Going to weigh in on $TWTR only because I love pain.

1/ Today's reaction on $TWTR reminds me a lot of May 6, 2014. I was in Detroit. $FCAU unveiled its ambition to grow volumes from 4.4 million to 7 million. The stock closed down 11.7%. Sergio bought shares that day.

1/ Today's reaction on $TWTR reminds me a lot of May 6, 2014. I was in Detroit. $FCAU unveiled its ambition to grow volumes from 4.4 million to 7 million. The stock closed down 11.7%. Sergio bought shares that day.

2/ Investors associated the stock reaction with a communication & management failure- which was really lost on me. After being "burned," no buy-siders bothered to attend the late day "chat" with Sergio... it was only that skeleton crew in the distance

3/ So me and 4-5 other lucky people had unfettered access to Sergio for a couple hours. In the moth-balled board room, he opened by lighting a cigarette & asked, "so what did you not like about the plan?" Almost exactly like this:

4/ a brave soul in the room quipped "your volume targets are not credible." His response was "I'm paying my people on these numbers- do you really think I would put something out we didn't think was achievable?" He went on to explain profit was more important- not volumes.

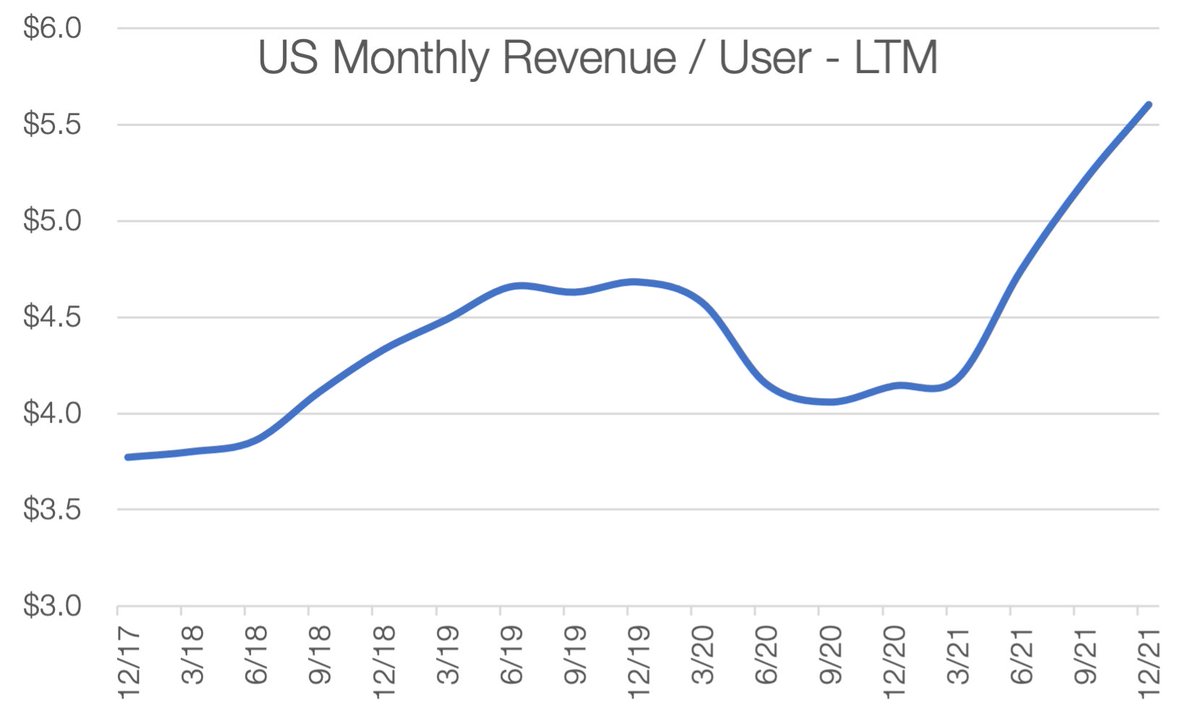

5/ flash forward to October 27, 2021. $TWTR is the only social media company that doesn't disappoint on both the quarter and the forward guide. THE ONLY ONE. It's driven by very strong acceleration in monetizing its base - the long held bull thesis.

6/ this was paired with commentary about how they're just getting started in commerce and monetization, with a long runway ahead. Refocusing MoPub's team exclusively on commerce & monetization is another reinforcement. Maintaining the $7.5B is a guide upgrade, just 6 months later

7/ Well-placed sarcasm on here has pointed that $TWTR doesn't have an IDFA effect because it's so bad at personalization of ads - that's ACTUALLY the opportunity here. Problem or opportunity? They are the same.

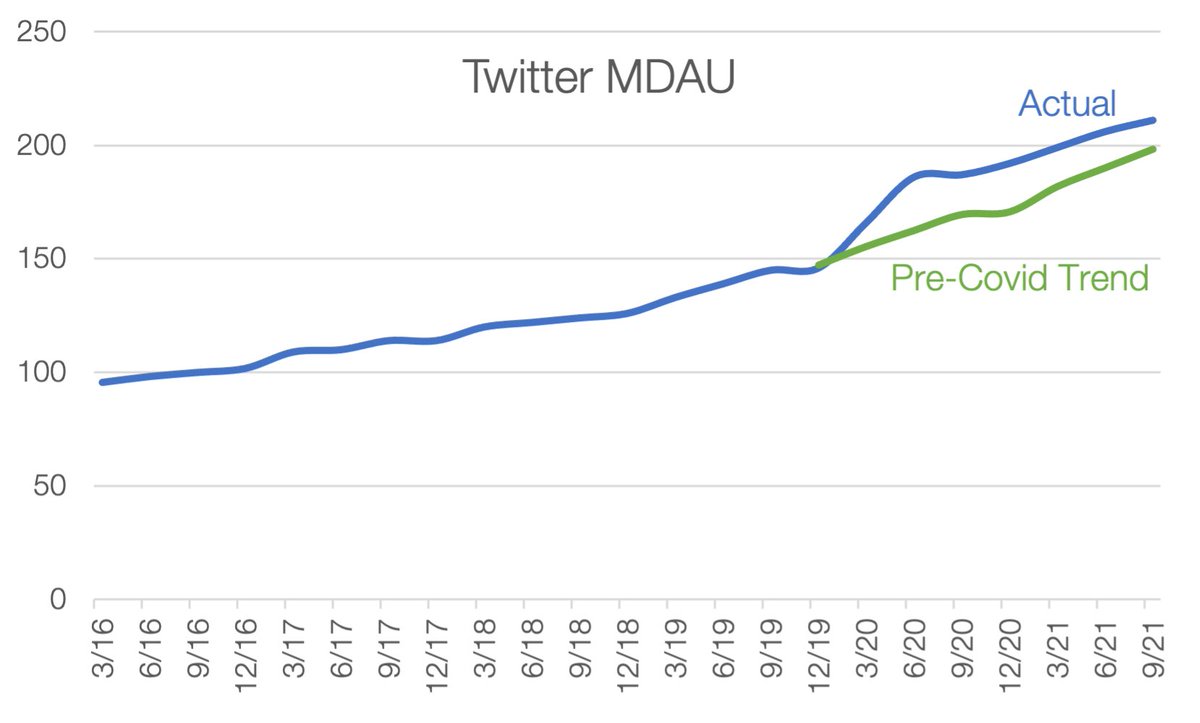

8/ then on a Spaces w/ @BillBrewsterTBB & @ElliotTurn, @nedsegal talked about a large number of ways to get to the "unachievable" 315m MDAU. Betting against this is betting against the law of compounding & of product iterations. It also ignores the the Covid bump on comparables

9/ Taking pre-covid trend numbers on today's base - along with compounding effects, $TWTR basically gets north of 315 MDAU some time in Q1 2024 - possibly 1 quarter late if they don't improve on the rate of growth- which they think they will.

10/ If monetization keeps accelerating, the day they hit 315 is irrelevant (Q4 '23 or Q1 '24). They're going to print at least $7.5 billion in revenue in '23- which 8 months ago (pre CMD), "consensus" never believed. Crazy, consensus will actually improve after yesterday’s print

11/ traders confusing a painful stock reaction w/ management ineptitude. I strongly disagree- mgmt is focusing on everything they need to. Do we want faster execution? Always. Did Sergio also have more than 1 CEO hat? Always. Was he ever respected before $RACE’s IPO? Almost never

12/ If the analogy has any relevance, the outcome will be short-sighted and this will prove to be a great buying opportunity. But that's totally up to you- @jack, @nedsegal. Keep building. Your platform is clearly a voting machine, but over time, the stock market is...

13/ A weighing machine. $FCAU doubled over NTM. But in the end, the skeptics were right. $FCAU never hit the 7m in volumes. Sergio instead exercised pricing power on Jeep & Ram and 5x'ed net income as promised. Shares also 5x'ed.

14/ @ned and @jack just keep that focus on monetization & personalization, and we'll all be toasting you in a few years. Oh, and #sergioisgod

• • •

Missing some Tweet in this thread? You can try to

force a refresh