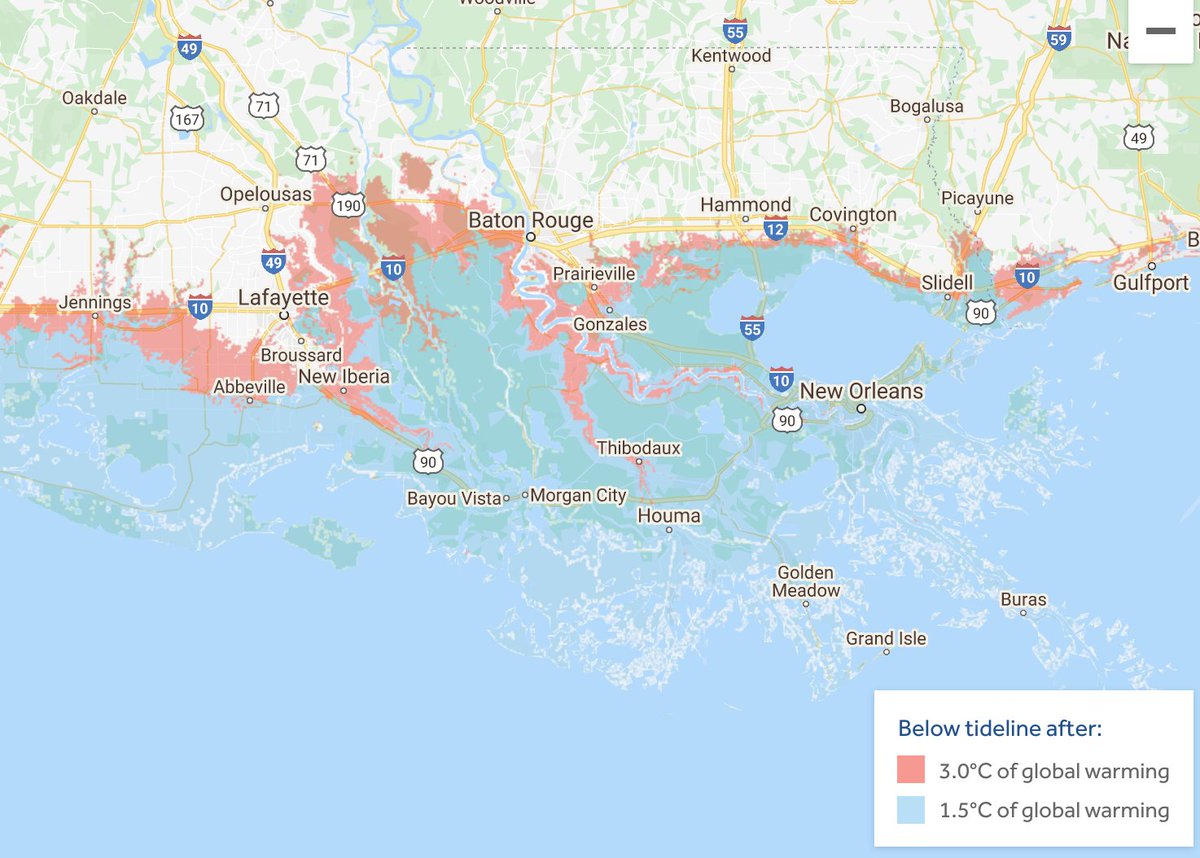

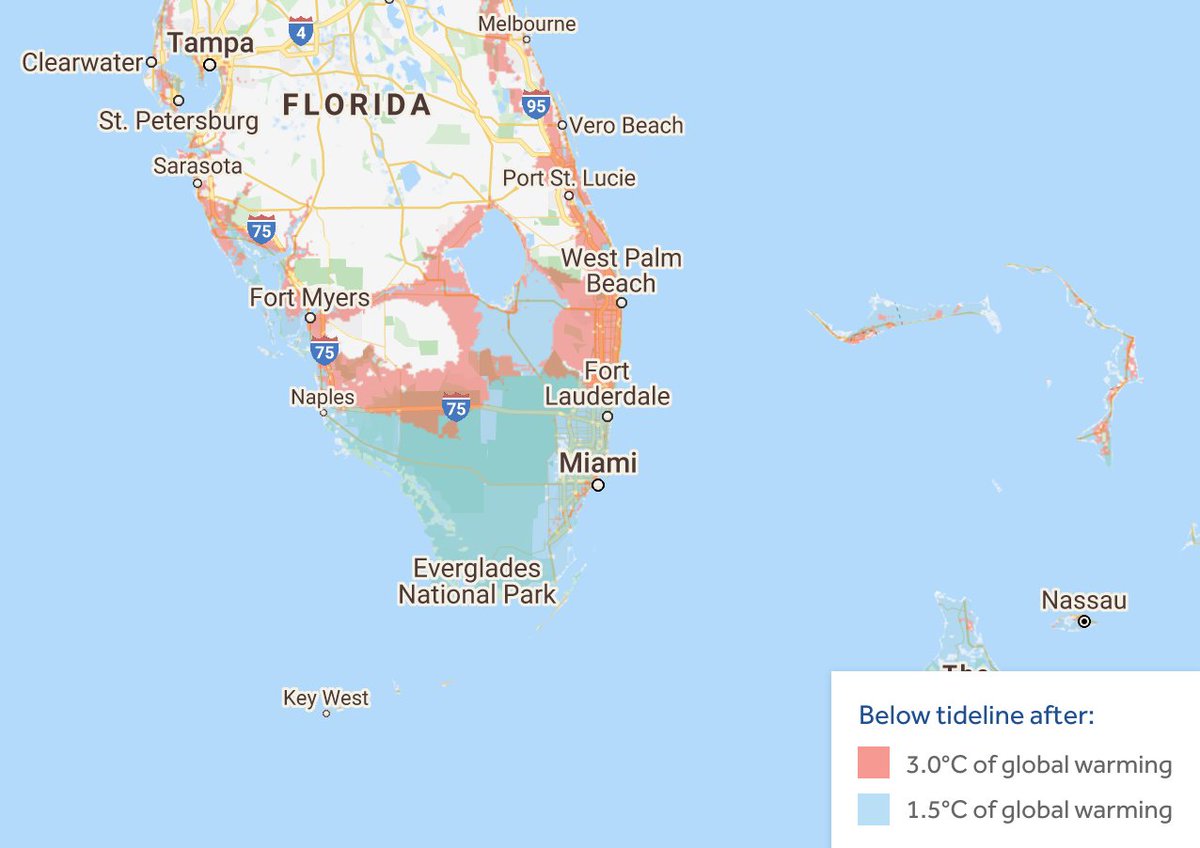

The unintentional lesson in this map is that for Boston, it doesn't really matter much whether we stop emitting greenhouse gases tomorrow or just relax and keep on going. The 1.5º C of warming responsible for most of the flooding is already baked in.

https://twitter.com/hyde_timothy/status/1447990884432113666

This fallacy comes up a lot in the discussions of climate change. Because so much warming is already locked in, the baseline for comparing various future scenarios should not be how things look today. That is an unattainable future goal unless we start doing crazy geoengineering.

When you stop framing the climate question as "can we save Miami?" and replace it with the more correct "can we save West Palm Beach?", it becomes less motivating. People have done a poor job communicating how much future impact is already irreversible.

The other lesson of these maps is that we're a few years away from crazy geoengineering projects (which I'm into!) to cool the planet becoming politically viable. It takes the whole world singing kum-ba-yah to limit emissions, but it only takes one country to blow up a volcano.

• • •

Missing some Tweet in this thread? You can try to

force a refresh