#UnitedSpirits - A story of the Spirits in India (Thread)

USL is subsidiary of global leader Diageo PLC. world’s second-largest spirits company by volume

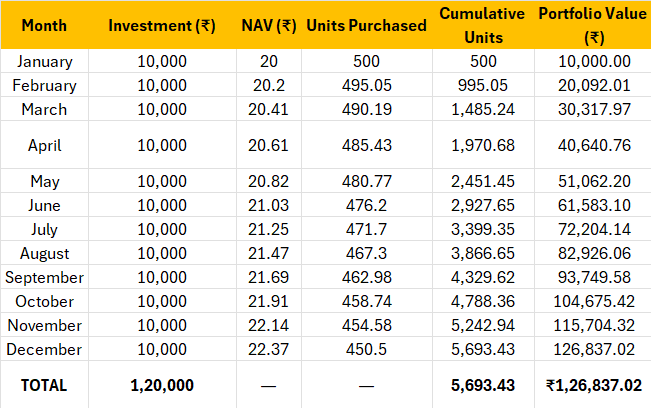

Disc - Personally invested and continue in SIP mode in this stock. Not a suggestion

cc - @dmuthuk

1/n

USL is subsidiary of global leader Diageo PLC. world’s second-largest spirits company by volume

Disc - Personally invested and continue in SIP mode in this stock. Not a suggestion

cc - @dmuthuk

1/n

The company manufactures, sells and distributes an outstanding portfolio of spirits

ranging from premium brands such as Johnnie Walker, Black Dog to Aspiring class including McDowell’s No1, White Mischief etc.

PRO - They have something for every class of income

2/n

ranging from premium brands such as Johnnie Walker, Black Dog to Aspiring class including McDowell’s No1, White Mischief etc.

PRO - They have something for every class of income

2/n

Growing industry - Rs 3.9 trillion alcohol beverage market to grow at 6.8% till 2023: ICRIER

The share of the upper-middle income group in alcohol consumption has increased steadily from 7 per cent to 21 per cent and is expected to increase to 44 per cent by 2030

3/n

The share of the upper-middle income group in alcohol consumption has increased steadily from 7 per cent to 21 per cent and is expected to increase to 44 per cent by 2030

3/n

India & Spirit growth -

- The country that consumes the most whiskey in the world is India

- The rising affluence of India’s middle class will drive the growth ~10% year in the $33B market

USL's focus is forward looking in the right direction to tap consumer spend

4/n

- The country that consumes the most whiskey in the world is India

- The rising affluence of India’s middle class will drive the growth ~10% year in the $33B market

USL's focus is forward looking in the right direction to tap consumer spend

4/n

As the industry continues to grow, it also offers a moat status with very low chances of disruption, highly regulated in India and complex policies on liquor

Premiumization is phenomenon playing out and it is benefitting USL - Prestige & Above segment net sales grew 20-30%

5/n

Premiumization is phenomenon playing out and it is benefitting USL - Prestige & Above segment net sales grew 20-30%

5/n

COVID Shifts

- Consumption at home making alcohol semi-essential

- Home-delivery opened up in some areas

- Shift from beer to Scotch & Whiskey

Once workplaces, bars open, social drinking will open up and some of the home consumption would still continue

6/n

- Consumption at home making alcohol semi-essential

- Home-delivery opened up in some areas

- Shift from beer to Scotch & Whiskey

Once workplaces, bars open, social drinking will open up and some of the home consumption would still continue

6/n

Transformation

- High experience retail stores opening in Tier 1 & Tier 2 cities

- Increased demand for premium upper prestige liquor (as home consumption made these more affordable. the same brand costs 2x to 3x in bars) = MORE VALUE TO THE CUSTOMER at same price

7/n

- High experience retail stores opening in Tier 1 & Tier 2 cities

- Increased demand for premium upper prestige liquor (as home consumption made these more affordable. the same brand costs 2x to 3x in bars) = MORE VALUE TO THE CUSTOMER at same price

7/n

Innovation - Strengthen exists brands, Make in India & also bring global brands to India

- One of the most loved beer globally (Guinness) to be introduced to India

- Craft continues to excel due to the low price and fresh brewed - Epitome Reserve 100% rice grain

8/n

- One of the most loved beer globally (Guinness) to be introduced to India

- Craft continues to excel due to the low price and fresh brewed - Epitome Reserve 100% rice grain

8/n

Financials

- Sharp growth in revenue and PAT over the last few quarters

- Key focus on becoming debt free (Less debt == less interest == more value)

Focus on stakeholder value generation

- long-term value to all our Stakeholders

- Dividend payout in future

9/n

- Sharp growth in revenue and PAT over the last few quarters

- Key focus on becoming debt free (Less debt == less interest == more value)

Focus on stakeholder value generation

- long-term value to all our Stakeholders

- Dividend payout in future

9/n

Social responsibility and education

- Launch of DrinkIQ India website

- Moving India towards ‘Drink Better, not More’

11/n

- Launch of DrinkIQ India website

- Moving India towards ‘Drink Better, not More’

11/n

Key triggers & shift

- New leadership team with new strategy

- Fixing balance sheet by getting rid of debt

- Controlling operations and supply chain by improving efficiencies and improving margin

- Focus on Premiumization

- Focused investment on core brands

12/n

- New leadership team with new strategy

- Fixing balance sheet by getting rid of debt

- Controlling operations and supply chain by improving efficiencies and improving margin

- Focus on Premiumization

- Focused investment on core brands

12/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh