I am old enough to remember Shilpa Medicare was suppose to the Laurus lab of Pharma industry. 7 yrs on the returns are zero.

It was one of the 7 stocks in Motilal Oswal 100 bagger stocks.

We know less about stocks that we would care to admit.

It was one of the 7 stocks in Motilal Oswal 100 bagger stocks.

We know less about stocks that we would care to admit.

I am old enough to remember Mayur uniquoter was suppose to be the best auto ancillary co in India. Its sales were supposed to zoom with massive capex (in 2014/15?)/

Seven and a half years later the returns are zero.

Seven and a half years later the returns are zero.

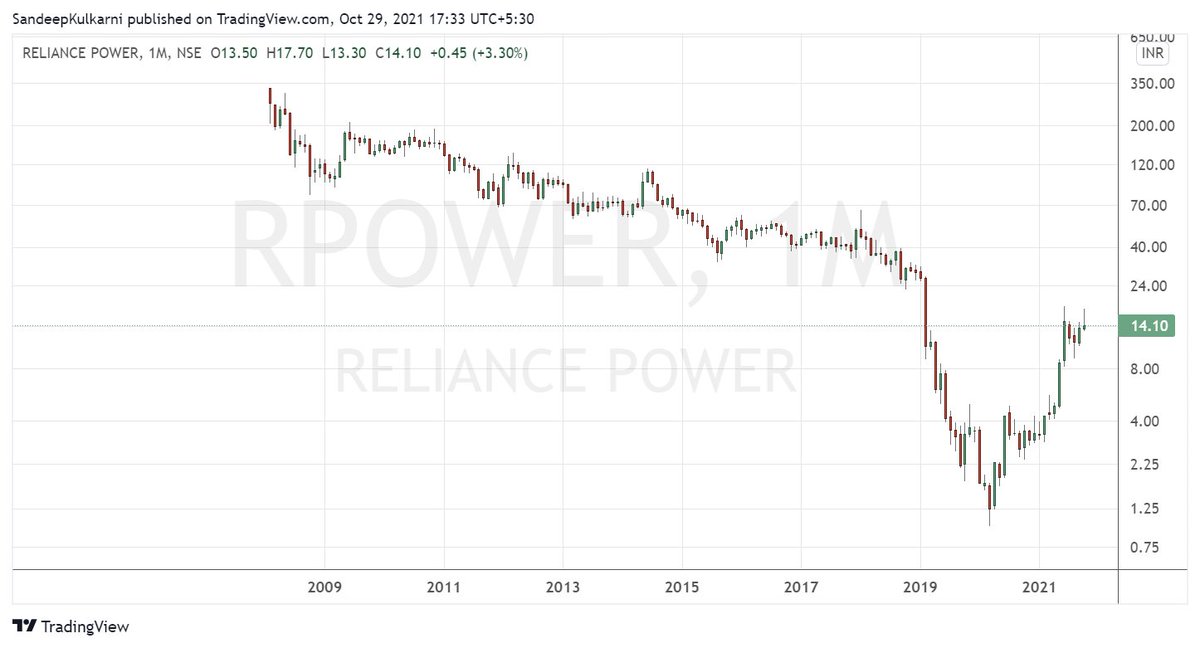

I am old enough to remember the mad rush for Reliance Power IPO in Jan 2008. One story itched in my mind is about a peon in govt office who took 50k personal loan to apply for this IPO.

14 yrs on the stock is 95% lower

14 yrs on the stock is 95% lower

I am old enough to remember the fanfare around Quess corp & Thomas cook, Prem Vatsa's investment vehicle.

Now they don't talk about them. They talk about platform companies.

Now they don't talk about them. They talk about platform companies.

I am old enough to remember Va Tech Wabag was suppose to be a 'world class', 'asset-light' business that was supposed to be a big beneficiary of 'Namome Gange'(yeh kounsi baala ka naam hai 😂) . It was discovered by none other than Kenneth Andrade.

I am old enough to remember La Opala was supposed to be excellent play on urban consumption. Discovered by Shyam Shekhar(?)

