1/

Get a cup of coffee.

In this thread, I'll share with you some thoughts on portfolio optimization.

This will help you understand: a) the basic math of optimization, and b) under what circumstances it makes sense to choose investments that maximize CAGR/IRR.

Get a cup of coffee.

In this thread, I'll share with you some thoughts on portfolio optimization.

This will help you understand: a) the basic math of optimization, and b) under what circumstances it makes sense to choose investments that maximize CAGR/IRR.

3/

Here's the poll question I asked:

Suppose we have a stock that multiplies in value by a factor of N.

But it takes N years to do so.

What's the *maximum* rate of return (CAGR) that we can get from such a stock -- assuming we are free to choose whatever N we like?

Here's the poll question I asked:

Suppose we have a stock that multiplies in value by a factor of N.

But it takes N years to do so.

What's the *maximum* rate of return (CAGR) that we can get from such a stock -- assuming we are free to choose whatever N we like?

4/

The right answer is ~44.47% -- the CAGR we get from a stock that grows by a factor of ~2.718 in as many years.

Unfortunately, only ~29.2% of respondents got this question right. The other ~70.8% got it wrong.

The right answer is ~44.47% -- the CAGR we get from a stock that grows by a factor of ~2.718 in as many years.

Unfortunately, only ~29.2% of respondents got this question right. The other ~70.8% got it wrong.

5/

So, let's work out the solution to this problem.

And then we'll discuss broader implications for investors.

👇👇👇

So, let's work out the solution to this problem.

And then we'll discuss broader implications for investors.

👇👇👇

6/

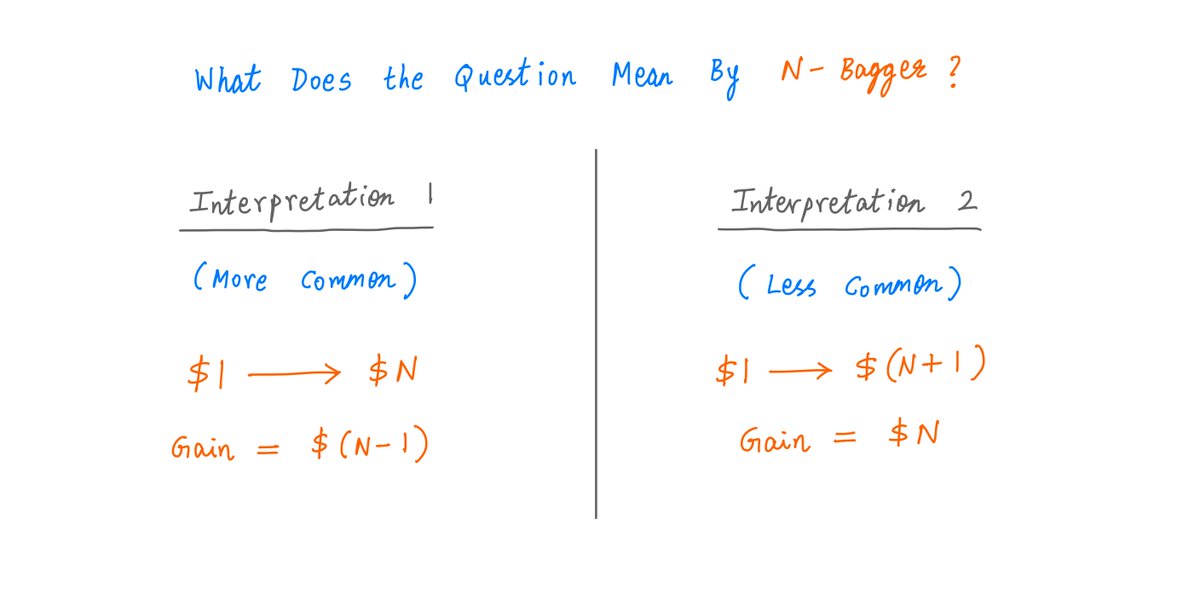

First, we should clarify a potential ambiguity in the phrasing of the question.

The question uses the phrase "N-bagger" to mean "a stock that grows in value by a factor of N".

But there are 2 ways to interpret this.

First, we should clarify a potential ambiguity in the phrasing of the question.

The question uses the phrase "N-bagger" to mean "a stock that grows in value by a factor of N".

But there are 2 ways to interpret this.

7/

The more common interpretation: Every $1 invested in the stock turns into N dollars -- ie, a *gain* of N - 1 dollars.

The less common interpretation: Every $1 invested in the stock turns into N + 1 dollars -- ie, a *gain* of N dollars.

Which of these does the question mean?

The more common interpretation: Every $1 invested in the stock turns into N dollars -- ie, a *gain* of N - 1 dollars.

The less common interpretation: Every $1 invested in the stock turns into N + 1 dollars -- ie, a *gain* of N dollars.

Which of these does the question mean?

8/

Fortunately, the question gives us 2 CAGR numbers that we can use to resolve this ambiguity:

a) A 10 bagger in 10 years: ~25.89%, and

b) A 100 bagger in 100 years: ~4.71%.

These CAGR numbers will tally for only ONE interpretation, NOT the other.

Fortunately, the question gives us 2 CAGR numbers that we can use to resolve this ambiguity:

a) A 10 bagger in 10 years: ~25.89%, and

b) A 100 bagger in 100 years: ~4.71%.

These CAGR numbers will tally for only ONE interpretation, NOT the other.

9/

When we calculate these CAGRs for both interpretations, we see that ONLY the more common interpretation tallies.

This resolves our ambiguity:

A 10-bagger means every $1 we put in becomes $10 (NOT $11) -- ie, $9 (NOT $10) worth of gains for every $1 invested.

When we calculate these CAGRs for both interpretations, we see that ONLY the more common interpretation tallies.

This resolves our ambiguity:

A 10-bagger means every $1 we put in becomes $10 (NOT $11) -- ie, $9 (NOT $10) worth of gains for every $1 invested.

10/

So, we've resolved our ambiguity.

Let's now solve the question.

We want to find whatever N maximizes the CAGR of a $1 investment turning into $N in N years.

This CAGR is easy enough to calculate as a function of N.

Here's how:

So, we've resolved our ambiguity.

Let's now solve the question.

We want to find whatever N maximizes the CAGR of a $1 investment turning into $N in N years.

This CAGR is easy enough to calculate as a function of N.

Here's how:

11/

Now that we have our CAGR as a function of N, all that remains is to find out which N maximizes the function.

A simple way to do this is to just *plot* the function. Then we zoom in on the plot to find the N we want.

This gives us N = ~2.718 years, for a ~44.47% CAGR.

Now that we have our CAGR as a function of N, all that remains is to find out which N maximizes the function.

A simple way to do this is to just *plot* the function. Then we zoom in on the plot to find the N we want.

This gives us N = ~2.718 years, for a ~44.47% CAGR.

12/

So, we have our answer.

The *maximum* CAGR we can get from an "N-bagger in N years" is ~44.47%.

We get this maximum CAGR when N = ~2.718.

That's the third option in the poll: Max CAGR >= 40%, < 50%.

So, we have our answer.

The *maximum* CAGR we can get from an "N-bagger in N years" is ~44.47%.

We get this maximum CAGR when N = ~2.718.

That's the third option in the poll: Max CAGR >= 40%, < 50%.

13/

A more sophisticated way to solve the problem is via Differential Calculus.

This has 2 advantages over "plotting and zooming":

a) We don't need a computer. We can work out the answer using just pen and paper. And,

b) We get an *exact* answer -- not just an approximation.

A more sophisticated way to solve the problem is via Differential Calculus.

This has 2 advantages over "plotting and zooming":

a) We don't need a computer. We can work out the answer using just pen and paper. And,

b) We get an *exact* answer -- not just an approximation.

14/

The central idea in Differential Calculus is the *derivative* -- a measure of how *quickly* a function changes when its inputs change.

Here, we have CAGR as a function of N.

So, the "derivative" of this function measures how quickly CAGR changes when we change N.

The central idea in Differential Calculus is the *derivative* -- a measure of how *quickly* a function changes when its inputs change.

Here, we have CAGR as a function of N.

So, the "derivative" of this function measures how quickly CAGR changes when we change N.

15/

The blue curve below is our CAGR function.

The orange curve is the "derivative" of CAGR -- obtained using Differential Calculus.

The blue curve below is our CAGR function.

The orange curve is the "derivative" of CAGR -- obtained using Differential Calculus.

