Here's my latest Tesla forecast, in the customary 69-tweet format.

Even with this score of charts, I cannot underscore enough: the $TSLA growth story will continue for many years to come.

/1

Even with this score of charts, I cannot underscore enough: the $TSLA growth story will continue for many years to come.

/1

Here's how Tesla's revenue has grown over the years.

These are *actuals*, not my forecast.

In a week, we'll know the Q3 figure. I'm guessing it'll be a new all-time record over $14 billion.

/2

These are *actuals*, not my forecast.

In a week, we'll know the Q3 figure. I'm guessing it'll be a new all-time record over $14 billion.

/2

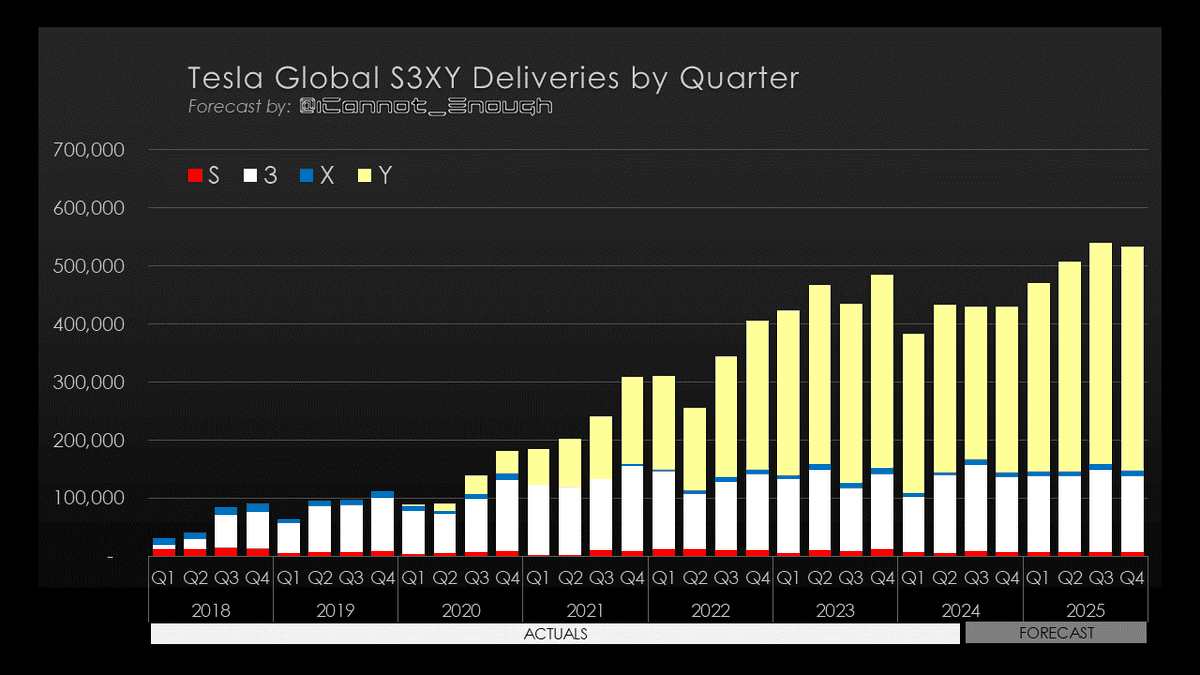

Here's a S3XY chart showing global deliveries per quarter.

This is the first time I'm tweeting my forecast through 2025.

I'm forecasting 896,024 deliveries in 2021 which would make *almost 80% Year-over-year growth*. 👀

/3

This is the first time I'm tweeting my forecast through 2025.

I'm forecasting 896,024 deliveries in 2021 which would make *almost 80% Year-over-year growth*. 👀

/3

Here's a chart showing deliveries for Tesla's 2 best-selling models (2 of 2020's Top 3 premium vehicles sold in the U.S.)

