Sometimes you forget how many zeros are in a million. In a billion. In a trillion. But don't worry. I am going to tell you how many zeros there are.

A million has 6 zeros: 1,000,000

A billion has 9 zeros: 1,000,000,000

A trillion has 12 zeros: 1,000,000,000,000

A million has 6 zeros: 1,000,000

A billion has 9 zeros: 1,000,000,000

A trillion has 12 zeros: 1,000,000,000,000

T = Trillion B = Billion

2T = 2,000B

3T = 3,000B

3.2T = 3,200B

3.5T = 3,500B

3.9T = 3,900B

4.0T = 4,000B

4.2T = 4,200B

4.23T = 4,230B

4.67T = 4,670B

5.55T = 5,550B

5.73T = 5,730B

6T = 6,000B

12T = 12,000B

12.2T = 12,200B

13T = 13,000B

13.64T = 13,640B

15T = 15,000B

2T = 2,000B

3T = 3,000B

3.2T = 3,200B

3.5T = 3,500B

3.9T = 3,900B

4.0T = 4,000B

4.2T = 4,200B

4.23T = 4,230B

4.67T = 4,670B

5.55T = 5,550B

5.73T = 5,730B

6T = 6,000B

12T = 12,000B

12.2T = 12,200B

13T = 13,000B

13.64T = 13,640B

15T = 15,000B

15.06T = 15,060B

15.29T = 15,290B

17T = 17,000B

18.641T = 18,641B

21.008T = 21,008B

24.024T = 24,024B

28.587T = 28,587B

32T = 32,000B

32.198T = 32,198B

34.085T = 34,085B

32T is not equal to 3.2T

32T is not equal to 3,200B

15.29T = 15,290B

17T = 17,000B

18.641T = 18,641B

21.008T = 21,008B

24.024T = 24,024B

28.587T = 28,587B

32T = 32,000B

32.198T = 32,198B

34.085T = 34,085B

32T is not equal to 3.2T

32T is not equal to 3,200B

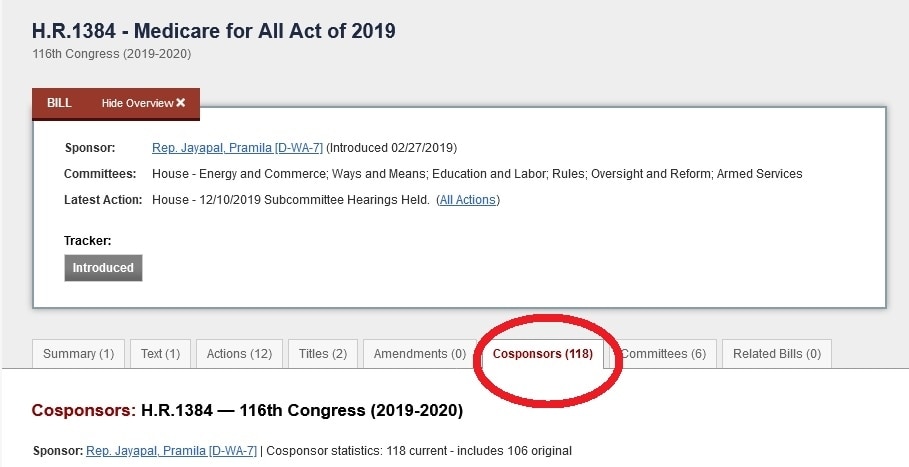

Total Medicare For All Bills:

2003 to 2018 HR 676 Expanded & Improved Medicare For All Act

2017 S 1804 Medicare for All Act of 2017

2019 HR 1384 Medicare for All Act of 2019

2019 S 1129 Medicare for All Act of 2019

2021 HR 1976 Medicare for All Act of 2021

2003 to 2018 HR 676 Expanded & Improved Medicare For All Act

2017 S 1804 Medicare for All Act of 2017

2019 HR 1384 Medicare for All Act of 2019

2019 S 1129 Medicare for All Act of 2019

2021 HR 1976 Medicare for All Act of 2021

How many Cosponsors do each Medicare For All Bill received?

HR 676 received 124 Cosponsors

S 1804 received 16 Cosponsors

HR 1384 received 118 Cosponsors

S 1129 received 14 Cosponsors

HR 1976 received 117 Cosponsors

HR 676 received 124 Cosponsors

S 1804 received 16 Cosponsors

HR 1384 received 118 Cosponsors

S 1129 received 14 Cosponsors

HR 1976 received 117 Cosponsors

.@SenSanders came up with Options To Finance Medicare For All. There are 10 different Tax options. The two main ones are:

1) 7.5% Employer Payroll Tax

And

2) 4% Employee Health Tax Net Income

How does it work? Simple!