16/

Our derivative (the orange curve) has some useful properties:

When the curve is POSITIVE, an *increase* in N produces an *increase* in CAGR.

And when the curve is NEGATIVE, an *increase* in N produces a *decrease* in CAGR.

Our derivative (the orange curve) has some useful properties:

When the curve is POSITIVE, an *increase* in N produces an *increase* in CAGR.

And when the curve is NEGATIVE, an *increase* in N produces a *decrease* in CAGR.

17/

We want to find the point where CAGR is at its *maximum*.

That is: *upto* this point, CAGR *increases* with N. But *after* this point, CAGR *decreases* with N.

And that means: we're looking for the point where our orange curve *transitions* from POSITIVE to NEGATIVE.

We want to find the point where CAGR is at its *maximum*.

That is: *upto* this point, CAGR *increases* with N. But *after* this point, CAGR *decreases* with N.

And that means: we're looking for the point where our orange curve *transitions* from POSITIVE to NEGATIVE.

18/

"Transitioning from POSITIVE to NEGATIVE" means "Crossing ZERO".

So, the point where our orange curve crosses zero is exactly where our CAGR will be maximum.

That's the point we want to find.

And Differential Calculus lets us find it *exactly*.

Like so:

"Transitioning from POSITIVE to NEGATIVE" means "Crossing ZERO".

So, the point where our orange curve crosses zero is exactly where our CAGR will be maximum.

That's the point we want to find.

And Differential Calculus lets us find it *exactly*.

Like so:

19/

So, calculus is telling us that we'll find our maximum CAGR at N = e = ~2.718...

This, of course, matches the approximation we found via "plot and zoom".

e is a fundamental and fascinating math quantity. It pops up in all kinds of places.

For more:

So, calculus is telling us that we'll find our maximum CAGR at N = e = ~2.718...

This, of course, matches the approximation we found via "plot and zoom".

e is a fundamental and fascinating math quantity. It pops up in all kinds of places.

For more:

https://twitter.com/10kdiver/status/1409171698532847616

20/

Our poll question also carries broader investing implications.

For example, one immediate conclusion is that we can't just focus on how many "multiples" we bag.

The *time* it takes to bag said multiple is crucial.

Our poll question also carries broader investing implications.

For example, one immediate conclusion is that we can't just focus on how many "multiples" we bag.

The *time* it takes to bag said multiple is crucial.

21/

I see lots of discussions on FinTwit about 10 baggers, 100 baggers, etc.

But very few of these discussions incorporate the *time* factor.

Even a 100 bagger is NOT particularly wonderful -- if it takes 100 years to work its magic. As we've seen, that's only a ~4.71% CAGR.

I see lots of discussions on FinTwit about 10 baggers, 100 baggers, etc.

But very few of these discussions incorporate the *time* factor.

Even a 100 bagger is NOT particularly wonderful -- if it takes 100 years to work its magic. As we've seen, that's only a ~4.71% CAGR.

22/

But on the other hand, we also shouldn't focus on JUST maximizing CAGR/IRR -- to the exclusion of everything else.

A key question to ask is: *how long* can we sustain a particular CAGR/IRR?

But on the other hand, we also shouldn't focus on JUST maximizing CAGR/IRR -- to the exclusion of everything else.

A key question to ask is: *how long* can we sustain a particular CAGR/IRR?

23/

For example, suppose we buy a stock and it goes up 2% in one day.

That's a whopping (1.02^365 - 1)*100 = ~137,641% CAGR!

But is it sustainable? Can we grow our portfolio at 2% per day every single day? Most likely not.

For example, suppose we buy a stock and it goes up 2% in one day.

That's a whopping (1.02^365 - 1)*100 = ~137,641% CAGR!

But is it sustainable? Can we grow our portfolio at 2% per day every single day? Most likely not.

24/

Over short time durations, CAGRs/IRRs can be very misleading.

For most of us, a *decent* CAGR that can be sustained for *decades* will leave us better off than a *great* CAGR that quickly peters out.

We should direct our search for investment opportunities accordingly.

Over short time durations, CAGRs/IRRs can be very misleading.

For most of us, a *decent* CAGR that can be sustained for *decades* will leave us better off than a *great* CAGR that quickly peters out.

We should direct our search for investment opportunities accordingly.

25/

A closely related concern is "re-investment risk".

For example, Business #1 may be able to invest capital at a 50% IRR.

