We're in an equity bubble. History doesn't repeat, but it often rhymes....let's look at the parallels that prevailed during the Dot Com #bubble in the late 90's vs today...time for a 🧵👇

Let's start with a summary table of some parallels...they include rapid changes like a reduction in trading costs as well as popular mutual funds (ETFs today) like $ARKK

(1) Prolonged time since the prior sustained bear market: bloomberg.com/news/articles/… 90% of day traders are under the age of 40. The absence of a recent sustained large decline in the stock market tends to encourage reckless behaviour amongst market participants....

...Investors in 1999 had not experienced a monthly drawdown in the U.S. 500 Index of over -30% since the famous 1987 crash. It took thirteen years for the market to produce a peak-trough drop in excess of 30% to remind market participants that stocks are risky.

(2) Exogenous market support: The Federal Reserve’s supportive actions are not new and extend back to Alan Greenspan’s tenure at the Fed from Aug 1987 to Jan 2006. Observers coined the term "Greenspan Put". Pundits began referring to the ‘Bernanke Put’ as early as 2010...

...When market participants feel emboldened to take excessive risks, or risks they would not otherwise take, it generally results in prices of assets deviating from what can reasonably be justified by their fundamentals.

(3) Exponential growth in assets managed by popular funds: In late 1999 Janus received 70 cents of every Dollar which entered the entire US mutual fund industry. A lot of that went into the Janus Twenty

https://twitter.com/hindsightcapllp/status/1376295596965961728?s=20...

...the popular $ARKK ETF is identical to the Janus 20, "The introduction of a technologically enabled new product or service that potentially changes the way the world works". Janus said the same about the internet. April 1999, Scott Schoelzel (PM of Janus 20) wrote:

(4) Greater accessibility to the stock market: In the late 1990's rising stock markets coupled with the proliferation of the Internet in people’s homes helped to boost the popularity of electronic trading and led to the rise of the day trader...

...Covid forced millions indoors and into online trading with the rise of “commission free” trading enabled by newer, mobile-first platforms like Robinhood. The proliferation of online trading apps like $HOOD is reminiscent of the sharp rise in online trading in the 1990s:

(5) Proliferation of leverage and online message boards: online brokers like Robinhood provide a significant amount of leverage to retail traders through options and margin trading...

...In March 2021, WallStreetBets had 9.7m members and is a reincarnation of the popular online message boards of the 1990s. Users would anonymously post stock ideas during the Dot-com bubble, and often bragged about how much they made or lost.

(6) Non-traditional valuation metrics to justify high prices: During the formation of the Dot-com bubble, analysts used a host of non-traditional measures and metrics to justify stock valuations. Naysayers just ‘didn’t get it’. Such metrics included:

...price-per-click, number of engaged shoppers, total website visits, page views per user per month and length of stay (on a website). Today, the Big Data revolution has resulted in an abundance of non-traditional metrics and key performance indicators including:

...Daily/Weekly/Monthly Active Users, Dollar-based Net Retention, Customer Attrition or Churn, Customer Acquisition Costs, Average Revenue per Customer, Total Addressable Market etc. We've even witnessed EV/TAM from the $ARVL investor presentation: sec.gov/Archives/edgar…

(7) Valuation Dispersions: the ratio of the median Price/Sales ratio of the most expensive 10% of stocks vs the market median P/S indicates we are near tech-bubble extremes after having corrected some since May 2020. Credit to @alphaarchitect for the chart. Value is attractive.

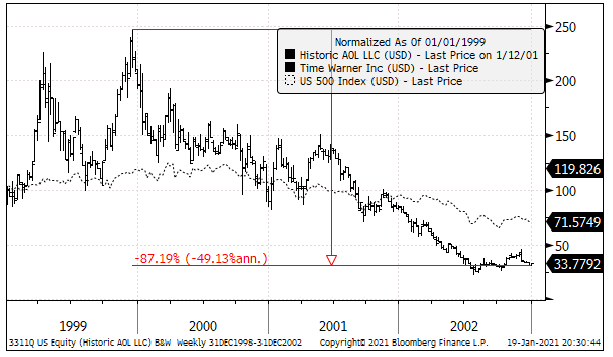

Those are just a few of the parallels I see with what transpired during the Dot Com bubble. Are there any I've missed? Don't forget high-fliers that disappeared: Webvan, AOL, Pets dot com, eToys dot com, Garden dot com, Beyond dot com, theGlobe dot com, eDigital and the Janus 20!

• • •

Missing some Tweet in this thread? You can try to

force a refresh