1) 7.5% Employer Payroll Tax

And

2) 4% Employee Health Tax Net Income

How does it work? Simple!

7.5% Employer Payroll Tax:

1. Excludes the first $2 Million in Payroll

2. Applies to both Government & Private Employers

3. Substantial Medium/Large sized Companies (Businesses)

4. Huge savings for the States

1. Excludes the first $2 Million in Payroll

2. Applies to both Government & Private Employers

3. Substantial Medium/Large sized Companies (Businesses)

4. Huge savings for the States

7.5% Employer Payroll Tax:

5. Example from a W2 Form:

Worker: $128,164

Health benefits paid by State Gov: $28,953 DD

NOTE: DD is the Code. Cost of Employer paid to Health Insurance Premiums

What was the % of Worker's salary going towards Health Insurance?

5. Example from a W2 Form:

Worker: $128,164

Health benefits paid by State Gov: $28,953 DD

NOTE: DD is the Code. Cost of Employer paid to Health Insurance Premiums

What was the % of Worker's salary going towards Health Insurance?

7.5% Employer Payroll Tax:

($28,953/$128,164) X 100% = 22.59%

6. Now, if it was 7.5% Employer Payroll Tax, it would have been:

$128,164 X 7.5% = $9,612.30

($28,953/$128,164) X 100% = 22.59%

6. Now, if it was 7.5% Employer Payroll Tax, it would have been:

$128,164 X 7.5% = $9,612.30

4% Employee Health Tax Net Income:

1. It's so easy to calculate

2. On the 1040 Tax Form, you take your Annual Income minus Standard Deduction & then you multiply by 4%

3. The formula is:

1. It's so easy to calculate

2. On the 1040 Tax Form, you take your Annual Income minus Standard Deduction & then you multiply by 4%

3. The formula is:

4% Employee Health Tax Net Income:

(Annual Income - Standard Deduction) X 4% = How much you are going to pay for the entire year

4. For example on 1040 Tax Form:

(Annual Income - Standard Deduction) X 4%

($124,800 - $24,800) X 4% = $4,000

(Annual Income - Standard Deduction) X 4% = How much you are going to pay for the entire year

4. For example on 1040 Tax Form:

(Annual Income - Standard Deduction) X 4%

($124,800 - $24,800) X 4% = $4,000

Just using these two Tax options to pay for Medicare For All alone:

4% Employee Health Tax Net Income would generate $350B per year

7.5% Employer Payroll Tax would generate $390B per year

Now add these two together:

$350B + $390B = $740B

Remember this amount ➡️ $740B

4% Employee Health Tax Net Income would generate $350B per year

7.5% Employer Payroll Tax would generate $390B per year

Now add these two together:

$350B + $390B = $740B

Remember this amount ➡️ $740B

1. Current System means The Total Cost right now without Medicare For All per year

2. Medicare For All means The Total Cost of Medicare For All fully operated right now per year

3. Annual Total Cost means same answer from # 2

4. Existing Revenue means How much we already have

2. Medicare For All means The Total Cost of Medicare For All fully operated right now per year

3. Annual Total Cost means same answer from # 2

4. Existing Revenue means How much we already have

right now

5. How much is needed to pay means Answer from # 3 minus Existing Revenue

6. Remember that $740B means using both 4% Employee Health Tax Net Income PLUS 7.5% Employer Payroll Tax

7. Now how much is really needed to pay means Answer from # 5 minus $740B

5. How much is needed to pay means Answer from # 3 minus Existing Revenue

6. Remember that $740B means using both 4% Employee Health Tax Net Income PLUS 7.5% Employer Payroll Tax

7. Now how much is really needed to pay means Answer from # 5 minus $740B

HR 676 National Health Expenditures

Current System: $3.6T

M4A: $2.9T

Annual Total Cost: $2,900B

Existing Revenue: $2,000B

How much is needed? $2,900B - $2,000B = $900B

Remember that $740B?

Now how much is really needed?

$900B - $740B = $160B

Current System: $3.6T

M4A: $2.9T

Annual Total Cost: $2,900B

Existing Revenue: $2,000B

How much is needed? $2,900B - $2,000B = $900B

Remember that $740B?

Now how much is really needed?

$900B - $740B = $160B

HR 676 National Health Expenditures

Current System: $3.6T

M4A: $2,878B

Annual Total Cost: $2,878B

Existing Revenue: $2,006B

How much is needed? $2,878B - $2,006B = $872B

Remember that $740B?

Now how much is really needed?

$872B - $740B = $132B

Current System: $3.6T

M4A: $2,878B

Annual Total Cost: $2,878B

Existing Revenue: $2,006B

How much is needed? $2,878B - $2,006B = $872B

Remember that $740B?

Now how much is really needed?

$872B - $740B = $132B

S 1804 National Health Expenditures

Current System: $3.63T

M4A: $2.93T

Annual Total Cost: $2,930B

Existing Revenue: $1,880B

How much is needed? $2,930B - $1,880 = $1,050B

Remember that $740B?

Now how much is really needed?

$1,050B - $740B = $310B

Current System: $3.63T

M4A: $2.93T

Annual Total Cost: $2,930B

Existing Revenue: $1,880B

How much is needed? $2,930B - $1,880 = $1,050B

Remember that $740B?

Now how much is really needed?

$1,050B - $740B = $310B

Total Annual Cost For Medicare For All:

Dr. Friedman came up with $2,878B = $2.878T

PERI came up with $2,930B = $2.93T

Lancet 2020 Study came up with $3,034B = $3.034T

After maintaining Federal & State dollars (Existing Revenue) how much is needed to pay for M4A per year?

Dr. Friedman came up with $2,878B = $2.878T

PERI came up with $2,930B = $2.93T

Lancet 2020 Study came up with $3,034B = $3.034T

After maintaining Federal & State dollars (Existing Revenue) how much is needed to pay for M4A per year?

Dr. Friedman came up with $872B

PERI came up with $1,050B

Lancet 2020 Study came up with $773B

However, it does not stop here. Recall that @SenSanders came up with Options To Finance Medicare For All. There are 10 different Tax options. The two main ones are:

PERI came up with $1,050B

Lancet 2020 Study came up with $773B

However, it does not stop here. Recall that @SenSanders came up with Options To Finance Medicare For All. There are 10 different Tax options. The two main ones are:

1) 7.5% Employer Payroll Tax

And

2) 4% Employee Health Tax Net Income

Just using these two Tax options to pay for Medicare For All alone:

4% Employee Health Tax Net Income would generate $350B per year

7.5% Employer Payroll Tax would generate $390B per year

And

2) 4% Employee Health Tax Net Income

Just using these two Tax options to pay for Medicare For All alone:

4% Employee Health Tax Net Income would generate $350B per year

7.5% Employer Payroll Tax would generate $390B per year

Now add these two together:

$350B + $390B = $740B

Now how much is really needed to pay for Medicare For All per year?

Dr. Friedman:

$872B - $740B = $132B

PERI:

$1,050B - $740B = $310B

Lancet 2020 Study:

$773B - $740B = $33B

$350B + $390B = $740B

Now how much is really needed to pay for Medicare For All per year?

Dr. Friedman:

$872B - $740B = $132B

PERI:

$1,050B - $740B = $310B

Lancet 2020 Study:

$773B - $740B = $33B

Average Total Annual Cost = $2.95T = $2,950B

Average Existing Revenue = $2.05T = $2,050B

How much is needed? $2,950B - $2,050B = $900B

Don't stop here. Recall that @SenSanders came up with Options To Finance Medicare For All. There are 10 different Tax options. The two

Average Existing Revenue = $2.05T = $2,050B

How much is needed? $2,950B - $2,050B = $900B

Don't stop here. Recall that @SenSanders came up with Options To Finance Medicare For All. There are 10 different Tax options. The two

main ones are:

1) 7.5% Employer Payroll Tax

And

2) 4% Employee Health Tax Net Income

Just using these two Tax options to pay for Medicare For All alone:

4% Employee Health Tax Net Income would generate $350B per year

7.5% Employer Payroll Tax would generate $390B per year

1) 7.5% Employer Payroll Tax

And

2) 4% Employee Health Tax Net Income

Just using these two Tax options to pay for Medicare For All alone:

4% Employee Health Tax Net Income would generate $350B per year

7.5% Employer Payroll Tax would generate $390B per year

Now add these two together:

$350B + $390B = $740B

Now how much is really needed (Average) to pay for Medicare For All per year?

$900B - $740B = $160B

$350B + $390B = $740B

Now how much is really needed (Average) to pay for Medicare For All per year?

$900B - $740B = $160B

• • •

Missing some Tweet in this thread? You can try to

force a refresh