Birkin Bags are the crown jewel in Hermès $170B+ luxury empire. One bag can cost ~$50k and the record sale is $500k.

Why so pricey? Hermès has perfected the psychology of scarcity and demand (or as its CEO Axel Dumas describes it: “creating desire”).

Here’s a breakdown🧵

Why so pricey? Hermès has perfected the psychology of scarcity and demand (or as its CEO Axel Dumas describes it: “creating desire”).

Here’s a breakdown🧵

1/ Hermès is the world's top ultra-premium lux brand. And it runs its own playbook with:

◻️Few ads

◻️No marketing dept

◻️Few celebrity endorsements

Rather, Hermès creates desire for its products (including Birkin Bag) in 2 powerful ways: *managed scarcity* and *managed desire*.

◻️Few ads

◻️No marketing dept

◻️Few celebrity endorsements

Rather, Hermès creates desire for its products (including Birkin Bag) in 2 powerful ways: *managed scarcity* and *managed desire*.

2/ Long heritage

A powerful source of scarcity is history. Founded in 1837 by Thierry Hermès as a leather workshop, Hermès passed through 6 family generations and is now run by the Dumas clan.

(Lux competitor LVMH knows the power of heritage:it owns 10+ brands over 100yr old)

A powerful source of scarcity is history. Founded in 1837 by Thierry Hermès as a leather workshop, Hermès passed through 6 family generations and is now run by the Dumas clan.

(Lux competitor LVMH knows the power of heritage:it owns 10+ brands over 100yr old)

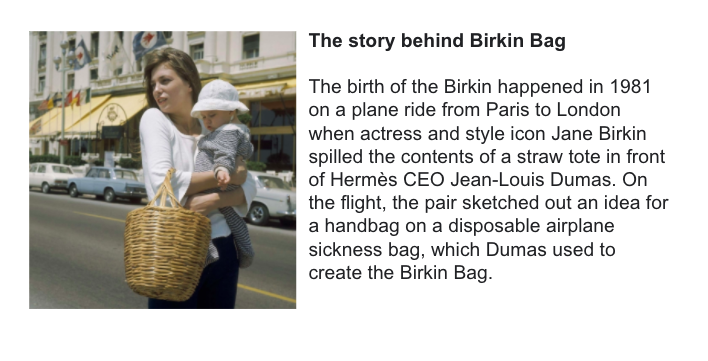

3/ One-of-a-kind founding story

Humans are attracted to narrative, which Hermès fosters in all of its products.

The Birkin Bag’s founding story has become legend, which adds another layer of scarcity as it is obviously exclusive to the product:

Humans are attracted to narrative, which Hermès fosters in all of its products.

The Birkin Bag’s founding story has become legend, which adds another layer of scarcity as it is obviously exclusive to the product:

4/ Rare craftwork

Birkin craftsmanship takes 2yrs of training (Hermès only trains 200 people per year). Each one takes 20-25hrs to make, entirely by hand w/ pricy inputs (leather, croc skin, gold).

The Dumas Credo:“We don’t have a policy of image, we have a policy of product”.

Birkin craftsmanship takes 2yrs of training (Hermès only trains 200 people per year). Each one takes 20-25hrs to make, entirely by hand w/ pricy inputs (leather, croc skin, gold).

The Dumas Credo:“We don’t have a policy of image, we have a policy of product”.

5/ Perfection takes time

Hermès products are held to the highest industry standard (can't mass manufacture).

The dedication began w/ Thierry Hermès making leather horse saddles for the Napoleons: the “saddle stitch” had to be perfect to handle animal power and not come undone.

Hermès products are held to the highest industry standard (can't mass manufacture).

The dedication began w/ Thierry Hermès making leather horse saddles for the Napoleons: the “saddle stitch” had to be perfect to handle animal power and not come undone.

6/ Tight supply

The rigorous craftwork limits the Birkin supply:an estimated 12k are made a year (infamously Hermès burns bags w/ slightest defect).

Each one is truly *different*.

There are ~200k Birkin Bags in circulation (by comparison, Coach sells 4m+ handbags a *year*).

The rigorous craftwork limits the Birkin supply:an estimated 12k are made a year (infamously Hermès burns bags w/ slightest defect).

Each one is truly *different*.

There are ~200k Birkin Bags in circulation (by comparison, Coach sells 4m+ handbags a *year*).

7/ Managing demand

In economics, a high demand product is rationed by price. Hermès rations demand by *queue*, making the product even more sough after.

It does so by managing demand (aka “desire”) at every level: From a network of 300+ stores to sales staff to shoppers.

In economics, a high demand product is rationed by price. Hermès rations demand by *queue*, making the product even more sough after.

It does so by managing demand (aka “desire”) at every level: From a network of 300+ stores to sales staff to shoppers.

8/ Stores battle over goods

Twice a year, 1k store reps go to Hermès HQ in Paris and curate collections.

Hermès doesn't say how many Birkins it's making and forces each store to stock items in all categories (shoes, watches, fragrances) to ensure the whole line is showcased.

Twice a year, 1k store reps go to Hermès HQ in Paris and curate collections.

Hermès doesn't say how many Birkins it's making and forces each store to stock items in all categories (shoes, watches, fragrances) to ensure the whole line is showcased.

