Part 1: In the last few weeks, Bitcoin has made an impressive rally on the back of potential ETF approvals and just pushed to a 62,910 high on the back of the Valkyrie and Proshares approval. Here’s our take on the matter. 🧵

1. The approval of a Bitcoin ETF is a positive development. Whatever the case may be, a progressive step from the regulator is good for Bitcoin and the cryptocurrency market at large.

2. We've always said a Bitcoin ETF would be a game-changer. However, in our minds this ETF would have physical Bitcoin as its underlying. The ETFs currently in line for approval have CME futures contracts as the underlying instead.This makes a huge difference.

In fact, an ETF based on futures contracts would likely sideline institutional players and end up becoming a largely retail product.

To begin with, most institutional players have direct access to CME futures.

Typically, the main reason they would choose to trade ETFs instead of futures would be to avoid tracking error (against spot price) from futures roll costs or price deviations from to contango or backwardation.

As such, having the ETF based on CME futures defeats the fundamental advantage of ETFs; to track spot price as closely as possible.

It would make sense for retail players though. The tracking error of a futures-based ETF would still be significantly lower than the current Bitcoin proxies in the equities market like Grayscale, Microstrategy or even Coinbase.

3. Futures-based ETFs tend to underperform ETFs with physical underlying.

The following chart takes a look at the various Gold ETFs available.

The following chart takes a look at the various Gold ETFs available.

The blue rows are the physical ETFs, the yellow rows are futures-based ETFs and the orange rows are ETNs. Number 11, with a 1x futures underlying product shows gross underperformance in return compared to any of the physical ETFs.

The reasons, as highlighted above, are the futures roll costs and the fact that Gold futures are usually in contango. This means the futures price is above the physical spot price and the futures-based ETF is effectively buying at a higher price.

This will be the same for Bitcoin except the contango in Bitcoin is much steeper. Bitcoin futures have been trading at a 15-20% premium to spot on an annualised basis. Compared to this the Gold contango looks negligible.

A futures-based ETF is typically only necessary when the product includes some financial engineering such as leverage (2x-3x) or an inverse (i.e. short futures) product.

For these reasons, the physical ETFs are way more popular than futures in the case of Gold. In Chart 1, the top seven ETFs are all physical with a combined AUM of $91 billion. This overshadows the size of the remaining ETFs & ETNs with just $846 million in total.

4. We are not sure if these futures-based ETFs will be able to draw enough new money to trigger an exponential move higher like the one we saw in Q4 2020.

We do expect inflow from investors switching out of Gold ETFs into BTC. However, with BTC above 60k, the market capitalisation is above $1.1 trillion. It’s going to take a lot to move the needle.

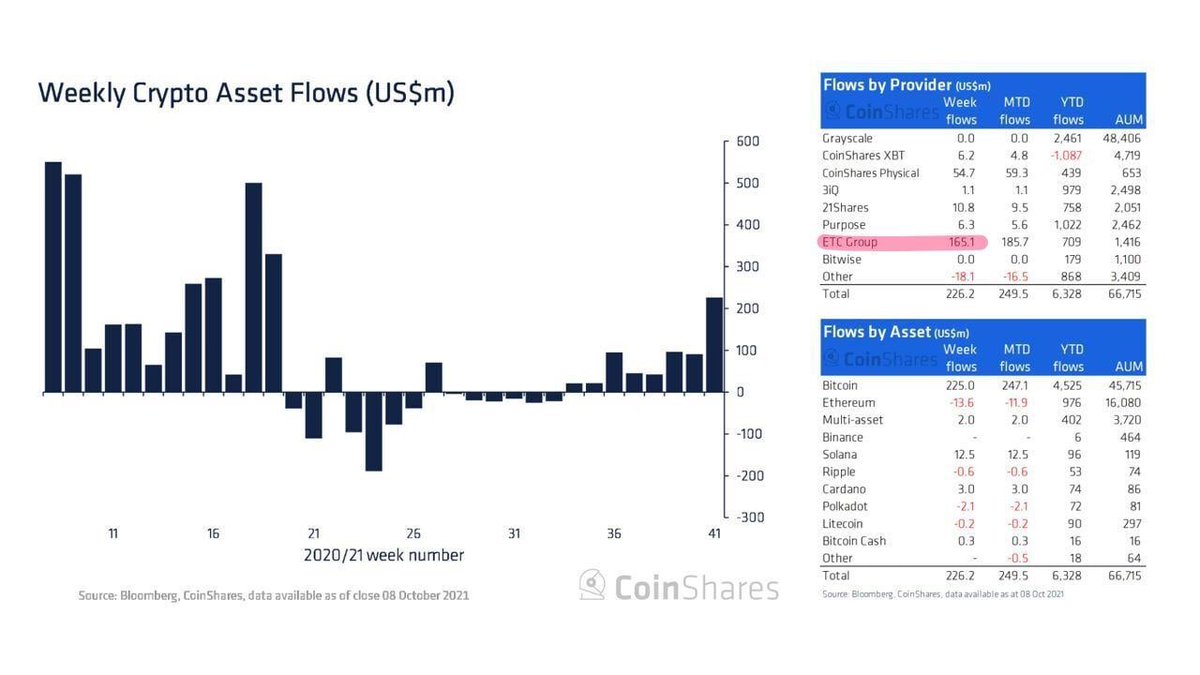

The market has also priced in the Bitcoin ETF approvals ahead of time. Besides the obvious rise in spot price and also an increase in the futures premium, we’ve seen large inflows into foreign-listed ETFs this week:

the largest since May. 73% of that was attributed to the European listed Physical Bitcoin ETF (Chart - Red Highlight).

We suspect that after SEC Chair Gensler indirectly ruled out a physical BTC ETF in the US for the foreseeable future, investors able to access these overseas markets have decided to participate there rather than investing in the upcoming futures ETFs in the US.

5. The various ETF applicants have distinct differences in their applications and it will be interesting to see if the SEC approves them wholesale or with specific conditions (full list of ETFs in Chart)

For example, while the Valkyrie application is entirely futures based with a fixed rolling strategy, the Proshares application includes clauses that would give the fund the ability to hold other Bitcoin-related instruments without touching the physical coins itself. (Cont in p2)

• • •

Missing some Tweet in this thread? You can try to

force a refresh