THE US WORKER HAS OFFICIALLY COME OUT AHEAD

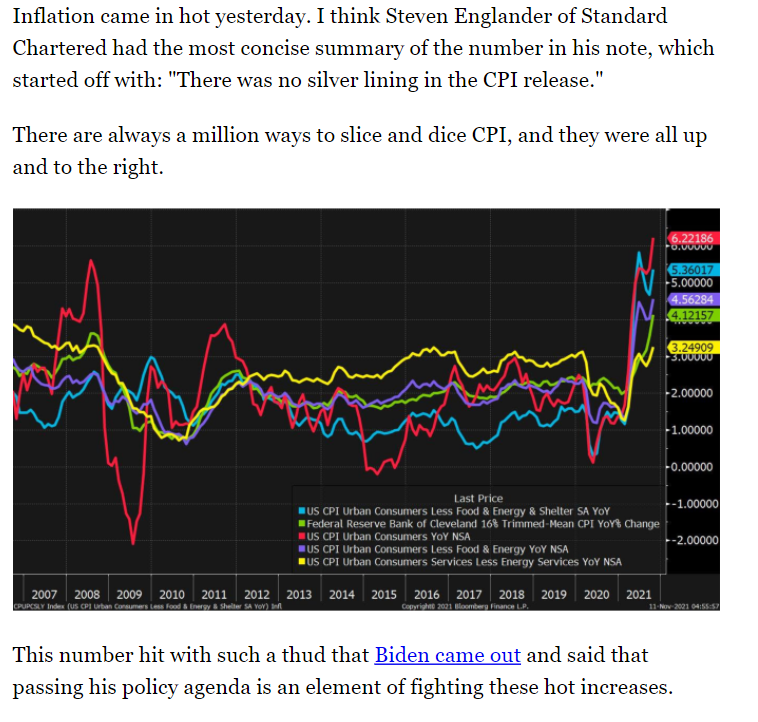

For CPI day in today's @markets newsletter, I wrote about how basically no matter how you slice it, the last 18 months have been a big W for workers and economic policymakers.

Get the newsletter here:

bloomberg.com/account/newsle…

For CPI day in today's @markets newsletter, I wrote about how basically no matter how you slice it, the last 18 months have been a big W for workers and economic policymakers.

Get the newsletter here:

bloomberg.com/account/newsle…

@markets As I note at the end, the best months for "real" take home pay (income minus inflation) have been the months where we sent out more checks to people. So if you're worried about declining real incomes, then you should support more stimulus and UI.

@markets There are nearly 20 million Americans who have gone from unemployed to employed since the depths of the pandemic. Their hourly wage growth, therefore, is infinity% over that time. If you're talking about negative real wage growth, you're ignoring the labor market's biggest story.

Phenomenal piece from @vebaccount on the incoherence of people talking about falling real wages employamerica.org/researchreport…

@vebaccount Brilliant metaphor here that I had never seen expressed this clearly employamerica.org/researchreport…

• • •

Missing some Tweet in this thread? You can try to

force a refresh