How to get URL link on X (Twitter) App

https://twitter.com/NeckarValue/status/1545823421279469573

Unexpected:

Unexpected:

"We always short the same way. ... I try and think of a situation 12 to 18 months from now and if I think the security prices are going to be less, I short.

"We always short the same way. ... I try and think of a situation 12 to 18 months from now and if I think the security prices are going to be less, I short.

"A company creates value when its ROIC is in excess of cost of capital. Stated differently, it makes a dollar worth of investment worth more than a dollar in market value.

"A company creates value when its ROIC is in excess of cost of capital. Stated differently, it makes a dollar worth of investment worth more than a dollar in market value.

"Some might see buying and creating value from others’ mistakes as a form of exploitation, but I see it as giving neglected or devalued assets new life.

"Some might see buying and creating value from others’ mistakes as a form of exploitation, but I see it as giving neglected or devalued assets new life.

"the company has also been building a separate data sales business, which pipes raw data directly to clients that neither need nor want a terminal subscription, called B-PIPE. One former insider estimates this business now probably makes about $2bn a year."

"the company has also been building a separate data sales business, which pipes raw data directly to clients that neither need nor want a terminal subscription, called B-PIPE. One former insider estimates this business now probably makes about $2bn a year."

Munger: "I think that a life properly lived is to just learn, learn, learn all the time. Berkshire’s gained enormously from decisions by learning through a long, long period."

Munger: "I think that a life properly lived is to just learn, learn, learn all the time. Berkshire’s gained enormously from decisions by learning through a long, long period."

"This book is about long term investing. The Davises provide a 50-year case study not only in how to tend a portfolio but how to raise children who break the mold, work hard, and compound the family fortune. Theirs is true long term investing: perpetual."

"This book is about long term investing. The Davises provide a 50-year case study not only in how to tend a portfolio but how to raise children who break the mold, work hard, and compound the family fortune. Theirs is true long term investing: perpetual."

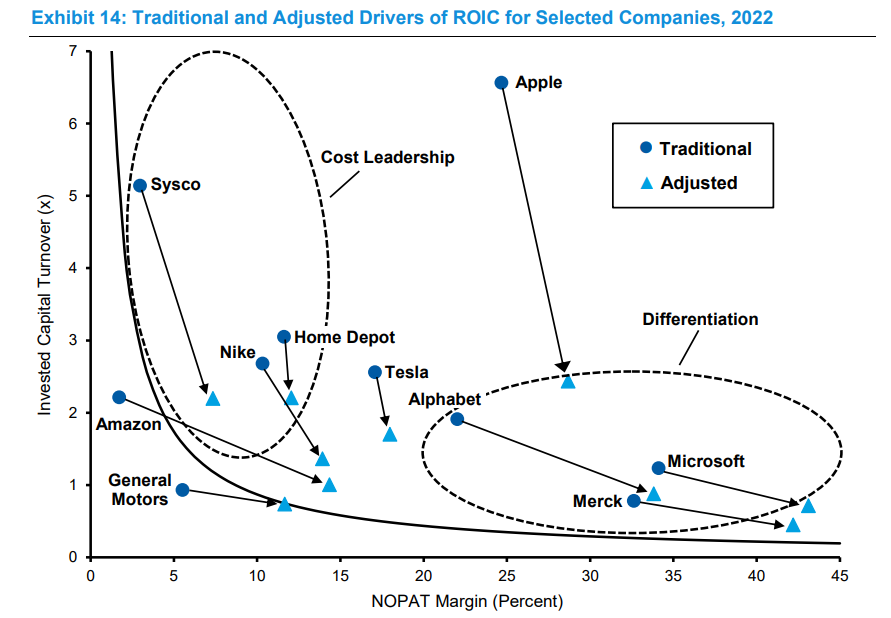

The framework is straightforward: high profits attract competition. Competition increases, returns decline.

The framework is straightforward: high profits attract competition. Competition increases, returns decline.

July 30, 1931.

July 30, 1931.

Sometimes life offers a chance to experiment with a new character, like when you go off to college or move to a different city or country. Or when you switch careers or enter a new community.

Sometimes life offers a chance to experiment with a new character, like when you go off to college or move to a different city or country. Or when you switch careers or enter a new community.