#CotD #3 - American Tower

Operating 214k cell towers (43k US + Canada), $AMT is the world's largest tower owner. Its revenue has grown w/ mobile data usage. As this trend persists, & w/ 5G on the horizon, AMT may grow for years to come, like other $BYTE Index members.

1/x🧵👇👇

Operating 214k cell towers (43k US + Canada), $AMT is the world's largest tower owner. Its revenue has grown w/ mobile data usage. As this trend persists, & w/ 5G on the horizon, AMT may grow for years to come, like other $BYTE Index members.

1/x🧵👇👇

$AMT exhibits:

• Global scale

• Stable growth

• Durable, strong cash flow

• Levered capital returns

These attractive features, coupled with secular growth trends around mobile data consumption, have helped drive a 22% CAGR over the past ten years!! (7.3x your $)

2/

• Global scale

• Stable growth

• Durable, strong cash flow

• Levered capital returns

These attractive features, coupled with secular growth trends around mobile data consumption, have helped drive a 22% CAGR over the past ten years!! (7.3x your $)

2/

Secular growth trends remain.

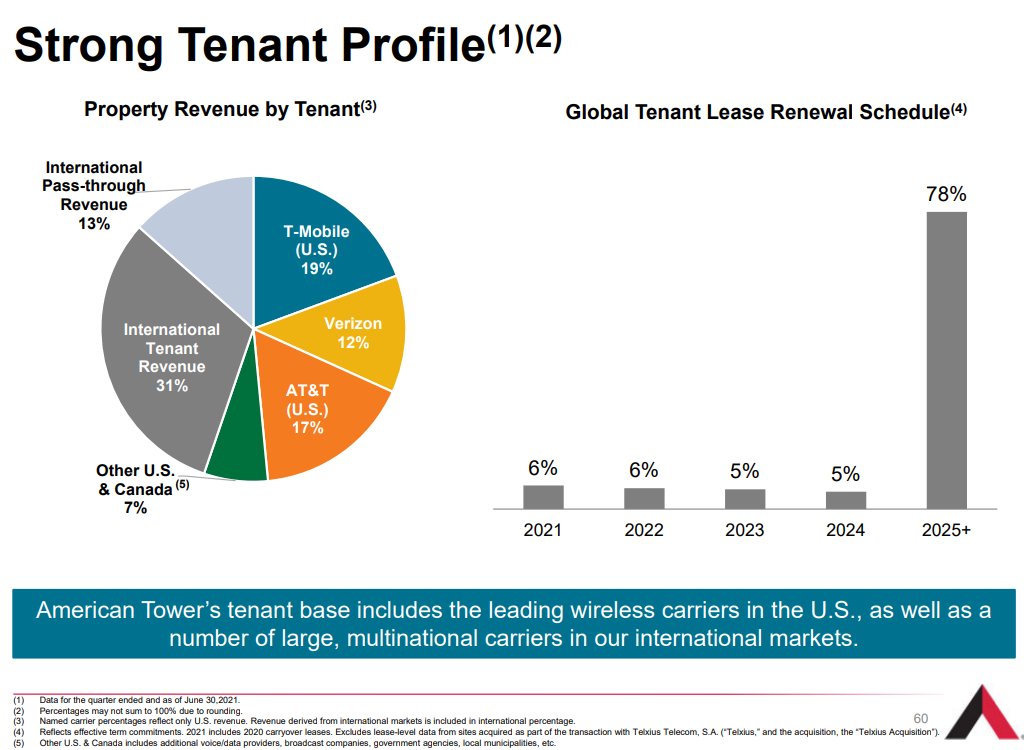

Recent organic rev growth has been mid-single digits and AFFO (cash flow) closer to 10%.

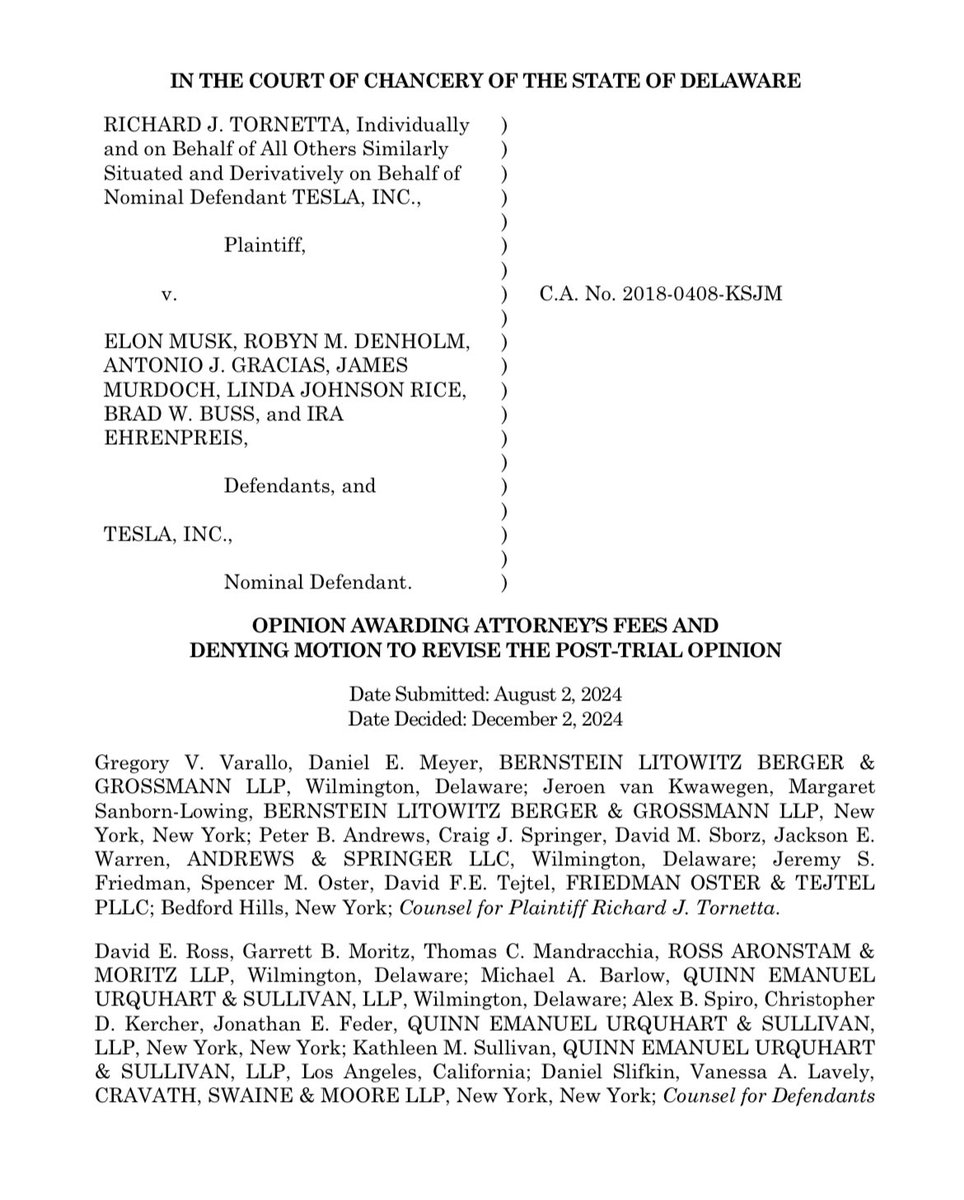

Rev. is primarily from LONG-term leases w/ huge mobile cos (eg, AT&T). These have inflation escalators and only a modest portion face renewal risk each yr.

3/

Recent organic rev growth has been mid-single digits and AFFO (cash flow) closer to 10%.

Rev. is primarily from LONG-term leases w/ huge mobile cos (eg, AT&T). These have inflation escalators and only a modest portion face renewal risk each yr.

3/

Zoning new towers is NIMBY-hard, often turning towers into local monopolies.

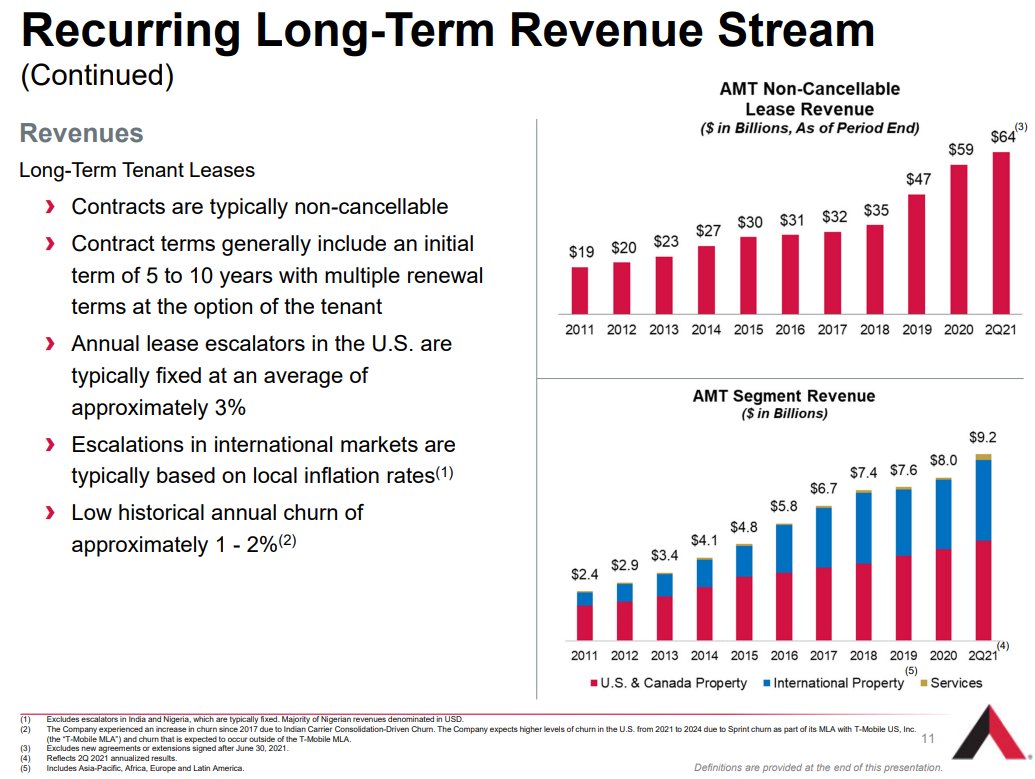

A given tower often holds multiple tenants ($VZ + AT&T + T-Mo), with each additional tenant providing highly incremental cash flow.

The examples below illustrate the economics of additional tenants:

4/

A given tower often holds multiple tenants ($VZ + AT&T + T-Mo), with each additional tenant providing highly incremental cash flow.

The examples below illustrate the economics of additional tenants:

4/

This game is won by owning hard-to-replace towers and leasing them up - real estate 101. (HT: @moseskagan)

4G + increasing data consumption drove the last 15 years.

5G and the Internet of Everything will drive the next 15 years.

5/

4G + increasing data consumption drove the last 15 years.

5G and the Internet of Everything will drive the next 15 years.

5/

5G is just starting - it is a massive opportunity for tower operators, as each time a new antenna is hung on a tower, it requires a contract modification with the tower owner ($AMT).

5G also requires fiber, which benefits many other $AMT / $BYTE-style digital infra companies.

6/

5G also requires fiber, which benefits many other $AMT / $BYTE-style digital infra companies.

6/

5G is not just "faster mobile internet". It is a ubiquitous, high throughput, low latency, edge internet. A future filled with full self-driving mode Teslas, robotics, and the metaverse.

Deploying 5G will take a decade or more, pushing tower and fiberco growth alongside it.

7/

Deploying 5G will take a decade or more, pushing tower and fiberco growth alongside it.

7/

$AMT's AFFO growth has been strong and persistent, enabling capital allocation flexibility.

Capital allocation starts with organic tower new-builds. As it has grown, and new build opps moderated, M&A has been a big tool. AMT's dividend has CAGR'd at 19%!! for the past 5 yrs.

8/

Capital allocation starts with organic tower new-builds. As it has grown, and new build opps moderated, M&A has been a big tool. AMT's dividend has CAGR'd at 19%!! for the past 5 yrs.

8/

All cos have plenty of risks, including $AMT:

- Consolidation among MNOs (eg, T-Mo acquiring Sprint)

- Technological obsolescence (what if we don't need towers?)

- A levered business

- Reliance on regulatory/zoning protections

etc.

9/

- Consolidation among MNOs (eg, T-Mo acquiring Sprint)

- Technological obsolescence (what if we don't need towers?)

- A levered business

- Reliance on regulatory/zoning protections

etc.

9/

But like many digital infrastructure businesses, it has shown incredible predictability and resilience, allowing for inflation+ pricing, recurring revenue, & attractive margins.

$AMT's ROIC has been stable over many yrs &, as its cost of capital has declined, cash flow is up.

8/

$AMT's ROIC has been stable over many yrs &, as its cost of capital has declined, cash flow is up.

8/

Note: I never intend Tweets as investment advice. This is meant as a basic, high-level overview of what $AMT does and how one might begin to look at the business.

-End-

Please Like, Follow, & RT if you find these useful:

3 down, 2 to go! 🤸♀️🤸♂️

-End-

Please Like, Follow, & RT if you find these useful:

3 down, 2 to go! 🤸♀️🤸♂️

https://twitter.com/compound248/status/1453731224267026439

• • •

Missing some Tweet in this thread? You can try to

force a refresh