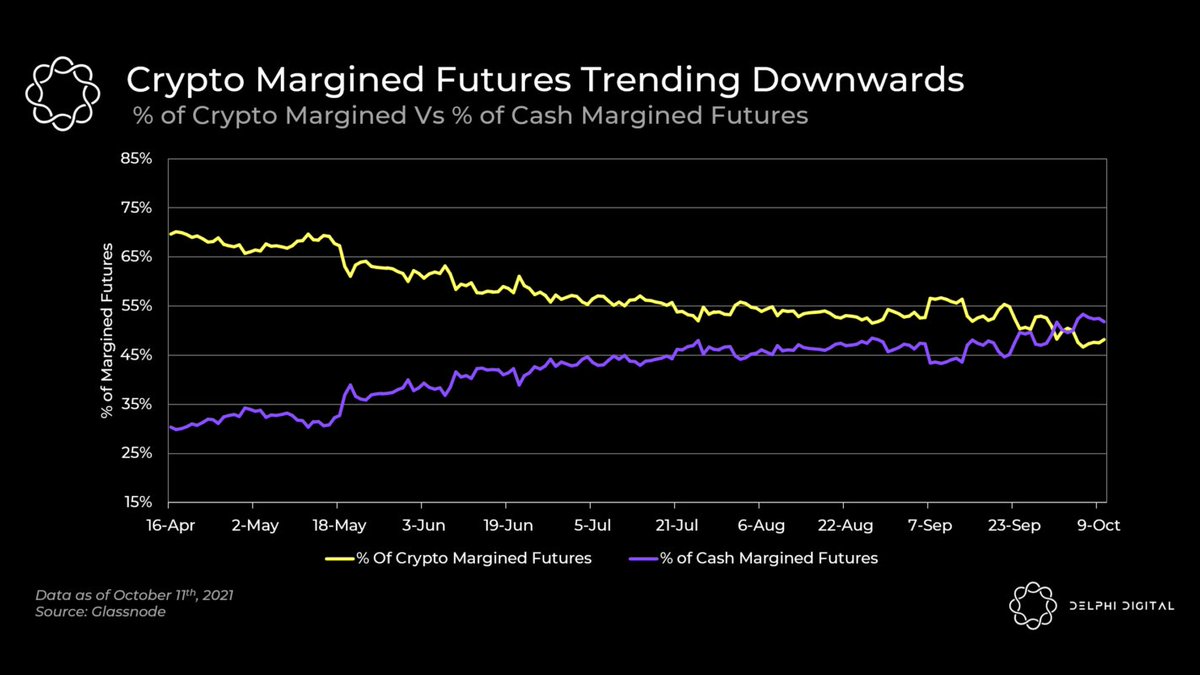

4/ Since May 2021, crypto-margined futures have been on a multi-month downtrend as cash-margined futures gain a significant share of futures OI.

One of the main implications of this is reduced directional convexity.

One of the main implications of this is reduced directional convexity.

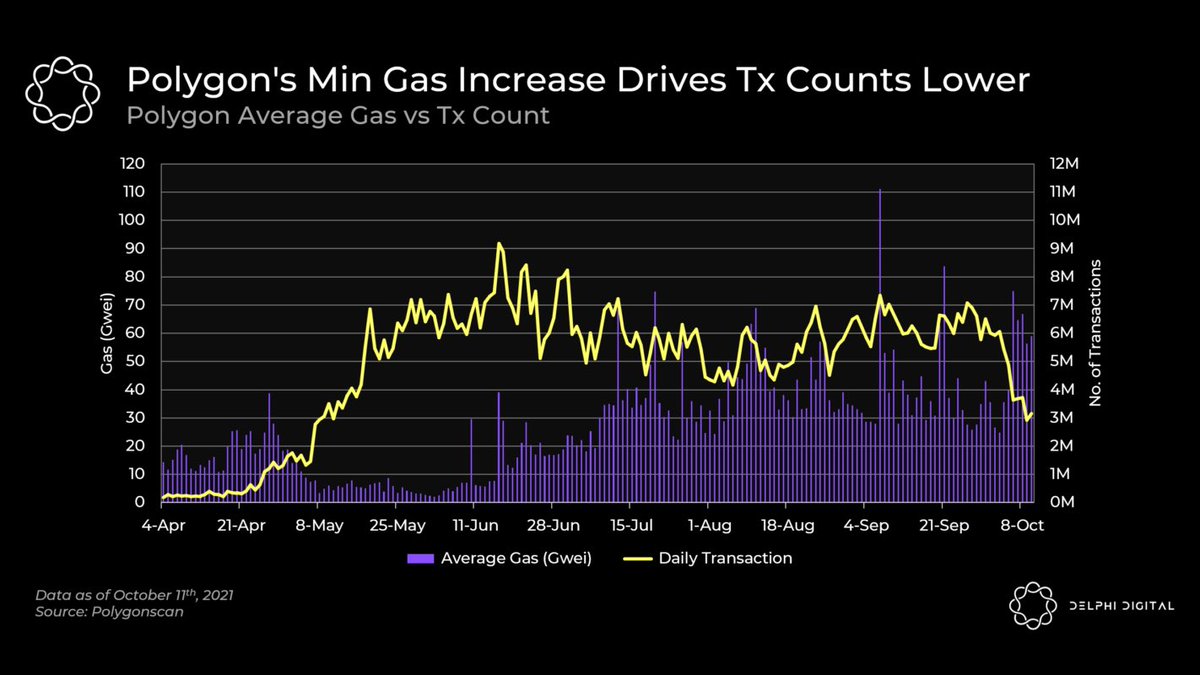

5/ On Saturday, @0xPolygon’s made a decision to push a client update to increase min gas to fight spam and improve network health.

Average gas has spiked and is consistently above 50+ Gwei since then and the increased fees have likely caused daily tx count to fall substantially

Average gas has spiked and is consistently above 50+ Gwei since then and the increased fees have likely caused daily tx count to fall substantially

6/ Tweets of the day!

Fantastic $MIM explainer from our very own @larry0x.

Fantastic $MIM explainer from our very own @larry0x.

https://twitter.com/larry0x/status/1447510323532029955

8/ Check your wallets for the $BOTTO airdrop.

https://twitter.com/redlioneye13/status/1446828070241980420

10/ Crypto moves fast. Delphi has you covered. Sign up here to get Delphi's free daily newsletter delivered right to your inbox every weekday

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh