How to get URL link on X (Twitter) App

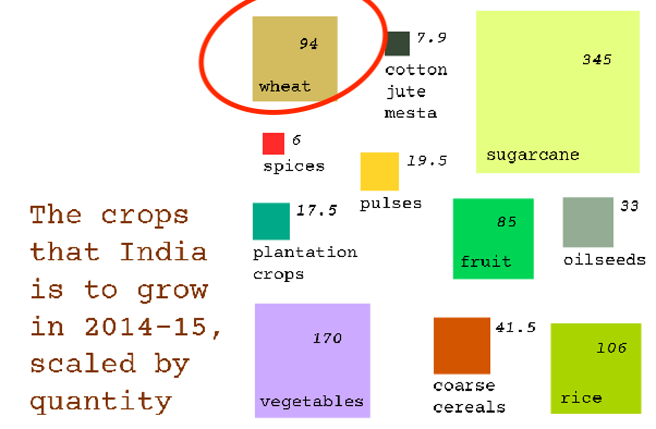

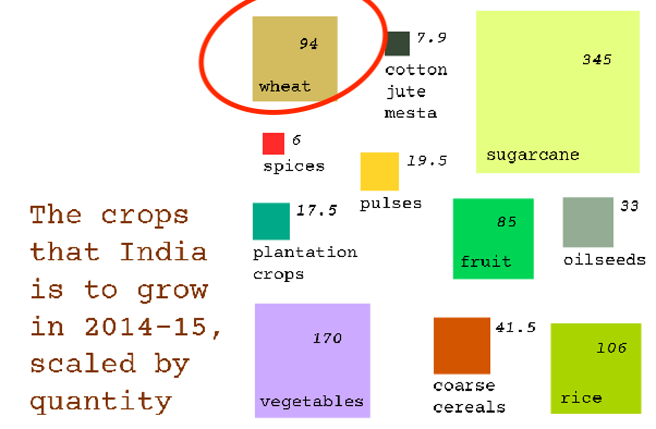

The chart is “corporate earnings to GDP”. Pls ignore the header. Numbers are fine.

The chart is “corporate earnings to GDP”. Pls ignore the header. Numbers are fine.

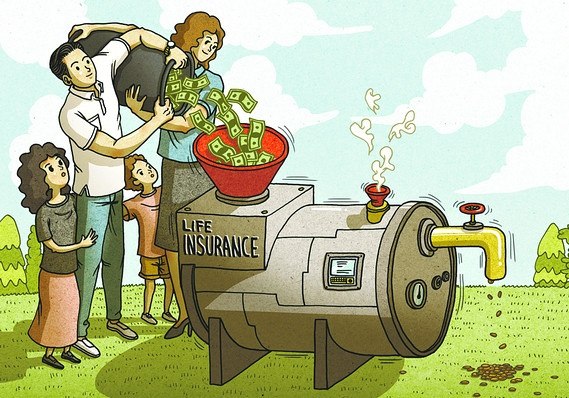

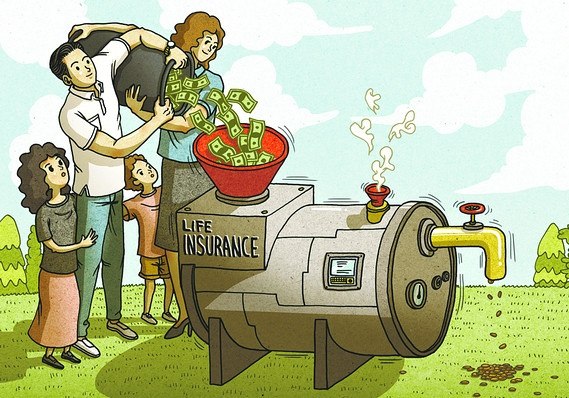

See the picture above Does the farmer in the picture needs a govt subsidy or support?

See the picture above Does the farmer in the picture needs a govt subsidy or support?

I’m not sure if you will change your valuation framework. But at the end of this post, you will definitely understand why FIIs may be selling.

I’m not sure if you will change your valuation framework. But at the end of this post, you will definitely understand why FIIs may be selling.

Well, looks like some of us did learn something. Markets at all time highs, SBI cards is still flat since 3 years. I don’t want to sound arrogant claiming victory. We are all learning here. So let's revisit what SBI cards promised (or implied) & what it delivered. Here we go -

Well, looks like some of us did learn something. Markets at all time highs, SBI cards is still flat since 3 years. I don’t want to sound arrogant claiming victory. We are all learning here. So let's revisit what SBI cards promised (or implied) & what it delivered. Here we go -

We’ve all heard this story. Had you invested in Sensex at inception in 1979, you got 660x returns, CAGR of ~17% . Simple math- Sensex started at 100 & now is hovering at 66,000.

We’ve all heard this story. Had you invested in Sensex at inception in 1979, you got 660x returns, CAGR of ~17% . Simple math- Sensex started at 100 & now is hovering at 66,000.

I’ll post a thread later if you can’t read behind the paywall.

I’ll post a thread later if you can’t read behind the paywall.

2/n

2/n

2/n

2/n

(1) Indian custom to buy LIC, passed through generations: LIC has the most entrenched network of 12 lac advisers & a legacy of 60 plus yrs. It has become customary to buy LIC. Your dad is bound to recommend the you same once you get your first salary.

(1) Indian custom to buy LIC, passed through generations: LIC has the most entrenched network of 12 lac advisers & a legacy of 60 plus yrs. It has become customary to buy LIC. Your dad is bound to recommend the you same once you get your first salary.

If you couldn’t understand why we needed 2.5 hours speech to convey this budget, you’re not alone. To simplify, GDP = Consumption + Investment + Govt spends + (Exports – Imports).We need all cylinders to fire, for #India with highest working age population in the world.Let's see

If you couldn’t understand why we needed 2.5 hours speech to convey this budget, you’re not alone. To simplify, GDP = Consumption + Investment + Govt spends + (Exports – Imports).We need all cylinders to fire, for #India with highest working age population in the world.Let's see

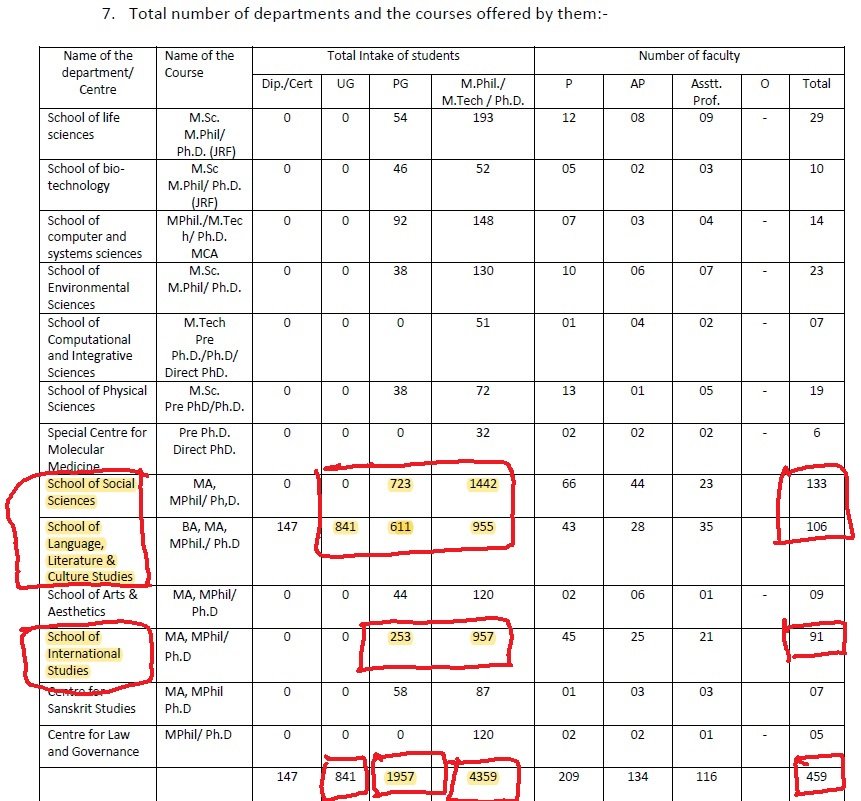

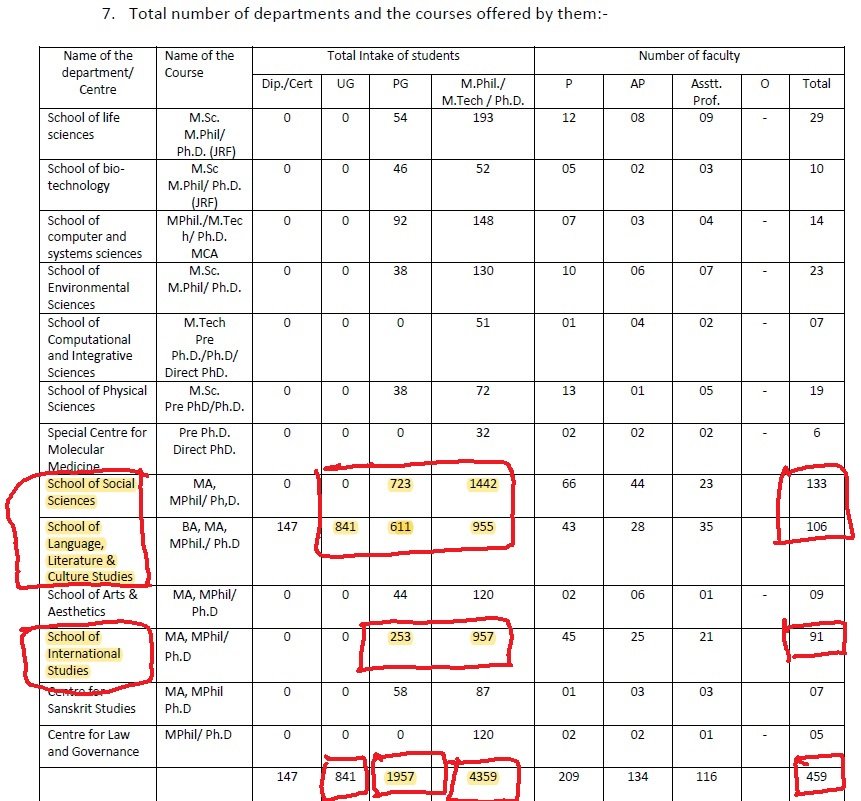

We see that there are a total of ~8000 students at JNU. Of this, the lion’s share of 57% students is of social sciences, language, literature & arts (4578 students) & International studies 15% ( 1210 students). Almost 55% of the total i.e. 4359 students are doing M.Phil. or Ph.D

We see that there are a total of ~8000 students at JNU. Of this, the lion’s share of 57% students is of social sciences, language, literature & arts (4578 students) & International studies 15% ( 1210 students). Almost 55% of the total i.e. 4359 students are doing M.Phil. or Ph.D