Tesla shares rallied more than 30% over the last few weeks, hitting $1 trillion in valuation.

The media and investors attributed that to the success of the Hertz deal.

But do you know who actually did the heavy lifting behind the scenes?

Let's find out 👇

The media and investors attributed that to the success of the Hertz deal.

But do you know who actually did the heavy lifting behind the scenes?

Let's find out 👇

2/ So what was behind $TSLA's parabolic move at the end of October?

The popular argument points to fundamental players who bought Tesla for the fundamental reason of higher earnings from the Hertz deal.

The popular argument points to fundamental players who bought Tesla for the fundamental reason of higher earnings from the Hertz deal.

https://twitter.com/RampCapitalLLC/status/1282655576581967872

3/ Fundamentals-shmundamentals...

It's Tesla we're talking about!

Where we're going, we don't need fundamentals!

Right, Doc?

It's Tesla we're talking about!

Where we're going, we don't need fundamentals!

Right, Doc?

4/ Right, anyway...

When fundamentals don't matter, what do we turn to?

Technicals!

No, no, not that kind of technicals... Although, nothing's stopping you from drawing a double wedge on a $TSLA chart.

When fundamentals don't matter, what do we turn to?

Technicals!

No, no, not that kind of technicals... Although, nothing's stopping you from drawing a double wedge on a $TSLA chart.

5/ I'm talking about price-insensitive buying, forced selling and other joys of non-discretionary trading.

Yeah, those kinds of technicals.

But before we dig into them, let's take a short trip down memory lane.

Yeah, those kinds of technicals.

But before we dig into them, let's take a short trip down memory lane.

6/ Remember how your relationship with Tesla stock started?

You were both young and had a great time together.

2020 was just magical.

But then - as usually happens with relationships - one of you grew up.

And this time, it's not you - it's them.

You were both young and had a great time together.

2020 was just magical.

But then - as usually happens with relationships - one of you grew up.

And this time, it's not you - it's them.

7/ By the end of 2020, Telsa has changed.

It was no longer this carefree and fun stock to have.

It got a real job.

It started making money.

It joined a respectable equity index, had a stock split and began doing all these things that typical adult stocks do.

It was no longer this carefree and fun stock to have.

It got a real job.

It started making money.

It joined a respectable equity index, had a stock split and began doing all these things that typical adult stocks do.

8/ This is clearly visible in Tesla's implied volatility, which came down significantly ever since joining the $SPX in December 2020.

9/ And that's life.

It's just one of those things that happen.

Tesla is now on a path of becoming a dull value stock, so the best we can do is embrace it, which is what many investors did.

It's just one of those things that happen.

Tesla is now on a path of becoming a dull value stock, so the best we can do is embrace it, which is what many investors did.

10/ But the memory of superb 2020 returns was still fresh.

Many started wondering - is there a way to squeeze (no pun intended) some extra bps of return out of Tesla shares?

Many started wondering - is there a way to squeeze (no pun intended) some extra bps of return out of Tesla shares?

11/ Enter call overwriting.

Selling covered calls is a popular strategy and is frequently used among dividend-paying value stocks.

And Tesla made a good candidate for this - volatility was still nice and juicy and above other $SPX members of similar market cap.

Selling covered calls is a popular strategy and is frequently used among dividend-paying value stocks.

And Tesla made a good candidate for this - volatility was still nice and juicy and above other $SPX members of similar market cap.

12/ But it wasn't just Tesla shareholders who thought selling calls would be a good idea.

As you know, Tesla has been the most wanted short for many years - and the most hated short too 😬

And selling naked out-of-the-money calls is one of the ways that a stock can be shorted.

As you know, Tesla has been the most wanted short for many years - and the most hated short too 😬

And selling naked out-of-the-money calls is one of the ways that a stock can be shorted.

14/ Not only it avoids the hassle of borrowing shares, but gives a bit of wiggle room - the stock doesn't necessarily need to go down for you to make money.

As long as it doesn't explode higher...

As long as it doesn't explode higher...

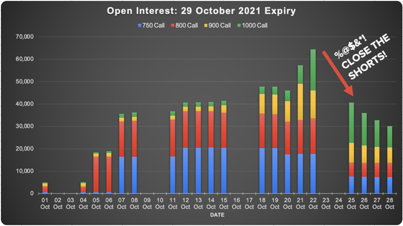

15/ $TSLA has been trading around the $600-$720 range over the summer of 2021, moving into ~$750 in September.

In October, the popular call strikes were $750, $800, $900 and $1000.

They would make great overwriting candidates, right? 😉

Oh yeah, baby, sell those calls!

In October, the popular call strikes were $750, $800, $900 and $1000.

They would make great overwriting candidates, right? 😉

Oh yeah, baby, sell those calls!

16/ The stock is already overextended anyway! It will retrace back, and we'll get to keep our nice call premiums.

For example, let's look at the end-of-month 29 October expiry.

All four of these strikes have seen an accumulation in open interest (OI) between 1 and 22 October.

For example, let's look at the end-of-month 29 October expiry.

All four of these strikes have seen an accumulation in open interest (OI) between 1 and 22 October.

17/ At this point, you might reasonably object:

"Excuse me, please, but why in the world do you think that this increase in call options OI was mostly driven by "sell-to-open" flows?"

Well, because of what happened next.

"Excuse me, please, but why in the world do you think that this increase in call options OI was mostly driven by "sell-to-open" flows?"

Well, because of what happened next.

18/ On Monday, 25 October, Hertz announced that it'll buy 100,000 cars from Tesla and $TSLA shares started the week at $950.53.

Happy Monday to all the short-sellers! 🙂

They now find themselves sitting on massive, convexity-enhanced losses.

Happy Monday to all the short-sellers! 🙂

They now find themselves sitting on massive, convexity-enhanced losses.

19/ It really Hertz when short calls go in-the-money.

20/ Investors who were short these calls desperately tried to limit their losses and rushed to cover.

They know they have to be quick before the WallStreetBets crowd wakes up and YOLOs their calls to the moon and beyond 🚀🌕

They know they have to be quick before the WallStreetBets crowd wakes up and YOLOs their calls to the moon and beyond 🚀🌕

21/ And here's why it looks like Tesla call purchases on Monday were driven mainly by "buy-to-close" flows from call overwriters.

The open interest for these calls DROPPED on Monday, October 25th!

Positions were closed.

The open interest for these calls DROPPED on Monday, October 25th!

Positions were closed.

22/ Even if we look at the monthly, 19 November expiry – same story – significant drop in options OI following Hertz announcement.

23/ And that's NET open interest, which means:

Calls Closed > Calls Opened

It dropped despite all the hype around the Hertz deal and the fresh demand for Tesla stock and its options.

Calls Closed > Calls Opened

It dropped despite all the hype around the Hertz deal and the fresh demand for Tesla stock and its options.

24/ It was almost like a call options short squeeze - the higher the call price, the more investors closed their short calls, driving the price higher in a self-reinforcing cycle...

And this is where the delicate dynamics of options comes into play.

And this is where the delicate dynamics of options comes into play.

25/ Initially, when an investor sells a $TSLA call option, say a $750 strike, a market maker on the other side is long that call.

They need to delta hedge it by selling $TSLA shares.

They need to delta hedge it by selling $TSLA shares.

26/When Tesla exploded to $1,000, investors started to close these shorts, and they bought back the calls from market makers.

Market makers now had to buy Tesla shares to unwind their delta hedges, which grew substantially larger as options were much deeper in-the-money now.

Market makers now had to buy Tesla shares to unwind their delta hedges, which grew substantially larger as options were much deeper in-the-money now.

27/ Coupled together with the classical speculative call buying, we get a gamma squeeze:

Rising stock prices increase the hedging requirements of market markets, who need to buy more shares to stay safe...

Rising stock prices increase the hedging requirements of market markets, who need to buy more shares to stay safe...

28/ Which, of course, drives the prices higher, encouraging more call buying and more delta hedging from the dealers.

29/ As the week went on, Elon tried to calm the markets...

At first, he was like, "wait, wait, it's not demand, it's supply..."

At first, he was like, "wait, wait, it's not demand, it's supply..."

https://twitter.com/elonmusk/status/1452727731452588041

30/ ...and then, he was like, "no contract has been signed! Deal has zero effect!"

https://twitter.com/elonmusk/status/1455351085170823169

31/ Yeah, like anyone cares.

Step aside, Elon, this is not about you anymore.

It's not even about Tesla.

It's about a chain reaction that was lit on Monday 25th, burned all the shorts, and launched Tesla into the new frontiers of 13-digit numbers.

Step aside, Elon, this is not about you anymore.

It's not even about Tesla.

It's about a chain reaction that was lit on Monday 25th, burned all the shorts, and launched Tesla into the new frontiers of 13-digit numbers.

32/ Even the institutional players felt the FOMO of missing this train.

JPMorgan reported that institutions accounted for most of the call buying since the Hertz announcement, overtaking retail in their own game.

JPMorgan reported that institutions accounted for most of the call buying since the Hertz announcement, overtaking retail in their own game.

https://mobile.twitter.com/garyblack00/status/1455820981579169793

33/ Just on 1 Nov, flows into Tesla calls have been higher than the rest of the call premiums combined.

By 5 November, $TSLA comfortably closed at $1,222, teaching yet another painful lesson to anyone who as much as even thought about shorting Tesla.

By 5 November, $TSLA comfortably closed at $1,222, teaching yet another painful lesson to anyone who as much as even thought about shorting Tesla.

https://twitter.com/Mayhem4Markets/status/1455202822581071872

34/ In conclusion, who came out as the ultimate winner from all this?

As Tesla hit a trillion dollar market cap, Tesla's largest shareholder became the world’s wealthiest person.

As Tesla hit a trillion dollar market cap, Tesla's largest shareholder became the world’s wealthiest person.

35/ Ironically, @elonmusk should really thank his short shorts as they were the ones doing most of the heavy lifting in unlocking his compensation package.

https://twitter.com/elonmusk/status/1278760930596270085

36/ And not just during the last few weeks...

But that's a story for another thread.

But that's a story for another thread.

37/ Thank you so much for taking the time to read this!

I hope you found it valuable.

Please sign up for the GRIT newsletter to make sure you won't miss the next one!

It's now #1 FREE finance newsletter on @SubstackInc

gritcapital.substack.com/welcome

I hope you found it valuable.

Please sign up for the GRIT newsletter to make sure you won't miss the next one!

It's now #1 FREE finance newsletter on @SubstackInc

gritcapital.substack.com/welcome

38/ And follow @perfiliev for more educational threads around stocks, options and other topics within the incredible world of financial markets.

• • •

Missing some Tweet in this thread? You can try to

force a refresh