Finally got around to reading the letters of Nick Sleep and Zak Zakaria's Nomad Partnership. These guys crushed the market and left behind a legacy of insights and worldly wisdom.

Going to share some favorite lessons and quotes:

Going to share some favorite lessons and quotes:

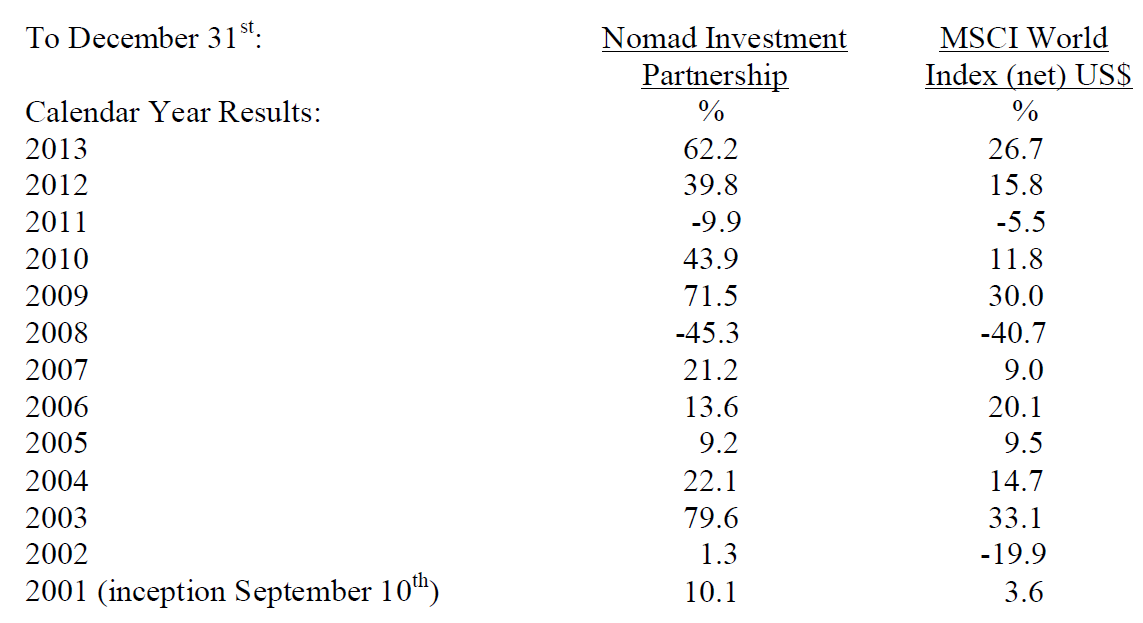

Sleep was an analyst at Marathon Asset Management and Zakaria at Deutsche Bank. The two connected over finding cheap stocks after the Asian financial crisis. In 2001, they set up their own investment partnership.

They closed it after 13 years. Such a mic drop..

They closed it after 13 years. Such a mic drop..

Intrinsic motivation.

They ran their partnership because they loved the intellectual challenge and craft, not just for money (but yes, they did earn enough to retire from performance fees). They closed the fund repeatedly and kept management fees low.

They ran their partnership because they loved the intellectual challenge and craft, not just for money (but yes, they did earn enough to retire from performance fees). They closed the fund repeatedly and kept management fees low.

"There are, perhaps, few things finer than the pleasure of finding out something new. Discovery is one of the joys of life and, in our opinion, is one of the real thrills of the investment process."

Long-term thinking.

They were obsessed with creating an ecosystem of long-term thinking among themselves, their investors, and the companies they invested in.

"One of Nomad’s key advantages will be the aggregate patience of its investor base."

They were obsessed with creating an ecosystem of long-term thinking among themselves, their investors, and the companies they invested in.

"One of Nomad’s key advantages will be the aggregate patience of its investor base."

"If Nomad is to have a competitive advantage over our peers this will come from the capital allocation skills of your manager and the patience of our investors."