9/ Flipped shopping model

Shoppers — even very rich ones — can’t just walk in a store and ask for a Birkin. Hermès has to *offer* them the chance to buy it (think about that).

Earning an offer takes work and the added effort increases the perceived value (aka"The Ikea Effect")

Shoppers — even very rich ones — can’t just walk in a store and ask for a Birkin. Hermès has to *offer* them the chance to buy it (think about that).

Earning an offer takes work and the added effort increases the perceived value (aka"The Ikea Effect")

10/ Work = buy other stuff

To be considered for a Birkin, a shopper has to have a relationship with sales staff. The way to develop that relationship is to buy other good (jewellery, watches, shoes, accessories).

This buying psychologically *commits* a shopper to Hermès.

To be considered for a Birkin, a shopper has to have a relationship with sales staff. The way to develop that relationship is to buy other good (jewellery, watches, shoes, accessories).

This buying psychologically *commits* a shopper to Hermès.

11/ Unofficial waitlist

Once in good graces, Hermès may offer you a Birkin, which is put on order but you still have to wait.

Months-long anticipation creates more perceived value. Sales staff isn't even sure which colors are available. You usually just take what they receive.

Once in good graces, Hermès may offer you a Birkin, which is put on order but you still have to wait.

Months-long anticipation creates more perceived value. Sales staff isn't even sure which colors are available. You usually just take what they receive.

12/ Social Proof

Access to Birkins is its own currency (not all rich people can get it). As the ultimate status signal, celebrities happily flaunt their “hard-earned” collections (above other lux items).

It creates mass desire, which makes the tight supply even more valuable.

Access to Birkins is its own currency (not all rich people can get it). As the ultimate status signal, celebrities happily flaunt their “hard-earned” collections (above other lux items).

It creates mass desire, which makes the tight supply even more valuable.

13/ The Birkin Halo Effect

With limited Birkin access, “consumer surplus” spills over to other Hermès products. People buy $1k scarves or $3k wallets to taste the magic.

Expertly managing Birkin's supply and desire helps Hermès bring in $7B+ a year and it's now worth $170B+.

With limited Birkin access, “consumer surplus” spills over to other Hermès products. People buy $1k scarves or $3k wallets to taste the magic.

Expertly managing Birkin's supply and desire helps Hermès bring in $7B+ a year and it's now worth $170B+.

14/ Birkin = great investment

Finally, Birkin Bags are at the vanguard of "handbags as an asset class".

A 2016 study found that Birkin -- over the preceding 30 years -- notched annual returns of 14%, outpacing the S&P 500 at 12% and Gold at 2% (LOL).

Finally, Birkin Bags are at the vanguard of "handbags as an asset class".

A 2016 study found that Birkin -- over the preceding 30 years -- notched annual returns of 14%, outpacing the S&P 500 at 12% and Gold at 2% (LOL).

15/ If you enjoyed that, I write threads breaking down tech and business 1-2x a week.

Def follow @TrungTPhan to catch them in your feed.

Here's a related one that might tickle your fancy:

Def follow @TrungTPhan to catch them in your feed.

Here's a related one that might tickle your fancy:

https://twitter.com/TrungTPhan/status/1454840628743847952

16/ FYI: To write this thread, I used the Synth browser to collect and organize my ideas (**DISCLAIMER: I’m an investor)

Here’s a cool feature: auto-ML tagging of all the Hermes-related articles I’ve read.

Check it: synth.app

Here’s a cool feature: auto-ML tagging of all the Hermes-related articles I’ve read.

Check it: synth.app

17/ Sources

Axel Dumas Q&A: scmp.com/magazines/styl…

Martin Roll: martinroll.com/resources/arti…

Bloomberg: bloomberg.com/news/articles/…

Psychology Today: psychologytoday.com/us/blog/the-sc…

Business Insider: businessinsider.com/hermes-birkin-…

Axel Dumas Q&A: scmp.com/magazines/styl…

Martin Roll: martinroll.com/resources/arti…

Bloomberg: bloomberg.com/news/articles/…

Psychology Today: psychologytoday.com/us/blog/the-sc…

Business Insider: businessinsider.com/hermes-birkin-…

18/ LVMH built up a secret ownership stake in Hermes in early 2000s.

By 2010, it had a 17% position and the Hermes clan had to join together to beat back the LVMH takeover attempt.

🔗 economist.com/business/2020/…

By 2010, it had a 17% position and the Hermes clan had to join together to beat back the LVMH takeover attempt.

🔗 economist.com/business/2020/…

19/ You may also enjoy this!

https://twitter.com/TrungTPhan/status/1421496101295722498

20/ While Hermes largely avoids official celebrity endorsements, LVMH def taps famous people for their campaigns.

An artist made virtual Birkin Bags (meta-Birkins). Hermes says its trademark infringement. Now, meta-Birkins are also being ripped off.

(Side note: Hermes says it’s not doing NFTs b/c it values the “tangible expression of handcrafted physical objects”)

thefashionlaw.com/from-baby-birk…

(Side note: Hermes says it’s not doing NFTs b/c it values the “tangible expression of handcrafted physical objects”)

thefashionlaw.com/from-baby-birk…

• • •

Missing some Tweet in this thread? You can try to

force a refresh