The following thread is on Ecuador's President's offshore bank "Banisi". @ICIJorg's #PandoraPapers revealed crucial information on Lasso's dealings. In Ecuador, no gov official can have property in havens.

Parliament issued its inquiry report:

Parliament issued its inquiry report:

https://twitter.com/lineaduraec/status/1457773272821428240?s=20

Banisi is owned by Banisi Holding, itself majority owned by Banisi International Foundation

The 3 are Panamanian entities

Panama is a tax haven in Ecuador's list. An anticorruption law (mandated by a 2017 referendum) says a gov official with property in a haven must be dismissed

The 3 are Panamanian entities

Panama is a tax haven in Ecuador's list. An anticorruption law (mandated by a 2017 referendum) says a gov official with property in a haven must be dismissed

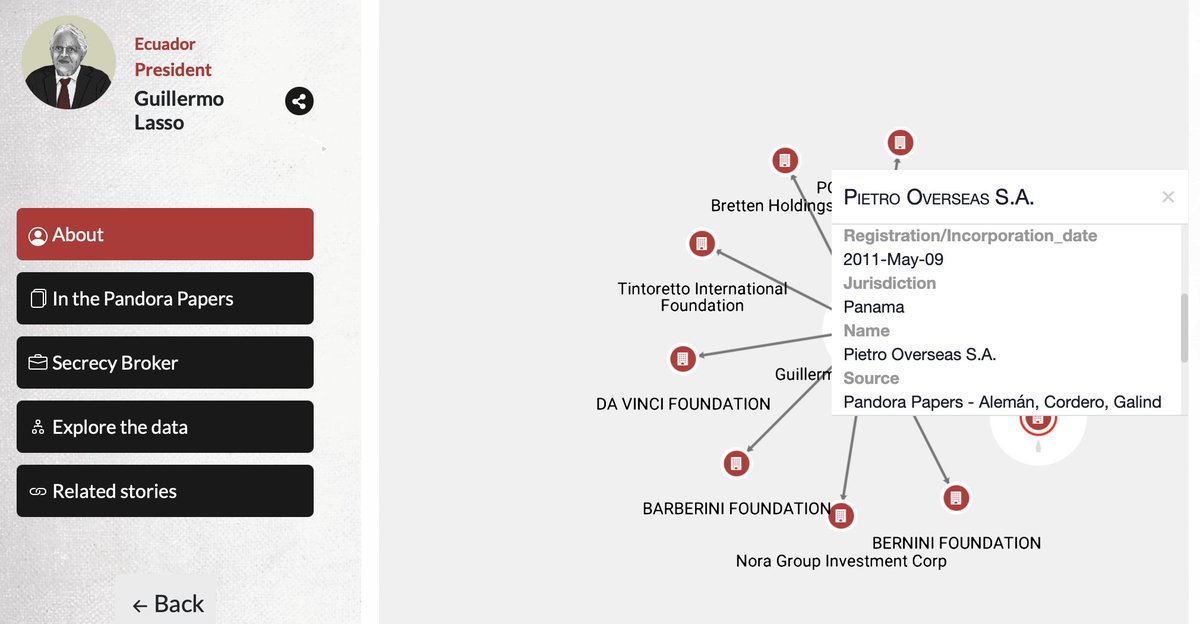

@ICIJorg's investigation was crucial because it obtained confidential documents that confirmed that Lasso was the true beneficial owner of Pietro Overseas, a Panama entity: documentcloud.org/documents/2109…

ICIJ's documents were published here:

ICIJ's documents were published here:

https://twitter.com/ICIJorg/status/1452359741733314568?s=20

If you check Panama's Registry on the surface (see below), it would appear Pietro has no relation to Lasso.

This is the starting point of the most important part of the inquiry.

This is the starting point of the most important part of the inquiry.

When Lasso responded -half heartedly- to @ICIJorg and to Parliament, Lasso admitted that he was the owner of Pietro Overseas.

projects.icij.org/investigations…

(Pietro is only one of many offshore entities revealed by the #PandoraPapers)

projects.icij.org/investigations…

(Pietro is only one of many offshore entities revealed by the #PandoraPapers)