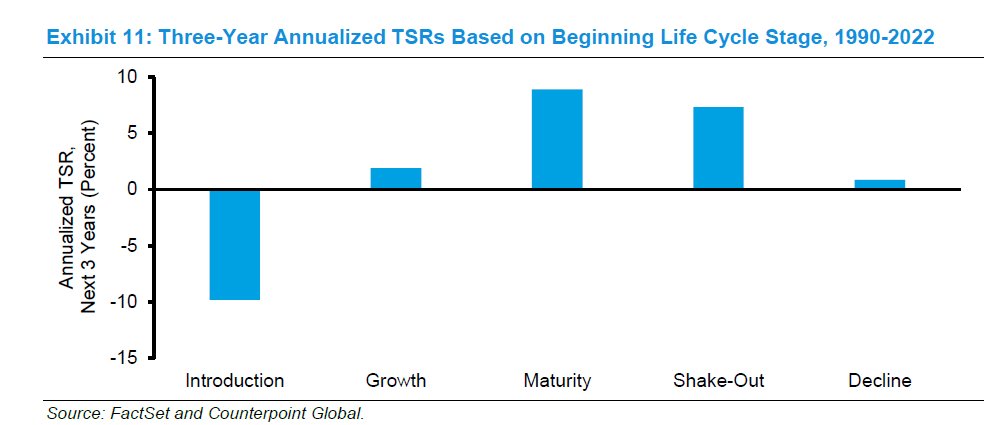

Only by looking further out than the short-term crowd can we expect to beat them.

Only by looking further out than the short-term crowd can we expect to beat them.

It is for this reason we named Nomad an Investment Partnership and not a fund. The relationship we seek is quite different."

Focus.

They removed as much noise as possible and spent their time on what *they* did best: analyzing companies and learning broadly.

"The prime determinants of outcome are price and capital allocation by management. ... It is these factors that occupy almost all our time."

They removed as much noise as possible and spent their time on what *they* did best: analyzing companies and learning broadly.

"The prime determinants of outcome are price and capital allocation by management. ... It is these factors that occupy almost all our time."

One big idea.

Marathon provided an education in capital cycle investing and Nomad started with "cigar butts": distressed telco firms, emerging markets, the turnaround of UK bus operator Stagecoach.

But they found one big idea that, over time, dominated the portfolio.

Marathon provided an education in capital cycle investing and Nomad started with "cigar butts": distressed telco firms, emerging markets, the turnaround of UK bus operator Stagecoach.

But they found one big idea that, over time, dominated the portfolio.

It started out with an investment in Costco and its every-day-low-pricing model:

"This is a very simple and honest consumer proposition in the sense that the membership buys the customer's loyalty (and is almost all profit) and Costco sells goods whilst just covering costs."

"This is a very simple and honest consumer proposition in the sense that the membership buys the customer's loyalty (and is almost all profit) and Costco sells goods whilst just covering costs."

They called it "retail’s version of perpetual motion"

Greater scale became an advantage rather than an impediment to growth as "efficiency gains are passed back to the consumer in order to drive further revenue growth."

Greater scale became an advantage rather than an impediment to growth as "efficiency gains are passed back to the consumer in order to drive further revenue growth."

"Management describe the strategy as “easy to understand and hard to operate" perhaps because the temptation is to mark up the goods and break the contract with the customer.

Costco is as perfect a growth stock as we have analysed."

Costco is as perfect a growth stock as we have analysed."

