@ElonMusk and I own Tesla (along with several other people).

14 subscribers

How to get URL link on X (Twitter) App

Tesla may yet break all previous production & delivery records in 2024, as they've done for many years now. ... and I expect they'll do it again in 2025, 2026, 2027...

Tesla may yet break all previous production & delivery records in 2024, as they've done for many years now. ... and I expect they'll do it again in 2025, 2026, 2027...

Tesla will break all previous production & delivery records in 2024, by a wide margin, as they've done for many years now.

Tesla will break all previous production & delivery records in 2024, by a wide margin, as they've done for many years now.

Tesla will break all previous production & delivery records in 2023, by a wide margin, as they've done for many years now.

Tesla will break all previous production & delivery records in 2023, by a wide margin, as they've done for many years now.

... and collecting barely more than half as much revenue:

... and collecting barely more than half as much revenue:

If you're used to seeing my forecast threads, this one's going to flow a bit differently.

If you're used to seeing my forecast threads, this one's going to flow a bit differently.

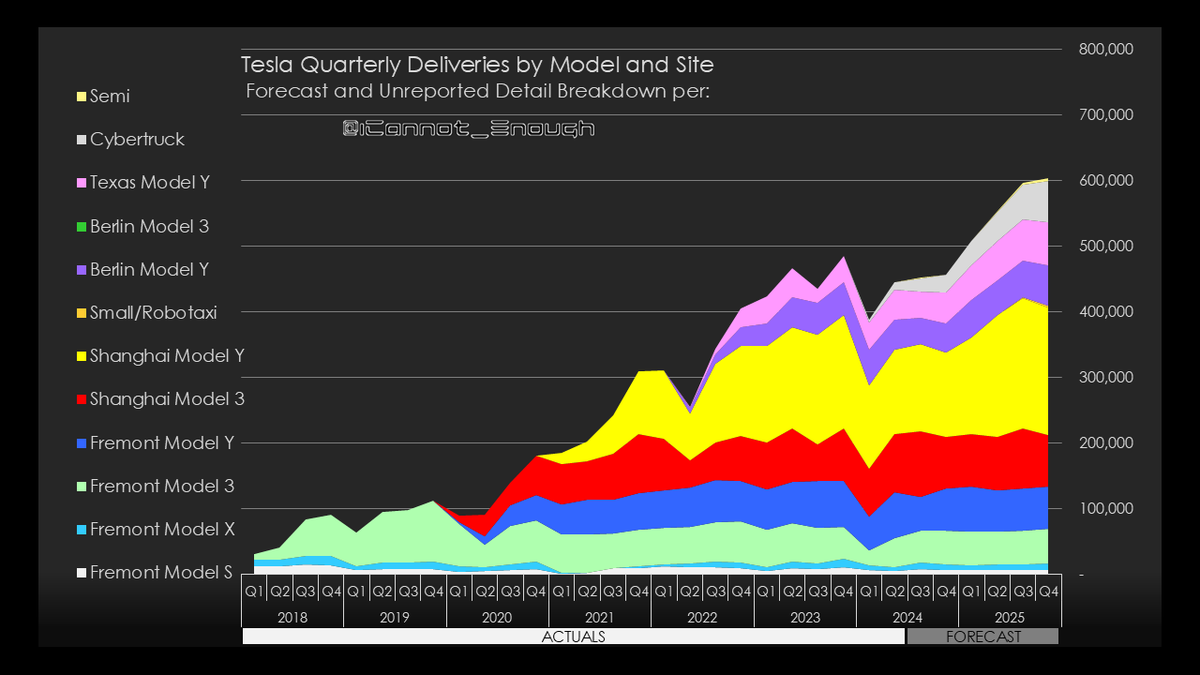

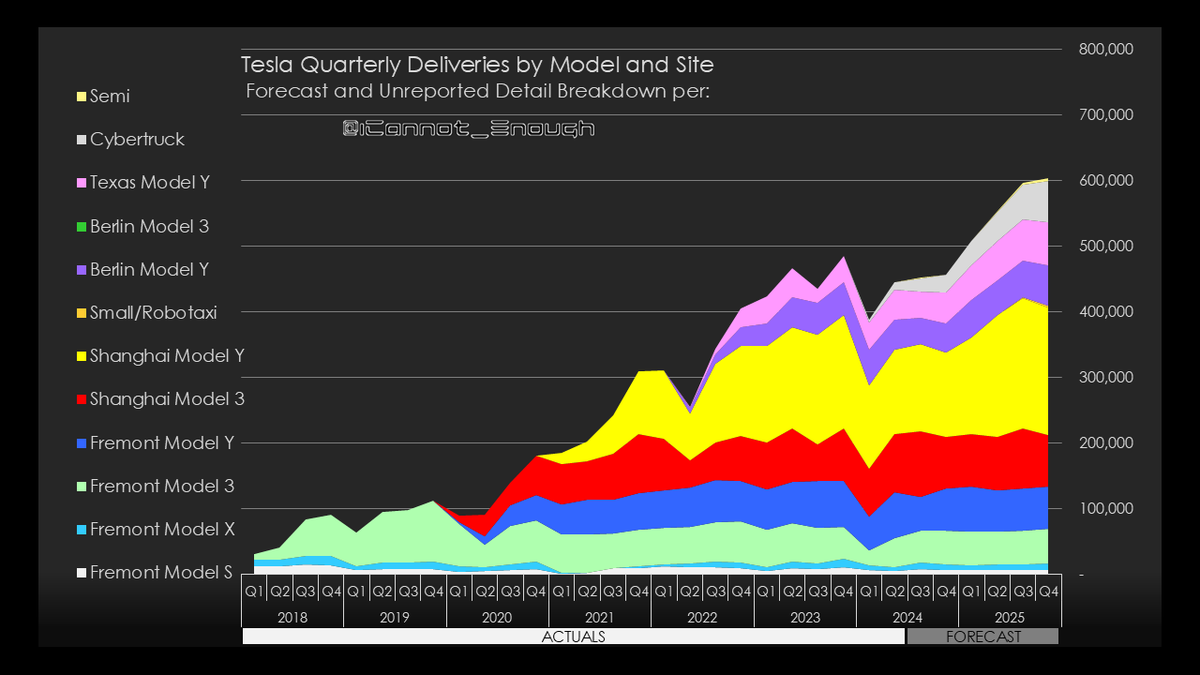

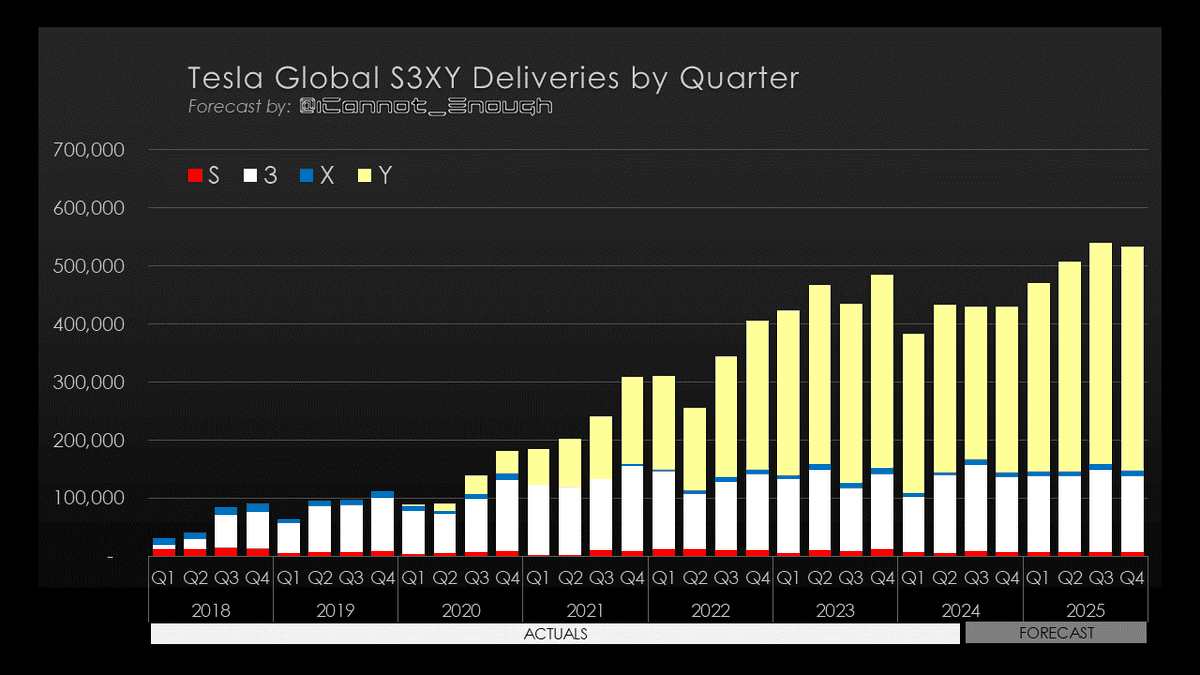

Earlier today, a notorious short seller claimed Tesla will never sell more than 400,000 vehicles in a quarter again... 🤣

Earlier today, a notorious short seller claimed Tesla will never sell more than 400,000 vehicles in a quarter again... 🤣

Tesla continues expanding global production of its S3XY lineup, and record deliveries will follow in 2023 and into the future.

Tesla continues expanding global production of its S3XY lineup, and record deliveries will follow in 2023 and into the future.

Q3 & Q4 deliveries both missed analyst expectations due to Tesla winding down "the wave" of deliveries.

