0/ In today’s Delphi Daily - @CurveFinance hits $100B lifetime volume!

We explore Curve’s tokenomics design and growth, the broader implications for DeFi, and the recent rise of meme coins.

For a deeper dive 🧵👇

We explore Curve’s tokenomics design and growth, the broader implications for DeFi, and the recent rise of meme coins.

For a deeper dive 🧵👇

1/ @CurveFinance has facilitated over $100B of volume since launching in Jan. 2020.

CRV’s token economics were heavily criticized because of incredibly small float and rapid emissions, but they’ve since proven their token model works and is one of the most efficient across DeFi

CRV’s token economics were heavily criticized because of incredibly small float and rapid emissions, but they’ve since proven their token model works and is one of the most efficient across DeFi

2/ Curve’s liquidity provision and token locking model have led to competition amongst farming products built on top of Curve.

Convex’s model has quickly helped it establish itself as the leader with over 35% of veCRV supply held by Convex.

Convex’s model has quickly helped it establish itself as the leader with over 35% of veCRV supply held by Convex.

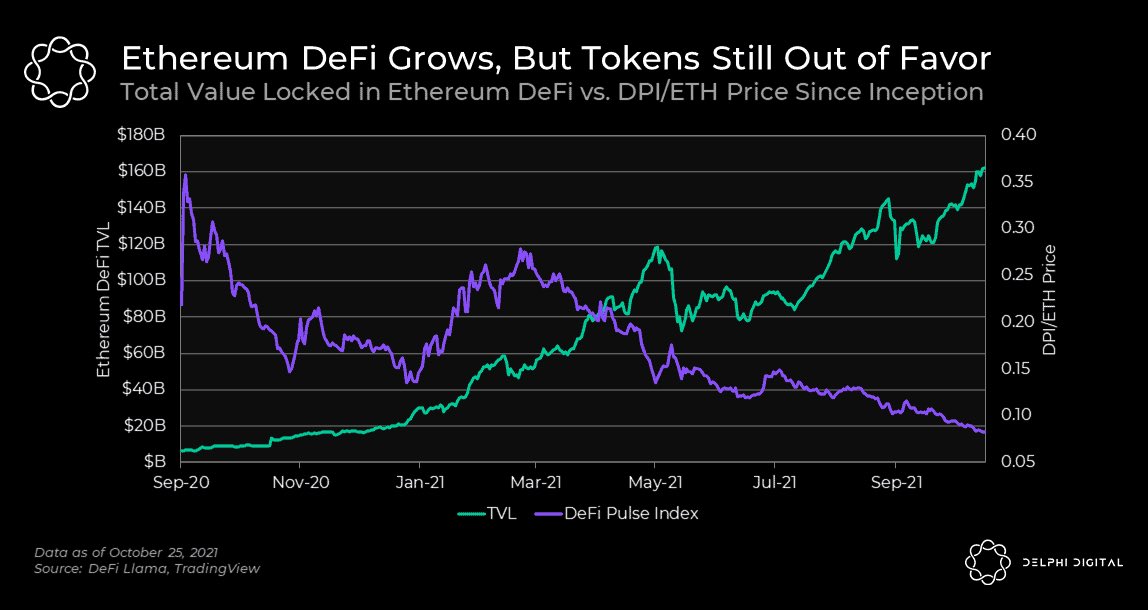

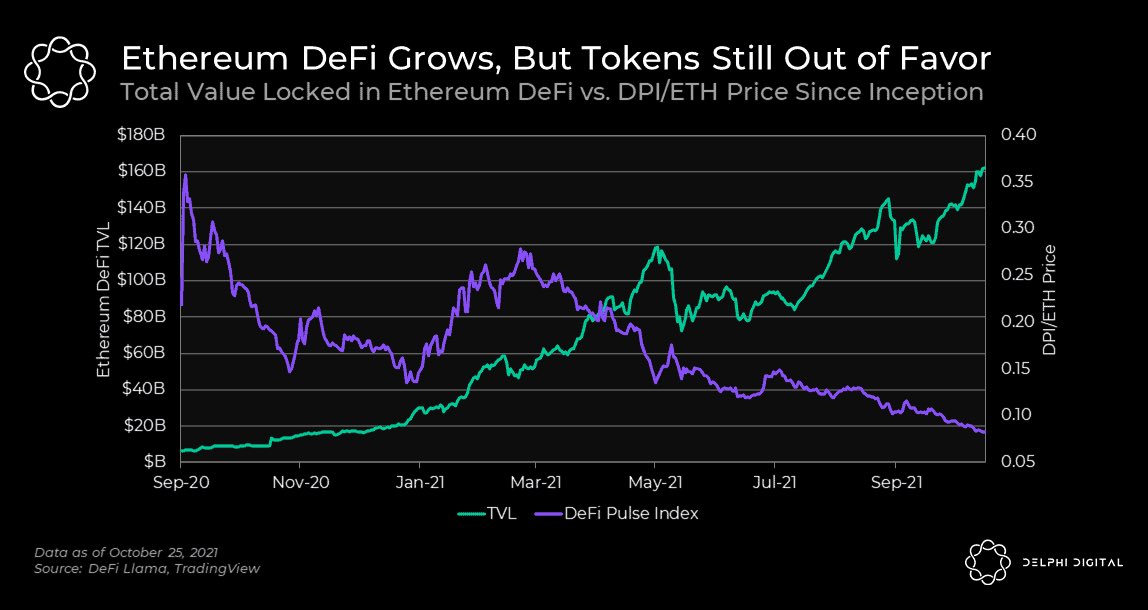

3/ TVL in Ethereum DeFi protocols crossed $160B, surging to its highest level ever.