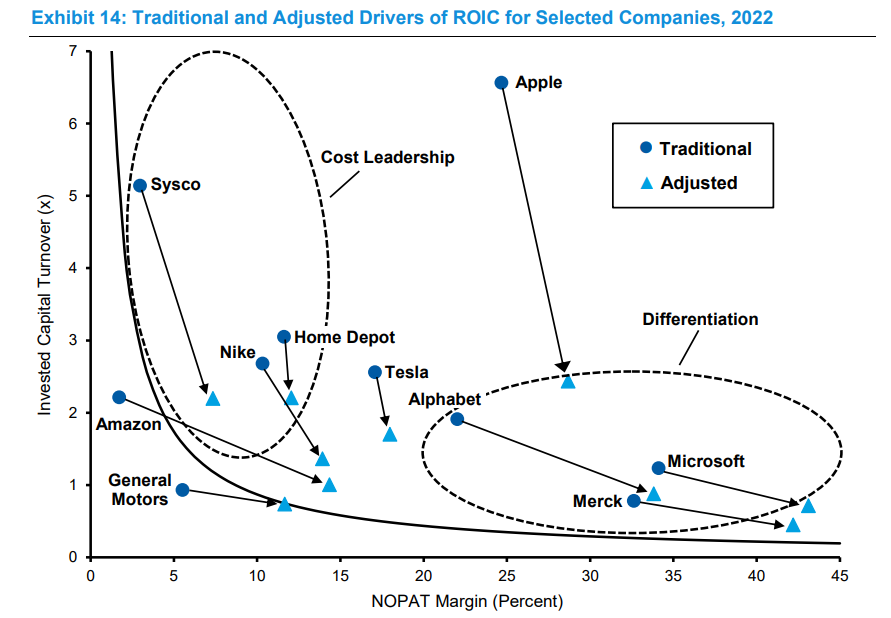

As they dug deeper, they found this business model was driving a number of outlier companies: GEICO, Southwestern Airlines, Walmart, Dell, Costco.

They called it "scale efficiencies shared."

They called it "scale efficiencies shared."

Invert.

They inverted the question: "What is it about growth stocks that dooms them to failure?" New capital competes away the excess returns.

But what if the shared cost advantage at increasing scale made that less likely?

They inverted the question: "What is it about growth stocks that dooms them to failure?" New capital competes away the excess returns.

But what if the shared cost advantage at increasing scale made that less likely?

"Michael Dell succeeded by keeping costs low and passing back his scale benefits to the buyer of his PCs. By the time the competition had matched him in pricing he had moved on."

Self-funded growth with an increasing moat at greater scale "lowered the probability of failure" and allowed them to be more concentrated in the stock.

"To a far greater extent the company controls its own destiny. What attracted us to Costco is the predictability of outcome."

"To a far greater extent the company controls its own destiny. What attracted us to Costco is the predictability of outcome."

The perfect company.

Another exercise: what is the perfect business? A huge marketplace, high barriers to entry, low levels of capital required.

Soon, they'd find exactly that.

Another exercise: what is the perfect business? A huge marketplace, high barriers to entry, low levels of capital required.

Soon, they'd find exactly that.

They discovered their next Costco in Jeff Bezos's annual letters.

“We have made a decision to continuously and significantly lower prices for customers year after year as our efficiency and scale make it possible."

“We have made a decision to continuously and significantly lower prices for customers year after year as our efficiency and scale make it possible."

"This is a précis of the scale efficiencies shared model... and is deployed by companies which have now come to dominate Nomad: Costco, Dell, Amazon and Berkshire (Geico, Nebraska Furniture Mart)"

"Traders have many small ideas, and we have one big idea."

"Traders have many small ideas, and we have one big idea."

They heard about another asset manager which had sold both IBM and Walmart too early. How could they avoid the same error of omission?

"The market struggled to appreciate the magnitude and longevity of the business’ success. But why?"

"The market struggled to appreciate the magnitude and longevity of the business’ success. But why?"

"It could be argued that lots of things had to go right for Wal-Mart to grow for forty years. .. at its heart, a very few simple things really mattered"

"The central engine of success at Wal- Mart was a thrift orientation fueling growth with the savings shared with the customer"

"The central engine of success at Wal- Mart was a thrift orientation fueling growth with the savings shared with the customer"

They called this "deep reality"

"This should have had the greatest weighting in the minds of longterm investors even if other things looked more important at the time."

"There are very few business models where growth begets growth. Scale economics turns size into an asset."

"This should have had the greatest weighting in the minds of longterm investors even if other things looked more important at the time."

"There are very few business models where growth begets growth. Scale economics turns size into an asset."