At the annual shareholders' meeting, @elonmusk posited that Model Y could become the #1 selling vehicle by revenue in 2022 and by unit volume in 2023. 🥂

/4

At the annual shareholders' meeting, @elonmusk posited that Model Y could become the #1 selling vehicle by revenue in 2022 and by unit volume in 2023. 🥂

/4

Here's a chart showing the relationship between Production and Deliveries over time, including my forecast through 2025.

Growth over the next 2 years will come primarily from ramping up 2 new factories:

Giga Berlin & Giga Austin

... with an exciting product lineup to follow.

/5

Growth over the next 2 years will come primarily from ramping up 2 new factories:

Giga Berlin & Giga Austin

... with an exciting product lineup to follow.

/5

This chart show Tesla's Adjusted EBITDA, a measure of profitability that excludes non-cash stock compensation and many things beyond management's control, such as depreciation on existing assets and tax expense.

This is also the metric used in Elon's stock compensation plan.

/6

This is also the metric used in Elon's stock compensation plan.

/6

Here's a few charts on one slide showing 4 different looks at Tesla's profitability:

1 Gross Profit (Revenues - Cost of Sales)

2 Adj. EBITDA (see note above)

3 Non-GAAP earnings (before Stock-based comp.)

4 GAAP Earnings (as reported)

There's a trend here. Up. 🤓

/7

1 Gross Profit (Revenues - Cost of Sales)

2 Adj. EBITDA (see note above)

3 Non-GAAP earnings (before Stock-based comp.)

4 GAAP Earnings (as reported)

There's a trend here. Up. 🤓

/7

Here's a revenue chart I keep updated for @TESLAcharts , who orphaned it after Q2 2020.

Gee, why would a perennial Tesla hater & short seller have picked that particular quarter to stop updating it?? 🤔

(red bars are my forecast)

/8

Gee, why would a perennial Tesla hater & short seller have picked that particular quarter to stop updating it?? 🤔

(red bars are my forecast)

/8

Here's a chart showing Tesla's regulatory credit revenue over time.

This is a notoriously difficult line item to forecast, but I'm guessing the revenue dollars will increase even as the revenue *per vehicle will decline* because the number of vehicles sold will grow so much.

/9

This is a notoriously difficult line item to forecast, but I'm guessing the revenue dollars will increase even as the revenue *per vehicle will decline* because the number of vehicles sold will grow so much.

/9

Here's a chart showing stock-based compensation expense related to the 2018 CEO Performance Award (Tesla doesn't pay Elon any salary or cash bonuses).

This is a non-cash expense that will not exceed $2.283B ($1.784B of which has already hit) over the plan's 10-year life.

/10

This is a non-cash expense that will not exceed $2.283B ($1.784B of which has already hit) over the plan's 10-year life.

/10

Here's a chart showing where the average dollar of Tesla revenue comes from, over time (including my forecast through 2025), using a 12-month trailing average to smooth out seasonality.

Regulatory credits (in orange) are a small and diminishing component of total revenue.

/11

Regulatory credits (in orange) are a small and diminishing component of total revenue.

/11

Similarly, this chart shows how Tesla *spends* each dollar of revenue, on average.

📉 When Tesla spent *more than* the total revenue, there was a Non-GAAP *loss*

📈 When Tesla spent *less than* the total revenue, there were Non-GAAP *profits*

/12

📉 When Tesla spent *more than* the total revenue, there was a Non-GAAP *loss*

📈 When Tesla spent *less than* the total revenue, there were Non-GAAP *profits*

/12

Here's a chart showing Tesla's quarterly:

Beginning Inventory (Finished Goods vehicles ready for sale)

Production

Deliveries, and

Ending Inventory

One month's ending inventory is the next month's beginning inventory.

Deliveries cannot exceed Beginning Inventory + Production

/13

Beginning Inventory (Finished Goods vehicles ready for sale)

Production

Deliveries, and

Ending Inventory

One month's ending inventory is the next month's beginning inventory.

