1/ Question: What can you develop by looking at a lot of financial statements for different companies?

Why does Tren often ask on Twitter:

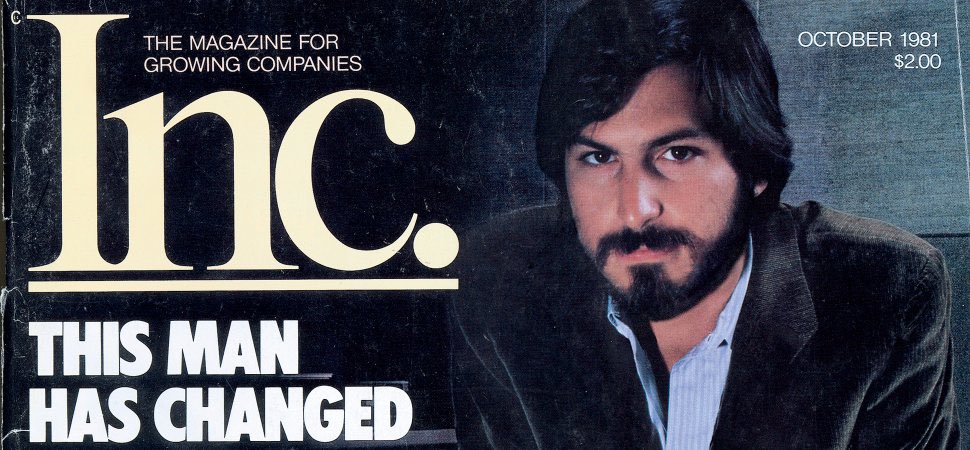

What company is this?

Answer: Pattern recognition can be developed using an outside view via base rates. research-doc.credit-suisse.com/docView?langua…

Why does Tren often ask on Twitter:

What company is this?

Answer: Pattern recognition can be developed using an outside view via base rates. research-doc.credit-suisse.com/docView?langua…

2/ Using the outside view requires finding and applying an appropriate reference class, or base rate. The more businesses you learn about, the more you improve your probability distribution of outcomes.

Goal: Find a gap between what is priced into a stock and likely reality.

Goal: Find a gap between what is priced into a stock and likely reality.

3/ Example: Assume SaaS company X reveals only partial data about unit economics. X provides no data to investors on churn or CAC. An investor with the right reference class (data about similar businesses) will be more able to spot a mis-priced opportunity. Pattern recognition!

4/ A venture capitalist who has seen the unit economics of many businesses acquires pattern recognition skill that helps them understand an investment they are evaluating. Base rates inform them about the probability of success. They can do sensitivity analysis on key factors.

5/ A founder of a business can use pattern recognition developed via base rates to make judgements about where to devote time and attention to improving unit economics. For example, they'll know from the data the benefits of greater retention (lower churn) can be non linear.

6/ A manager inside a business (eg Netflix) knows exactly what customer churn is and can break it down by cohorts. Investors don't always have the data. Investors with pattern recognition via base rates are better positioned to identify gaps been current price and actual value.

• • •

Missing some Tweet in this thread? You can try to

force a refresh