And returned to the concept when tempted to buy cigar butts again:

"One of the things we have learnt over the last few years is that our most profitable insights have come from recognizing the deep reality of some businesses, not from being more contrarian than everyone else."

"One of the things we have learnt over the last few years is that our most profitable insights have come from recognizing the deep reality of some businesses, not from being more contrarian than everyone else."

Increasingly, they focused on a company's culture, "very hard to create and almost impossible to create if not put in place at the firm’s genesis."

Rather than a smoking gun as the reason for success, they often found "an interlocking, self-reinforcing network of small actions"

Rather than a smoking gun as the reason for success, they often found "an interlocking, self-reinforcing network of small actions"

This perfectly fit their orientation:

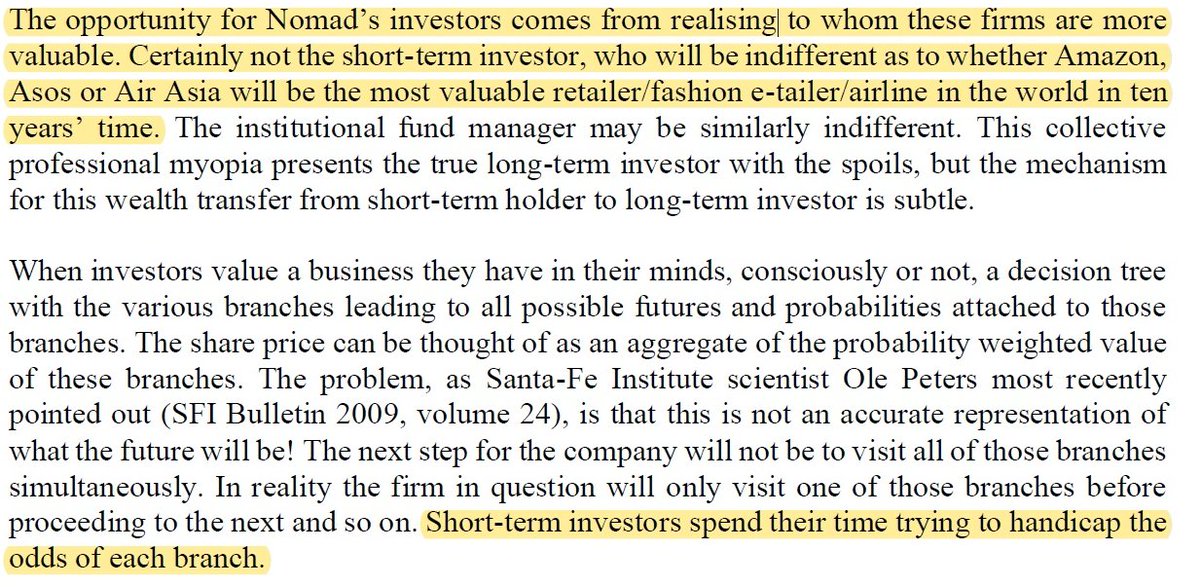

"The opportunity comes from realising to whom these firms are more valuable. Certainly not the short-term investor, who will be indifferent whether Amazon, Asos or Air Asia will be the most valuable retailer... in the world in ten years"

"The opportunity comes from realising to whom these firms are more valuable. Certainly not the short-term investor, who will be indifferent whether Amazon, Asos or Air Asia will be the most valuable retailer... in the world in ten years"

What's important is not just idea but that they made it the central tenet of their portfolio.

When they asked investors to lift the concentration limit so they could buy more $AMZN, 20% redeemed according to @williamgreen72

Again, they were focus on the longterm.

When they asked investors to lift the concentration limit so they could buy more $AMZN, 20% redeemed according to @williamgreen72

Again, they were focus on the longterm.

@williamgreen72 Ran out of tweets I was allowed to thread. Ok, what else?

Keep it simple.

"Zak and I run a single partnership that has long-term investments in the shares of, ... ten companies ... We own the ... advisor and, ordinarily, are closed and free of marketing obligations. That’s it."

Keep it simple.

