Every founder I know wants to speed through seed stage and get that big Series A check.

That is a huge mistake.

Here's how you can build a much bigger company by making your time in seed count:

That is a huge mistake.

Here's how you can build a much bigger company by making your time in seed count:

Many many founders find good market traction with an idea. Very very few keep experimenting until they find insatiable demand and true product market fit.

The thing about startups is that their outcomes are pretty binary. Have you built something that people love or not? If you race through seed, the likelihood that you've put the time in to find the largest opportunity in the space you are exploring is very small.

The Marshmallow Test famously studied children who could resist eating a marshmallow for a period of time in order to receive more marshmallows later.

en.wikipedia.org/wiki/Stanford_…

en.wikipedia.org/wiki/Stanford_…

Researchers found a good link between the ability to delay gratification and measurable life outcomes of those children, including SAT scores, BMI, and educational attainment. It’s widely accepted that the ability to delay gratification is a solid contributor to life happiness.

Founders face a very significant marshmallow test very early in their companies. Do you want some traction now and get into execution or do you want to find Product Market Fit (PMF)?

For a long time, startups were mechanically difficult and capital intensive because they involved making hardware, or standing up bunches of physical servers, and a lot of very low-level development.

The opposite is true for most startups today. There is no physical product, your servers are taken care of by AWS, you build off of large open source frameworks, and post-covid your people aren’t even in one physical office.

But we still develop companies as if there was a huge cost to change and experimentation. And we still have a culture that the way to get to insatiable demand is to start with good demand and iterate on it. When change was hard, that was the only path. Now it is not.

My experience is that incremental change rarely finds a 10x bigger opportunity for a seed stage startup. In my first company, NetGravity, we iterated on our idea for an ad server for six months, talking to dozens of potential customers, before figuring out what to build.

And then within three months, realized that the much bigger opportunity was in moving to completely real-time ad serving from the static model we had started with.

And a couple of years in, it became clear that moving to a fully cloud-based model where customers didn’t install our software would be better for them and us. The whole process was intentional, but slow. Fast forward to today, this type of intentional discovery is 100x easier.

When my friend Neil D’Souza set out to figure out his next company, he had a dozen ideas. Every week he would run a set of experiments and look for strong demand. If he found it, he would double down in that area and see if he could 10x demand again.

He spent an entire year going through the ideas, but eventually landed on getsetup.io, a senior to senior live learning community and social network, which has some of the strongest product-market fit I have ever seen.

In a year, he built something with much higher PMF than NetGravity, a company I took public and sold for $750 million.

Back to the marshmallow test. The marshmallow for a founder is good product-market fit. Moving from “your idea sucks” to “someone likes your idea” is a really incredible feeling. Almost every founder grabs that marshmallow and wolfs it down.

They go into execution mode, hire people, and build a business around it. The iconic founder does not. She is happy about that early signal, but has in her mind what insatiable demand looks like and keeps experimenting until she finds it.

One of the reasons I almost never invest in seed companies alongside venture firms is that they have a post-PMF mentality. They want to understand the northstar metrics and evaluate the team on improving those metrics through solid execution.

That is a very good way to create a moderately successful company. Great seed stage companies are creative rather than execution plays.

Just as developing an execution cadence is so crucial to later stage companies, developing a creative cadence is crucial to seed companies. You have to find the absolute maximum demand in the space you are exploring. The best cadence is to run a new uncorrelated experiment daily.

While demanding, you are likely to find the point of highest demand this way. It is incredibly easy to abandon this kind of rigor and delayed gratification, eat the marshmallow and take a good idea and execute on it. Great founders resist that, and great investors do too.

I hope you liked this thread. I write about all of the issues facing early stage startups. Please follow me @jwdanner and please retweet this to help other founders.

Here is a blog piece I wrote about this in case you aren't tired of this yet :)

johnwdanner.medium.com/pmf-is-the-fou…

johnwdanner.medium.com/pmf-is-the-fou…

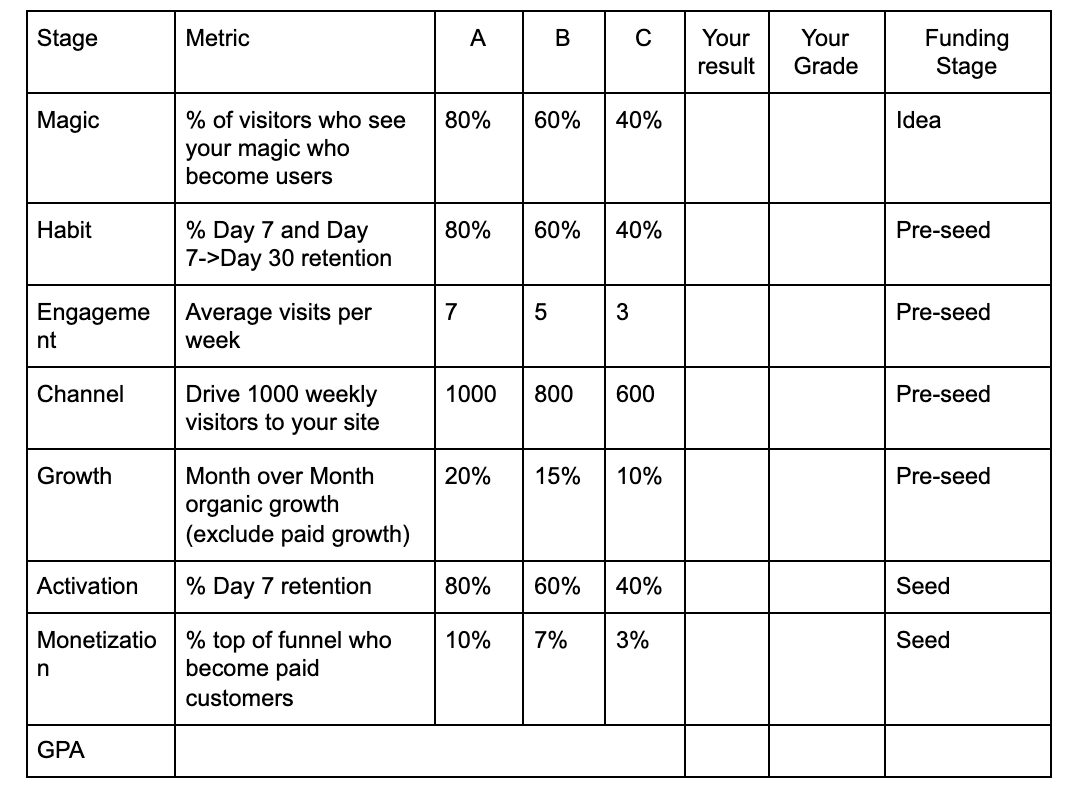

And here is the PMF framework I use with my founder's to intentionally experiment until they find PMF:

docs.google.com/document/d/1ya…

docs.google.com/document/d/1ya…

• • •

Missing some Tweet in this thread? You can try to

force a refresh