1/ With #TerraAutumn🍁 here, I'm diving into one of the ecosystem's most promising projects, @mars_protocol

Why am I so excited about Mars?

Mars provides two fundamental improvements to existing defi money markets:

✦ Uncollateralized Lending

✦ Dynamic Interest Rate Model

Why am I so excited about Mars?

Mars provides two fundamental improvements to existing defi money markets:

✦ Uncollateralized Lending

✦ Dynamic Interest Rate Model

2/ Let's take a deep dive into Mars and how it works

TLDR: 🦧🔴

nfa

TLDR: 🦧🔴

nfa

3/ Mars aims to be a decentralized bank controlled by its users and stakeholders

"Mars is a bank of the future: non-custodial, open-source, transparent, algorithmic and community-governed"

"Mars is a bank of the future: non-custodial, open-source, transparent, algorithmic and community-governed"

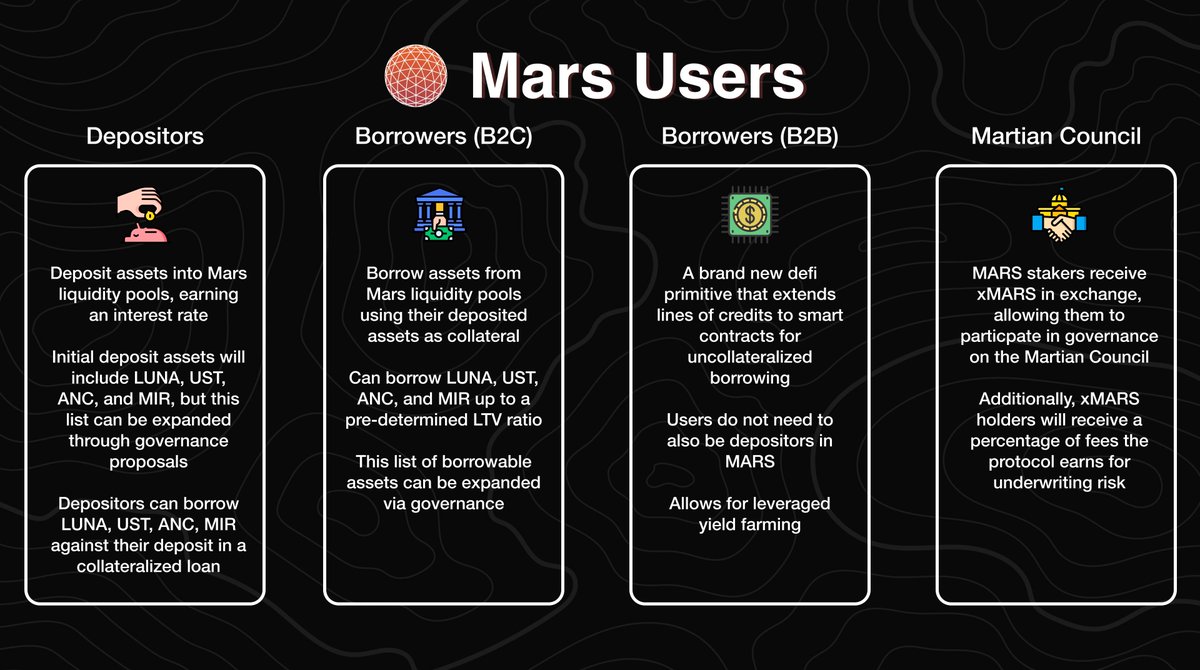

4/ The protocol will have 4 types of users:

1. Depositors

2. Collateralized Borrowers (B2C)

3. Uncollateralized Borrowers (B2SC)

4. Martian Council Members

1. Depositors

2. Collateralized Borrowers (B2C)

3. Uncollateralized Borrowers (B2SC)

4. Martian Council Members

5/ Collateralized borrowing on Mars works much like it does on @anchor_protocol

Users can borrow up to a fixed LTV of their deposited collateral

However, Mars users can borrow LUNA, UST, ANC, and MIR, along with other CW-20 tokens in the future

Users can borrow up to a fixed LTV of their deposited collateral

However, Mars users can borrow LUNA, UST, ANC, and MIR, along with other CW-20 tokens in the future

https://twitter.com/mars_protocol/status/1432383953504178181?s=20

6/ Use cases for borrowing CW-20 assets, ANC in this example:

-A staking opportunity for ANC, but you don't think ANC's current price will hold

-LP opportunities: Example, borrow ANC to use in @SpecProtocol or @ApolloDAO

-Shorting ANC

-A staking opportunity for ANC, but you don't think ANC's current price will hold

-LP opportunities: Example, borrow ANC to use in @SpecProtocol or @ApolloDAO

-Shorting ANC

7/ Shorting:

Let's say you think the price of ANC will go down.

Mars allows you to take a short position on ANC by depositing collateral and borrowing ANC, then selling ANC on the open market

Let's say you think the price of ANC will go down.

Mars allows you to take a short position on ANC by depositing collateral and borrowing ANC, then selling ANC on the open market

8/ ANC Short Example

If you borrow 10 ANC at $5 and sell it on the open market, you have 50 $UST

ANC's price proceeds to fall to $3 and you use that $30 of that $50 to buy ANC back and repay your 10 ANC loan, pocketing $20 on the spread

If you borrow 10 ANC at $5 and sell it on the open market, you have 50 $UST

ANC's price proceeds to fall to $3 and you use that $30 of that $50 to buy ANC back and repay your 10 ANC loan, pocketing $20 on the spread

9/ Collateralized borrowing has been a defi staple with many tried and true use cases

✦ Uncollateralized borrowing via smart contract, however, is a brand new defi primitive that totally changes the game

✦ Uncollateralized borrowing via smart contract, however, is a brand new defi primitive that totally changes the game

10/ By extending credit lines to smart contracts, MARS is opening up defi to an enormous new cohort:

Non-lenders

This will generate higher borrow demand, utilisation rates and therefore higher yields for Mars lenders

Non-lenders

This will generate higher borrow demand, utilisation rates and therefore higher yields for Mars lenders

11/ What does it mean to extend a credit line to a smart contract?

MARS B2SC lending will initially launch with 2 smart contract strategies, MIR-UST and ANC-UST one-click, autocompounding farms on Mirror and Anchor, respectively

Additional SCs will be added via governance

MARS B2SC lending will initially launch with 2 smart contract strategies, MIR-UST and ANC-UST one-click, autocompounding farms on Mirror and Anchor, respectively

Additional SCs will be added via governance

12/ An example of a MIR-UST farming strategy:

A user deposits MIR into the MARS MIR-UST farming strategy contract

UST is then borrowed from the MARS UST market to create a leverage MIR-UST pair

A user deposits MIR into the MARS MIR-UST farming strategy contract

UST is then borrowed from the MARS UST market to create a leverage MIR-UST pair

13/ This pair is put through an AMM contract (@astroport_fi? 😉) and converted to LP tokens that are staked on Mirror

The LP rewards are fed back to the strategy contract that borrowed the UST and made available for withdrawal

The LP rewards are fed back to the strategy contract that borrowed the UST and made available for withdrawal

14/ @larry0x lays out a number of exciting use cases for MARS uncollateralized B2SC borrowing in this thread

This is just the tip of the iceberg

As a new defi primitive, it's hard to even imagine all the awesome ways this will be employed and built on

This is just the tip of the iceberg

As a new defi primitive, it's hard to even imagine all the awesome ways this will be employed and built on

https://twitter.com/larry0x/status/1421164692547022853?s=20

15/ Liquidations

Liquidations can and will occur with both collateralized and uncollateralized borrowing on MARS so users will need to responsibly manage LTV ratios

Seems like a match made in heaven for @NexusProtocol 😉

Liquidations can and will occur with both collateralized and uncollateralized borrowing on MARS so users will need to responsibly manage LTV ratios

Seems like a match made in heaven for @NexusProtocol 😉

16/ ✦ Dynamic Interest Rate Model

In contrast to Anchor and traditional defi money markets, MARS will employ a dynamic interest rate model based on control theory, allowing for greater responsiveness and capital efficiency