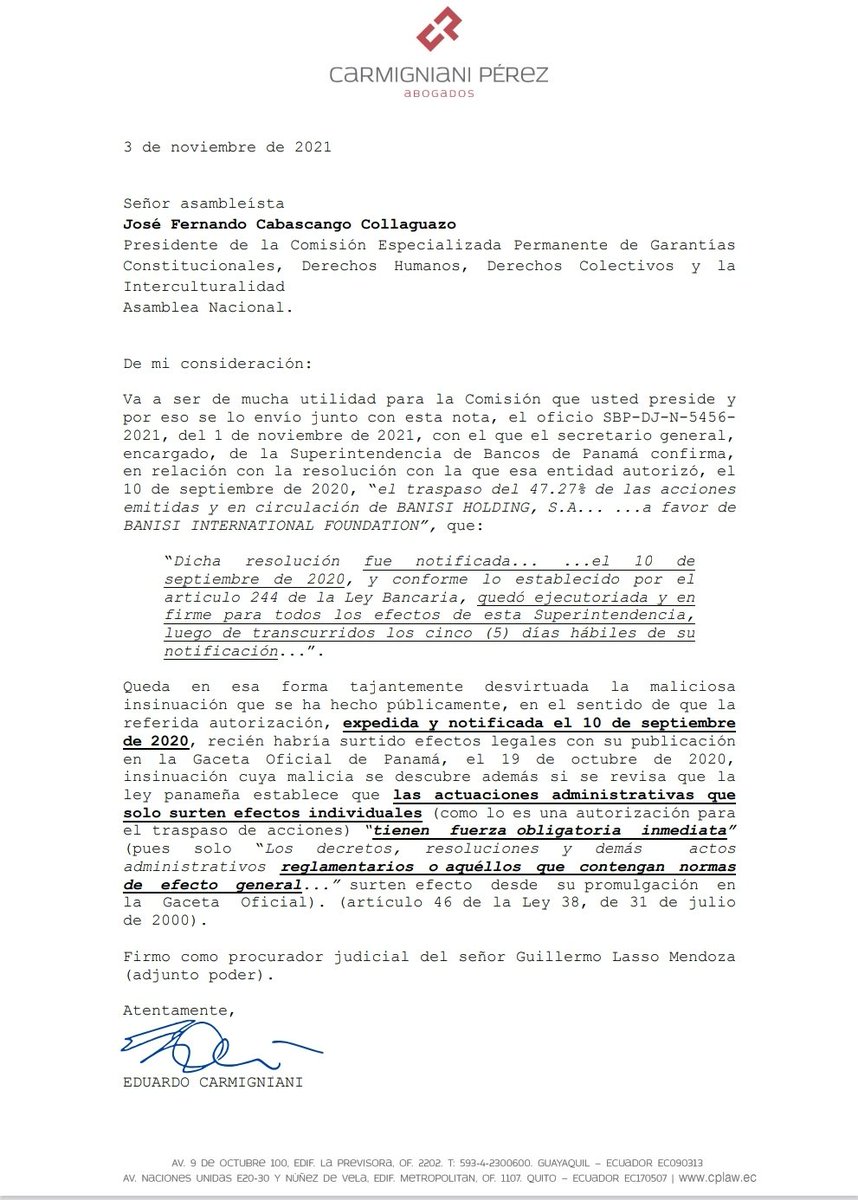

Lasso's lawyer sent a letter to Parliament signed by the Superintendency of Banks of Panama, recognizing the fact that Pietro Overseas moved the shares of Banisi Holding to Banisi International Foundation.

Up to this point, Lasso says he "got rid of his property just before candidate registration".

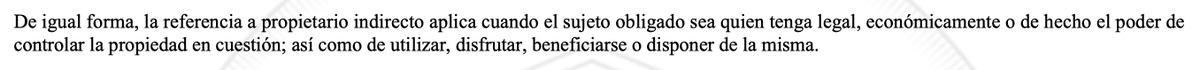

This is not true, because art.4 of the law also refers to INDIRECT OWNERSHIP, an anti loophole term, defined broadly to include de facto control, use, benefit or disposing of property.

This is not true, because art.4 of the law also refers to INDIRECT OWNERSHIP, an anti loophole term, defined broadly to include de facto control, use, benefit or disposing of property.

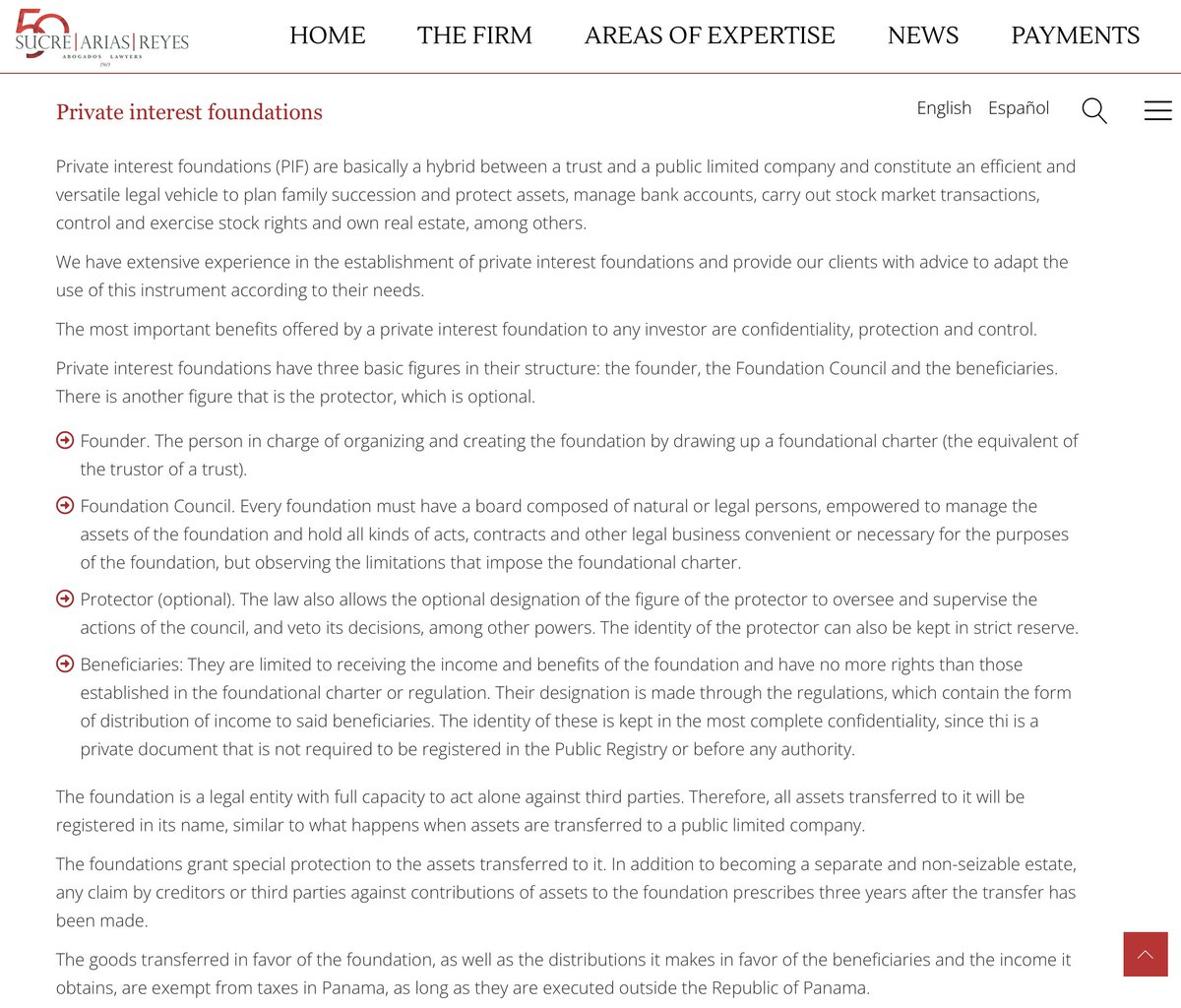

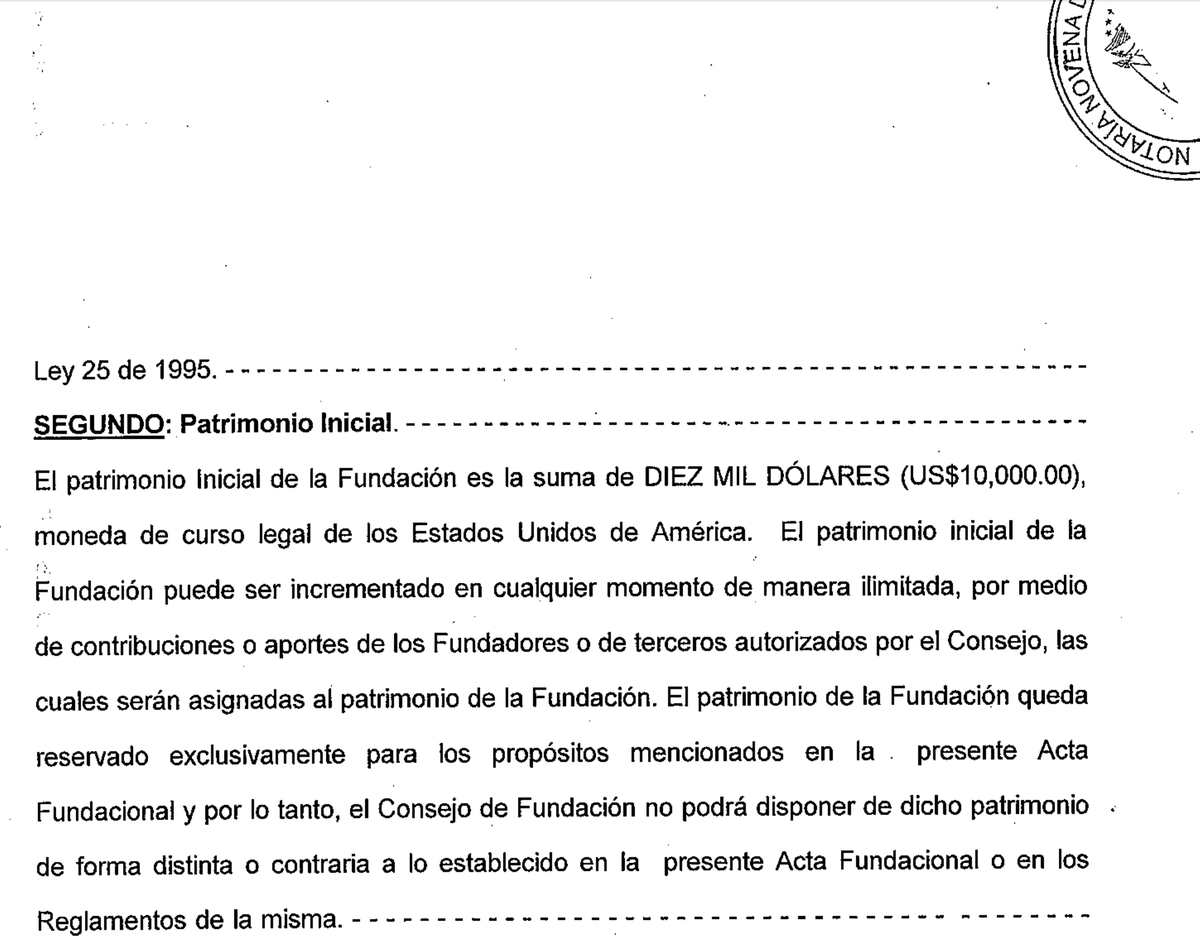

Banisi International Foundation is a private interest foundation in Panama. According to the law firm that hosts the foundation sucre.net, it is a hybrid for family succession and asset protection; its main benefits are confidentiality, protection and control.