Deliveries cannot exceed Beginning Inventory + Production

/13

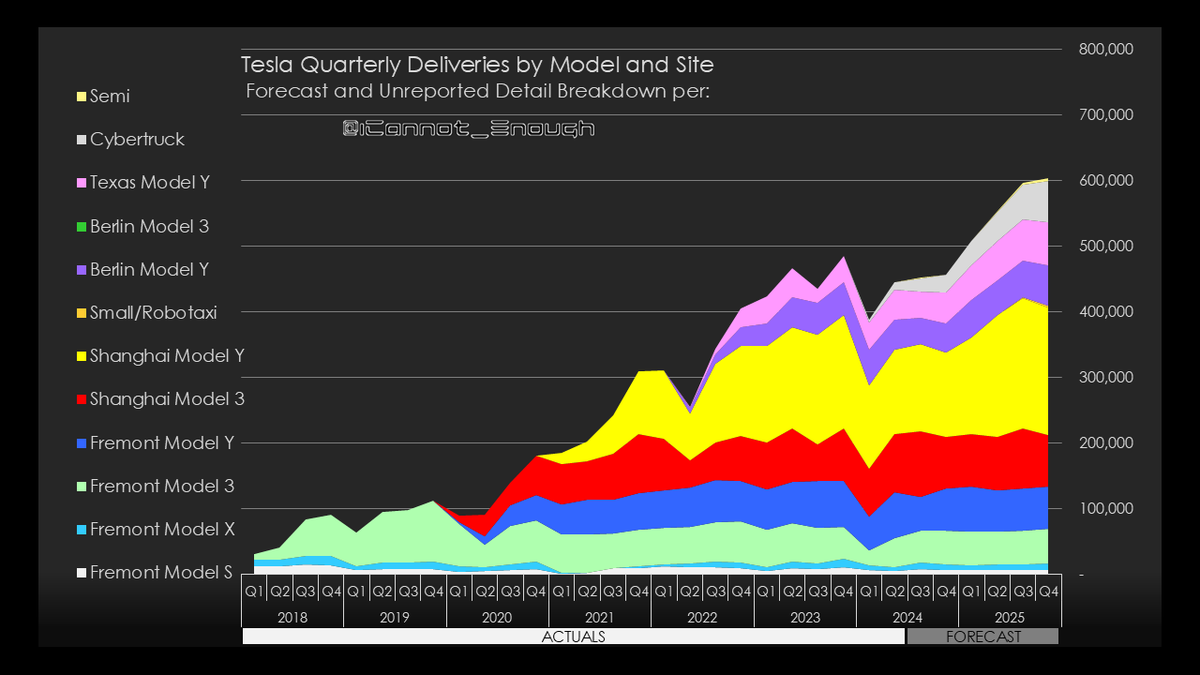

Here's a stacked area chart showing how Tesla's deliveries grow by year and quarter, by model, by site, including my forecast through 2025.

On top of the ~80% YOY growth I expect in 2021, I think 2022 growth will be ~60% YOY... if the 2 new gigafactories ramp smoothly. 🤞

/14

On top of the ~80% YOY growth I expect in 2021, I think 2022 growth will be ~60% YOY... if the 2 new gigafactories ramp smoothly. 🤞

/14

Here's non-GAAP earnings per delivery, smoothed using a 12-month trailing average.

I placed a dashed box around the 4 quarters when I'm forecasting favorability due to declaring tax benefits from prior years' losses. Timing on that is far from certain.

/15

I placed a dashed box around the 4 quarters when I'm forecasting favorability due to declaring tax benefits from prior years' losses. Timing on that is far from certain.

/15

"Now subtract regulatory credits!" I can hear the haters shout. 😂🤣

Fine. 🧐 Here it is if you just subtract regulatory credits revenue from bottom-line earnings-- which, btw, is a *totally invalid financial metric* the short sellers only wish was actually a thing.

