Blackrock manages more money than God.

So when they talk, you better listen…I did!

They addressed the 5 biggest fears facing investors.

Time for a thread 👇

So when they talk, you better listen…I did!

They addressed the 5 biggest fears facing investors.

Time for a thread 👇

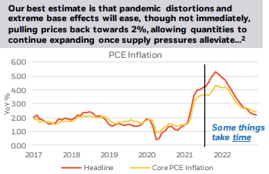

1/ FEAR #1: Stagflation could be coming to our doorsteps…

BlackRock: False. This is not the 1970s.

Inflation is transitory.

BlackRock: False. This is not the 1970s.

Inflation is transitory.

2/FEAR #2: Demand destruction

BlackRock: False. The downward shift on the demand curve will not be permanent.

They don’t think that this will happen with lumber (already reversed course after falling from record highs).

BlackRock: False. The downward shift on the demand curve will not be permanent.

They don’t think that this will happen with lumber (already reversed course after falling from record highs).

3/ And they don’t think it will happen elsewhere (think: oil). Why not?

Income Growth + Built-up Savings = CONSUMPTION POWER

Consumers have accumulated $670B in excess savings from “normal income” over the last 18 months...

Income Growth + Built-up Savings = CONSUMPTION POWER

Consumers have accumulated $670B in excess savings from “normal income” over the last 18 months...

4/...PLUS another $2T one-time transfers…

...for a total of $2.7T in buying power above & beyond future income growth.

...for a total of $2.7T in buying power above & beyond future income growth.

5/Assuming consumption grows at 6.5% per year with 4.5% annual income growth…

It would take 4 years of dipping into the $2.7T before it’s gone.

That’s a MASSIVE tailwind for demand.

It would take 4 years of dipping into the $2.7T before it’s gone.

That’s a MASSIVE tailwind for demand.

6/With all this buying power and interest rates going up moderately, BlackRock is avoiding fixed-income products (i.e., bonds).

They’re overweight equities, specifically consumer discretionary like $AMZN $LVMUY $MCD $HD

They’re overweight equities, specifically consumer discretionary like $AMZN $LVMUY $MCD $HD

7/FEAR# 3: Energy prices and supply-driven shocks

BlackRock: False. Again, this is not the 1970s.

Gas prices are not as important as they used to be. Their share as a % of the consumer wallet is shrinking:

BlackRock: False. Again, this is not the 1970s.

Gas prices are not as important as they used to be. Their share as a % of the consumer wallet is shrinking:

8/Rieder believes energy prices will go higher, but will not destroy consumption.

Used vehicle prices are up, sure, but they’re still cheap vs. medical services and housing, for example.

He believes healthcare represents the biggest investment opportunity in the world.

Used vehicle prices are up, sure, but they’re still cheap vs. medical services and housing, for example.

He believes healthcare represents the biggest investment opportunity in the world.

9/FEAR #4: Earnings (profit warnings)

BlackRock: False. A small amount of inflation is good for profits.

Companies have real operating leverage in this environment.

BlackRock: False. A small amount of inflation is good for profits.

Companies have real operating leverage in this environment.

11/FEAR #5: Interest rates

BlackRock: Rate increases will not kill the market.

The 2 expected moves in 2022 will not be very big. The market is not going to tip over - still plenty of liquidity.

BlackRock: Rate increases will not kill the market.

The 2 expected moves in 2022 will not be very big. The market is not going to tip over - still plenty of liquidity.

12/ With the incredible growth in the labor market about to happen, the Fed should feel confident in normalizing policy.

The 10 yr yield is not going to 3%.

Interest rates have to stay low: 1.75-2.75% over the next 5 years.

The 10 yr yield is not going to 3%.

Interest rates have to stay low: 1.75-2.75% over the next 5 years.

13/We are moving away from Emergency Policy…

...and towards a more Normal Policy environment which should see the US dollar strengthen moderately (especially vs Euro).

So what does this all mean? Should you be looking at bonds? Fixed income? Prefs?

...and towards a more Normal Policy environment which should see the US dollar strengthen moderately (especially vs Euro).

So what does this all mean? Should you be looking at bonds? Fixed income? Prefs?

14/ BOTTOM LINE: There is a ton of fear, uncertainty, and doubt (FUD) out there, but the underlying equities have not changed.

The best place to compound your money is still stocks!

GRIT’s ACTION: Buy great companies & leave them alone!

The best place to compound your money is still stocks!

GRIT’s ACTION: Buy great companies & leave them alone!

15/ Want more?

Every week I write a newsletter to +43k investors. I have 3 goals:

- Make you Laugh

- Make you Learn

- Make you Money

No fluff, no bullshit, no suits.

It’s the #1 Free Finance Newsletter on Substack Globally!

Subscribe 👇

gritcapital.substack.com

Every week I write a newsletter to +43k investors. I have 3 goals:

- Make you Laugh

- Make you Learn

- Make you Money

No fluff, no bullshit, no suits.

It’s the #1 Free Finance Newsletter on Substack Globally!

Subscribe 👇

gritcapital.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh