#PolicybazaarIPO Long thread: There is monetary printing by RBI, there is lending by banks & finally there is the Indian IPO. “Foreign owned” company with ~1 Bn investment is selling “Indian” unicorn to “savvy” Indians for $ 6.2 Bn. Want to know how this printing works? Let’s go-

The basics: Rs 6017 Cr being raised by new shares (Rs 3750) & re-selling (Rs 2267). Face value Rs 2 offered at Rs ~1000 per share is one of a kind. Who decides the price? Examine the valuation ladder below.

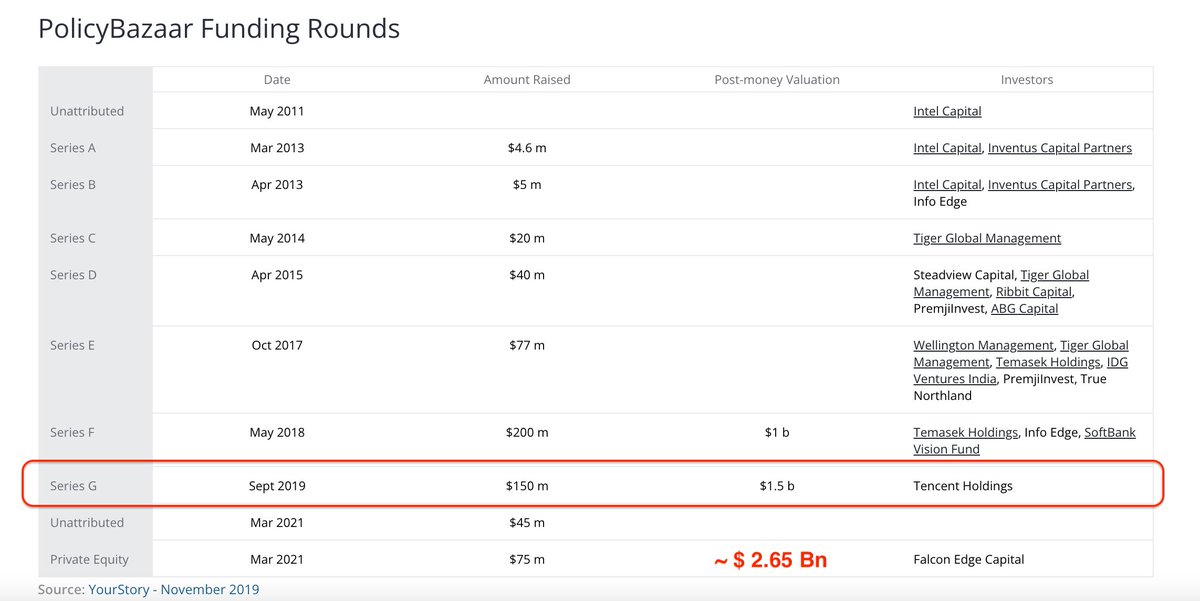

With ~$ 150 Mn invested till 2017, we see $ 525 Mn rushes in after 2018

With ~$ 150 Mn invested till 2017, we see $ 525 Mn rushes in after 2018

So, a company valued $1 Bn in 2018 & $ 1.5 Bn in 2019 by key investors like Tencent, suddenly “needs money” in March 2021. Falcon Edge “invests” all of $ 75 Mn in March at valuation of $ 2.65 Bn.

Enter IPO bankers a couple of months later & they value the company at $ 6.2 Bn

Enter IPO bankers a couple of months later & they value the company at $ 6.2 Bn

Why does PolicyBazaar need $ 75 Mn just 6 months before IPO & give away 2.5 times in returns? And it doesn’t even use that money as the B/S reflects appx Rs 1000 Cr in cash lying around.

What kind of a favor is that? Why do they need US investment bank for this just before IPO?

What kind of a favor is that? Why do they need US investment bank for this just before IPO?

Notice 50% rise in shareholding of promotors here & a 1: 500 bonus share issue. After all, how do you print money & still keep share price at “reasonable” Rs 1000?

Without bonus issue in June 2021, each share would have costed Rs 50,000. Heard of circular valuation?

Without bonus issue in June 2021, each share would have costed Rs 50,000. Heard of circular valuation?

Well, let’s move on to the business model & future potential here. The whole story is tied to the “enormous potential” of insurance in India & how under-penetrated it is.

The DRHP devotes significant weight to mark & Sullivan report on Indian insurance. See the snapshot below:

The DRHP devotes significant weight to mark & Sullivan report on Indian insurance. See the snapshot below:

DHRP quotes “Indian life insurance premiums will grow at 18% CAGR from 2021 till 2030". The 2020 (pre covid) premiums were Rs 5.7 lac Cr.

It adds reasons – under-penetrated market, demographic dividend, need for life insurance, blah blah. So what’s wrong with this?

It adds reasons – under-penetrated market, demographic dividend, need for life insurance, blah blah. So what’s wrong with this?

Well, for one, try searching any other report from Frost & Sullivan for last 10 yrs on Indian insurance. You find nothing. So let me quote no less than the #BCG report for Indian insurance in 2011.

Life insurance was to grow 8 times from 2011 to 2020 to a premium of Rs 20 lac Cr

Life insurance was to grow 8 times from 2011 to 2020 to a premium of Rs 20 lac Cr

Except that it didn’t. Not only did #BCG missed the mark, it missed it by 70%. Life insurance could muster a measly Rs 5.7 lac Cr in 2020. A projected CAGR of 25% came to barely 4% for a decade. But it is BCG, so in 2021, it says “Indian has disappointed". Disappointed whom? BCG?

The fun doesn’t end here. The same consultants publish with yet another report in 2021 & this time take a CAGR of 15% till 2025. The same as Frost & Sullivan report that PolicyBazaar quotes.

Most within industry know that it not feasible. But it does help bullish IPO, never mind

Most within industry know that it not feasible. But it does help bullish IPO, never mind

Move to another lever of growth: The power of digitization & why PolicyBazaar can do what insurers couldn’t. Drive online business at low cost.

Let’s examine this myth in view of life insurance that is almost ~60% of revenue for PB. Life ins is a people intensive push business.

Let’s examine this myth in view of life insurance that is almost ~60% of revenue for PB. Life ins is a people intensive push business.

There comes complexity of scale. Look at below P&L & examine the employee expense. These range from 80% in 2019 to 62% in 2021, despite positioning for IPO. It's standard for life insurance biz.

How can #policybazaar scale digitally when 65% costs are employee expenses?

How can #policybazaar scale digitally when 65% costs are employee expenses?

And it talks of opening branches for better conversions (Read - selling insurance like bank RMs do). Aside of term plans, life insurance is pushed by salesforce.

Revenue = Salesmen x policies sold x avg premiums. Can't beat this equation. Have you ever bought a ULIP on your own?

Revenue = Salesmen x policies sold x avg premiums. Can't beat this equation. Have you ever bought a ULIP on your own?

Talking of push, let’s compare the revenue growth for PB with some banks. Firstly #SEBI, pls ask 5 yr financials for loss making cos seeking to list. Post Covid, 3 yr P&L doesn’t tell us much. Of course, PB also hasn’t disclosed anything more.

If you’re impressed that losses in 2021 have reduced, just notice "advt & sales promotion" expenses. If we keep the same proportions as last 2 yrs, the loss % would be exactly the same.

But magically, the promotional exp reduce in IPO year. How? Ask Zomato & Paytm. Same trick.

But magically, the promotional exp reduce in IPO year. How? Ask Zomato & Paytm. Same trick.

For a ~ Rs 1000 Cr sales, the valuation of #policybazaaripo is 46 times SALES. You heard it, “times sales, not profits”.

Assume a 15% profit margin in distant future, the PE works out at ~ 306. So how about banks that earn similar revenues from brokerage?

Assume a 15% profit margin in distant future, the PE works out at ~ 306. So how about banks that earn similar revenues from brokerage?

IndusInd bank earned Rs 4500 Cr from fee income & its valuation is $ 12 BN. Axis Bank with Rs 14,000 fee income is valued at $ 30 Bn. And these are BANKS where fee is just a side income.

PolicyBazaar with just Rs 1000 Cr (fee income) revenue is asking $ 6 Bn !

PolicyBazaar with just Rs 1000 Cr (fee income) revenue is asking $ 6 Bn !

Last resort – “Well PB is not only insurance but PaisaBazaar also. It is expanding into lending & can make money there”. Well, not really.

First, PB is 70% insurance biz. Second, the PB revenues have been growing on “outsourcing services” & “Online consulting”. What's that story

First, PB is 70% insurance biz. Second, the PB revenues have been growing on “outsourcing services” & “Online consulting”. What's that story

#PaisaBazaar revenues have fallen adversely due to lack of loan disbursals in covid (Paisa Bazaar loan disbursal fell by 50% in FY 21). But there is always Frost & Sullivan with their rosy projections (no track record), under-penetrated loan market, & blah blah.

Again, not happening. Loan growth in India has been falling consistently since 2019 as the below chart indicates (Sajjid Chinoy of Morgan Stanly).

If banks can’t have loan growth, brokers like #paisabazar can’t grow more on their backs.

If banks can’t have loan growth, brokers like #paisabazar can’t grow more on their backs.

Finally, look at contribution margins for #policybazaaripo . The margins look fine in 9 – 13%, but bloat to 39% in the IPO year.

Suddenly, revenue seems to go up with a fall in employee costs & promotion expenses. This one-year fall raises more questions than it tries to answer

Suddenly, revenue seems to go up with a fall in employee costs & promotion expenses. This one-year fall raises more questions than it tries to answer

Let not all pessimism cloud us. Yashish Dahiya, Alok Bansal & team have built a unique company that tries to make buying insurance easy, less messy with digital touch & good service. Hats-off to their resilience as entrepreneurs.Very few can do this in a tough & regulated market

Conclusion: To buy or not to buy?

We have a business that grows 4 times in valuation in 3 yrs & 2.5 times in just 6 months, operates in an industry that has grown by just 4% CAGR in last decade. The business is people intensive & digital scalability benefits are limited

We have a business that grows 4 times in valuation in 3 yrs & 2.5 times in just 6 months, operates in an industry that has grown by just 4% CAGR in last decade. The business is people intensive & digital scalability benefits are limited

With no 5-year financials, sharp drop in expenses in 2021 look out of line with trend. To pay 305 PE multiple for a semi-mature business, looks very pricey.

Light all fire crackers this Diwali but stay away from this financial bomb. You may burn your fingers.

Light all fire crackers this Diwali but stay away from this financial bomb. You may burn your fingers.

A correction- #PolicybazaarIPO issued 1:499 bonus shares in June 2021. Had it not done the bonus issue, the IPO share price would have been Rs 5 lac per share ( not 50k as quoted earlier). Now you know the reason behind bonus shares.

• • •

Missing some Tweet in this thread? You can try to

force a refresh