Happy #JobsDay.

Strong job gains in October: +531K.

+235K in upward revisions of the prior 2 months.

Strong job gains in October: +531K.

+235K in upward revisions of the prior 2 months.

Job growth had looked a lot slower over the last couple of months but these upward revisions change the picture a bit. According to estimates now, has been more steady.

This is average monthly job growth over recent windows.

This is average monthly job growth over recent windows.

Unemployment rate down 0.2 percentage points (pp). Good news.

Really excellent news is that the number of long-term unemployed fell by 15%, down 356K to 2.326 million.

In many recoveries, the long-term unemployed struggle to re-attach but this is excellent progress.

Really excellent news is that the number of long-term unemployed fell by 15%, down 356K to 2.326 million.

In many recoveries, the long-term unemployed struggle to re-attach but this is excellent progress.

The labor force participation rate was unchanged at 61.6%, remained in a narrow range of 61.4-61.7% since June 2020.

The employment-population ratio (EPOP) was up 0.1 pp over the month to 58.8%, but BLS says little changed. Likely up due to close rounding.

So looks like unemployment down for good reasons as unemployed jobseekers find work.

So looks like unemployment down for good reasons as unemployed jobseekers find work.

The share of prime-age adults employed is a key measure of core labor market strength, that omits younger & older people on the markets' margins.

It accelerated up 0.3 pp, after being stalled last month.

We're back to early 2017 levels.

It accelerated up 0.3 pp, after being stalled last month.

We're back to early 2017 levels.

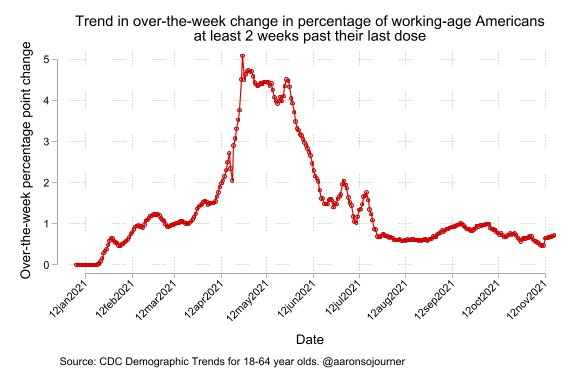

From CDC, 65% of working-age Americans who are at least 2 weeks past their final COVID-19 vaccination dose today, so 35% aren't.

Progress on working-age vaccinations has accelerated slightly, now 0.7 pp of working age population each week. At that rate, 80% vaxd in 5 months.

Progress on working-age vaccinations has accelerated slightly, now 0.7 pp of working age population each week. At that rate, 80% vaxd in 5 months.

The share of American adults employed among those without a high school degree is down 1.8 pp below pre-pandemic.

For those with a high school degree and no college, it's still down 4.3 pp.

For those with a high school degree and no college, it's still down 4.3 pp.

Black & Hispanic women's employment remain the farthest off pre-pandemic levels, with Black and Hispanic men next.

Little gender gap among white Americans.

Little gap remaining for Asian Americans.

Little gender gap among white Americans.

Little gap remaining for Asian Americans.

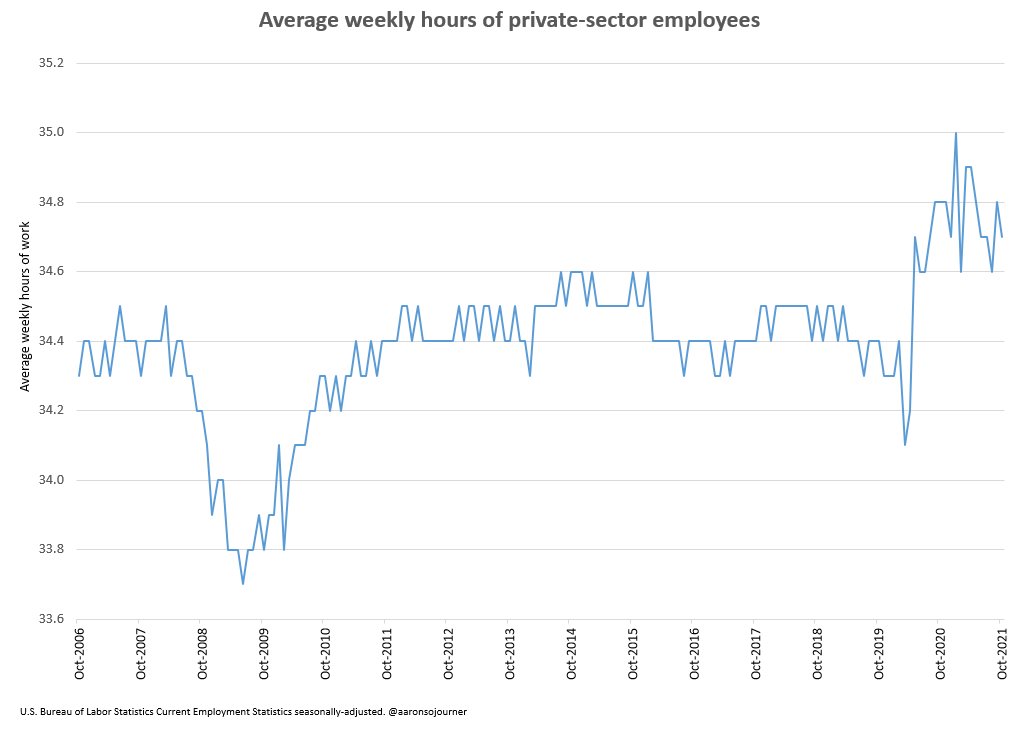

That’s the extensive quantity (Q) margin. Intensive Q margin is average hours.

Average workweek hours for private sector ticks down 0.1 to 34.7 hours.

In pandemic, employers worked staff longer hours as alternative to hiring more people.

Hours up this recession, unlike GR.

Average workweek hours for private sector ticks down 0.1 to 34.7 hours.

In pandemic, employers worked staff longer hours as alternative to hiring more people.

Hours up this recession, unlike GR.

The number of Americans stuck in a part time job but wanting full time fell in October & is almost down to pre-pandemic levels.

My suspicion is that employers would rather raise hours & pay some OT than raise base compensation, as would be needed to attract new hires & retain.

My suspicion is that employers would rather raise hours & pay some OT than raise base compensation, as would be needed to attract new hires & retain.

3.6 million more Americans are out of the labor force & not wanting a job now versus 2 years ago.

3.3m rise in older Americans (55+) in this group accounts for 91% of rise.

# of young folks in the group actually down 299K.

Early retirements, COVID concern, grandkid care...

3.3m rise in older Americans (55+) in this group accounts for 91% of rise.

# of young folks in the group actually down 299K.

Early retirements, COVID concern, grandkid care...

In sum:

Labor market recovery stronger over last 3 months than we had understood,

A long way to go to a fully-healthy, full-employment labor market. Easy gains gone.

Pandemic accelerated older Americans exit to sidelines. Better jobs & pub health necessary to pull people back.

Labor market recovery stronger over last 3 months than we had understood,

A long way to go to a fully-healthy, full-employment labor market. Easy gains gone.

Pandemic accelerated older Americans exit to sidelines. Better jobs & pub health necessary to pull people back.

Context: profits are up more than wages.

The virus makes many jobs worse.

Many companies can improve jobs & are doing so quickly.

Others can't or won't do so fast enough.

People will continue to move towards those who do.

The virus makes many jobs worse.

Many companies can improve jobs & are doing so quickly.

Others can't or won't do so fast enough.

People will continue to move towards those who do.

https://twitter.com/aaronsojourner/status/1447969510074486788

Last thing. @BLS_gov does amazing work to create timely, accurate info about America's working families, a huge public good.

They are there for us & we need to show up for them.

If you are a labor economist or care about workers & employment, follow & join @Friends_of_BLS.

They are there for us & we need to show up for them.

If you are a labor economist or care about workers & employment, follow & join @Friends_of_BLS.

• • •

Missing some Tweet in this thread? You can try to

force a refresh