/16

Fine. 🧐 Here it is if you just subtract regulatory credits revenue from bottom-line earnings-- which, btw, is a *totally invalid financial metric* the short sellers only wish was actually a thing.

/16

Here's a chart illustrating a truly impressive feat:

Even as average selling prices (ASPs) have fallen over the last few years (because sales mix shifted to more affordable Model 3 & Y), Tesla actually *improved gross margins* by lowering per vehicle manufacturing costs.

/17

Even as average selling prices (ASPs) have fallen over the last few years (because sales mix shifted to more affordable Model 3 & Y), Tesla actually *improved gross margins* by lowering per vehicle manufacturing costs.

/17

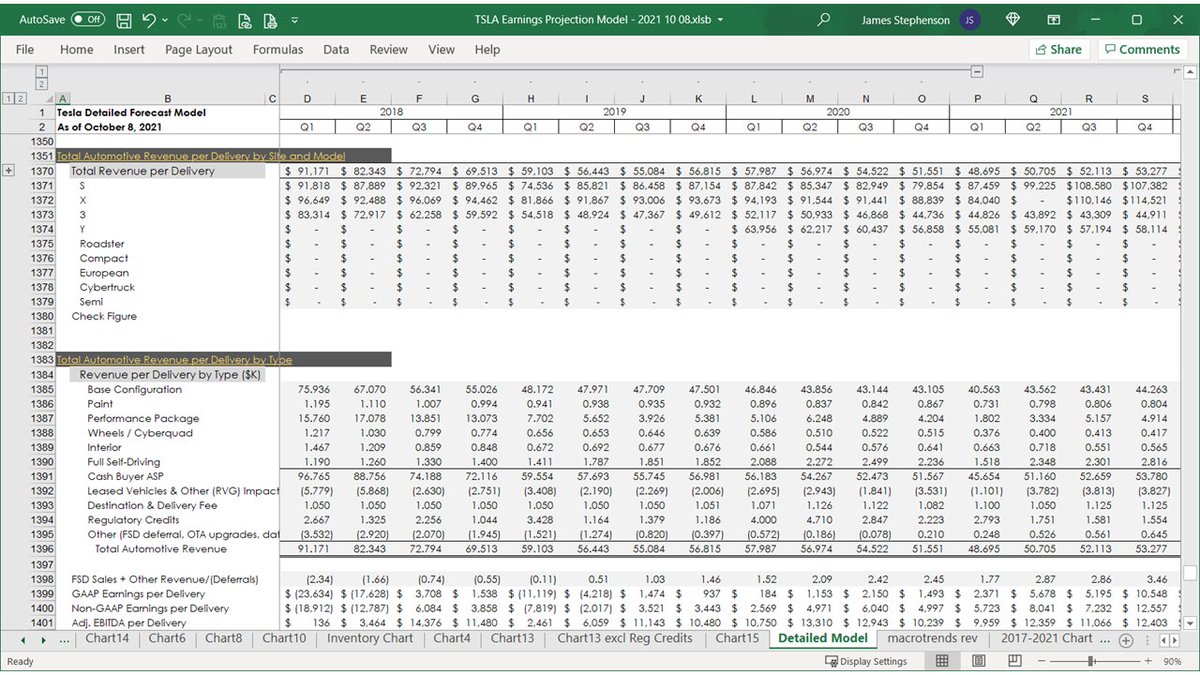

That's all of the charts for today's 🧵.

The next 3 tweets summarize my forecast in tables.

This one shows global unit sales, revenue per delivery, and revenue dollars, by model, by quarter.

/18

The next 3 tweets summarize my forecast in tables.

This one shows global unit sales, revenue per delivery, and revenue dollars, by model, by quarter.

