MASTER-CLASS on Avoiding noise in trading.🚨

-How to avoid noise.

-Finding effective trading system.

-Executing better trades.

A THREAD.

-How to avoid noise.

-Finding effective trading system.

-Executing better trades.

A THREAD.

I have added points you need to keep in mind while making your own system.

Let this be a guideline.

-One indicator can be complex for someone and easy for another.

-Pay special attention to point 4.

-I hope you enjoy the Round guy cartoons.

Let this be a guideline.

-One indicator can be complex for someone and easy for another.

-Pay special attention to point 4.

-I hope you enjoy the Round guy cartoons.

1. The illusion of complex analysis.

Most people who made the most amount of money in Crypto are probably who didn't think too much and bought Bitcoin and didn't think about anything..

Forgot to follow the Development or price movement. Just bought early and slept.

Most people who made the most amount of money in Crypto are probably who didn't think too much and bought Bitcoin and didn't think about anything..

Forgot to follow the Development or price movement. Just bought early and slept.

Crypto is a complex asset class but your analysis doesn't have to be. A ground level understanding of tokenomics is some times enough to understand the future of the token.

The revenue generation aspects and usage analysis can be easily read from third parties.

The revenue generation aspects and usage analysis can be easily read from third parties.

Find sources of info and stick to the basics.

If you don't have a vast experience as a dev or Crypto, sticking to basics will help you.

I know trades on the P&L leader board who got these just swing trading with Market Structure, S/R and learning a Bit of economics.

Be simple.

If you don't have a vast experience as a dev or Crypto, sticking to basics will help you.

I know trades on the P&L leader board who got these just swing trading with Market Structure, S/R and learning a Bit of economics.

Be simple.

2. Myth- More data is more control.

Beginners buy the TradingView Premium pack and put every indicator they can find on the chart.

This gives them a sense of more data, more visuals and more control of the market.

Beginners buy the TradingView Premium pack and put every indicator they can find on the chart.

This gives them a sense of more data, more visuals and more control of the market.

You're essentially adding more perspectives which is saying the same thing in different ways and saying a bunch of nothing.

If you can't simplify your system at least in the beginning, you'll have a bad execution.

Remember, trading depends on execution and not analysis.

If you can't simplify your system at least in the beginning, you'll have a bad execution.

Remember, trading depends on execution and not analysis.

Ask yourself what exactly you need this indicator or data.

What is it exactly that it shows and what can you use it for effectively.

If you don't completely understand the above about a tool, you need to study it more or probably get rid of it.

What is it exactly that it shows and what can you use it for effectively.

If you don't completely understand the above about a tool, you need to study it more or probably get rid of it.

3. High concentration on recent events.

Just because something has been working right in the current event, doesn't mean it'll work forever.

Just because something didn't work for a time in the past, doesn't mean it'll not work now.

Just because something has been working right in the current event, doesn't mean it'll work forever.

Just because something didn't work for a time in the past, doesn't mean it'll not work now.

Paying too much concentration on what works in the short term and using it as a long term rule will kill you.

Eg. During De-Fi session, everything that pretended to be a Defi pumped. This was momentary. If you continue this as your investment thesis forever, you'll get burnt

Eg. During De-Fi session, everything that pretended to be a Defi pumped. This was momentary. If you continue this as your investment thesis forever, you'll get burnt

4. Risky management can't make you money but makes sure you won't lose it.

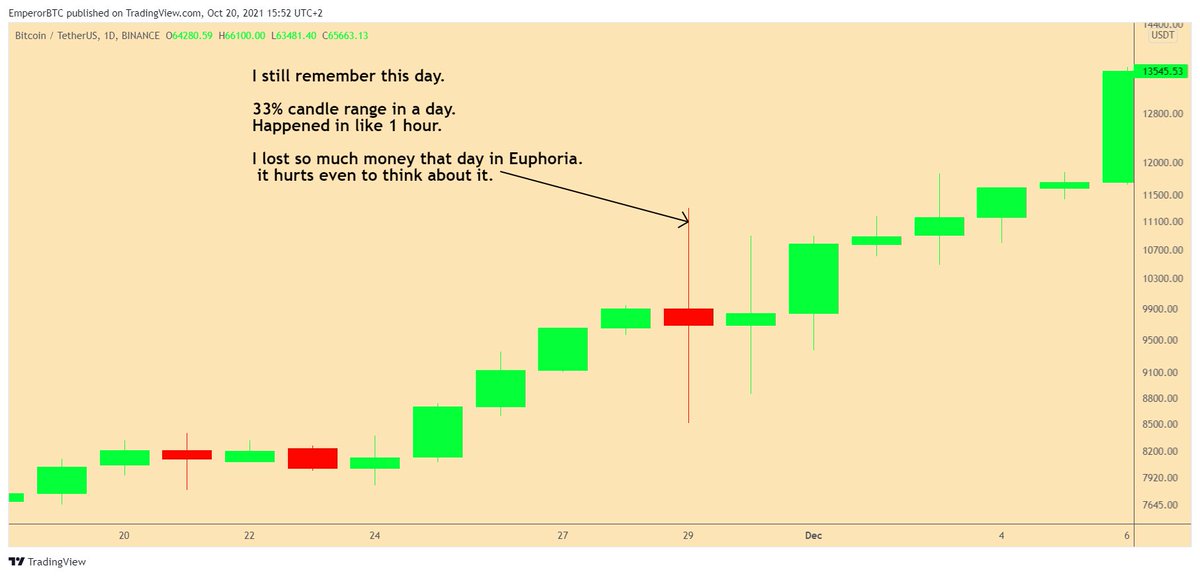

I know a friend who made 2100% profit in Bitcoin Trading on Bitfinex and then lost it all all in December 2017.

It takes one bad trade to lose it all

He thought the price could never dip to 13K from 19K.

I know a friend who made 2100% profit in Bitcoin Trading on Bitfinex and then lost it all all in December 2017.

It takes one bad trade to lose it all

He thought the price could never dip to 13K from 19K.

Kept on using the profits to add more leverage.

All his portfolio was in Bitcoin leverage.

How could Bitcoin crash so much he thought?

And hence lost it all.

I am pretty sure a lot of you have thought, if I keep my liquidation very low, nothing can happen.

All his portfolio was in Bitcoin leverage.

How could Bitcoin crash so much he thought?

And hence lost it all.

I am pretty sure a lot of you have thought, if I keep my liquidation very low, nothing can happen.

And risked all your positions and still lost money.

Remember, you hear stories of people making millions of dollars in the market. Where do you think that money comes from?

A thousand people lose a thousand dollar each to help one guy make a million.

Remember, you hear stories of people making millions of dollars in the market. Where do you think that money comes from?

A thousand people lose a thousand dollar each to help one guy make a million.

Don't be a Market participant who works hard to transfer all his money to someone else. People are working hard to take your money. That's how profit is made. Don't let that happen.

Better cautious than Sorry.

Better cautious than Sorry.

Conclusion.

1. More data isn't better necessarily.

2. Ask yourself why you need that data for. Unless it helps you specifically, you don't need it.

3. The market is smarter than you and looking to take your money. It always has it always be. Protect it.

4. Evolve or die.

1. More data isn't better necessarily.

2. Ask yourself why you need that data for. Unless it helps you specifically, you don't need it.

3. The market is smarter than you and looking to take your money. It always has it always be. Protect it.

4. Evolve or die.

I hope this has given you an insight into what needs to be done.

If it feels to complex, leave it. Find a good source or news and not signals.

Will see you guys soon.

Please send some love. I need it today, like always.

If it feels to complex, leave it. Find a good source or news and not signals.

Will see you guys soon.

Please send some love. I need it today, like always.

• • •

Missing some Tweet in this thread? You can try to

force a refresh