Here’s a 22 tweet thread

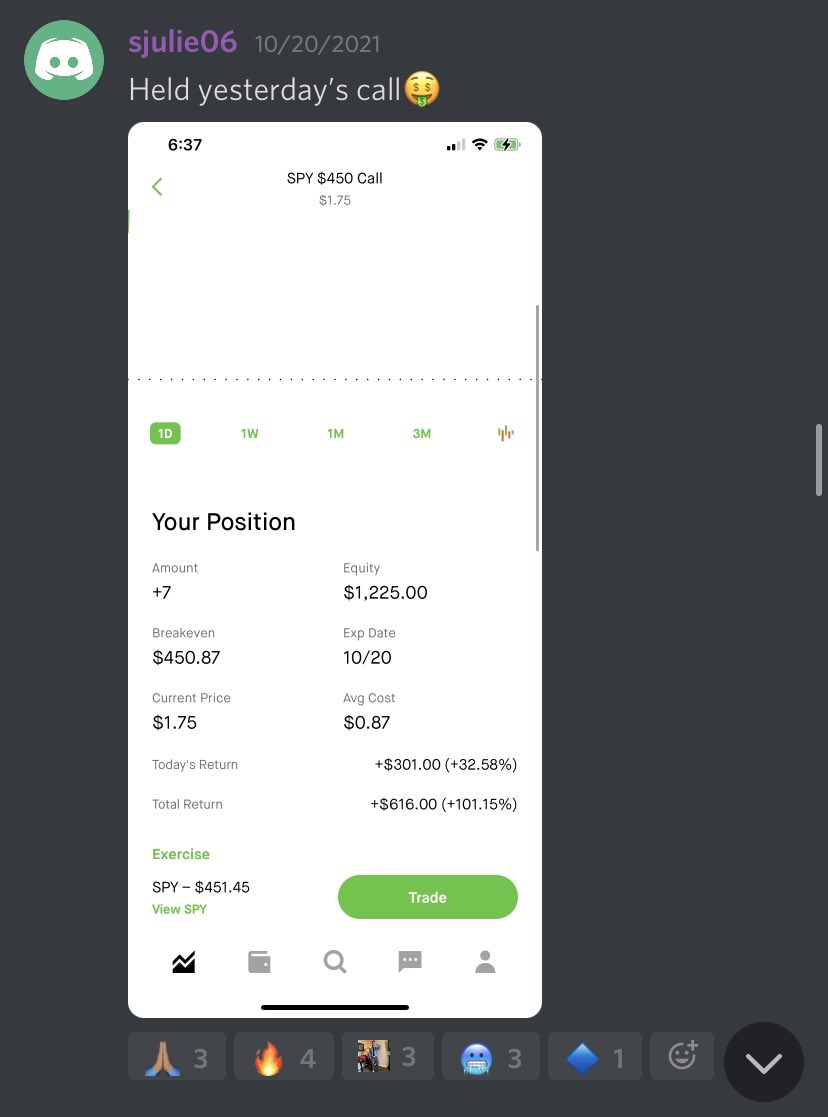

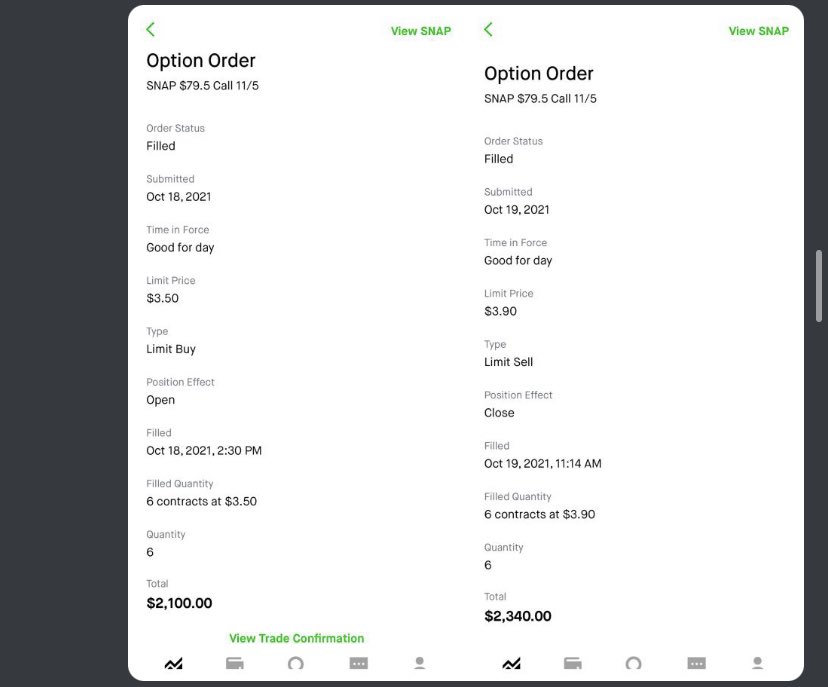

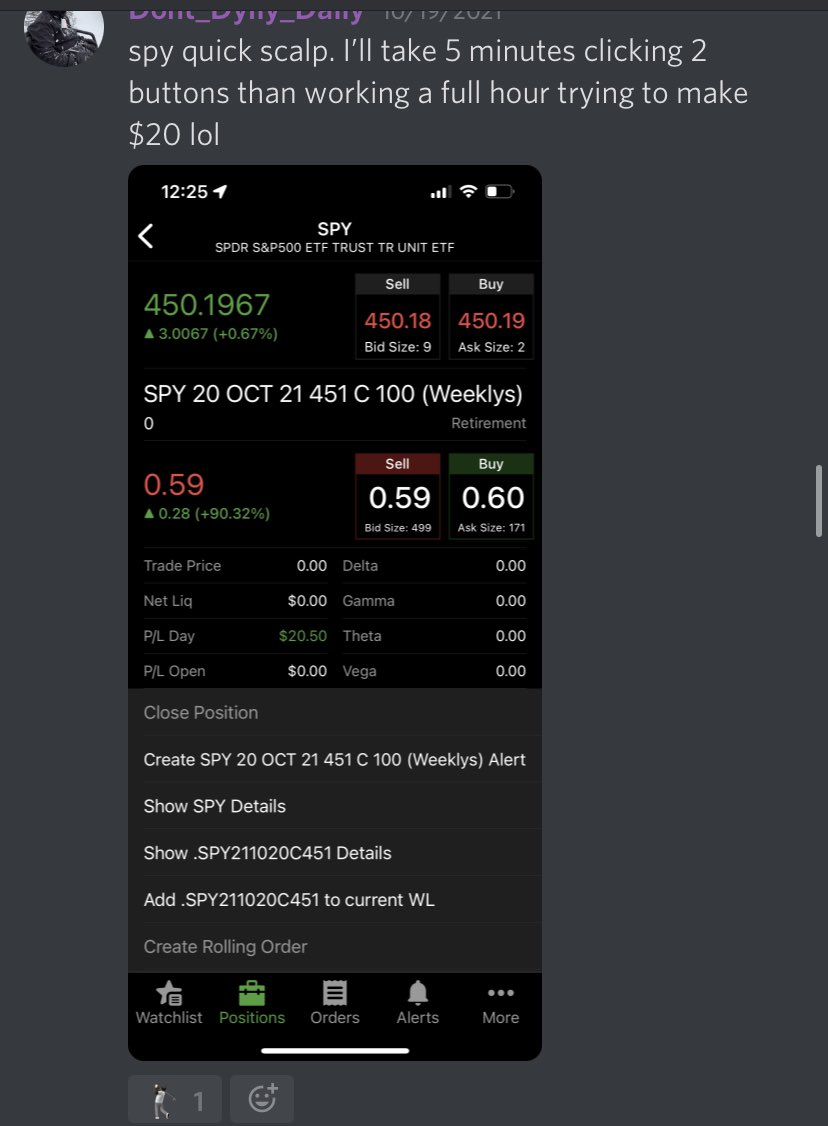

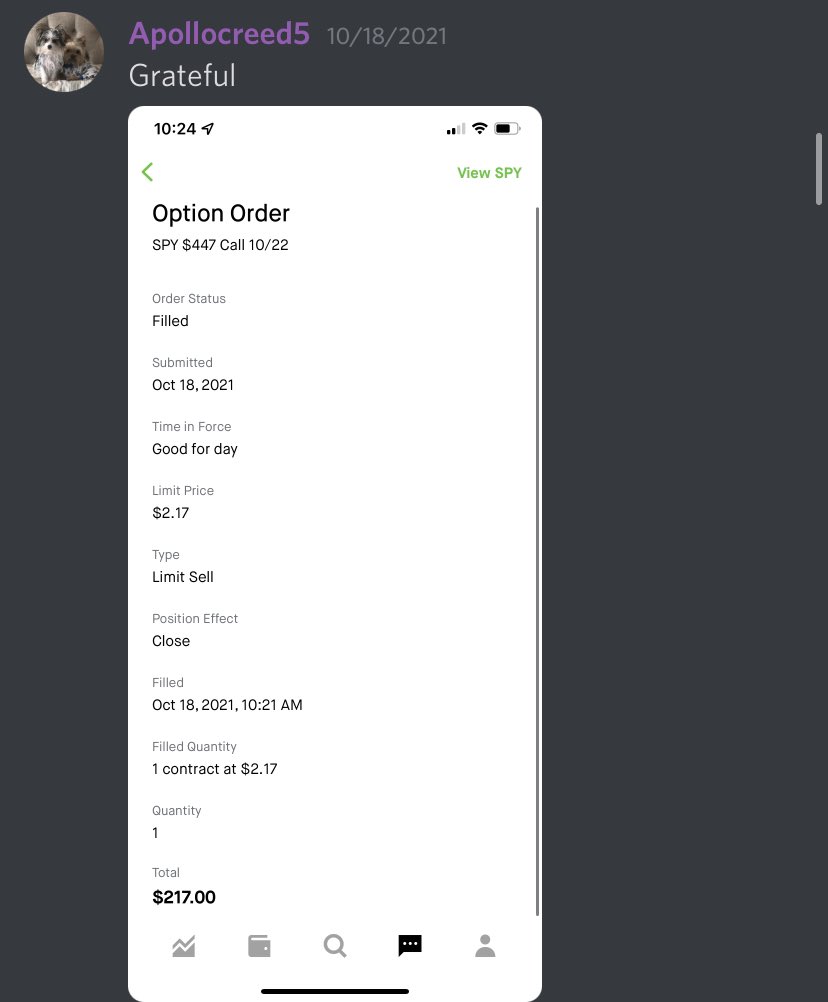

A 22 tweet thread of wins from the first week with our new members

Wolves Win. They thrive on knowledge so the next kill is even easier. They work with the pack (community) to accomplish this.

The movement is only beginning. #Wolves are taking over..

A 22 tweet thread of wins from the first week with our new members

Wolves Win. They thrive on knowledge so the next kill is even easier. They work with the pack (community) to accomplish this.

The movement is only beginning. #Wolves are taking over..

• • •

Missing some Tweet in this thread? You can try to

force a refresh