TRANSCRIPT:

The full text of our discussion with @GoddessofGrain is out.

Just a crazy amount of insight into what's driving the surge in grain prices, and therefore meat, dairy and all kinds of other stuff we eat.

bloomberg.com/news/articles/…

The full text of our discussion with @GoddessofGrain is out.

Just a crazy amount of insight into what's driving the surge in grain prices, and therefore meat, dairy and all kinds of other stuff we eat.

bloomberg.com/news/articles/…

@GoddessofGrain Angie knows this stuff so well, and is a fount of insight.

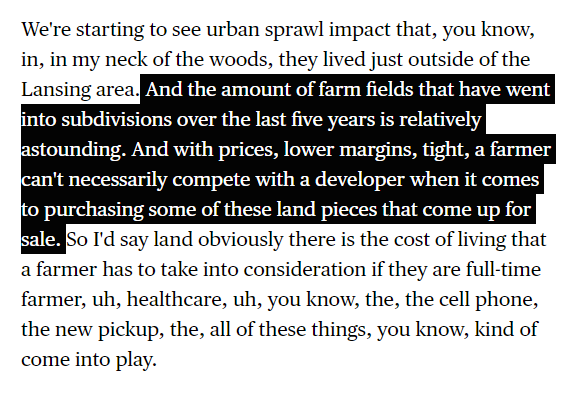

I hadn't thought about, for example, how the booming housing market makes it harder for farmers to acquire land, driving up their costs, and therefore the price of food bloomberg.com/news/articles/…

I hadn't thought about, for example, how the booming housing market makes it harder for farmers to acquire land, driving up their costs, and therefore the price of food bloomberg.com/news/articles/…

@GoddessofGrain Also just like everyone else right now, farmers are worried about the future availability of part supplies (like a belt for their tractor) so are attempting to build up their buffers.

And of course, if you don't want to read the episode, it's available on all the apps

Apple: podcasts.apple.com/us/podcast/thi…

Spotify: open.spotify.com/episode/5dgm55…

Etc.

Apple: podcasts.apple.com/us/podcast/thi…

Spotify: open.spotify.com/episode/5dgm55…

Etc.

• • •

Missing some Tweet in this thread? You can try to

force a refresh