How to calculate Profit/Loss on Options:

(A Thread)

1. Find a fixed R (risk) in Options is necessary just like trading commons

2. For day trades, Δ aka delta is the most important factor. Δ determines payout per $1 movement up in the underlying

Ex .5 pays $.50 on premium cost

(A Thread)

1. Find a fixed R (risk) in Options is necessary just like trading commons

2. For day trades, Δ aka delta is the most important factor. Δ determines payout per $1 movement up in the underlying

Ex .5 pays $.50 on premium cost

So if starting premium costed $.50 and the stock moves $1 up you get paid $.50 or 100%

3. Options closer to expiry have a high delta thus paying better for smaller movements in the underlying price ex. 0dte options

3. Options closer to expiry have a high delta thus paying better for smaller movements in the underlying price ex. 0dte options

4. Out the Money options are less expensive than ITM options. This is because In The Money options have intrinsic value, and At the Money options are very close to having intrinsic value. OTM options have no intrinsic value! The only value OTM have is extrinsic (Time +IV)

5. IntheMoney vs OutTheMoney -> ITM options have higher delta thus paying better on small movements. OTM options need a bigger movement in the underlying to actually pay.

6. Delta is not fixed->As an OTM option moves ITM its delta changes and pays bigger but needs a bigger move

6. Delta is not fixed->As an OTM option moves ITM its delta changes and pays bigger but needs a bigger move

7. Swinging Options -> Now that we understood Δ, we must consider Θ, or time decay.

Θ is the price you pay per day to hold an option. Yes, you pay to swing options! The closer to expiry the higher the higher Θ! So swinging far out expiry is safer than early expiry

Θ is the price you pay per day to hold an option. Yes, you pay to swing options! The closer to expiry the higher the higher Θ! So swinging far out expiry is safer than early expiry

8. IF CALCULATING DELTA AND THETA SEEMS DIFFICULT THERE IS AN EASIER WAY TO KNOW YOUR RISK/REWARD!!

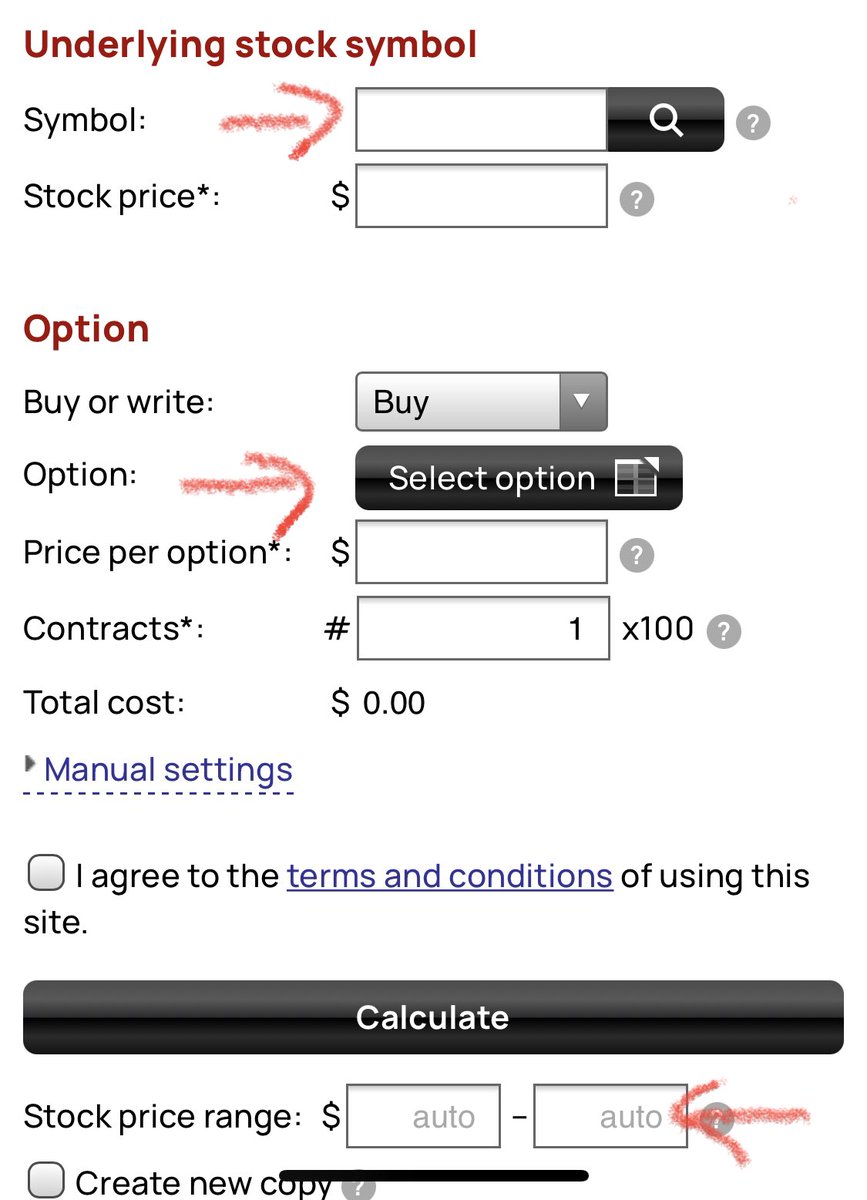

-> Go to Optionsprofitcalculator.com

-> Choose long call or long put in the main page

-> Put the ticker you want to look at and choose the expiry and strike

-> enter your PT!

-> Go to Optionsprofitcalculator.com

-> Choose long call or long put in the main page

-> Put the ticker you want to look at and choose the expiry and strike

-> enter your PT!

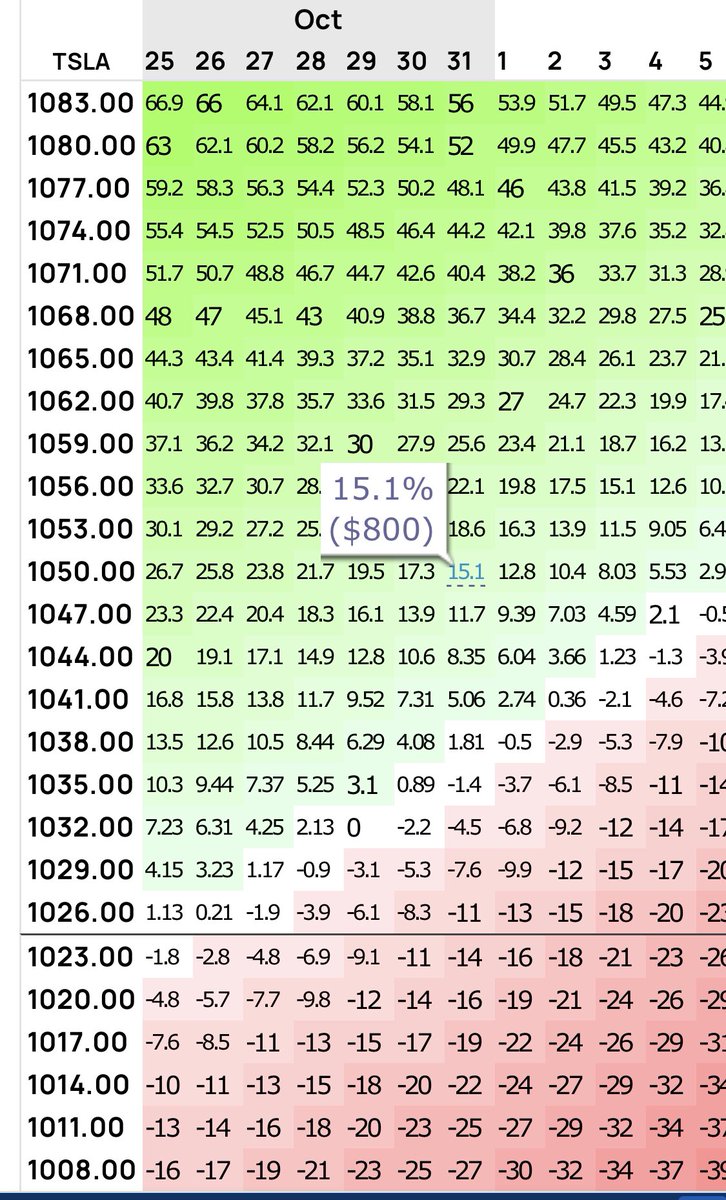

9. It will then generate a price vs time! -> now you will know what the premium will be worth if a stock hits X price by X date

(Very useful for swinging)

Ex. $TSLA $1025 Nov 19 calls shown below

If $TSLA hits to 1050 by October 31-> these options pay 15%

(Very useful for swinging)

Ex. $TSLA $1025 Nov 19 calls shown below

If $TSLA hits to 1050 by October 31-> these options pay 15%

10. Using this resource you now know what price change in the underlying will result in % change for your specific options!

-> now instead of getting shaken out by seeing your P/L moving, you can set price points for profit grabs and stop losses on your position!

Voila!

-> now instead of getting shaken out by seeing your P/L moving, you can set price points for profit grabs and stop losses on your position!

Voila!

• • •

Missing some Tweet in this thread? You can try to

force a refresh