/18

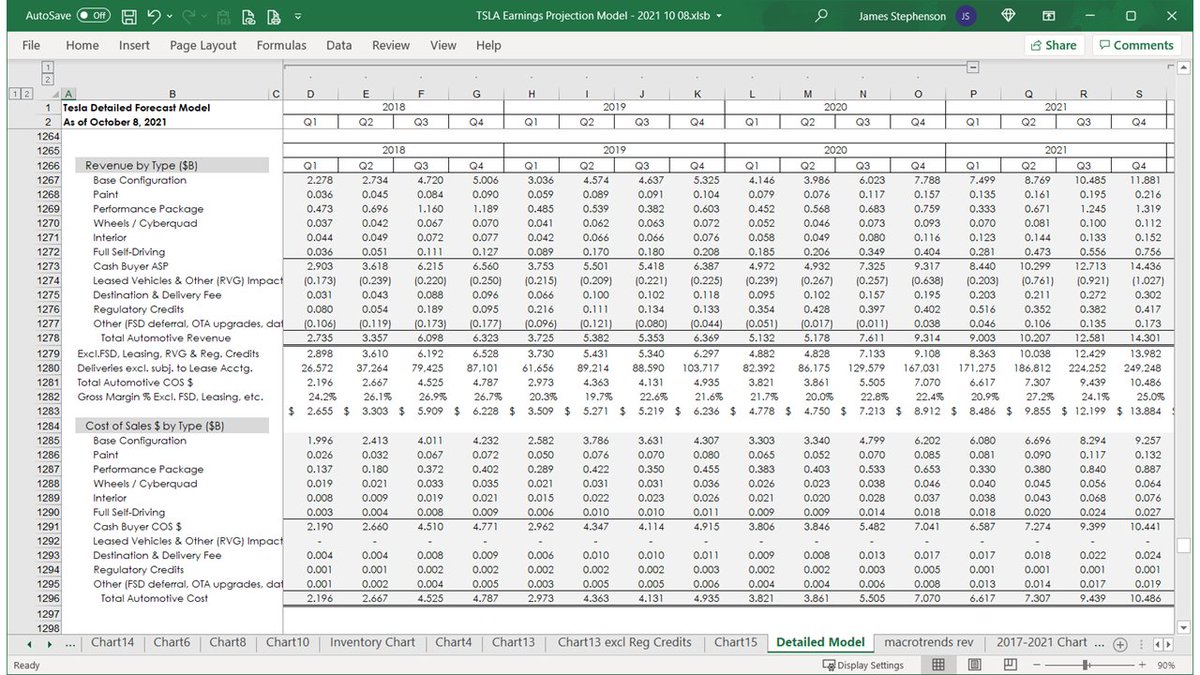

My entire process is ultimately to forecast the numbers on this page: the Income Statement.

I have to forecast that Tesla will take the benefit against income tax expense from prior years' losses at some point, so I have 80% of it in Q4 2021 and the remaining 20% in Q1 2022.

/19

I have to forecast that Tesla will take the benefit against income tax expense from prior years' losses at some point, so I have 80% of it in Q4 2021 and the remaining 20% in Q1 2022.

