Market Crashes are Scary 😱

They don't have to be 😌

Here are four actionable steps to transform them

1⃣

2⃣

3⃣

4⃣

A mini-thread⤵️

They don't have to be 😌

Here are four actionable steps to transform them

1⃣

2⃣

3⃣

4⃣

A mini-thread⤵️

1⃣Prepare INTELLECTUALLY

If you're around long enough, bad stuff WILL happen.

Our example: Russian Roulette

If you play one round, you have a 83% chance of survival (five empty chambers of six)

But if you agree to five rounds, you only have 40% chance of living

If you're around long enough, bad stuff WILL happen.

Our example: Russian Roulette

If you play one round, you have a 83% chance of survival (five empty chambers of six)

But if you agree to five rounds, you only have 40% chance of living

1⃣Prepare INTELLECTUALLY

Let's apply to investing: a 30% drop in market occurs ~once per decade.

Odds of NO 30% drop in one year = 90%

But if you invest for 30 years (as many do), *at least* one such drop is guaranteed. This uses same math as above, but with 9➗10

Let's apply to investing: a 30% drop in market occurs ~once per decade.

Odds of NO 30% drop in one year = 90%

But if you invest for 30 years (as many do), *at least* one such drop is guaranteed. This uses same math as above, but with 9➗10

Have you accepted that now?

Good, time to work on

2⃣ Emotional Preparation

Everyone says, "I can buy high and sell low"

But when you're LIVING IN IT. It's a different story.