In contrast to Anchor and traditional defi money markets, MARS will employ a dynamic interest rate model based on control theory, allowing for greater responsiveness and capital efficiency

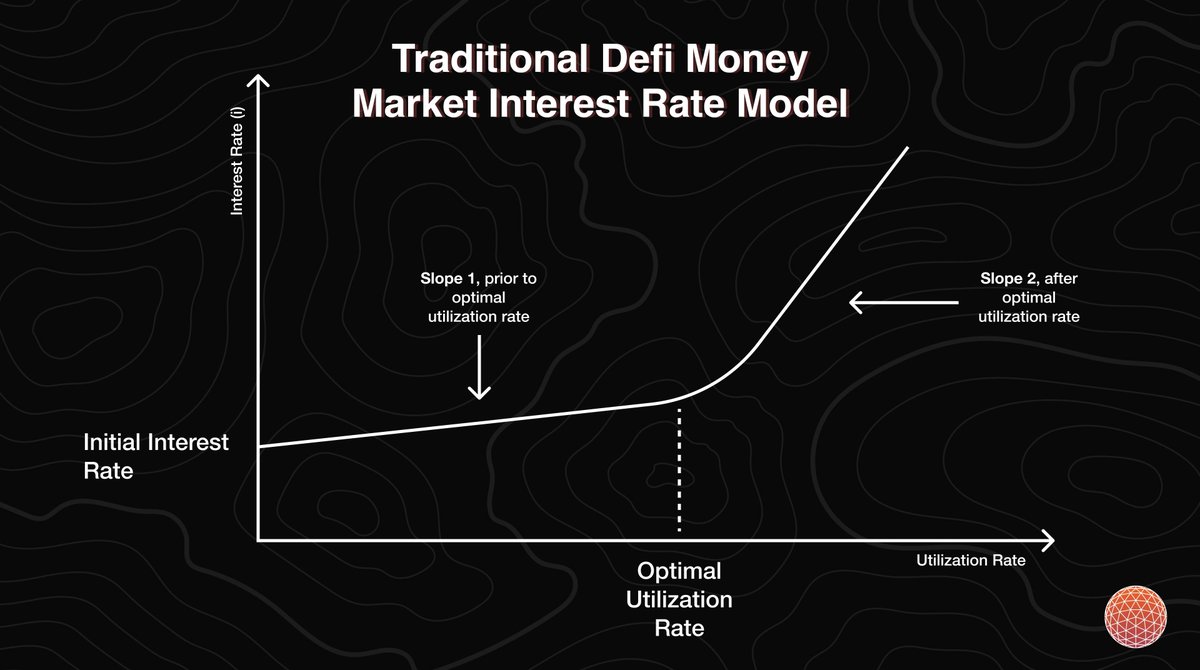

17/ Traditional MMs like Compound set the interest rate in a 2 step process

1st a target utilization rate (amount borrowed/deposited) is set

Then a curve is hard coded to discourage utilization past the target rate by sharply increasing the interest rate slope

1st a target utilization rate (amount borrowed/deposited) is set

Then a curve is hard coded to discourage utilization past the target rate by sharply increasing the interest rate slope

18/ This model can lead to inefficient markets where the borrow and lend APRs are miles apart, resulting in insufficient farming liquidity

The only way to address this is by changing the MM’s interest rate model via governance

This is slow and requires very active governance

The only way to address this is by changing the MM’s interest rate model via governance

