ELI5 for @KlimaDAO dashboard made by @cujowolf_klima:

a thread reviewing the 10 day performance of $KLIMA and explaining the significance of each metric on dashboard.

dune.xyz/Cujowolf/Klima…

a thread reviewing the 10 day performance of $KLIMA and explaining the significance of each metric on dashboard.

dune.xyz/Cujowolf/Klima…

Hard to believe that @KlimaDAO launched barely 10 days ago. Since then it has hit a billion in market cap and accumulated ~7 million tons of carbon credits in its treasury!

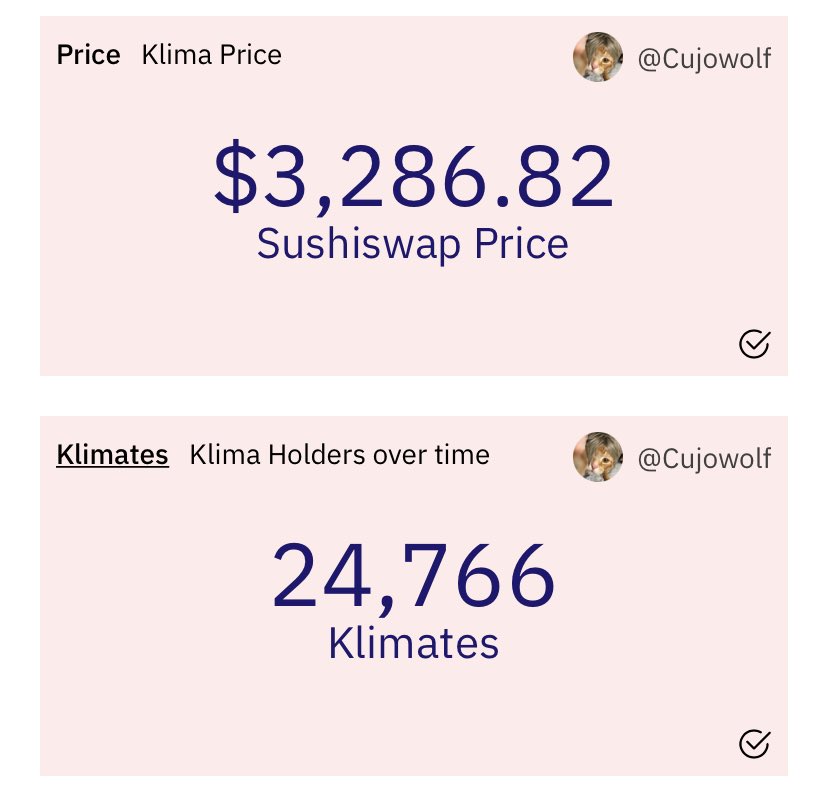

Each $KLIMA trades for $3,286 and 24,766 unique wallets currently hold $KLIMA.

Each $KLIMA trades for $3,286 and 24,766 unique wallets currently hold $KLIMA.

$KLIMA total supply of 334k is about 4K more than circulating supply. The difference is held by the DAO and is in unvested bonds.

1.14 Index means 1 $KLIMA staked on Oct 18 is now 1.14 $KLIMA.

BCT is Base Carbon Ton. Price of $KLIMA in BCT terms is 535.

1.14 Index means 1 $KLIMA staked on Oct 18 is now 1.14 $KLIMA.

BCT is Base Carbon Ton. Price of $KLIMA in BCT terms is 535.

Only 1.5% of $KLIMA is not staked. 2.3% is in the liquidity pools which @KlimaDAO owns and 96.2% is staked.

If this staking % figure falls, APY will rise. Current APY is 32,500% in $KLIMA terms.

If this staking % figure falls, APY will rise. Current APY is 32,500% in $KLIMA terms.

1 $KLIMA must always be backed by 1 $BCT. Risk Free Value is the BCT balance in $KLIMA treasury and the written down value of $BCT in $KLIMA liquidity pools.

There are 6.9 mm tons of BCT in $KLIMA treasury which currently trade at $10.5/ton resulting in a market value of $73 mm

There are 6.9 mm tons of BCT in $KLIMA treasury which currently trade at $10.5/ton resulting in a market value of $73 mm

The Risk Free Value is made up of 1.14 mm BCT that came in as Reserve Bonds and 344,492 is the written down value of KLIMA-BCT liquidity pools.

Written down value = 2sqrt(amount of KLIMA * amount of BCT) * % pool owned by $KLIMA

BCT-USDC not counted b/c RFV is in BCT terms.

Written down value = 2sqrt(amount of KLIMA * amount of BCT) * % pool owned by $KLIMA

BCT-USDC not counted b/c RFV is in BCT terms.

Market value on the other hand captures both liquidity pools ie BCT-KLIMA and BCT-USDC in addition to the market value of BCT held in KLIMA treasury.

Impressive to see a $72 mm treasury in just 10 days from launch.

Impressive to see a $72 mm treasury in just 10 days from launch.

Carbon is held in three ways by $KLIMA treasury

1. Reserve BCT bonds ie just sell BCT to KLIMA

2. KLIMA-BCT liquidity pool token

3. BCT-USDC liquidity pool token

Two pools were made to make it seamless for folks to buy $KLIMA from $USDC.

1. Reserve BCT bonds ie just sell BCT to KLIMA

2. KLIMA-BCT liquidity pool token

3. BCT-USDC liquidity pool token

Two pools were made to make it seamless for folks to buy $KLIMA from $USDC.

Total $BCT supply is all the carbon brought on chain by @ToucanProtocol.

Pro tip: if you click on Total BCT Supply you can see how much BCT was minted each day relative to how much came into $KLIMA.

Pro tip: if you click on Total BCT Supply you can see how much BCT was minted each day relative to how much came into $KLIMA.

Out of all the BCT that has been minted by @ToucanProtocol , 80% is held by @KlimaDAO

This graph shows much more BCT can be brought into $KLIMA treasury without bringing additional BCT from off chain to on chain.

This graph shows much more BCT can be brought into $KLIMA treasury without bringing additional BCT from off chain to on chain.

IMO tracking total BCT supply, how much comes on chain each day and how much is in $KLIMA’s treasury is the most important KPI.

The carbon black hole surely works. But getting carbon credits off chain to on chain quickly and reliably is essential for $KLIMA success.

The carbon black hole surely works. But getting carbon credits off chain to on chain quickly and reliably is essential for $KLIMA success.

$KLIMA owns 100% of the KLIMA-BCT pool and 86.1% of the BCT-USDC pool.

I expect BCT-USDC to go to 100% over time. For a BCT-USDC token holder, bond discount may not always make sense relative to the fees they may be earning by LPing.

I expect BCT-USDC to go to 100% over time. For a BCT-USDC token holder, bond discount may not always make sense relative to the fees they may be earning by LPing.

$KLIMA has earned $3.6 mm in trading fees in just 10 days. For contrast Olympus has earned $11.2 mm from launch till date (7 months).

100 day runway means that if bond sales go to zero, with the current Risk Free Value of BCT ie 1.14 mm BCT, the current APY can be sustained for 100 days.

Since total $KLIMA supply is 334k, it follows that 806k more $KLIMA can be minted based on current reserves alone.

Since total $KLIMA supply is 334k, it follows that 806k more $KLIMA can be minted based on current reserves alone.

LP fee are and growth in holders over time has just been staggering. $KLIMA makes $300-400k/day in trading fees and has close to 25k holders, up from 6k just 10 days ago!

That’s incredible growth.

That’s incredible growth.

While one $KLIMA sells for 535 BCT, a single $KLIMA is backed by 4.5 BCT.

While the premium is staggering, the growth in backing per $KLIMA is also impressive. High multiples are a function of growth expectations.

While the premium is staggering, the growth in backing per $KLIMA is also impressive. High multiples are a function of growth expectations.

All of the above can be accessed at this link below and it updates real time.

dune.xyz/Cujowolf/Klima…

dune.xyz/Cujowolf/Klima…

In addition, there is also a $KLIMA policy dashboard which can be accessed here. The BCVs are not showing right now due to a query error but it has some very insightful graphs as well.

dune.xyz/Cujowolf/Klima…

dune.xyz/Cujowolf/Klima…

I quite like this one that shows emissions breakdown between stakers and bonders. Over time share of bonders will rise as it happened with $OHM.

The dark green here shows the total liquidity owned and green is total volume. When light green more than dark green, it implies that utilization was over 100%!

This is why $KLIMA is earning incredible trading fees.

This is why $KLIMA is earning incredible trading fees.

• • •

Missing some Tweet in this thread? You can try to

force a refresh