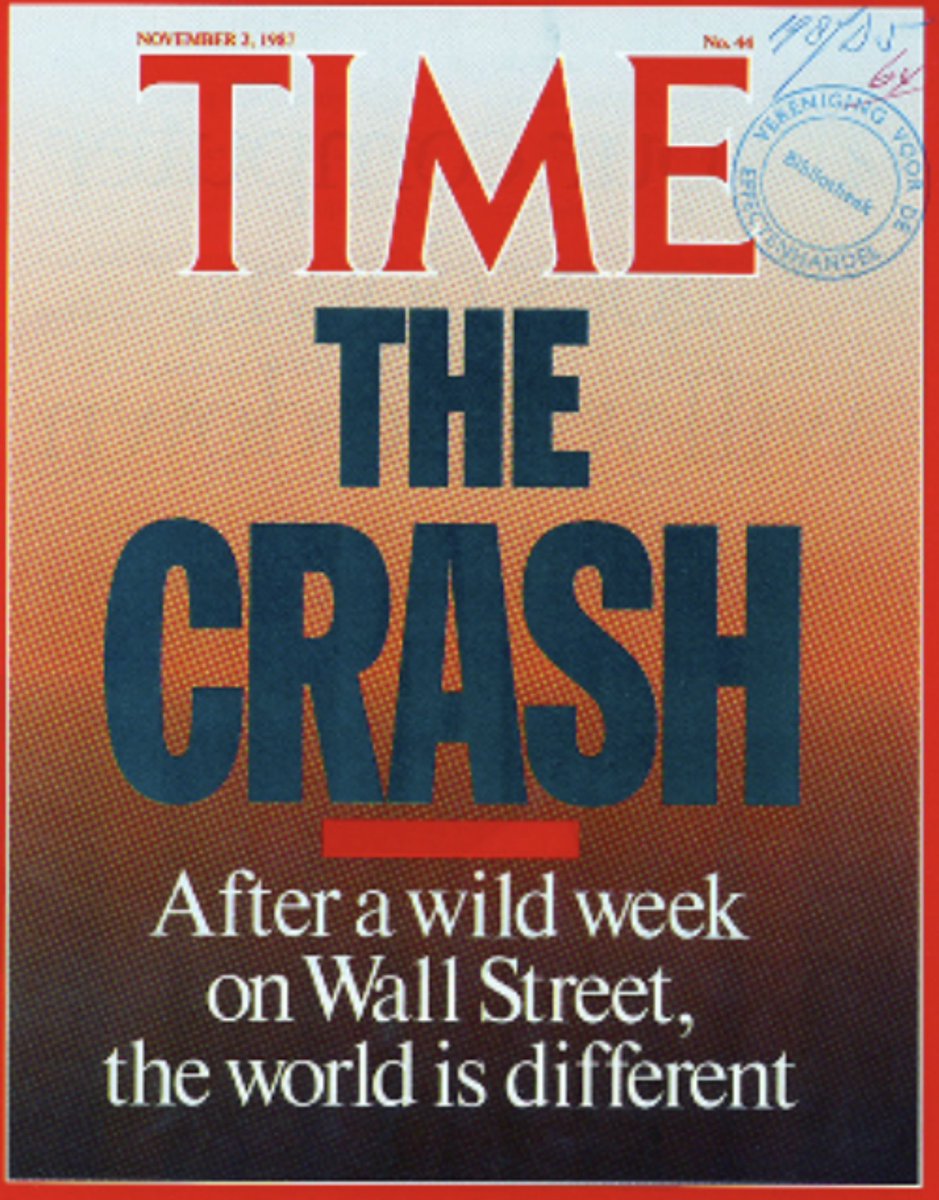

Here's what the headlines (1987, 2008, 2020) look like

Good, time to work on

2⃣ Emotional Preparation

Everyone says, "I can buy high and sell low"

But when you're LIVING IN IT. It's a different story.

Here's what the headlines (1987, 2008, 2020) look like

The balm for that FEAR?

1) Having No high-interest debt

2) Having emergency savings

3) Remembering what those investments are for.

And then, study what the market did over the next five years (and in case of March 2020, took a few months)

1) Having No high-interest debt

2) Having emergency savings

3) Remembering what those investments are for.

And then, study what the market did over the next five years (and in case of March 2020, took a few months)

If you can accept that BAD THINGS will happen -- and that YOU'LL BE OK -- you can move on:

3⃣ Financial Preparation

As @nntaleb has taught, if you are the only one with cash when sh*#! hits the fan, you can be ANTI-FRAGILE

@morganhousel developed a plan for how to do this

3⃣ Financial Preparation

As @nntaleb has taught, if you are the only one with cash when sh*#! hits the fan, you can be ANTI-FRAGILE

@morganhousel developed a plan for how to do this

3⃣ Financial Preparation

He even went back to show the power of having that optionality between 2004 and 2012.

To be clear, he (and I) am not saying to do this with ALL of your money. Just set some aside for the opportunity.

He even went back to show the power of having that optionality between 2004 and 2012.

To be clear, he (and I) am not saying to do this with ALL of your money. Just set some aside for the opportunity.

But even if you have:

1⃣Accepted that crashes will happen

2⃣Researched the benefits to staying invested when they do

And

3⃣ Have a plan for capitalizing on them...

I have bad news.

YOU'RE STILL HUMAN. AND IT'S SCARY

So you need to:

4⃣ Set up some guard-rails

1⃣Accepted that crashes will happen

2⃣Researched the benefits to staying invested when they do

And

3⃣ Have a plan for capitalizing on them...

I have bad news.

YOU'RE STILL HUMAN. AND IT'S SCARY

So you need to:

4⃣ Set up some guard-rails

Don't underestimate the power of :

* Establishing a cool-down period

* Becoming a part of a supportive investing community (H/T @themotleyfool)

* Putting up visual reminders that stock market moves should have little effect on how you live today

* Establishing a cool-down period

* Becoming a part of a supportive investing community (H/T @themotleyfool)

* Putting up visual reminders that stock market moves should have little effect on how you live today

I have no idea when the next crash will be, but @BrianFeroldi are interested in helping make sure it's not scary.

We've made an easy-to-digest video on just this topic:

We've made an easy-to-digest video on just this topic:

If you like it, subscribe to our channel.

We put out 3-4 FREE videos every week in the hopes of spreading financial wellness and helping people to live whole-hearted lives

youtube.com/brianferoldiyt…

We put out 3-4 FREE videos every week in the hopes of spreading financial wellness and helping people to live whole-hearted lives

youtube.com/brianferoldiyt…

To review. To prepare for a market crash:

1⃣ (INTELLECTUAL) Accept it will happen

2⃣ (EMOTIONAL) If you stay invested, you won't be harmed

3⃣ (FINANCIAL) If you have a plan, you can actually get stronger

4⃣ (GUARD RAILS) But put some structures in place in case you're wrong

1⃣ (INTELLECTUAL) Accept it will happen

2⃣ (EMOTIONAL) If you stay invested, you won't be harmed

3⃣ (FINANCIAL) If you have a plan, you can actually get stronger

4⃣ (GUARD RAILS) But put some structures in place in case you're wrong

• • •

Missing some Tweet in this thread? You can try to

force a refresh