7 yrs--->Nada

7 yrs--->Nada

I am old enough to remember Symphony was a 1000 bagger growing at scorching pace.

7 yrs and all that investors have got is 🔄

7 yrs and all that investors have got is 🔄

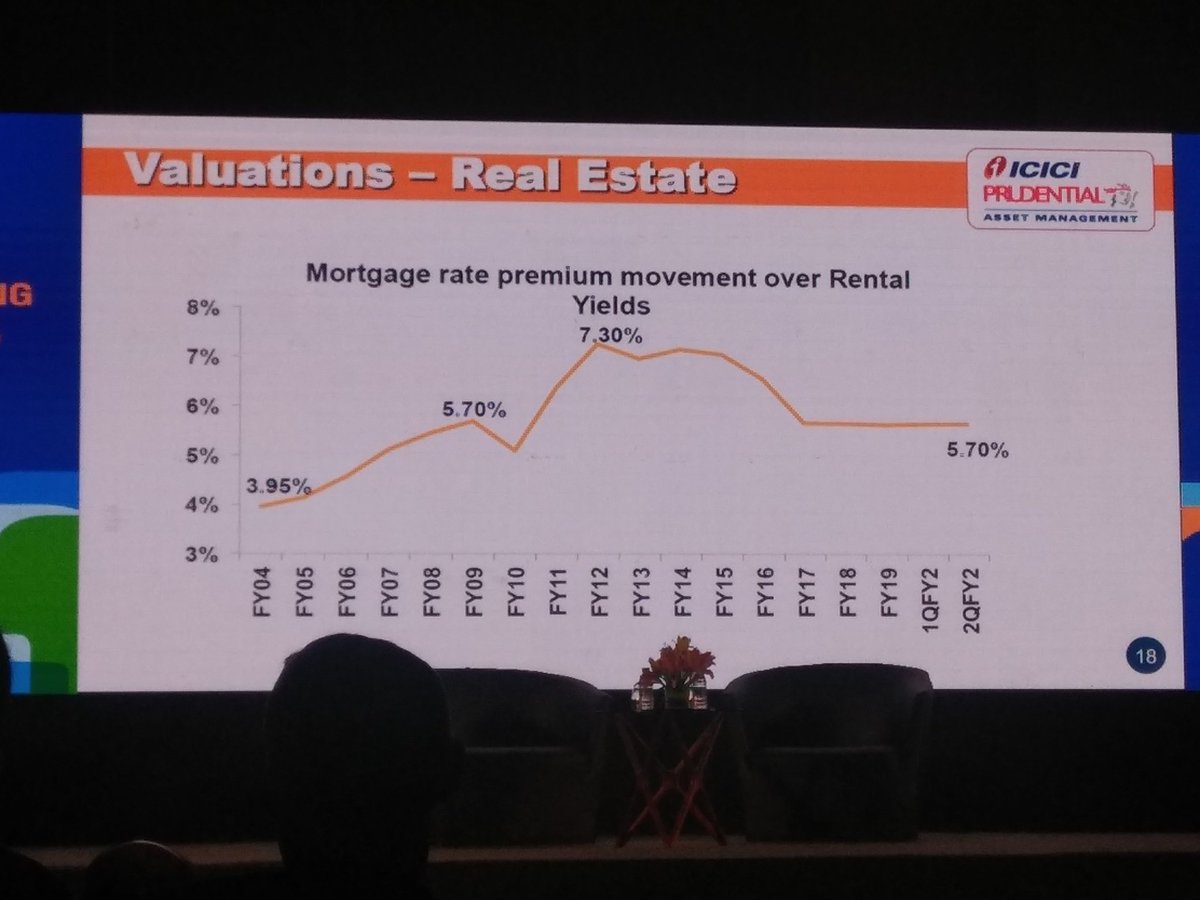

Next time I meet S Naren I am going to ask him why has he kept this stock in Value Discovery for so many years(13+ yrs to be precise). What does he see in this company that market is not able to see?

• • •

Missing some Tweet in this thread? You can try to

force a refresh