OlympusDAO 101: Notice the similarities between the bitcoin supply curve and the @OlympusDAO supply curve? OlympusDAO $OHM aims to be the decentralised reserve-backed currency of crypto and here is how Thread 🧵 (1/12)

Each $OHM is backed by 1 unit of RFV, which comes from bond sales + other revenue (LP fees OlymPRO,etc.) To increase the supply of $OHM in the long run, the RFV in the treasury must increase by AT LEAST a proportional amount

1 unit of $OHM is backed by 1 unit of RFV (2/12)

1 unit of $OHM is backed by 1 unit of RFV (2/12)

To increase RFV in the treasury, it needs to incentivise constant inflow of deposits for stables/crypto assets/LP tokens from users. How do we do that from users? Giving them bond discount + attractive yields for staking $OHM (3/12)

OlympusDAO makes A LOT of revenue from bond sales because protocol only costs 1 DAI to mint 1 unit of $OHM, but it is selling $OHM to users at a slight discount from market price profiting from the huge spread in price. (4/12)

As the treasury of crypto deposits increases, it creates a stronger backing & stability base for new $OHM to be minted (it wants to increase $OHM supply in long run).

More bond sales > more stables/crypto/LP > Higher backing for future $OHM minting (5/12)

More bond sales > more stables/crypto/LP > Higher backing for future $OHM minting (5/12)

Higher RFV/TVL in OlympusDAO treasury drives higher confidence and growth for $OHM. Market price increases, leading to more people staking $OHM, higher revenue from bond sales & higher bond capacity for minting $OHM (6/12)

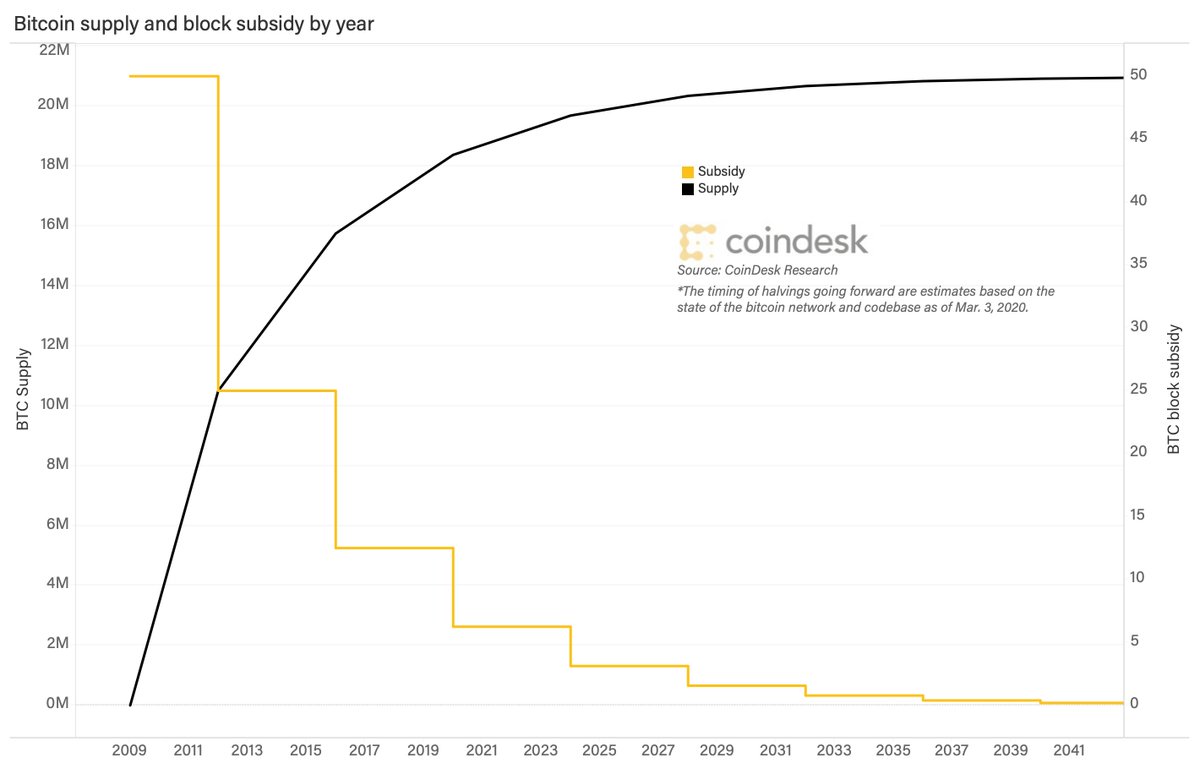

Newly minted $OHM for stakers come from emission that takes total supply, reward rate & ohm staked into consideration. The rate at which $OHM is minted into circulation mimics how bitcoin block rewards are minted into circulation. Rate of emission slows down over time (7/12)

Supply of $OHM is backed by value of treasury. Bond sales is what help value of treasury to increase. Through bonding, OlympusDAO also owns all the liquidity giving no room for mercenary capital. Market value of treasury is within the DAO's control, that is powerful. (8/12)

Price of $OHM fluctuates, but it is backed by value of treasury in OlympusDAO and that can be assured (no liquidity locust). It also makes revenue from LP fees (currently 11.2m) and this compounds as more LP deposits come in. (9/12)

In the long run, price of $OHM should converge to the average price of a diversified basket of crypto assets in the treasury. Through game theory and incentives, it creates a market scenario where token supply & treasury assets increase sustainably over time (10/12)

& with that, the end game is to be somewhat like bitcoin, except it is better in a way that it is "backed" It would have billions/trillions of crypto assets in its treasury, earning billions from its capital & each ohm in circulation is backed by what is stored in the DAO (11/12)

A decentralized reserved currency backed NOT by the dollar, by government faith, by gold, but by a basket of diversified crypto assets. #OHMISBACKED (12/12)

@ohmzeus

@OlympusDAO

@sayinshallah

@sh4dowlegend

@danielesesta

@ohmzeus

@OlympusDAO

@sayinshallah

@sh4dowlegend

@danielesesta

Overview of how OlympusDAO works. What does bonding, staking mean, where do the high APY yields come from and everything you need about OlympusDAO is explained in this video.

• • •

Missing some Tweet in this thread? You can try to

force a refresh