But only for a limited amount of time -- until the market gets saturated or competition steps up or whatever.

A closely related concern is "re-investment risk".

For example, Business #1 may be able to invest capital at a 50% IRR.

But only for a limited amount of time -- until the market gets saturated or competition steps up or whatever.

26/

This business has re-investment risk. It's unlikely that management will be able to keep re-investing profits for long at 50%.

By contrast, Business #2 may get an IRR of only 20%. But they may have a "moat" that lets them keep re-investing profits for decades at that rate.

This business has re-investment risk. It's unlikely that management will be able to keep re-investing profits for long at 50%.

By contrast, Business #2 may get an IRR of only 20%. But they may have a "moat" that lets them keep re-investing profits for decades at that rate.

27/

There's yet another factor: the amount of capital that can be deployed.

Businesses like Berkshire, for example, have tens of billions of dollars to invest.

An opportunity that lets them invest, say, $50M at a 200% IRR, still doesn't move the needle very much.

There's yet another factor: the amount of capital that can be deployed.

Businesses like Berkshire, for example, have tens of billions of dollars to invest.

An opportunity that lets them invest, say, $50M at a 200% IRR, still doesn't move the needle very much.

28/

By contrast, an opportunity that lets them earn only 10% to 12% IRR can still be very attractive -- IF it can absorb tens of billions of dollars every year.

Again, the goal isn't just to maximize IRR. It's to maximize end net worth/utility -- adjusted for risk.

By contrast, an opportunity that lets them earn only 10% to 12% IRR can still be very attractive -- IF it can absorb tens of billions of dollars every year.

Again, the goal isn't just to maximize IRR. It's to maximize end net worth/utility -- adjusted for risk.

29/

Thus, while choosing an investment for our portfolio, we should consider a bunch of factors:

- the IRR we'll get,

- how long this IRR will be sustained for,

- re-investment risk,

- how much capital can be deployed,

- the uncertainty around the IRR and its duration, etc.

Thus, while choosing an investment for our portfolio, we should consider a bunch of factors:

- the IRR we'll get,

- how long this IRR will be sustained for,

- re-investment risk,

- how much capital can be deployed,

- the uncertainty around the IRR and its duration, etc.

30/

Howard Marks (@HowardMarksBook) has written a wonderful memo dissecting some of these factors.

It has the lovely title: You Can't Eat IRR.

Link: oaktreecapital.com/docs/default-s…

Howard Marks (@HowardMarksBook) has written a wonderful memo dissecting some of these factors.

It has the lovely title: You Can't Eat IRR.

Link: oaktreecapital.com/docs/default-s…

31/

I'd also like to thank Ho Nam (@honam) for his perspectives on why many fund managers are incentivized to maximize IRR, and Prof. Sanjay Bakshi (@Sanjay__Bakshi) for his keen insights about re-investment risk.

I'd also like to thank Ho Nam (@honam) for his perspectives on why many fund managers are incentivized to maximize IRR, and Prof. Sanjay Bakshi (@Sanjay__Bakshi) for his keen insights about re-investment risk.

https://twitter.com/honam/status/1456271074115473413?s=20

32/

And if you want to learn more about the history of calculus and all the wonderful things it lets us do, here's an outstanding non-technical book by Prof. Steven Strogatz (@stevenstrogatz): Infinite Powers.

amazon.com/Infinite-Power…

And if you want to learn more about the history of calculus and all the wonderful things it lets us do, here's an outstanding non-technical book by Prof. Steven Strogatz (@stevenstrogatz): Infinite Powers.

amazon.com/Infinite-Power…

33/

I'll leave you with a quote from one of the world's greatest computer scientists, Don Knuth.

The key idea:

We shouldn't blindly optimize for IRR, or the chance of a 100 bagger, or re-investment risk, etc. We should look at the combined effect of all the important factors.

I'll leave you with a quote from one of the world's greatest computer scientists, Don Knuth.

The key idea:

We shouldn't blindly optimize for IRR, or the chance of a 100 bagger, or re-investment risk, etc. We should look at the combined effect of all the important factors.

34/

Thank you very much for taking the time to read all the way to the end.

Please stay safe. Enjoy your weekend!

/End

Thank you very much for taking the time to read all the way to the end.

Please stay safe. Enjoy your weekend!

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh