AMFI ARN: 287729

Aksha Moneyworks4u Pvt Ltd

TA Charts |

Stocks-Themes |

Fitness Enthusiast |

Travel Enthusiast |

Enquiry: https://t.co/N8SOn6AsF1

How to get URL link on X (Twitter) App

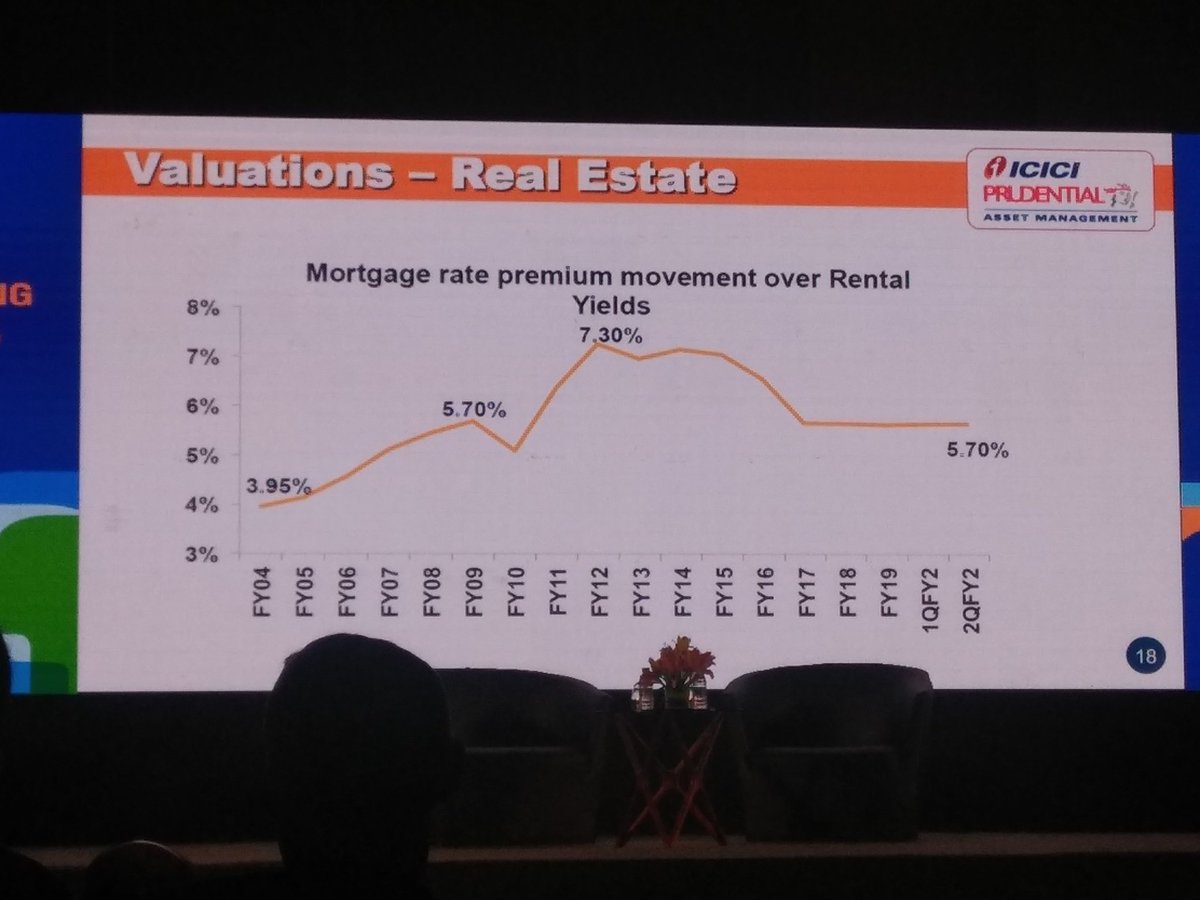

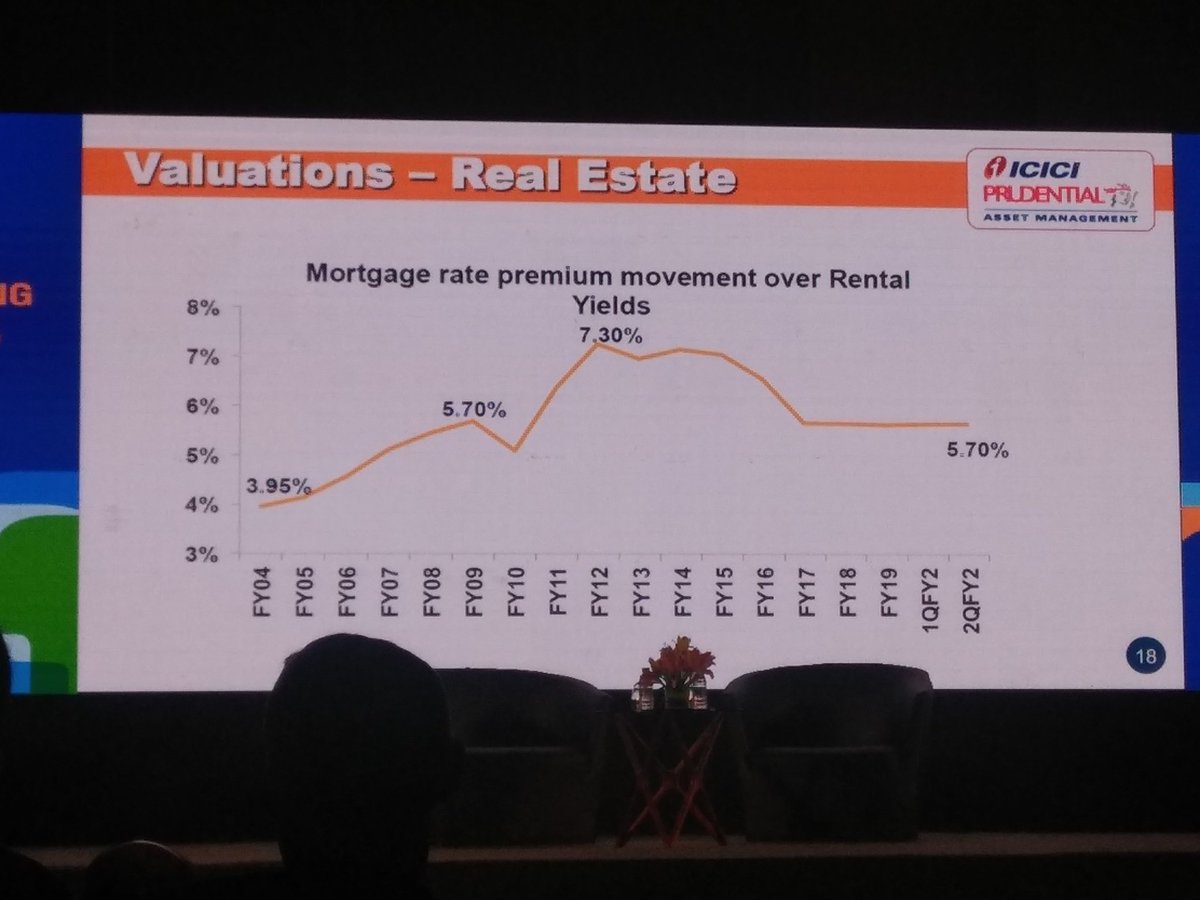

Real estate market peaked in 2013 when the gap became was as high as 7%(HL at 9% & rental yields sub 2 %). This number had gone down to 4% again in 2020 when rental yields were 3% & HL rate was 7%.

Real estate market peaked in 2013 when the gap became was as high as 7%(HL at 9% & rental yields sub 2 %). This number had gone down to 4% again in 2020 when rental yields were 3% & HL rate was 7%.

I am old enough to remember Mayur uniquoter was suppose to be the best auto ancillary co in India. Its sales were supposed to zoom with massive capex (in 2014/15?)/

I am old enough to remember Mayur uniquoter was suppose to be the best auto ancillary co in India. Its sales were supposed to zoom with massive capex (in 2014/15?)/

https://twitter.com/BloombergQuint/status/1183570620392587265- As the article suggests its over-valued relative to other large banks in the world.