This is slow and requires very active governance

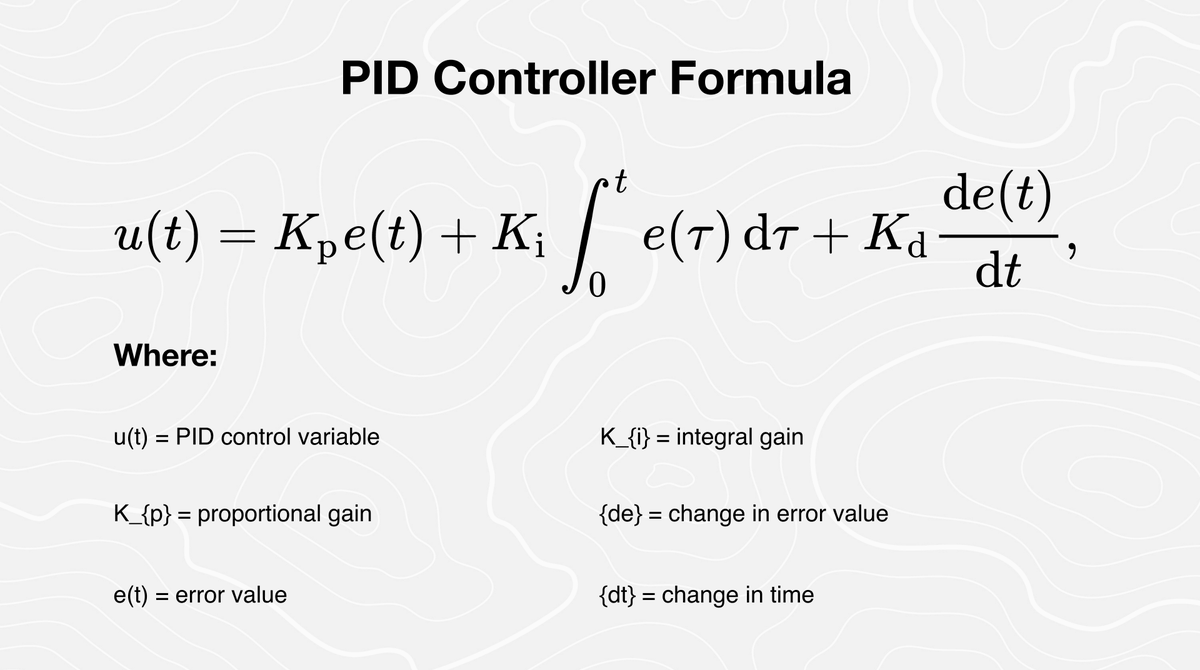

19/ ✦ The MARS Protocol solution to this problem is to target a utilization rate via dynamic, reactive interest rates using a PID controller model, most often associated with heating and cooling systems that regulate temperature

This is a brand new interest rate model for defi

This is a brand new interest rate model for defi

20/ "A PID controller continuously calculates the difference between the desired point (set point — optimal utilisation) and actual value (process variable — actual utilisation). Then it continuously corrects itself based on the proportional, derivative, and integral terms"

21/

Proportional (P): Yields a corrective response based on the error between target and actual utilisation.

Integral (I): Takes historical errors for a given time (t) into account

Derivative (D): Attempts to avoid I-term correction overshooting

Proportional (P): Yields a corrective response based on the error between target and actual utilisation.

Integral (I): Takes historical errors for a given time (t) into account

Derivative (D): Attempts to avoid I-term correction overshooting

22/ This dynamic interest rate model is the first of its kind and was developed by the team @Delphi_Digital with @ideocolab

You can dive further into the mechanics of the PID controller interest rate model here

cdn.delphidigital.io/uploads/2021/0…

You can dive further into the mechanics of the PID controller interest rate model here

cdn.delphidigital.io/uploads/2021/0…

23/ Mars will initially launch with just the Proportional variable of the PID controller

The Integral and Derivative components will be added as relevant data to the protocol's interest utilization is obtained

The Integral and Derivative components will be added as relevant data to the protocol's interest utilization is obtained

24/ Governance

All of this genius will be under the control of the Martian Council, aka MARS stakers

1 xMARS = 1 unit of voting power

Vote on:

✦ Asset listings

✦ Risk Parameters

✦ Treasury Spending

and more

All of this genius will be under the control of the Martian Council, aka MARS stakers

1 xMARS = 1 unit of voting power

Vote on:

✦ Asset listings

✦ Risk Parameters

✦ Treasury Spending

and more

25/ Fee Revenue

xMARS holders will be rewarded for underwriting protocol risk with a portion of the protocol fee revenue in the form of $MARS tokens

xMARS holders will be rewarded for underwriting protocol risk with a portion of the protocol fee revenue in the form of $MARS tokens

26/ Value Flows

80% of all interest earned will go to lenders with the remaining 20% being split between:

✦ Mars Treasury

✦ Mars Insurance Fund (held in a UST that will be used in the case of a shortfall event)

✦ xMARS holders ($MARS stakers)

80% of all interest earned will go to lenders with the remaining 20% being split between:

✦ Mars Treasury

✦ Mars Insurance Fund (held in a UST that will be used in the case of a shortfall event)

✦ xMARS holders ($MARS stakers)

27/ Token Distribution

A total of 100M MARS tokens

-55M to community

-5M for airdrop

-10M for initial investors

-20M for the team and advisors

-10M for Mars Reserve

A total of 100M MARS tokens

-55M to community

-5M for airdrop

-10M for initial investors

-20M for the team and advisors

-10M for Mars Reserve

28/ Mars Lockdrop:

Early community members will have the opportunity to lock their UST for a specified amount of time in exchange for MARS

The goal of this is to bootstrap the liquidity for the UST side of the Mars money market

Read the full post here:

mars-protocol.medium.com/ignition-phase…

Early community members will have the opportunity to lock their UST for a specified amount of time in exchange for MARS

The goal of this is to bootstrap the liquidity for the UST side of the Mars money market

Read the full post here:

mars-protocol.medium.com/ignition-phase…

29/ Lockdrop participants can choose to lock their UST in Mars from 1 to 52 weeks

The longer the chosen lockup period, the higher the multiplier attached to MARS rewards tokens

The longer the chosen lockup period, the higher the multiplier attached to MARS rewards tokens

30/ Upon conclusion of the ignition phase, lockdrop participants:

✦ MARS (claimable all at once)

✦ xMARS (accruing per block as UST remains deposited in Mars w/ a minimum period equal to the selected lockup length)

✦ UST as interest on their locked UST

✦ MARS (claimable all at once)

✦ xMARS (accruing per block as UST remains deposited in Mars w/ a minimum period equal to the selected lockup length)

✦ UST as interest on their locked UST

31/ When can we expect the Ignition Phase to begin?

@JayJaboneta is correct, Mars' launch is dependent on that of @astroport_fi's

@JayJaboneta is correct, Mars' launch is dependent on that of @astroport_fi's

https://twitter.com/JayJaboneta/status/1452909550038708224?s=20

32/ @ZeMariaMacedo of Delphi Labs has indicated a mid-November launch for Astro, in this (fantastic) thread here

https://twitter.com/ZeMariaMacedo/status/1453369406181060610?s=20

33/ If I were to guess, Mars will launch in the 2-4 weeks following Astroport, meaning anywhere from the end of November to mid-December

Not financial advice, but...

I'm all in on The Red Bank 🔴

Not financial advice, but...

I'm all in on The Red Bank 🔴

34/ Check out the entire Mars Litepaper here

Exciting times for the @terra_money blockchain

mars-protocol.medium.com/mars-protocol-…

Exciting times for the @terra_money blockchain

mars-protocol.medium.com/mars-protocol-…

Can't wait to see the awesome ways that the Terra gigabrains put @mars_protocol to work

@nicdors @NicolasFlamelX @traderrocko @CitrusMimosa @Speicherx @wencol5 @cryptosmiff @Josephliow @gtcapital_ @Danxia_Capital @TerraBitesPod @Bitcoin_Sage @lejimmy @AnonNgmi @mooneybagz

@nicdors @NicolasFlamelX @traderrocko @CitrusMimosa @Speicherx @wencol5 @cryptosmiff @Josephliow @gtcapital_ @Danxia_Capital @TerraBitesPod @Bitcoin_Sage @lejimmy @AnonNgmi @mooneybagz

I’ll be posting a lot more in the future

Follow me for more protocol breakdowns and alpha

Follow me for more protocol breakdowns and alpha

• • •

Missing some Tweet in this thread? You can try to

force a refresh