"Zak and I run a single partnership that has long-term investments in the shares of, ... ten companies ... We own the ... advisor and, ordinarily, are closed and free of marketing obligations. That’s it."

@williamgreen72 "One trick that Zak and I use when sieving data ... ask the question: does any of this make a meaningful difference to the relationship with their customers? This bond (or not!) between customers and companies is one of the most important factors in long-term business success."

@williamgreen72 More deep reality.

"the economics of incremental products (“line extensions”) and the psychology of advertising

A similar story can be told at Nike and Coca-Cola (manufacturing savings funneled into dominant advertising) or Wal-Mart & Costco (scale savings shared with customer)

"the economics of incremental products (“line extensions”) and the psychology of advertising

A similar story can be told at Nike and Coca-Cola (manufacturing savings funneled into dominant advertising) or Wal-Mart & Costco (scale savings shared with customer)

@williamgreen72 Early on, they lost their investment in Conseco. They also sold Stagecoach after its turnaround was completed.

As they watched Stagecoach compounding without them they became obsessed with avoiding this mistake.

As they watched Stagecoach compounding without them they became obsessed with avoiding this mistake.

@williamgreen72 "the biggest error an investor can make is the sale of a Wal-Mart or a Microsoft in the early stages of the company’s growth. Mathematically this error is far greater than the equivalent sum invested in a firm that goes bankrupt."

@williamgreen72 "The analytical mistake in both cases was to have a static view of a firm formed at the time of purchase, which failed to evolve as the facts changed. This error was reinforced by misjudgments such as denial (the facts had changed) and ego (we can’t be wrong)"

@williamgreen72 "There was also an over-reliance on price to value ratio type analysis, which can encourage a tighter range

of outcomes than occurs in reality."

of outcomes than occurs in reality."

@williamgreen72 A side effect of owning great companies was how they were able to navigate 2008. First off, they got hammered with a return of -45.3%

"It may not feel like it but, in many respects, these are the best of times for an investor."

"It may not feel like it but, in many respects, these are the best of times for an investor."

@williamgreen72 Their portfolio allowed them to stay calm in the depths of recession.

They quoted Sam Walton about the recession of the early 1990s: “I’ve thought about it and decided not to participate”.

Likewise, many of their companies invested and gained share.

They quoted Sam Walton about the recession of the early 1990s: “I’ve thought about it and decided not to participate”.

Likewise, many of their companies invested and gained share.

@williamgreen72 "The trick if one is to be a successful long-term investor, is to recognize the sources of enduring business success, get in early and own enough to make a difference. Which raises two questions: what are the sources of success and why are they not discounted already?"

@williamgreen72 Misanalysis:

"Factors such as culture, because they are hard to quantify, often go undervalued by investors"

In other words: finding companies that don't "fade" at the end of the projection period and outperform much longer than expected.

"Factors such as culture, because they are hard to quantify, often go undervalued by investors"

In other words: finding companies that don't "fade" at the end of the projection period and outperform much longer than expected.

@williamgreen72 "Active fund managers have to look active."

@williamgreen72 "Investing is, at its heart, a very simple discipline. Simple, perhaps, but not easy. And judging by my efforts, certainly hard to communicate."

"The truth is that there is not that much to say, at least, not much that hasn’t been said before."

"The truth is that there is not that much to say, at least, not much that hasn’t been said before."

@williamgreen72 Can't blame them for retirement after such a run: "Zak and I don’t want to be busy; we want to be right."

The letters are available for free here:

igyfoundation.org.uk/wp-content/upl…

The letters are available for free here:

igyfoundation.org.uk/wp-content/upl…

@williamgreen72 "All Zak and I have done is catch some better waves and try to ride them to the shore. Riding waves is not an expensive activity and Nomad’s (cost reimbursement) management fee remains around ten basis points."

@williamgreen72 "We say that our job is to “pass custody [of your investment] over at the right price and to the right people” and that “the approach will require patience”. That’s what investing is, at least for us."

• • •

Missing some Tweet in this thread? You can try to

force a refresh