1/ Thread on my expectations around $COTI and the impending surge in price due to token velocity

What is token velocity?

In simple terms, token velocity measures the amount a digital asset changes hands between parties.

Is this a ‘good’ thing? let’s first understand the maths!

What is token velocity?

In simple terms, token velocity measures the amount a digital asset changes hands between parties.

Is this a ‘good’ thing? let’s first understand the maths!

2/The formula for token velocity is simple:

Velocity = Total Transactional Volume / Average Network Volume

Therefore,

Average Network Volume = Total Transaction Volume / Velocity

This means the average network value is equal to the Velocity/Transaction Value

Velocity = Total Transactional Volume / Average Network Volume

Therefore,

Average Network Volume = Total Transaction Volume / Velocity

This means the average network value is equal to the Velocity/Transaction Value

3/Velocity is typically measured annually. If transactions are absent, then the token lacks liquidity and its velocity equals zero. Consequently, the asset will trade at a discounted rate. There must be some minimal velocity for a token to reach its full value.

4/ So price in relation to velocity is as follows of token velocity as follows:

MV=PQ

Where: M= size of the asset base, V= velocity of the asset, P= price of the digital resource being provisioned, Q= quantity of the digital resource being provisioned

MV=PQ

Where: M= size of the asset base, V= velocity of the asset, P= price of the digital resource being provisioned, Q= quantity of the digital resource being provisioned

5/In order to solve for token price, one must calculate M, by working out the size of the market in dollars (PQ), divide it by the velocity (V) and then divide M by the number of coins in supply. M = PQ/V

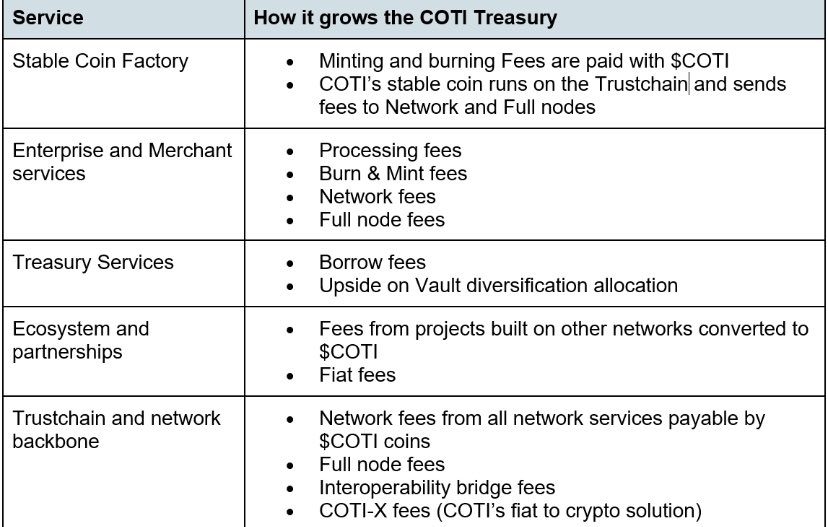

6/What does this all mean dread, well let’s really simplify put that into context well $COTI will be the backbone of all transaction on Cardano across the ecosystem as all transactions will be denominated in $DJED and fees converted into $COTI. Other services are as follows:

7/So just think the overnight transaction volume of $ADA was $3B Let’s assume $COTI fees are 1% that’s $30m a day or $10B a year and that’s just the beginning as the Cardano & $COTI ecosystem grows with smart contracts and NFT’s are utilised I think this would at least 5x

8/So 5x from here would be 50B just in fees, Couple this with the lockup of $COTI creating scarcity due to staking which are comparatively generous then you can see that there will be an explosion of price defined below

9/So all this means in terms of maths and value proposition is that the velocity of the coin is inversely proportional to the value of the token i.e. the longer people hold the token for, the higher the price of each token.

10/This is intuitive, because if the transactional activity of the economy is $50 billion (for the year) and coins circulate 10 times each over the course of the year, then the collective value of the coins is $5B.

11/This $5b calculation is my conservative estimate and why I’m so confident in a 10x from here possibly even 20x with exponential growth.

Credit to #investmentbank @theCOTIinvestor @Geordie_R @PhDCryptoDad @theholder19 for continued positive vibes!

#StayCOTI #COTI2TENDOLLARS

Credit to #investmentbank @theCOTIinvestor @Geordie_R @PhDCryptoDad @theholder19 for continued positive vibes!

#StayCOTI #COTI2TENDOLLARS

• • •

Missing some Tweet in this thread? You can try to

force a refresh