When Lasso moved the shares to the Foundation in which his children are the beneficiaries, Lasso continues to be the INDIRECT OWNER because, as Sucre Arias & Reyes says, Lasso retains protection and control.

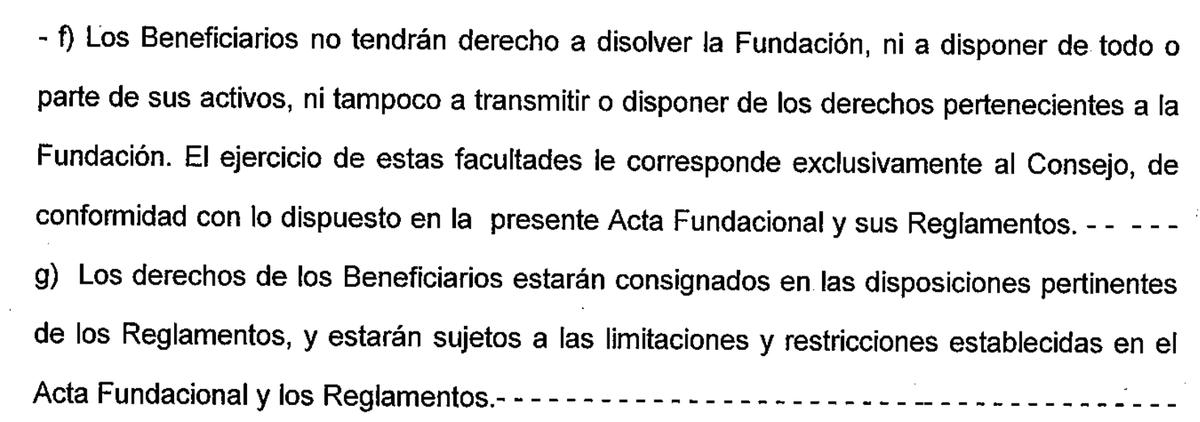

Excerpts from the Foundation's statute obtained by MP @MoniPalaciosZ:

Excerpts from the Foundation's statute obtained by MP @MoniPalaciosZ:

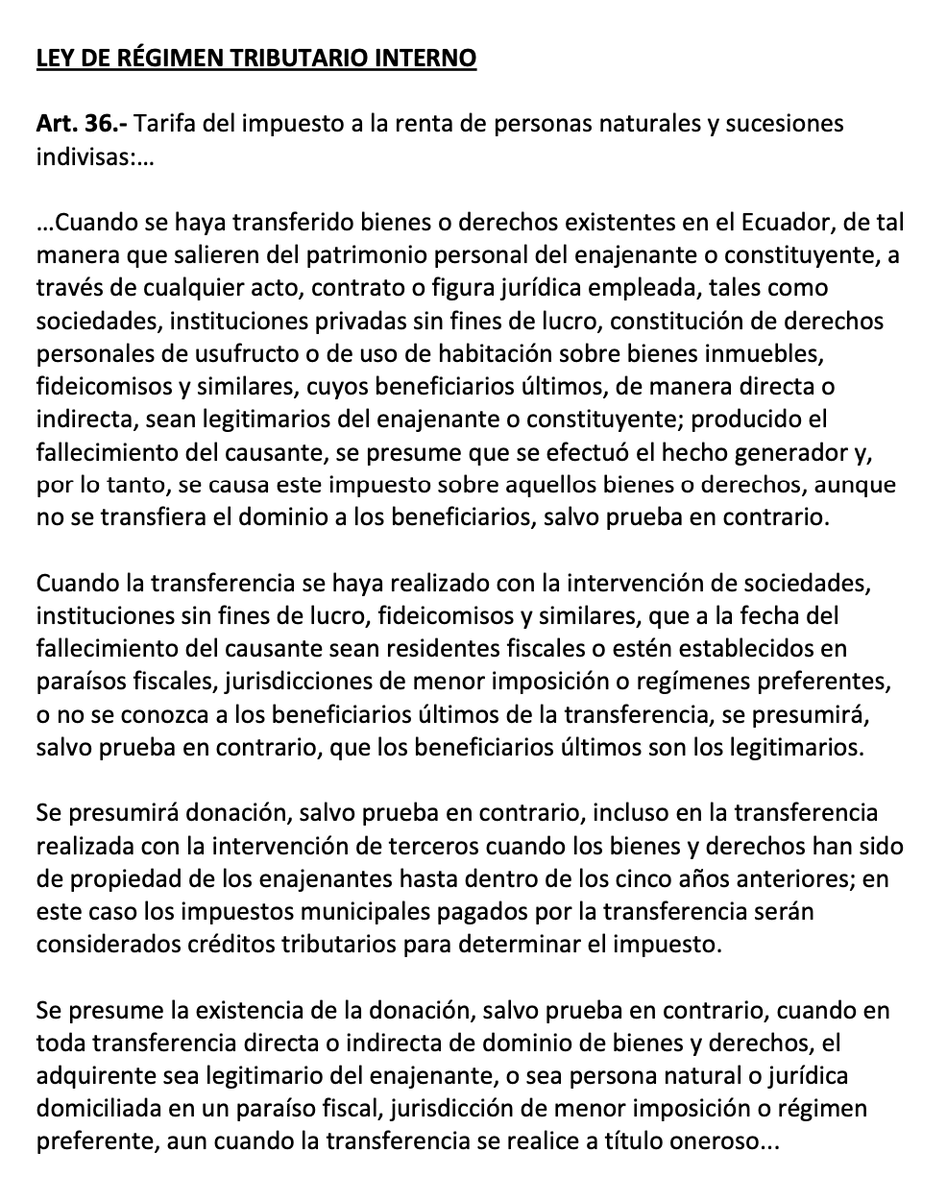

How do we know Lasso preserves control? Because if his children had control, then they would have had to pay inheritance tax in Ecuador. They didn't.

Tax authority (SRI.gob.ec) guide on inheritance tax obligations of assets in havens:

Tax authority (SRI.gob.ec) guide on inheritance tax obligations of assets in havens:

Lasso's lawyer's letter sent on Nov2, 2021 to Parliament includes a letter from the Supertinendency to Banisi Holding (Jorge Alexander Olivardia).

This shows Banisi Holding responds to Lasso.

Or, it shows that his children respond to Lasso (although may seem obvious/redundant).

This shows Banisi Holding responds to Lasso.

Or, it shows that his children respond to Lasso (although may seem obvious/redundant).

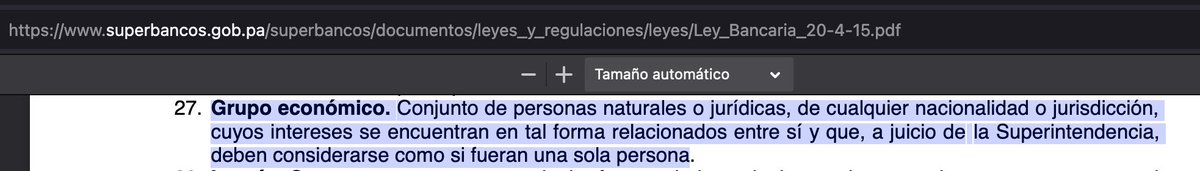

Furthermore, according to Panama's Banking Law, the share move was within the economic group, and there was no actual sale of shares.

This is very important because had it been an actual sale (with a quid pro quo), Lasso could have argued that it was a legitimate divestment.

This is very important because had it been an actual sale (with a quid pro quo), Lasso could have argued that it was a legitimate divestment.

In Ecuadorean legislation, indirect ownership is assumed when family members are shareholders:

Market Power Law (art 14c)

Internal Tax Law (art 10#2, 13#9a)

Monetary Law (art 169, 216, 256, 419)

Ethical Pact Law (transitory disp 1)

Market Power Law (art 14c)

Internal Tax Law (art 10#2, 13#9a)

Monetary Law (art 169, 216, 256, 419)

Ethical Pact Law (transitory disp 1)

In addition, Banisi Bank's management did not change after the shares were moved.

Before the move, Lasso's children were in management. After the move, Lasso's children were in management.

This demonstrates common ownership due to shared management.

Before the move, Lasso's children were in management. After the move, Lasso's children were in management.

This demonstrates common ownership due to shared management.

There's more. Banisi Holding's 2020 Report to Shareholders does not even mention the fact there was a change in ownership. And it includes a message from Guillermo Lasso Mendoza, who is not cited by chance, but because he has influence over the entity.

https://twitter.com/MoniPalaciosZ/status/1456619292405997571?s=20

More. ICANN's website lookup.icann.org reveals that Banisi Bank's domain is registered to Banco Guayaquil, by Telconet (an Ecuadorean Telco) in Guayas, Ecuador.

Back to finance.

Banisi Bank's net worth is $60 million.

Banisi International Foundation was founded on Aug2020 with $10 thousand.

Where did the Foundation get $30 million to buy 51% of the bank's shares in Sep2020.

There was no actual sale, only a simulation of divestment.

Banisi Bank's net worth is $60 million.

Banisi International Foundation was founded on Aug2020 with $10 thousand.

Where did the Foundation get $30 million to buy 51% of the bank's shares in Sep2020.

There was no actual sale, only a simulation of divestment.

The Superintendency authorized the share move on Sep10 but the Superintendency clearly states that the authorization will come in force 5 business days later: Sep17.

Because Lasso was in a hurry to register as a candidate, he dissolved Pietro on Sep14. The move was a simulation.

Because Lasso was in a hurry to register as a candidate, he dissolved Pietro on Sep14. The move was a simulation.

By the way, if the share move responded to an actual sale one day before he signed the sworn affidavit saying he didn't own offshore property (Sep18), the shares would have been sold for a large discount.

It's fine that Lasso wanted to be President, but he should have sold or dissolved - in reality, not as a simulation - his tax haven entities.

He chose to lie to the Electoral, Comptroller and Tax Authorities. And pay a hefty sum to Sucre Arias & Reyes for confidentiality.

He chose to lie to the Electoral, Comptroller and Tax Authorities. And pay a hefty sum to Sucre Arias & Reyes for confidentiality.

It is Lasso's right to own companies in tax havens, but since he has exerted that right, he has lost his right to be Ecuador's President.

It is forbidden by law. And nobody is above the law.

It is forbidden by law. And nobody is above the law.

• • •

Missing some Tweet in this thread? You can try to

force a refresh