/19

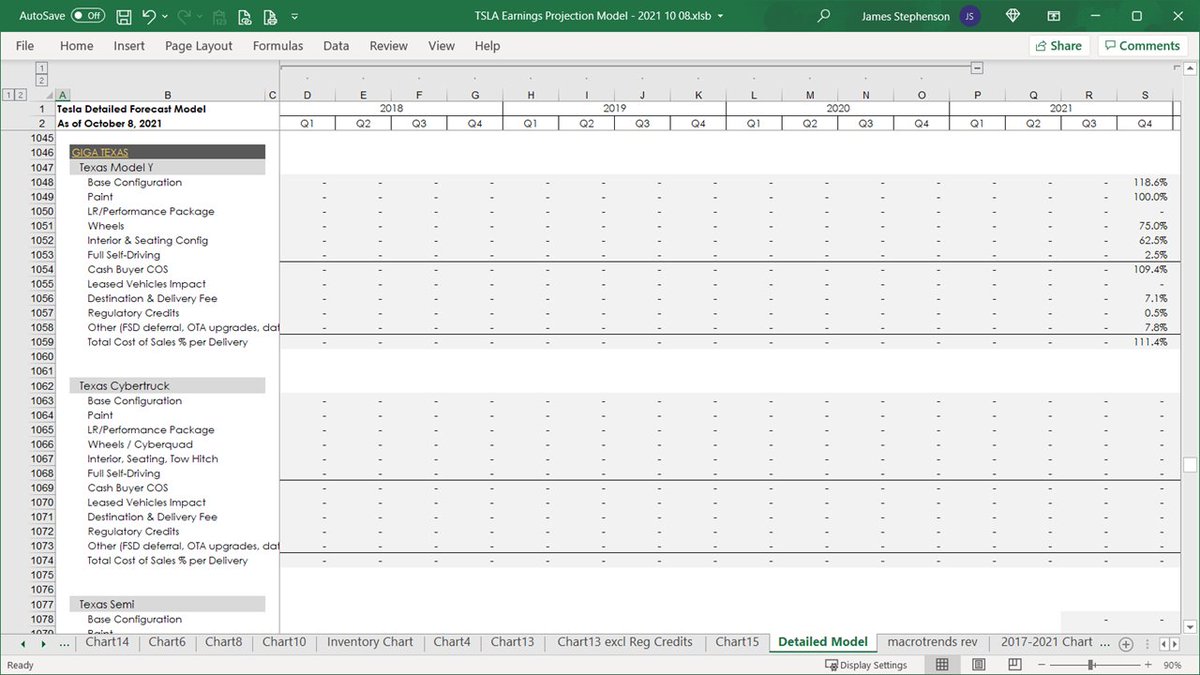

This page shows share count, EPS (mind the GAAP), Cost of Sales % detail by division, and Deliveries by site, model, and quarter.

See tweet #1 of this thread for my non-GAAP earnings forecast of $1.55 in Q3.

/20

See tweet #1 of this thread for my non-GAAP earnings forecast of $1.55 in Q3.

/20

The rest of this 🧵 shows my detailed Excel model that builds up from base forecast assumptions to all of the charts and tables you saw in the first 20 tweets.

Section 1 forecasts Production, Deliveries, and Inventory:

/21

Section 1 forecasts Production, Deliveries, and Inventory:

/21

I find it helpful to revisit all of the granular forecast assumptions at least twice every quarter so that variables like weeks of production and price changes by site and model get weighted appropriately.

It's easy to make a back-of-the-napkin forecast, but prone to error.

/22

It's easy to make a back-of-the-napkin forecast, but prone to error.

/22

A special thank you to @troyteslike for doing such great work tracking global production and deliveries. 🙏

I use Troy's numbers for actual time periods where Tesla does not provide detail by site and model.

If you follow Tesla news closely, you should be following Troy.

/23

I use Troy's numbers for actual time periods where Tesla does not provide detail by site and model.

If you follow Tesla news closely, you should be following Troy.

/23

I am hoping to see some production and deliveries of Model Y from both Giga Austin and Giga Berlin in Q4... but even if neither site delivers any, it won't miss these low expectations by very much.

/24

/24

Here's where I total up the production, deliveries (to cash buyers vs. subject to lease accounting), beginning and ending inventory levels, and calculate days of sales in ending inventory.

/25

/25

Section 2 of the detailed forecast builds up Automotive Revenue per vehicle, by model, by site, by quarter, from base price to total Automotive revenue per vehicle by making assumptions about option take rates, pricing, FSD, Leasing, etc.

