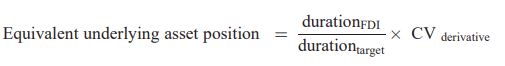

I think I have just read the most hilarious piece of regulation ever. It's called "Duration netting rules" for leverage calculation in the AIFM (alternative funds) directive. A quick thread.

This is for funds that primarily do interest rate derivatives. So you take each derivative you have and calculate its "Equivalent underlying asset position". The definition of target duration is pure gold, but that's not my point here.

Yes, you've read that right. You multiply it by 0.

BY F*** ZERO.

Seriously, who writes this ???????????

BY F*** ZERO.

Seriously, who writes this ???????????

@SMTuffy I think this means a LOT for FinReg, especially sanity wise.

• • •

Missing some Tweet in this thread? You can try to

force a refresh