Q3 & Q4 deliveries both missed analyst expectations due to Tesla winding down "the wave" of deliveries.

Q3 deliveries missed analyst expectations due to Tesla winding down "the wave" of deliveries.

Q3 deliveries missed analyst expectations due to Tesla winding down "the wave" of deliveries.

Q3 deliveries missed many analyst expectations due to higher-than-typical ending inventory levels.

Q3 deliveries missed many analyst expectations due to higher-than-typical ending inventory levels.

Shanghai lockdowns drove global S3XY deliveries lower in Q2, but I expect Tesla to report record-breaking quarterly delivery numbers every quarter into the foreseeable future.

Shanghai lockdowns drove global S3XY deliveries lower in Q2, but I expect Tesla to report record-breaking quarterly delivery numbers every quarter into the foreseeable future.

There's a longstanding battle over whether stock-based compensation expense should count against earnings or not.

There's a longstanding battle over whether stock-based compensation expense should count against earnings or not.

Giga Shanghai is Tesla's most profitable factory, and the divot clearly visible in total Q2 deliveries is caused by the local government lockdown impacts limiting their Model 3 & Y production in late April through June.

Giga Shanghai is Tesla's most profitable factory, and the divot clearly visible in total Q2 deliveries is caused by the local government lockdown impacts limiting their Model 3 & Y production in late April through June.

Take a look at Amazon‘s chart:

Take a look at Amazon‘s chart:

https://twitter.com/ihors3/status/1536446026214694915What are the remaining $TSLAQ short sellers thinking?? 😏

https://twitter.com/tryweirder/status/1528748976140193795Brianna’s first claim is that the growth of Tesla’s stock price has never been based on car sales.

https://twitter.com/icannot_enough/status/1395487498797735939It would be easy to look at a chart in a stock app (like the one below) and fret, “wow, $TSLA only up 11% over the last year.”