/27

/27

Hmmm. It's getting close to midnight Eastern time and I have to post all 69 tweets tonight. 🤔

I'd better stop writing something for every tweet or I'll be up all night. 😂🤣

/28

I'd better stop writing something for every tweet or I'll be up all night. 😂🤣

/28

Here are the global total ASPs for all models, for cash buyers vs. Leased vehicles, with combined totals at the bottom.

/37

/37

Section 3 of the detailed model projects the Automotive Cost of Sales in the same format and at the same level of detail as the Automotive Revenue section above.

/39

/39

Here is the Cost of Sales forecast for the Tesla Energy and Services & Other divisions.

Section 4 shows the Cost of Sales percentages you get when you divide the cost dollars in Section 3 by the revenue dollars in Section 2.

/47

Section 4 shows the Cost of Sales percentages you get when you divide the cost dollars in Section 3 by the revenue dollars in Section 2.

/47

This page shows the COS %'s for the Tesla Energy and Services & Other divisions, which is the end of Section 4 and the start of Section 5: The Income Statement.

/56

/56

All of the detail above was used to do as good a job as I can forecasting the dollars shown here above the Gross Margin line.

This format matches how Tesla reports it, so the bottom-line number here is GAAP earnings.

/57

This format matches how Tesla reports it, so the bottom-line number here is GAAP earnings.

/57

This page shows:

GAAP to Non-GAAP Net Income reconciliation

Share count

Earnings per share metrics

Share price

Market cap

CEO bonus milestone metrics

Stock-based compensation detail

... and several other items that may be of interest to you. 😘

NFA. DYOR.

/58

GAAP to Non-GAAP Net Income reconciliation

Share count

Earnings per share metrics

Share price

Market cap

CEO bonus milestone metrics

Stock-based compensation detail

... and several other items that may be of interest to you. 😘

NFA. DYOR.

/58

This page shows:

a reconciliation of GAAP Net Income to Adj. EBITDA

some share price, earnings growth, and valuation metrics

NFA. DYOR.

Gross margin % with and without Reg. Credits

Total production, deliveries, capacity, and inventory metrics

/59

a reconciliation of GAAP Net Income to Adj. EBITDA

some share price, earnings growth, and valuation metrics

NFA. DYOR.

Gross margin % with and without Reg. Credits

Total production, deliveries, capacity, and inventory metrics

/59

This page shows:

Total automotive cost of sales % by option type

Total revenue and COS per delivery ($)

Revenue per fully-diluted share (quarterly and TTM)

Total deliveries by site and model

/61

Total automotive cost of sales % by option type

Total revenue and COS per delivery ($)

Revenue per fully-diluted share (quarterly and TTM)

Total deliveries by site and model

/61

Here's a more complete look at the breakdown of deliveries by site and model shown partially on the previous slide, with combined totals (for vehicles produced at multiple sites such as Model Y).

/62

/62

Here's:

Revenue per delivery (by model and option type)

FSD sales net of deferred revenue, per delivery

Non-GAAP Earnings per Delivery

TTM Deliveries, Revenue, and Adj. EBITDA

/63

Revenue per delivery (by model and option type)

FSD sales net of deferred revenue, per delivery

Non-GAAP Earnings per Delivery

TTM Deliveries, Revenue, and Adj. EBITDA

/63

This slide shows:

Several Twelve Trailing Month metrics

The totally bogus earning minus reg. credits number I needed to make the chart on tweet #16 of this thread

The dollar amounts and calculations for the 100% stacked "same-size statement" charts (tweets #11 and 12)

/64

Several Twelve Trailing Month metrics

The totally bogus earning minus reg. credits number I needed to make the chart on tweet #16 of this thread

The dollar amounts and calculations for the 100% stacked "same-size statement" charts (tweets #11 and 12)

/64

These are the 12-trailing month calculations that smooth out the seasonality from the tables above.

