1/ @Uniswap v3 introduces a new form of MEV attack — Just-in-Time Liquidity (JIT), that allows LPs to add and remove concentrated liquidity positions atomically in one block. Sophisticated actors are running JIT bots to sandwich trades, to the detriment of pre-existing LPs 👇🧵

2/ Using @DuneAnalytics, we find the @Uniswap positions that are added and removed in the same block for the same LP. From this, we calculate the revenue from the fees of the sandwiched trade, and subtract the gas costs required to perform the JIT attack:dune.xyz/embeds/233623/…

3/ Only 2 MEV #flashbots are presently capable of JIT attacks. Over >$1M USD in profits have been gathered by JIT bots, to the detriment of frontrun non-sophisticated @uniswap v3 LPs. @bertcmiller @phildaian dune.xyz/embeds/233623/…

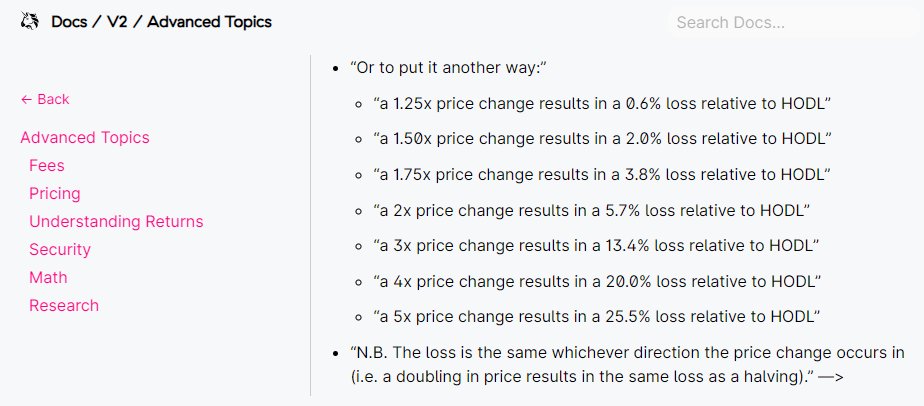

4/ JIT liquidity attacks cause non-sophisticated LPs to lose out on fee revenue they would have otherwise had. However, JIT liquidity attacks actually are good for traders, since slippage is lessened over the tick range of the trade. dune.xyz/queries/233623…

5/ A Work-in-Progress (WIP) dashboard on Just-in-Time (JIT) liquidity is here:

dune.xyz/ChainsightAnal…

dune.xyz/ChainsightAnal…

• • •

Missing some Tweet in this thread? You can try to

force a refresh