Quick thread shamelessly plagiarising/summarising the @OBR_UK's presentation just now (because v interesting). First, GDP forecasts better but still extremely painful.

This is the key slide for me, on which so much else rests - inflation spike expected to subside to a nice neat 2%. Business leaders I've spoken to are sceptical to say the least...

On tax, Sunak is clearly funding the extra spending from his tax rises - but keeping much of the cash back to cut borrowing/as a buffer against instability

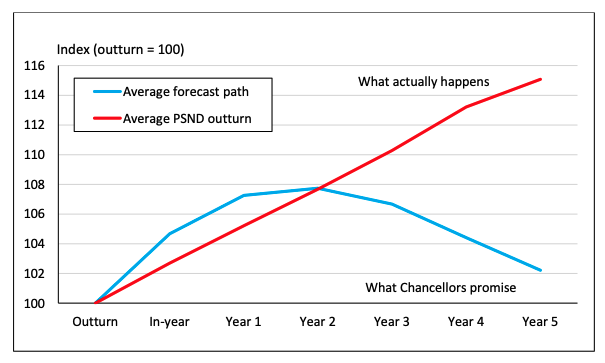

OBR flag that the new fiscal rules mean the Chancellor is now lashed to multiple masts - should be OK but something to watch for...

Good news on unemployment, which is way lower than was feared (though they expect it to rise slightly from this point, vs Bank of England who don't - explains some of the difference in scarring assumptions)

For those who were upset that the OBR gave Sunak extra time to do the spending review (as it did Osborne in 2015), here's the impact of that - you can see how inflation and interest rates bite into headroom...

Finally, here are the OBR's conclusions. Lighter scarring but still historically large state. More here obr.uk/efo/economic-a…

• • •

Missing some Tweet in this thread? You can try to

force a refresh