But DeFi tokens haven’t gotten the memo and have lagged the rest of the market (with certain exceptions).

The DeFi Pulse Index has consistently lost value against ETH.

But DeFi tokens haven’t gotten the memo and have lagged the rest of the market (with certain exceptions).

The DeFi Pulse Index has consistently lost value against ETH.

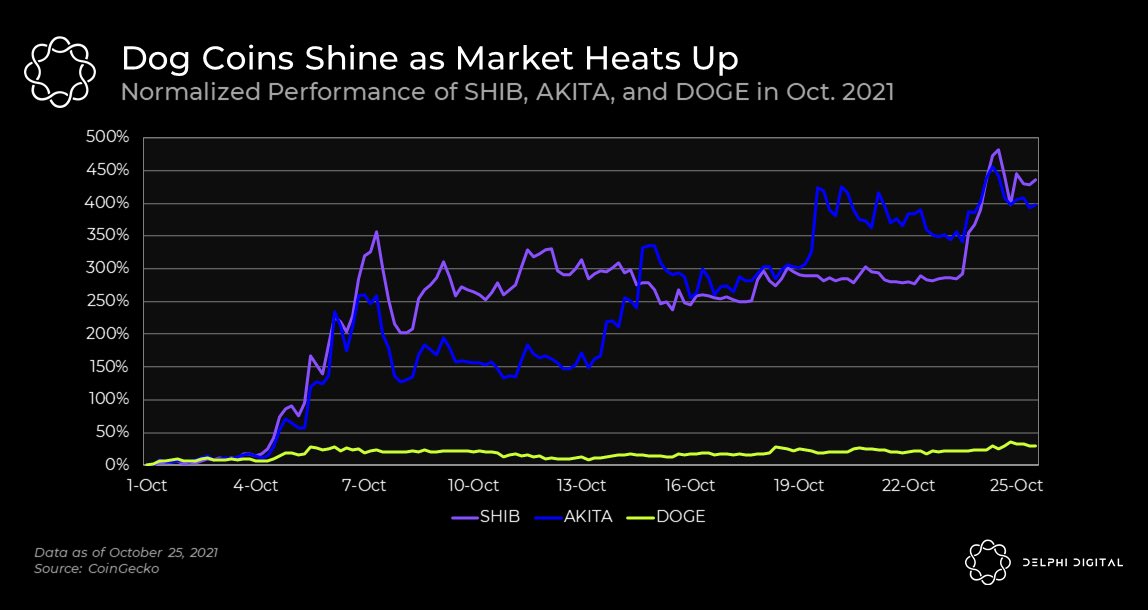

4/ Dog coins are mooning again, which has historically been a pretty good indication of an overheated market.

Both from Apr. – May. this year and in early Sept., dog coins were all the rage and quickly cratered as crypto markets cooled off or saw a fairly deep de-leveraging.

Both from Apr. – May. this year and in early Sept., dog coins were all the rage and quickly cratered as crypto markets cooled off or saw a fairly deep de-leveraging.

5/ Tweets of the day!

Facebook’s whistleblower talks briefly about her crypto

Facebook’s whistleblower talks briefly about her crypto

https://twitter.com/hshaban/status/1452453081099218949

6/ The Wolf of Wall Street got himself a punk

https://twitter.com/wolfofwallst/status/1452451833654521856

7/ The Korean Teachers Union is aping into Bitcoin

https://twitter.com/TheMoneyRaccoon/status/1452633208919674881

9/ Crypto moves fast. Delphi has you covered. Sign up here to get Delphi's free daily newsletter delivered right to your inbox every weekday

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh