HOW TO SEE BUBBLES, ACT ON OPPORTUNITY, WIN

- There's a lot of talk of market bubbles recently

- Often a normal correction is called a bubble

- But bubbles are rare & brutal, even to long term investors

See how to profit from the euphoria & get out without undue risk

THREAD 👇

- There's a lot of talk of market bubbles recently

- Often a normal correction is called a bubble

- But bubbles are rare & brutal, even to long term investors

See how to profit from the euphoria & get out without undue risk

THREAD 👇

3 LEVELS OF BUBBLE ANALYSIS

1. Valuation Narratives

2. Market Sentiment

3. Market Print: Bubble Signatures

1. Valuation Narratives

2. Market Sentiment

3. Market Print: Bubble Signatures

VALUATION NARRATIVES in Different Market Phases

Bubble Pop: Can the company survive?

Bear: Can the company minimize losses, remain profitable?

Bottoming: Can the company grow?

Bull: Can the company grow faster than expected?

Bubble: Can the company become 10x, 100x bigger?

Bubble Pop: Can the company survive?

Bear: Can the company minimize losses, remain profitable?

Bottoming: Can the company grow?

Bull: Can the company grow faster than expected?

Bubble: Can the company become 10x, 100x bigger?

During:

Major crashes

Valuation narratives are focussed on the quality of the balance sheet

Strong, sustainable growth periods

Valuation narratives are focussed on reasonable future cash flow expectations

Bubble Euphoria

Valuation narratives are focussed on lofty aspirations

Major crashes

Valuation narratives are focussed on the quality of the balance sheet

Strong, sustainable growth periods

Valuation narratives are focussed on reasonable future cash flow expectations

Bubble Euphoria

Valuation narratives are focussed on lofty aspirations

To know what kind of valuation narrative is reigning

Conduct a reverse-DCF analysis to see what the market price is implying about expectations. Are they conservative, reasonable or unrealistic?

For retail investors if you don't know about reverse-DCFs

- Learn

OR

- Skip this

Conduct a reverse-DCF analysis to see what the market price is implying about expectations. Are they conservative, reasonable or unrealistic?

For retail investors if you don't know about reverse-DCFs

- Learn

OR

- Skip this

MARKET SENTIMENT

Identifying the euphoria phase in a market cycle is critical to identifying a bubble.

One way to spot euphoria is to look at people who are CONSISTENTLY followers of their friends and family in trends, often driven by FOMO.

When they get in, it is a bubble.

Identifying the euphoria phase in a market cycle is critical to identifying a bubble.

One way to spot euphoria is to look at people who are CONSISTENTLY followers of their friends and family in trends, often driven by FOMO.

When they get in, it is a bubble.

MARKET PRINT: BUBBLE SIGNATURES

The last 2 sections are common knowledge

I have said nothing new

In this section

I share my Bubble Signatures criteria

Which is the result of my extensive study on market bubbles

We will also look at many case studies.

1st the Bubble Signatures:

The last 2 sections are common knowledge

I have said nothing new

In this section

I share my Bubble Signatures criteria

Which is the result of my extensive study on market bubbles

We will also look at many case studies.

1st the Bubble Signatures:

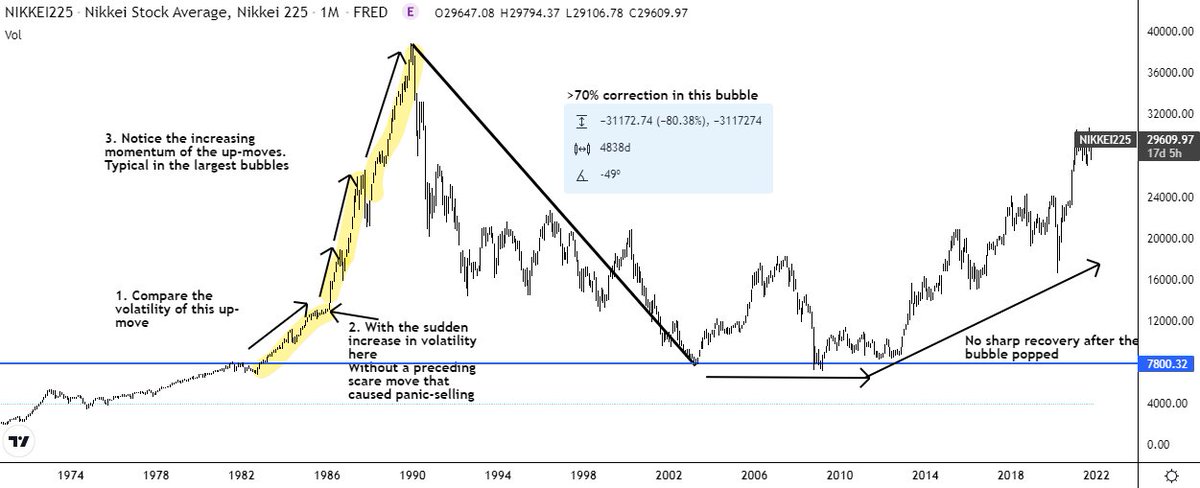

Bubble Signatures Before the Pop:

1. In the middle of an incumbent uptrend, there is a sudden burst of rising and accelerating volatility in the up-moves

2. There is no market scare or fear-inducing move that would have caused panic-selling prior to the sudden volatility increase

1. In the middle of an incumbent uptrend, there is a sudden burst of rising and accelerating volatility in the up-moves

2. There is no market scare or fear-inducing move that would have caused panic-selling prior to the sudden volatility increase

Bubble Signatures After the Pop:

1. USUALLY a >70% drawdown from the peak

2. A slower, gradual recovery as opposed to rapid, sharp recovery

1. USUALLY a >70% drawdown from the peak

2. A slower, gradual recovery as opposed to rapid, sharp recovery

Now we go into a few CASE STUDIES

To see historically, what was a bubble

And what was simply a correction

To see historically, what was a bubble

And what was simply a correction

PLAYING THE OPPORTUNITY

Bubble euphorias can go on for a very long time (see NIKKEI 225 example) and are a great source of profits for the trader

But one must ALWAYS be on guard. How?

One way is,

For a bubble signature on the Monthly

Get out when the Weekly makes a Lower Low:

Bubble euphorias can go on for a very long time (see NIKKEI 225 example) and are a great source of profits for the trader

But one must ALWAYS be on guard. How?

One way is,

For a bubble signature on the Monthly

Get out when the Weekly makes a Lower Low:

For long term investors,

Select stocks based on reasonable future cash flow expectations

This will help avoid the hype and crash in Market Bubbles

Select stocks based on reasonable future cash flow expectations

This will help avoid the hype and crash in Market Bubbles

This info about Bubble Signatures is a key source of edge for the investor/trader

As it allows one to have a confident view on stock market health, based on a process supported with empirical evidence

Follow me on Twitter for more

seeactwin.substack.com for more in-depth stuff

As it allows one to have a confident view on stock market health, based on a process supported with empirical evidence

Follow me on Twitter for more

seeactwin.substack.com for more in-depth stuff

@TihoBrkan , @alphaarchitect

This thread has the expanded reason for why I think we are not in a bubble.

This thread has the expanded reason for why I think we are not in a bubble.

@Callum_Thomas : Perhaps you would also be interested

LIVE EXAMPLE OF BUBBLE SIGNATURE PLAYING OUT:

#ResMed vs #Verisign spread RMD/VRSN

$RMD $VRSN

See seeactwin.substack.com/p/long-short-e… for another detailed example of a long-short equity trade

#ResMed vs #Verisign spread RMD/VRSN

$RMD $VRSN

See seeactwin.substack.com/p/long-short-e… for another detailed example of a long-short equity trade

• • •

Missing some Tweet in this thread? You can try to

force a refresh