/65

/65

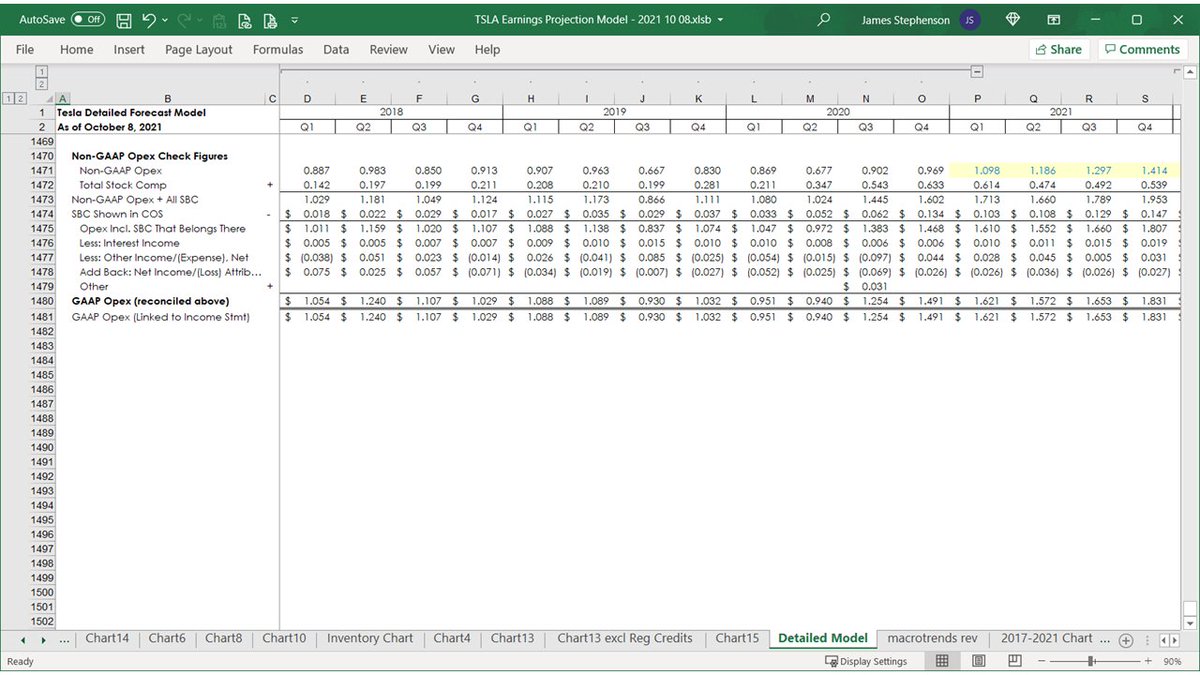

Here's the last tweet from the 'Detailed Model' tab of my forecast workbook, showing a reconciliation of what I called Non-GAAP "Operating Expenses" on the first tweet of this thread to GAAP Operating Expenses.

It's hard to show a whole income statement in only 4 lines.

/66

It's hard to show a whole income statement in only 4 lines.

/66

The last 3 tweets are my calculations for estimating Elon's bonus plan expense.

There's a lot of information here for the 11 people on Earth who care at all about any of it. 😂🤣

/67

There's a lot of information here for the 11 people on Earth who care at all about any of it. 😂🤣

/67

You made it to the end, you legend!

🍾🥳🎉

Don't miss my presentation on this very thread on Saturday, October 16 at 2 p.m. Eastern on @OfficialXPod with live Miro whiteboard-style visuals, and a Q&A at the end.

And we'll record and upload to YouTube afterwards.

/69 end of 🧵

🍾🥳🎉

Don't miss my presentation on this very thread on Saturday, October 16 at 2 p.m. Eastern on @OfficialXPod with live Miro whiteboard-style visuals, and a Q&A at the end.

And we'll record and upload to YouTube afterwards.

/69 end of 🧵

• • •

Missing some Tweet in this thread? You can try to

force a refresh